Free Customer Investment Profile

Prepared By: | [YOUR NAME] |

Company: | [YOUR COMPANY NAME] |

Address: | [YOUR COMPANY ADDRESS] |

Date Prepared: | [DATE] |

I. Overview

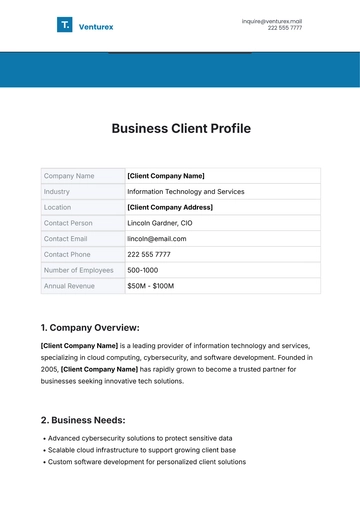

Creating a detailed overview of a customer's investment history, preferences, and behavior is essential for effective financial planning and investment strategies. This comprehensive Customer Investment Profile aims to gather detailed information about clients, enabling tailored financial guidance and personalized recommendations. By understanding the client's financial background, objectives, risk tolerance, and goals, financial advisors can provide targeted advice to help clients achieve their financial aspirations effectively.

This includes sections for Personal Information, Financial Background, Investment Profile, and Additional Information. Under Personal Information, basic details such as name, date of birth, and contact information are collected. The Financial Background section delves into income details, assets, and liabilities, providing a comprehensive snapshot of the client's financial situation. Investment Profile covers objectives, risk tolerance, preferences, and goals, guiding advisors in crafting suitable investment strategies. Finally, the Additional Information section allows clients to disclose any special considerations or provide additional financial details, ensuring a holistic understanding of their financial circumstances.

This serves as a structured framework for gathering crucial information, facilitating meaningful client-advisor interactions, and delivering tailored financial solutions that align with clients' unique needs and aspirations.

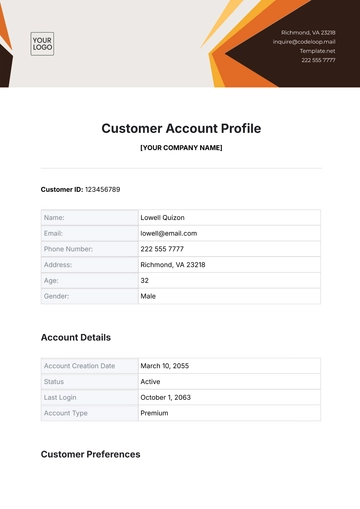

II. Personal Information

A. Basic Details

Client Name: John Doe

Date of Birth: January 1, 2050

Gender: Male

Marital Status: Married

Dependents: 2

B. Contact Information

Address: 123 Main Street, Anytown, USA

Phone Number: (555) 123-4567

Email Address: john.doe@example.com

III. Financial Background

A. Income Details

Occupation: Software Engineer

Employer: XYZ Tech Inc.

Annual Income: $120,000

Source(s) of Income: Salary, Investments

B. Assets

1. Liquid Assets

Asset Type | Value |

|---|---|

Cash | $20,000 |

Savings Accounts | $30,000 |

Money Market Funds | $15,000 |

Treasury Securities | $25,000 |

Other Liquid Assets | $10,000 |

2. Investment Assets

Asset Type | Value |

|---|---|

Stocks | $50,000 |

Bonds | $40,000 |

Mutual Funds | $35,000 |

ETFs | $20,000 |

Retirement Accounts | $100,000 |

C. Liabilities

Mortgages: $200,000

Auto Loans: $15,000

Credit Card Debt: $5,000

Other Debts: Personal Loan - $10,000

IV. Investment Profile

A. Investment Objectives

Primary Objective: Retirement Planning

Secondary Objective(s): Wealth Accumulation, Education Funding

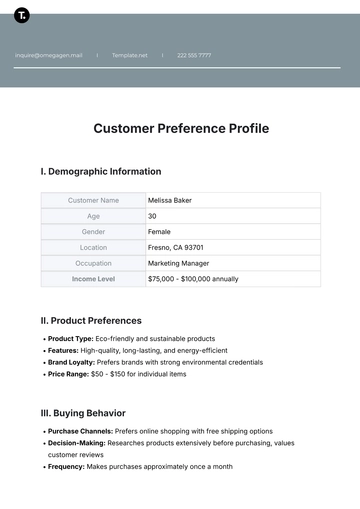

B. Investment Preferences

Asset Allocation Preference: Balanced Portfolio

Sector Preferences: Technology, Healthcare

Investment Style: Growth Investing

C. Financial Goals

Short-Term Goals: Family Vacation in 2 years

Medium-Term Goals: College Fund for Children in 10 years

Long-Term Goals: Retirement at age 65

V. Risk Analysis

A. Risk Profile

Risk Tolerance: Moderate

Risk Capacity: High

Risk Perception: Cautious optimism

B. Risk Management Strategy

Diversification: Balanced portfolio across sectors

Insurance Coverage: Life insurance, Health insurance

Emergency Fund: 6 months of living expenses

VI. Communication Preferences

Preferred Communication Channel: Email

Frequency of Updates: Quarterly

Preferred Language: English

VII. Additional Information

Special Considerations: None

Other Financial Information: No significant debts beyond what's listed

Documentation Provided: Recent Tax Returns, Investment Statements

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Customer Investment Profile Template from Template.net! Crafted with precision, it's your go-to solution for profiling customer investments. This editable and customizable template ensures tailored insights effortlessly. Need more? It's editable in our AI Editor too, empowering you to refine with ease. Elevate your customer analysis game today with this versatile tool!