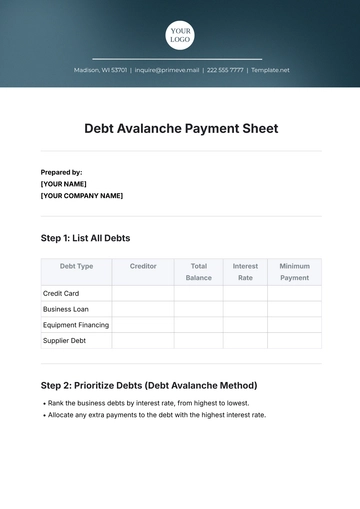

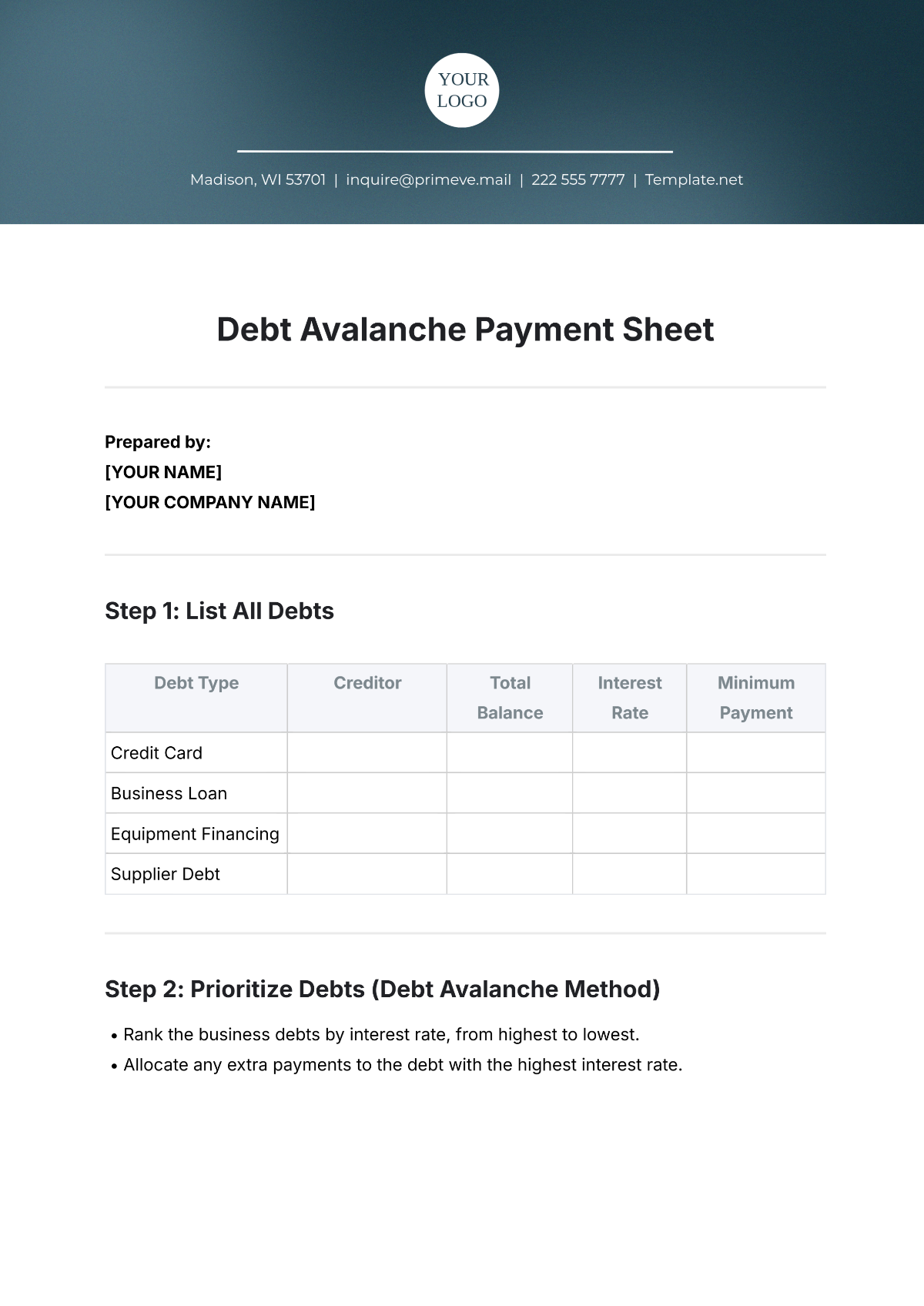

Free Debt Avalanche Payment Sheet

Prepared by:

[YOUR NAME]

[YOUR COMPANY NAME]

Step 1: List All Debts

Debt Type | Creditor | Total Balance | Interest Rate | Minimum Payment |

|---|---|---|---|---|

Credit Card | ||||

Business Loan | ||||

Equipment Financing | ||||

Supplier Debt |

Step 2: Prioritize Debts (Debt Avalanche Method)

Rank the business debts by interest rate, from highest to lowest.

Allocate any extra payments to the debt with the highest interest rate.

