Free Acquisition Finance Term Sheet

I. Introduction

In this section, XYZ Capital Ventures outlines the key terms and conditions for the financing of the acquisition of Sunshine Enterprises. The purpose of this term sheet is to provide a framework for the negotiation and execution of the financing arrangement between XYZ Capital Ventures and the borrower, specifying the loan amount, interest rate, repayment structure, collateral, and any contingencies.

II. Parties Involved

A. Lender: XYZ Capital Ventures

B. Borrower: Bright Future Holdings

III. Transaction Details

A. Acquisition Details:

Target Company: Sunshine Enterprises

Acquisition Amount: $50,000,000

Acquisition Purpose: Acquisition of Sunshine Enterprises to expand market presence in the renewable energy sector.

B. Financing Details:

Loan Amount: [$40,000,000]

Interest Rate: 4.5%

Term: 5 years

Repayment Structure:

Monthly installments of principal and interest.

A balloon payment of the remaining principal at the end of the term.

IV. Collateral

The following collateral will secure the loan provided by XYZ Capital Ventures:

All assets of Bright Future Holdings.

Personal guarantees from the major shareholders of Bright Future Holdings.

V. Contingencies

A. Due Diligence:

Comprehensive financial, legal, and operational due diligence to be conducted.

Deadline for completion: 60 days from the date of signing this term sheet.

B. Approvals:

Regulatory approvals from relevant authorities.

Shareholder approval from Bright Future Holdings.

VI. Conditions Precedent

A. Documentation:

Submission of audited financial statements of Bright Future Holdings for the past three years.

Execution of loan agreement and security documents.

B. Covenants:

Maintenance of certain financial ratios as agreed upon between XYZ Capital Ventures and Bright Future Holdings.

VII. Governing Law and Jurisdiction

This agreement shall be governed by and construed by the laws of the State of New York. Any disputes arising out of or in connection with this agreement shall be resolved exclusively by the courts of New York.

VIII. Confidentiality

All information exchanged between the parties during the negotiation and execution of this term sheet shall be treated as confidential and shall not be disclosed to any third party without the prior written consent of the other party.

IX. Miscellaneous

A. Amendments:

Any changes or adjustments made to this term sheet are required to be thoroughly documented in a written format and must also include the inclusion of signatures from both of the parties that are involved, for such modifications or alternations to be acknowledged as valid and legally binding.

B. Entire Agreement:

This term sheet constitutes the entire agreement between the parties concerning the subject matter hereof and supersedes all prior and contemporaneous agreements and understandings, whether written or oral.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance and Discover the Acquisition Finance Term Sheet Template from Template.net. Crafted for clarity and convenience, this editable and customizable document streamlines your financial negotiations. Seamlessly editable in our Ai Editor Tool, it empowers you to tailor terms effortlessly. Unlock precision and professionalism with this indispensable asset for your acquisition endeavors.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

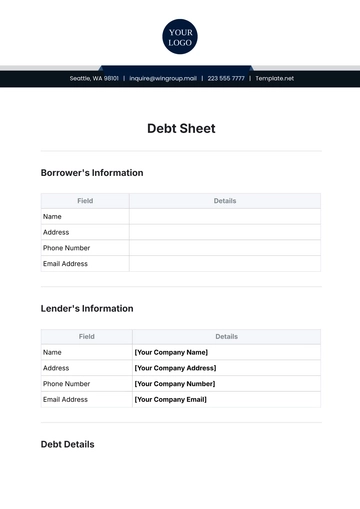

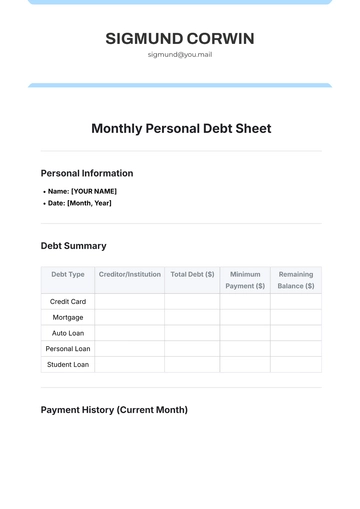

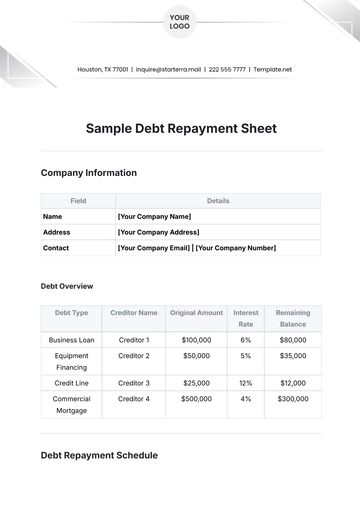

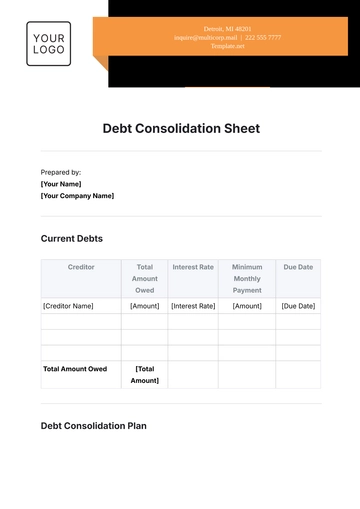

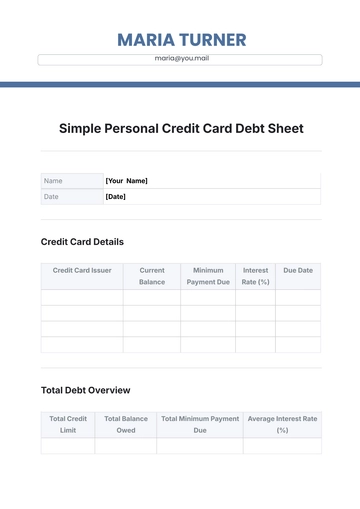

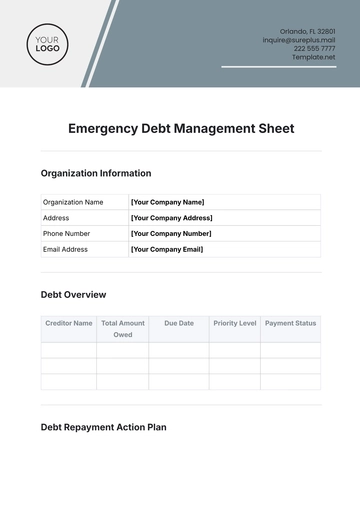

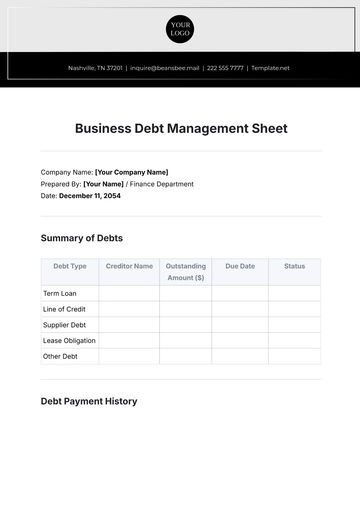

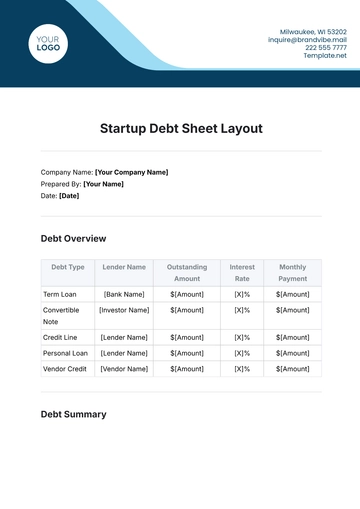

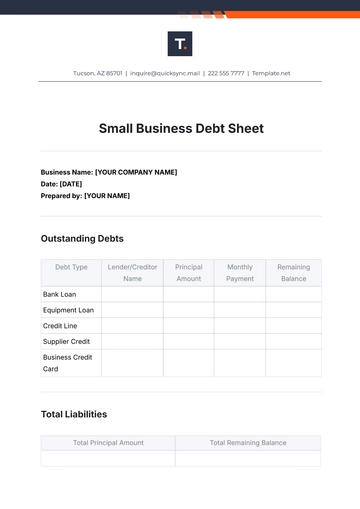

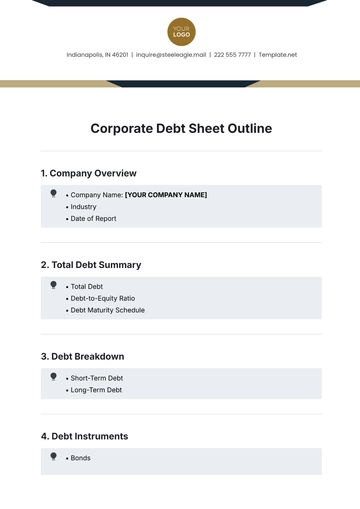

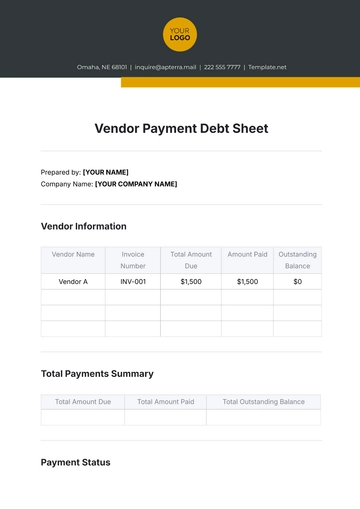

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

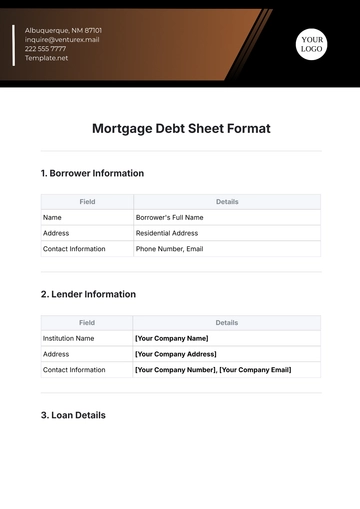

- Mortgage Sheet

- Answer Sheet

- Excel Sheet