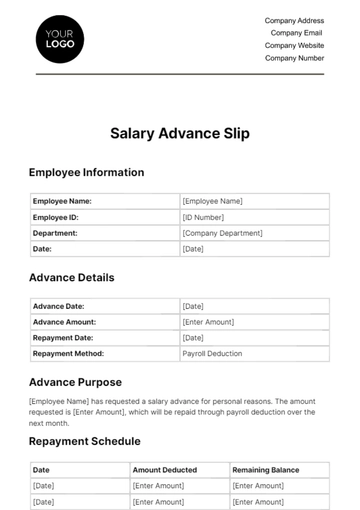

Free Wage Grade Slip HR

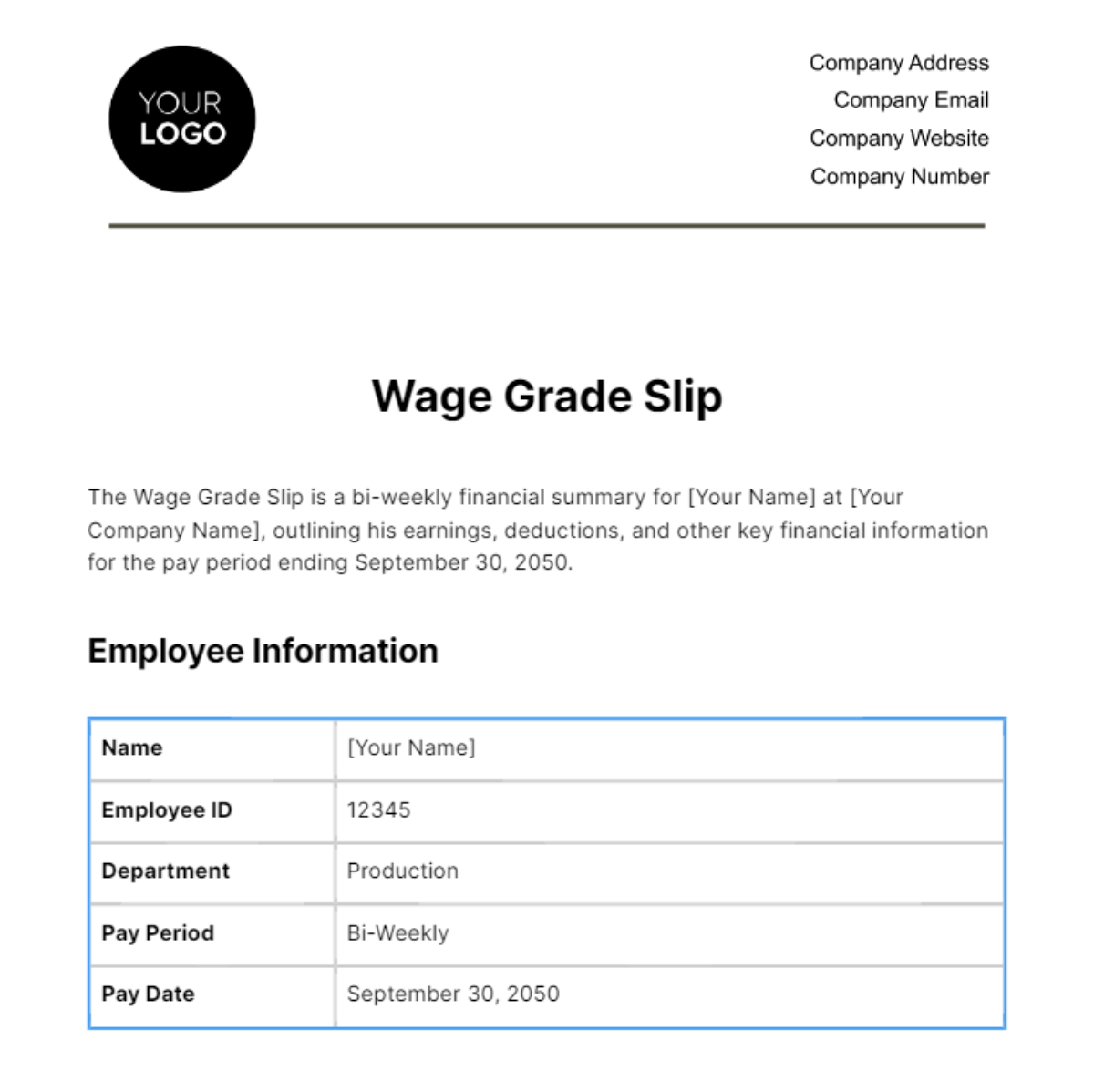

The Wage Grade Slip is a bi-weekly financial summary for [Your Name] at [Your Company Name], outlining his earnings, deductions, and other key financial information for the pay period ending September 30, 2050.

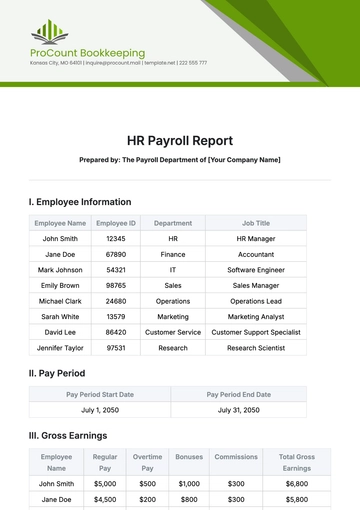

Employee Information

Name | [Your Name] |

Employee ID | 12345 |

Department | Production |

Pay Period | Bi-Weekly |

Pay Date | September 30, 2050 |

Earnings

Regular Hours | 80 hours @ $20.00/hr | $1,600.00 |

Overtime Hours | 10 hours @ $30.00/hr | $300.00 |

Total Earnings | $1,900.00 | |

Deductions

Federal Income Tax (10%) | $190.00 |

State Income Tax (5%) | $95.00 |

Social Security (6.2%) | $117.60 |

Medicare (1.45%) | $27.55 |

Health Insurance Premium | $100.00 |

401(k) Contribution (5%) | $80.00 |

Total Deductions | $610.15 |

Net Pay (after deductions) | $1,289.85 |

Year-To-Date (YTD) Information

Total Earnings YTD | $30,400.00 |

Total Deductions YTD | $6,850.75 |

Net Earnings YTD | $23,549.25 |

Employer Contributions

Employer 401(k) Match (3%) | $45.00 |

Additional Information

Vacation Balance | 40 hours |

Sick Leave Balance | 24 hours |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Wage Grade Slip HR Template from Template.net – your key to streamlined payroll management. This editable and customizable template ensures precision in recording employee wages. Elevate efficiency with ease using our Ai Editor Tool. Simplify your HR processes and enhance accuracy effortlessly. Upgrade to organized payroll perfection today!