Rank | Debt Type | Creditor | Interest Rate | Total Payment |

|---|---|---|---|---|

1 | ||||

2 | ||||

3 | ||||

4 | ||||

5 |

Step 3: Debt Repayment Schedule

Month | Debt Type | Total Payment | Amount Paid | Remaining Balance |

|---|---|---|---|---|

Step 4: Progress Tracker

Month | Amount Paid | Total Remaining Debt | Debt Paid Off | Remaining Debts |

|---|---|---|---|---|

Tips for Success

Pay More Than the Minimum: Whenever possible, make extra payments on the debt with the highest interest rate to reduce it faster.

Stay Consistent: Maintain the payment schedule each month and adjust only when necessary.

Reassess Regularly: Evaluate your repayment progress every 3 to 6 months and make adjustments to your strategy as needed.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

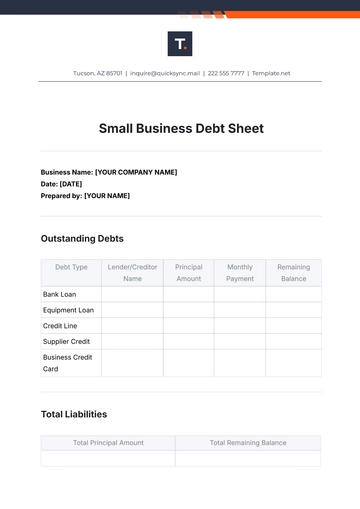

The Debt Avalanche Payment Sheet Template from Template.net is an editable and customizable tool designed to help you efficiently pay off debt using the debt avalanche method. Tailor the template to your financial needs. Editable in our Ai Editor Tool, it allows for quick modifications, ensuring an organized and effective approach to debt repayment.

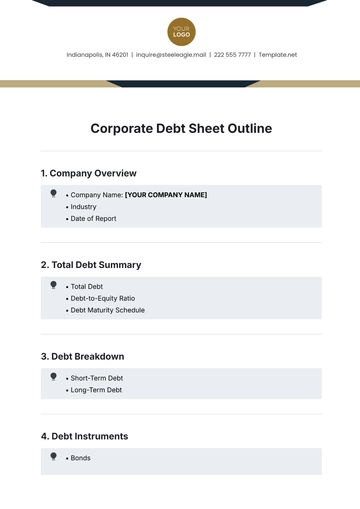

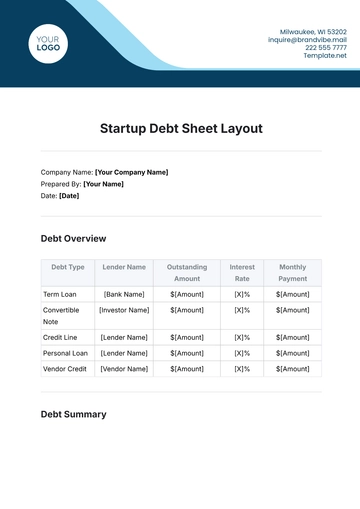

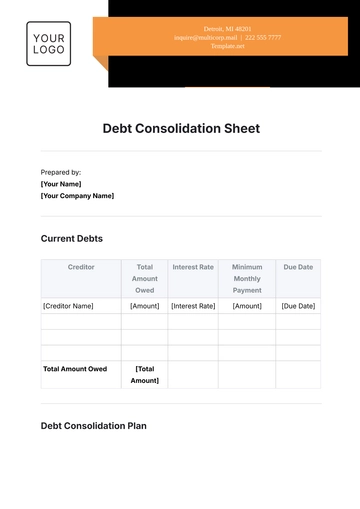

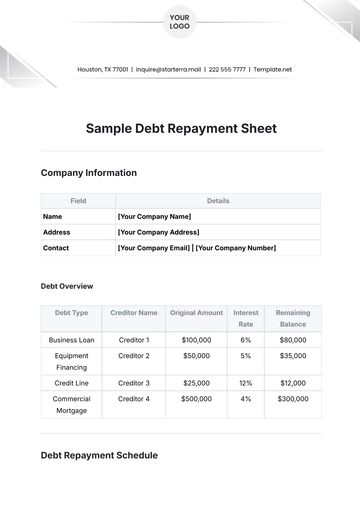

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

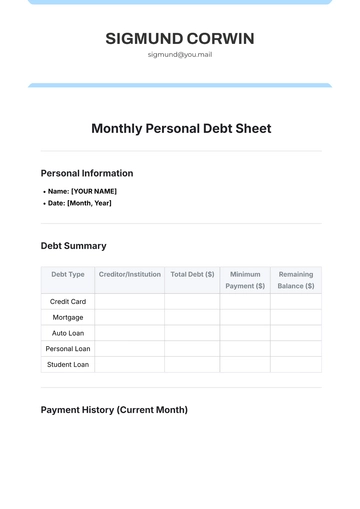

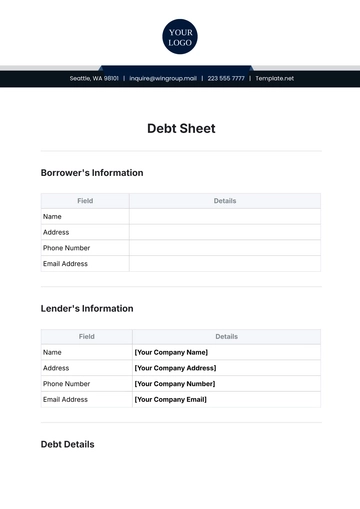

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet