Free Banking Financial Fact Sheet

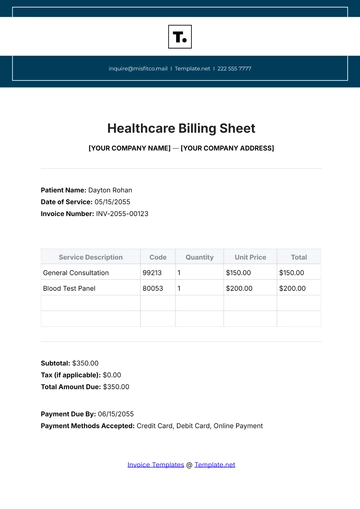

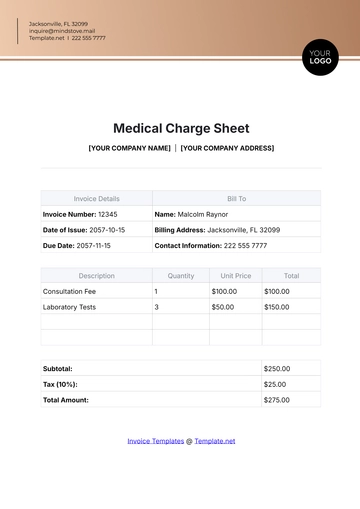

[Your Company Name]

As of December 31, 2050

Introduction

This Fact Sheet provides vital financial information about [Your Company Name], aimed at giving stakeholders a clear overview of our financial health and operational stability.

I. Overview

[Your Company Name], located at [Your Company Address], serves a broad spectrum of customers through an extensive range of financial services, including but not limited to loans, deposits, and transaction processing.

II. Financial Performance Overview

Key Financial Metrics

Metric | Amount (in millions) |

|---|---|

Total Assets | $15,000 |

Total Liabilities | $13,200 |

Shareholders' Equity | $1,800 |

Net Income | $250 |

Return on Equity (ROE) | 13.89% |

Return on Assets (ROA) | 1.67% |

Capital Adequacy Ratios

Ratio | Percentage |

|---|---|

Common Equity Tier 1 (CET1) Ratio | 12.5% |

Tier 1 Capital Ratio | 14.2% |

Total Capital Ratio | 15.8% |

III. Financial Performance

A. Financial Highlights (Last Fiscal Year)

Metric | Amount |

|---|---|

Total Assets | $10.5 billion |

Net Income | $200 million |

Total Deposits | $8 billion |

Loan Portfolio | $6.5 billion |

Return on Assets (ROA) | 1.8% |

Return on Equity (ROE) | 15.5% |

B. Recent Achievements

Introduced a new mobile banking app.

Expanded business lending operations.

Awarded "Best Bank of the Year" by Financial News.

IV. Asset and Liability Management

A. Assets

As of December 31, 2050, the major asset categories are:

Asset Category | Value | Percentage of Total Assets |

|---|---|---|

Liquid Assets | $2,500 million | 16.67% |

Loans and Advances | $8,000 million | 53.33% |

Other Assets | $3,500 million | 23.33% |

B. Liabilities

As of December 31, 2050, the composition of liabilities is as follows:

Liability Category | Value | Percentage of Total Liabilities |

|---|---|---|

Deposits | $11,000 million | 84.85% |

Borrowings | $1,500 million | 11.54% |

Other Liabilities | $700 million | 3.85% |

V. Compliance and Capital Adequacy

[Your Company Name] adheres to all regulatory requirements, maintaining a robust capital adequacy framework to ensure financial stability and operational resilience. The current CAR (Capital Adequacy Ratio) stands at 12.5%.

VI. Contact Information

Customer Service: [Your Company Number]

Email: [Your Company Email]

Website: [Your Company Website]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Banking Financial Fact Sheet Template from Template.net! This essential tool is perfect for financial professionals and analysts to create detailed fact sheets with ease. It's fully editable and customizable, allowing you to tailor content to specific financial data and insights. Use our Ai Editor Tool to refine and personalize financial information effortlessly. Streamline your reporting process today!

You may also like

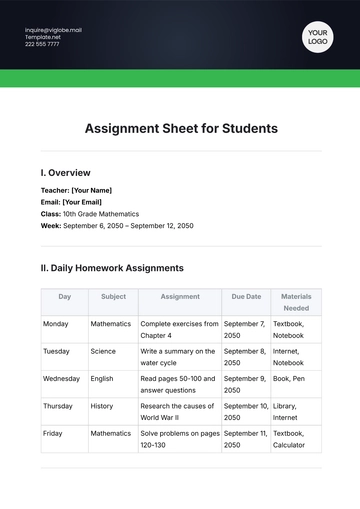

- Attendance Sheet

- Work Sheet

- Sheet Cost

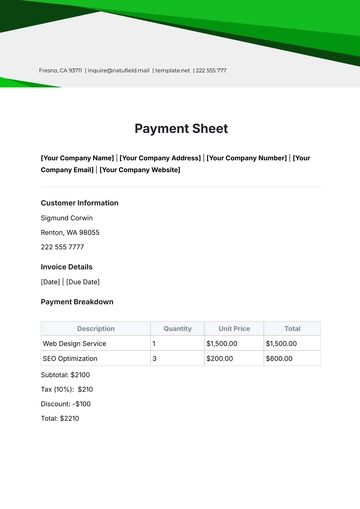

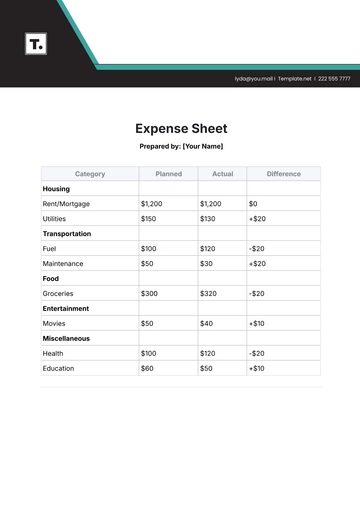

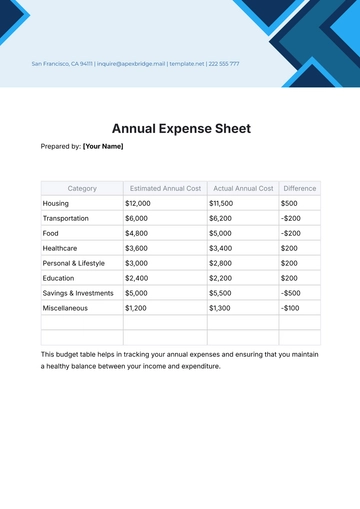

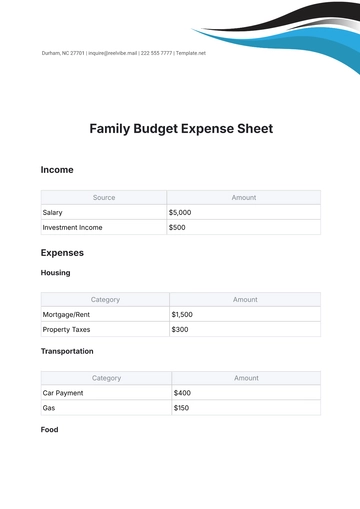

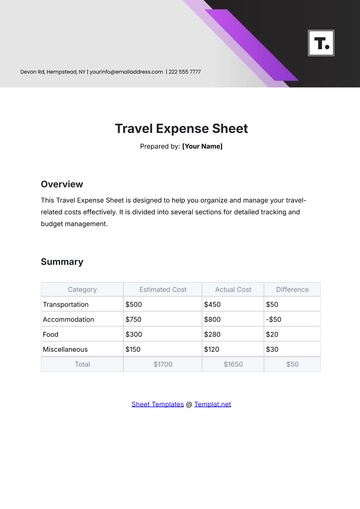

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

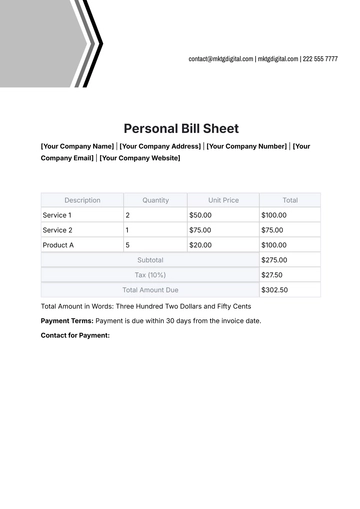

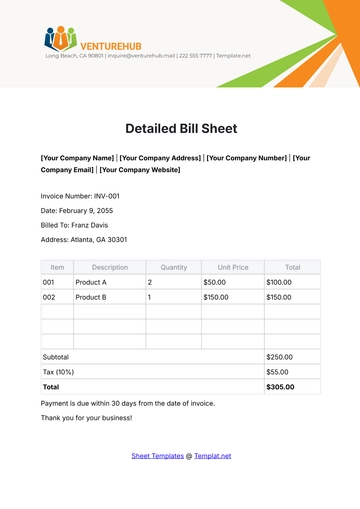

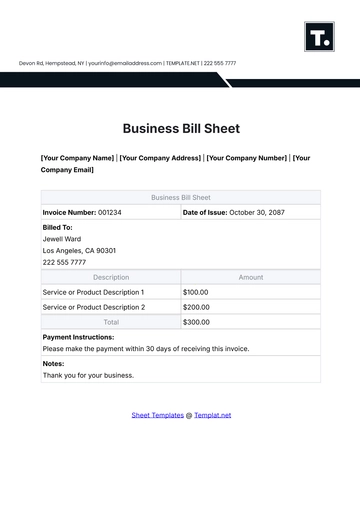

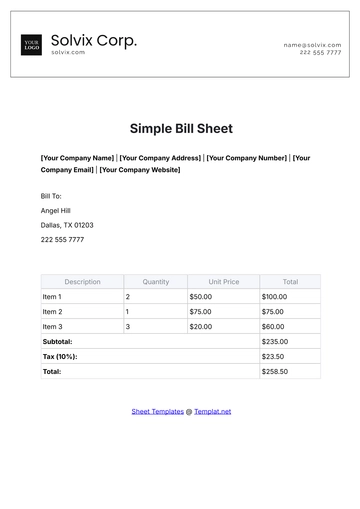

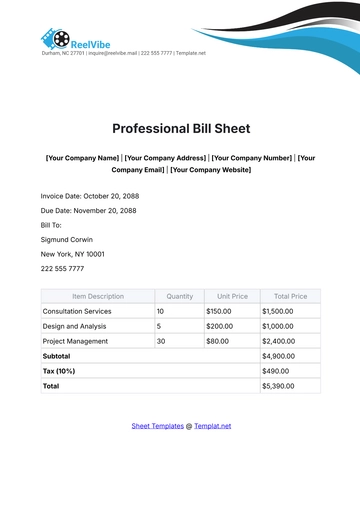

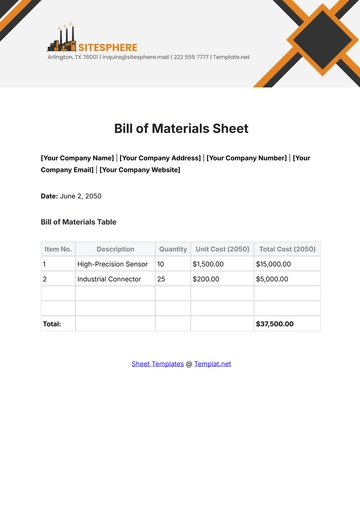

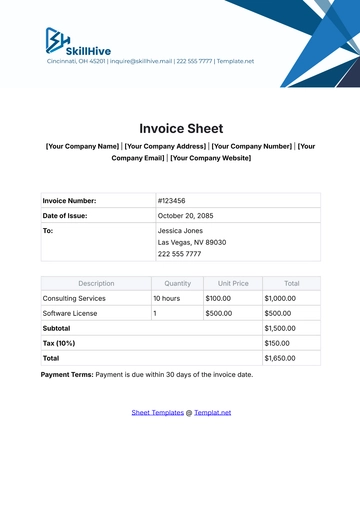

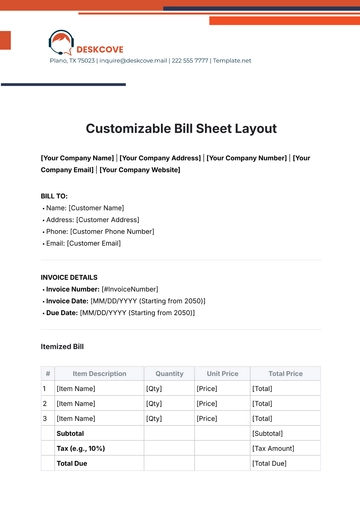

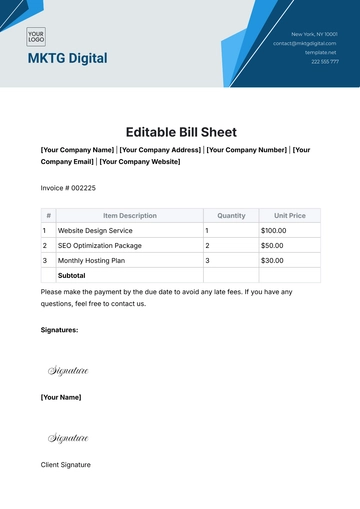

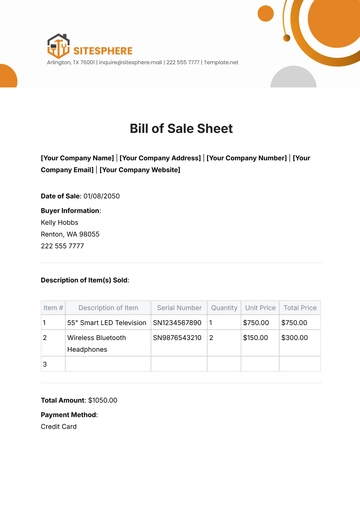

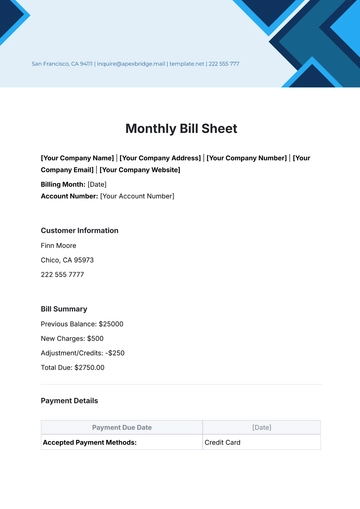

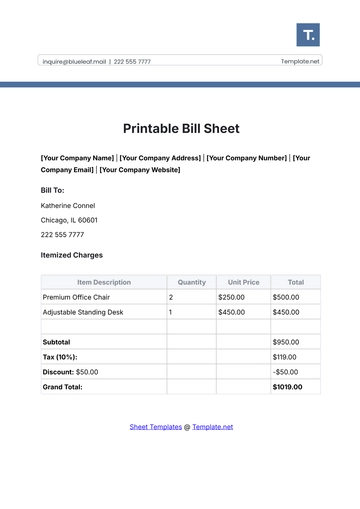

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

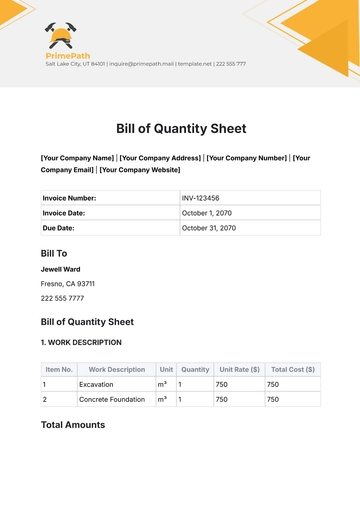

- Construction Sheet

- Cover Sheet

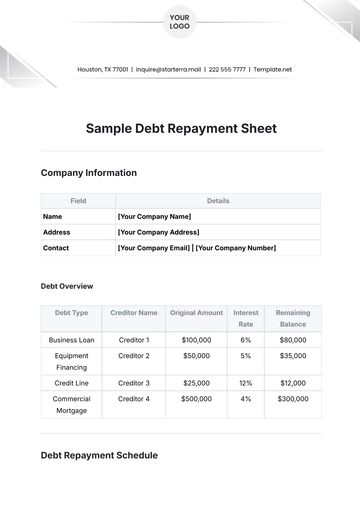

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

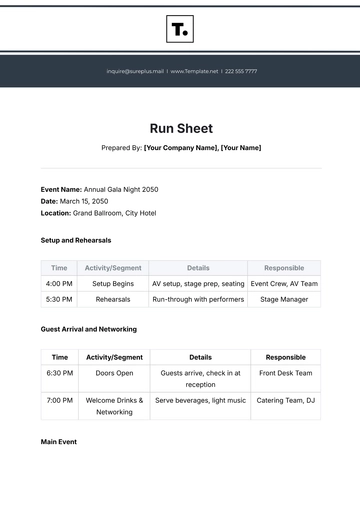

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

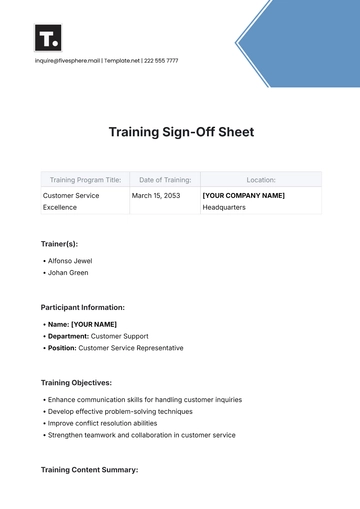

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet