Free High Yield Bond Fund Fact Sheet

I. Introduction

[Your Fund Name] focuses on providing investors with high income through investments in high-yield bonds. As these bonds carry higher risk, the fund aims to balance risk and reward efficiently. Whether you're a seasoned investor or new to the world of high-yield bonds, this Fact Sheet will help you understand our fund's performance, risk profile, and other essential details.

II. Overview

Fund Manager: [Fund Manager's Name]

Inception Date: January 20, 2050

Total Assets: [Amount]

Fund Type: Bond

Ticker: [Ticker]

CUSIP: [CUSIP]

III. Performance Statistics and Figures

Year | Annual Return |

|---|---|

2050 | [2050 Return]% |

2051 | [2051 Return]% |

2052 | [2052 Return]% |

IV. Portfolio Composition

The portfolio of [Your Fund Name] is composed primarily of high-yield corporate bonds across various sectors. Below is the breakdown of the top sectors represented in the fund:

Technology: 25%

Healthcare: 20%

Energy: 15%

Financial Services: 10%

V. Fee Structure

Management Fee: 1.0%

Custodian Fee: 0.1%

Performance Fee: None

VI. Common Myths

Myth 1: High-yield bonds are always high risk.

Reality: While high-yield bonds do carry higher risk compared to investment-grade bonds, proper risk management can mitigate this.

Myth 2: High-yield bonds are only suitable for aggressive investors.

Reality: High-yield bonds can be a valuable component of a diversified portfolio for investors seeking income and capital appreciation.

Myth 3: High-yield bonds perform poorly in economic downturns.

Reality: High-yield bonds may experience increased default rates during economic downturns, but their total return potential can still be attractive in various market conditions.

VII. FAQs

What is a high-yield bond?

A high-yield bond, also known as a junk bond, is a fixed-income security issued by companies or entities with lower credit ratings than investment-grade bonds.

What factors affect the performance of high-yield bond funds?

The performance of high-yield bond funds can be influenced by factors such as changes in interest rates, credit spreads, economic conditions, and issuer-specific risks.

How do interest rate changes impact high-yield bond funds?

High-yield bond prices are typically less sensitive to interest rate changes compared to investment-grade bonds. However, rising interest rates can increase borrowing costs for issuers and affect their ability to repay debt, which may impact high-yield bond prices.

VIII. Conclusion

In conclusion, the [Your Fund Name] High Yield Bond Fund offers investors an opportunity to access the potential returns of high-yield bonds while carefully managing associated risks. With a focus on diversification, experienced management, and consistent performance, our fund aims to deliver value to investors over the long term.

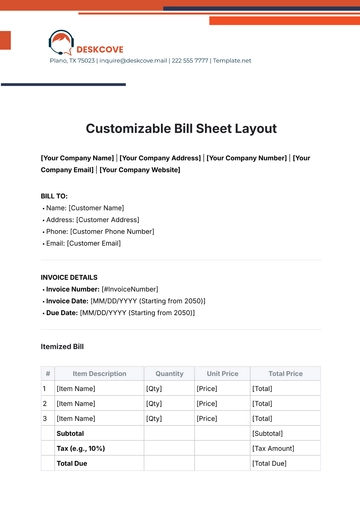

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Craft compelling fact sheets for your high yield bond fund effortlessly with Template.net. Our editable and customizable templates are tailor-made for finance professionals. Editable in our Ai Editor Tool, these templates streamline your process, ensuring accuracy and efficiency.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

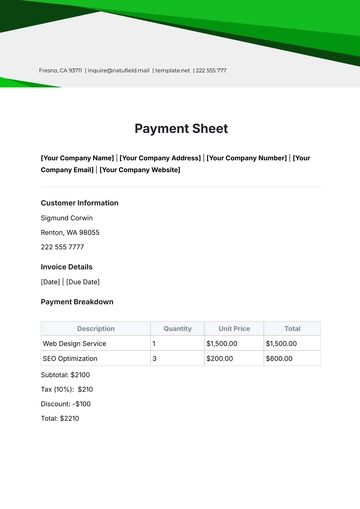

- Expense Sheet

- Tracker Sheet

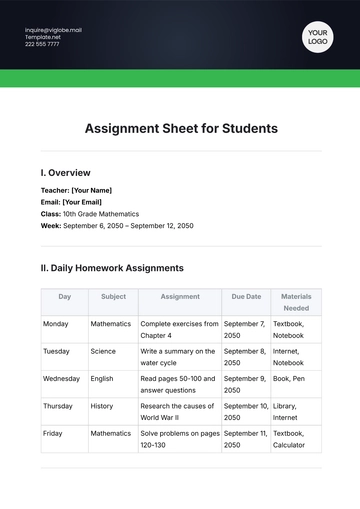

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

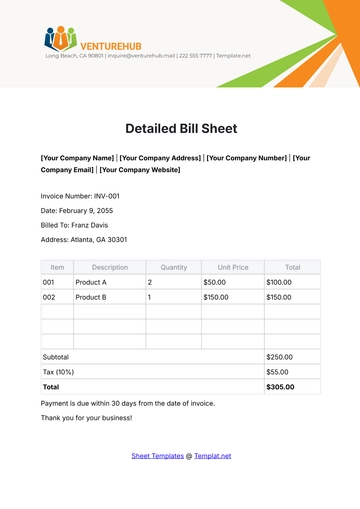

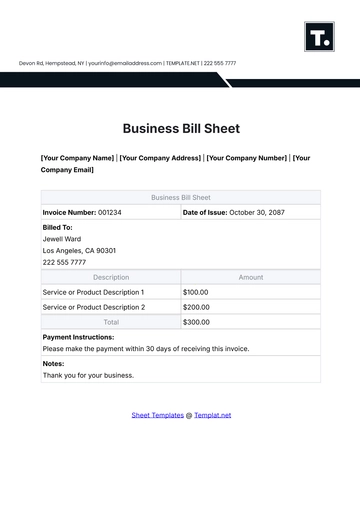

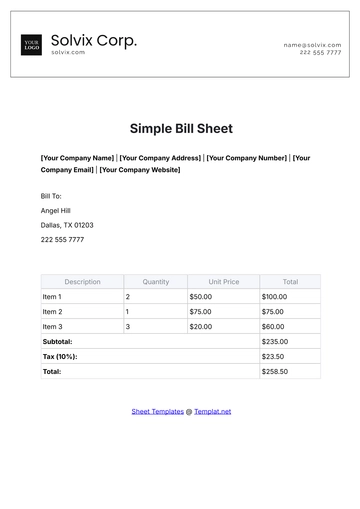

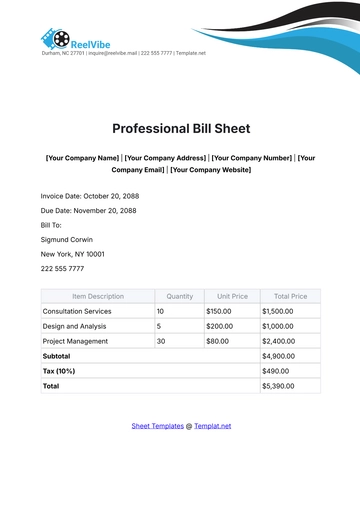

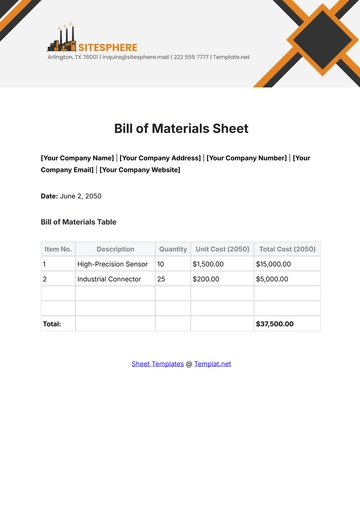

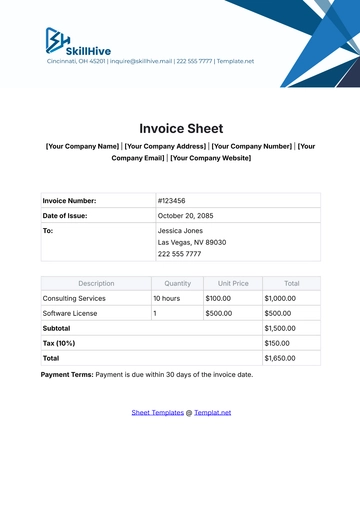

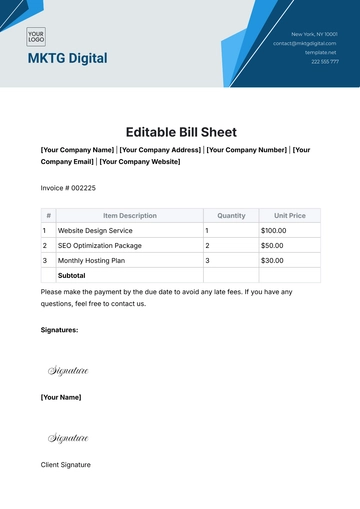

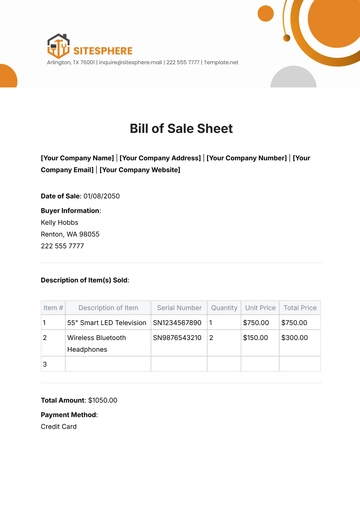

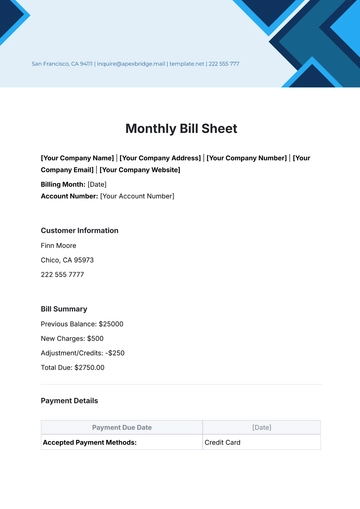

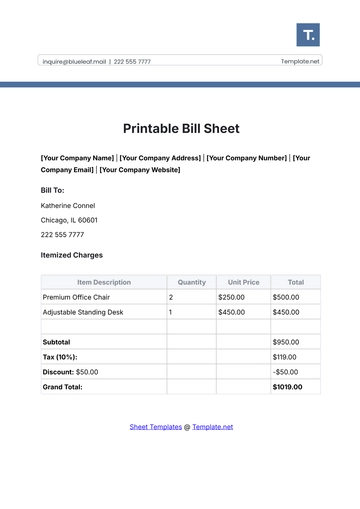

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

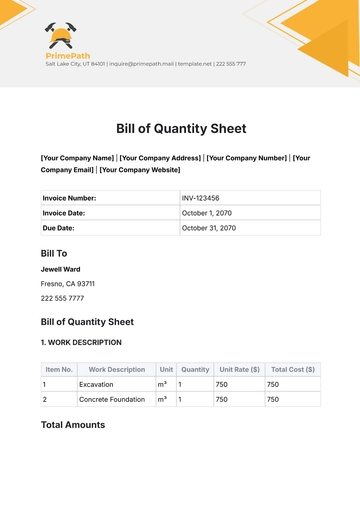

- Construction Sheet

- Cover Sheet

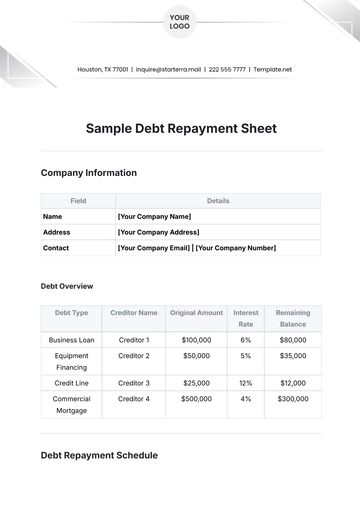

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

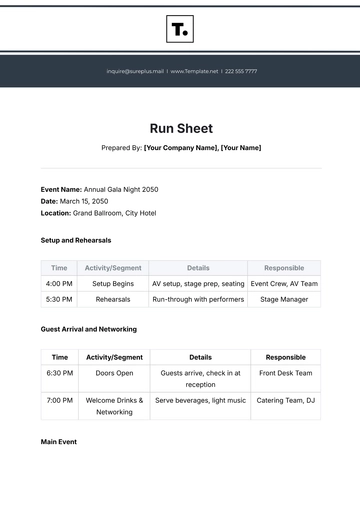

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

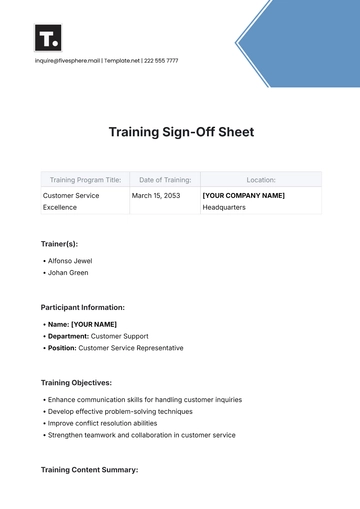

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet