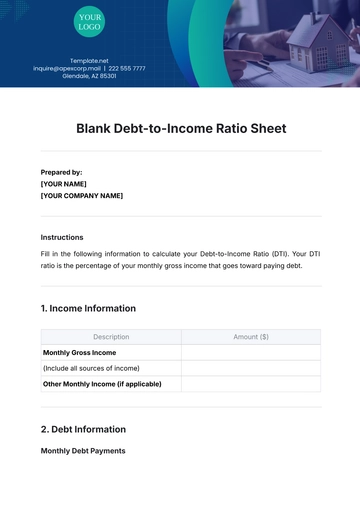

Free Blank Debt-to-Income Ratio Sheet

Prepared by:

[YOUR NAME]

[YOUR COMPANY NAME]

Instructions

Fill in the following information to calculate your Debt-to-Income Ratio (DTI). Your DTI ratio is the percentage of your monthly gross income that goes toward paying debt.

1. Income Information

Description | Amount ($) |

|---|---|

Monthly Gross Income | |

(Include all sources of income) | |

Other Monthly Income (if applicable) |

2. Debt Information

Monthly Debt Payments

Debt Type | Monthly Payment ($) |

|---|---|

Mortgage/Rent | |

Car Loan | |

Credit Card Payments | |

Student Loans | |

Personal Loans | |

Other Debts (specify) |

3. Debt-to-Income Ratio Calculation

Description | Amount ($) |

|---|---|

Total Monthly Debt Payments | |

(Sum of all debt payments) | |

Total Monthly Income | |

(Sum of all income sources) | |

Debt-to-Income Ratio (%) |

4. DTI Calculation Formula

DTI Ratio = (Total Monthly Debt Payments / Total Monthly Gross Income) × 100

Result

A DTI ratio of 36% or less is generally considered good by lenders.

A DTI ratio above 36% may indicate financial strain, which could affect loan eligibility.

Note

If you need further assistance in interpreting or improving your DTI ratio, consider consulting with a financial advisor.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Blank Debt-to-Income Ratio Sheet Template from Template.net is an editable and customizable tool designed to help you calculate and track your debt-to-income ratio. Easily personalize the template to suit your financial needs. Editable in our Ai Editor Tool, it allows quick adjustments to the layout and data for efficient financial management.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

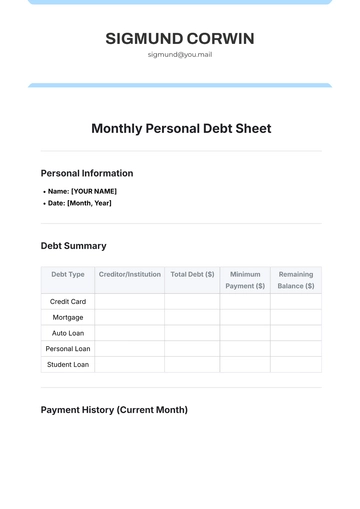

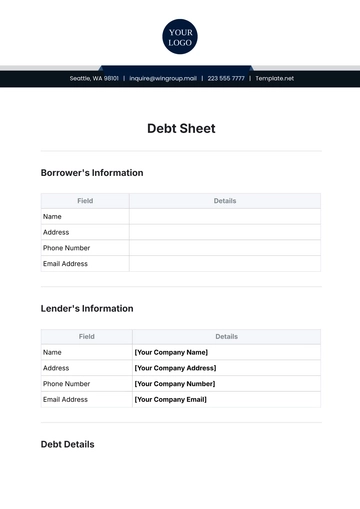

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet