Free Ca Final Direct Tax Summary Notes

Student: [YOUR NAME]

Course Title: CA Final - Direct Tax

Module: [MODULE NAME]

Date: [DATE]

Instructor: [INSTRUCTOR'S NAME]

I. Introduction

This template is tailored for CA Final students to efficiently summarize and review key concepts in Direct Tax. It organizes the vast topics into manageable sections, aiding in the preparation for the CA Final examination and providing a quick reference for essential tax laws and applications.

II. Key Concepts and Legislation

1. Income Tax Act, 1961:

Overview: Summary of the primary provisions and amendments pertinent to the fiscal year.

Key Sections: Details of crucial sections like [SECTIONS e.g., Section 80C, 10(10D)].

2. Residential Status and Tax Incidence:

Criteria for Determination: [EXPLANATION OF RESIDENCE RULES FOR TAX PURPOSES]

Tax Implications: Impact of residential status on tax liability.

3. Heads of Income:

Salaries: Tax treatment of allowances, perquisites, and retirement benefits.

Income from House Property: Calculation of Net Annual Value and deductions.

Profits and Gains from Business or Profession: Deductions and tax incentives.

Capital Gains: Short-term vs. long-term, exemptions under sections [SPECIFIC SECTIONS].

Income from Other Sources: Classification and implications.

III. Deductions and Exemptions

Overview of Deductions: Comprehensive list of allowable deductions under various sections of the Income Tax Act.

Specific Deductions: Detailed notes on [SPECIFY ANY PARTICULAR DEDUCTIONS e.g., Section 80C deductions, 80D, etc.].

Exemptions: Key exemptions available to individuals and entities, practical applications, and common pitfalls.

IV. Taxation of Entities

1. Corporate Tax:

Rates and Provisions: Current corporate tax rates, minimum alternate tax (MAT), and related provisions.

Dividend Distribution Tax (DDT): Implications and recent changes.

2. Partnership Firms:

Taxation Rules: How partnership firms are taxed under the Income Tax Act.

3. Trusts, AOPs, and BOIs:

Specific Provisions: Tax treatment and relevant sections.

V. International Taxation

Double Taxation Avoidance Agreements (DTAAs): Key concepts and application in cross-border transactions.

Transfer Pricing: Regulations, methods of computation, and documentation requirements.

VI. Recent Amendments and Case Law

Latest Amendments: Summary of the most recent legislative changes affecting direct taxes.

Important Case Laws: Insights into how recent judgements affect tax planning and compliance.

VII. Assessment Procedures

Filing of Returns: Procedures, deadlines, and related compliances.

Assessment Types: Regular, best judgement, and scrutiny assessments.

Appeals and Revisions: Overview of the appeals process.

VIII. GST Implications on Direct Tax

Interlink between GST and Direct Tax: Understanding the interaction and overlap between GST and direct taxes in business transactions.

IX. Conclusion

Recap the major areas covered and their significance in the context of the CA Final exam. Highlight the need for staying updated with continuous changes in tax laws to ensure effective tax planning and compliance. Emphasize the importance of practical applications of these laws in professional scenarios.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing our CA Final Direct Tax Summary Notes Template, meticulously designed to distill complex direct tax concepts effectively. Accessible on Template.net, this editable and customizable template ensures clarity and organization. Utilize our Ai Editor Tool to structure your notes by key topics, case laws, and amendments. Simplify your study process and enhance comprehension with our meticulously crafted template. Elevate your preparation for the CA Final exam with Template.net.

You may also like

- Delivery Note

- Notes Release

- Concept Note

- Class Note

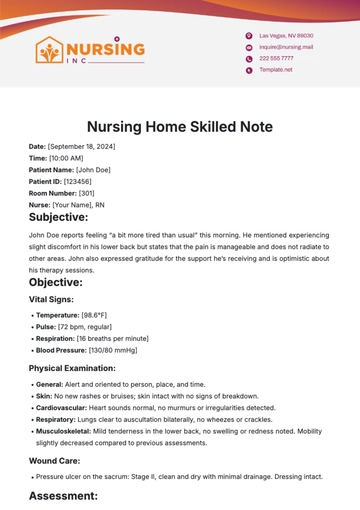

- Hospital Note

- Apology Note

- Credit Note

- Handover Note

- Personal Note

- Excuse Note

- Case Note

- Sample Doctor Note

- Lesson Note

- Appointment Note

- Piano Note

- School Note

- Progress Note

- Business Note

- SOAP Note Templates

- Therapy Note

- Briefing Note

- Summary Note

- Sample Note

- Printable Note