Free Cost Accounting Summary Notes

Student: [YOUR NAME]

Course Title: Cost Accounting

Topic: [TOPIC NAME]

Date: [DATE]

Instructor: [INSTRUCTOR'S NAME]

I. Introduction

This template is crafted to assist students in summarizing key concepts from Cost Accounting lectures, focusing on [TOPIC NAME]. It is designed to enhance understanding and retention of complex accounting principles and facilitate effective study sessions.

II. Overview of Cost Accounting

Purpose of Cost Accounting:

Understand the purpose and scope of cost accounting in business management.

Analyze how it assists in budgeting, cost control, and cost reduction.

Key Principles:

Detail the foundational principles that underpin cost accounting practices and their applications in real-world scenarios.

III. Main Concepts and Formulas

1. Cost Types:

Direct Costs: Costs directly tied to production, like raw materials and labor.

Indirect Costs: Overheads and administrative expenses not directly attributable to a specific product.

2. Cost Behavior:

Fixed Costs: Costs that remain constant regardless of the level of production or sales.

Variable Costs: Costs that vary directly with the level of production.

Semi-variable Costs: Costs comprising both fixed and variable components.

3. Costing Methods:

Job Costing: Assigning costs to specific units or batches.

Process Costing: System used where identical units are mass-produced.

Activity-Based Costing (ABC): Allocating overhead costs based on activities that drive costs.

4. Key Formulas:

Break-even Point: Calculate the point at which total costs and total revenue are equal.

Formula: Fixed Costs / (Selling Price per Unit - Variable Cost per Unit)

Contribution Margin: The remaining revenue after variable costs have been deducted.

Formula: (Sales Revenue - Variable Costs) / Sales Revenue

IV. Examples and Applications

Practical Application:

Apply cost concepts to a hypothetical manufacturing company to illustrate how different costing methods affect financial statements.

Real-World Example:

Discuss a case study from a well-known company, focusing on how strategic cost management has led to improved profitability.

V. Important Terms and Definitions

Term | Definition | Context/Usage |

|---|---|---|

Cost Allocation | The process of identifying, aggregating, and assigning costs to cost objects. | Used in activity-based costing. |

Overhead Rate | A measure used to assign indirect costs to produced goods. | Calculation: Total Overheads / Allocation Base |

Marginal Cost | The cost of producing one additional unit of a product. | Crucial for decision-making in production and pricing strategies. |

VI. Questions for Review

Question 1: How does understanding cost behavior help in managerial decision-making?

Question 2: What are the advantages and limitations of using ABC over traditional costing methods?

VII. Summary and Conclusion

Recap the key points discussed in the notes, emphasizing how the concepts learned in [TOPIC NAME] are essential for effective cost control and strategic business decisions. Reflect on how the methodologies and formulas can be applied in different business scenarios and how they help in financial forecasting and strategy development.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing our Cost Accounting Summary Notes Template, meticulously designed to distill intricate cost accounting concepts effectively. Accessible on Template.net, this editable and customizable template ensures clarity and organization. Utilize our Ai Editor Tool to structure your notes by key principles, formulas, and examples. Simplify your learning process and enhance comprehension with our meticulously crafted template. Elevate your understanding of cost accounting with Template.net.

You may also like

- Delivery Note

- Notes Release

- Concept Note

- Class Note

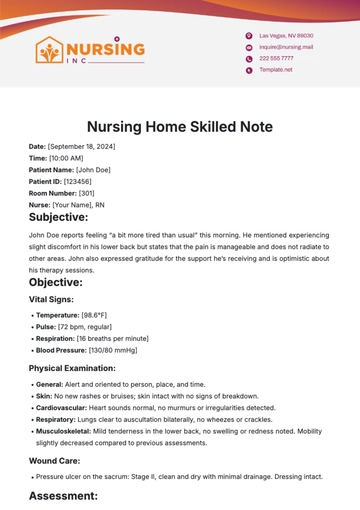

- Hospital Note

- Apology Note

- Credit Note

- Handover Note

- Personal Note

- Excuse Note

- Case Note

- Sample Doctor Note

- Lesson Note

- Appointment Note

- Piano Note

- School Note

- Progress Note

- Business Note

- SOAP Note Templates

- Therapy Note

- Briefing Note

- Summary Note

- Sample Note

- Printable Note