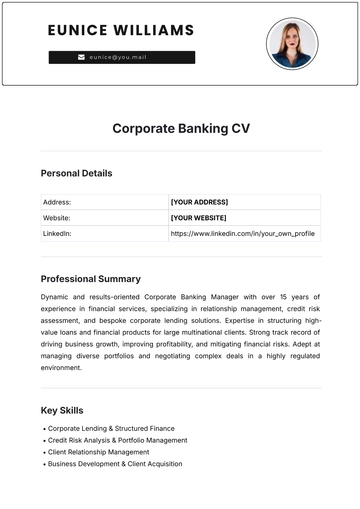

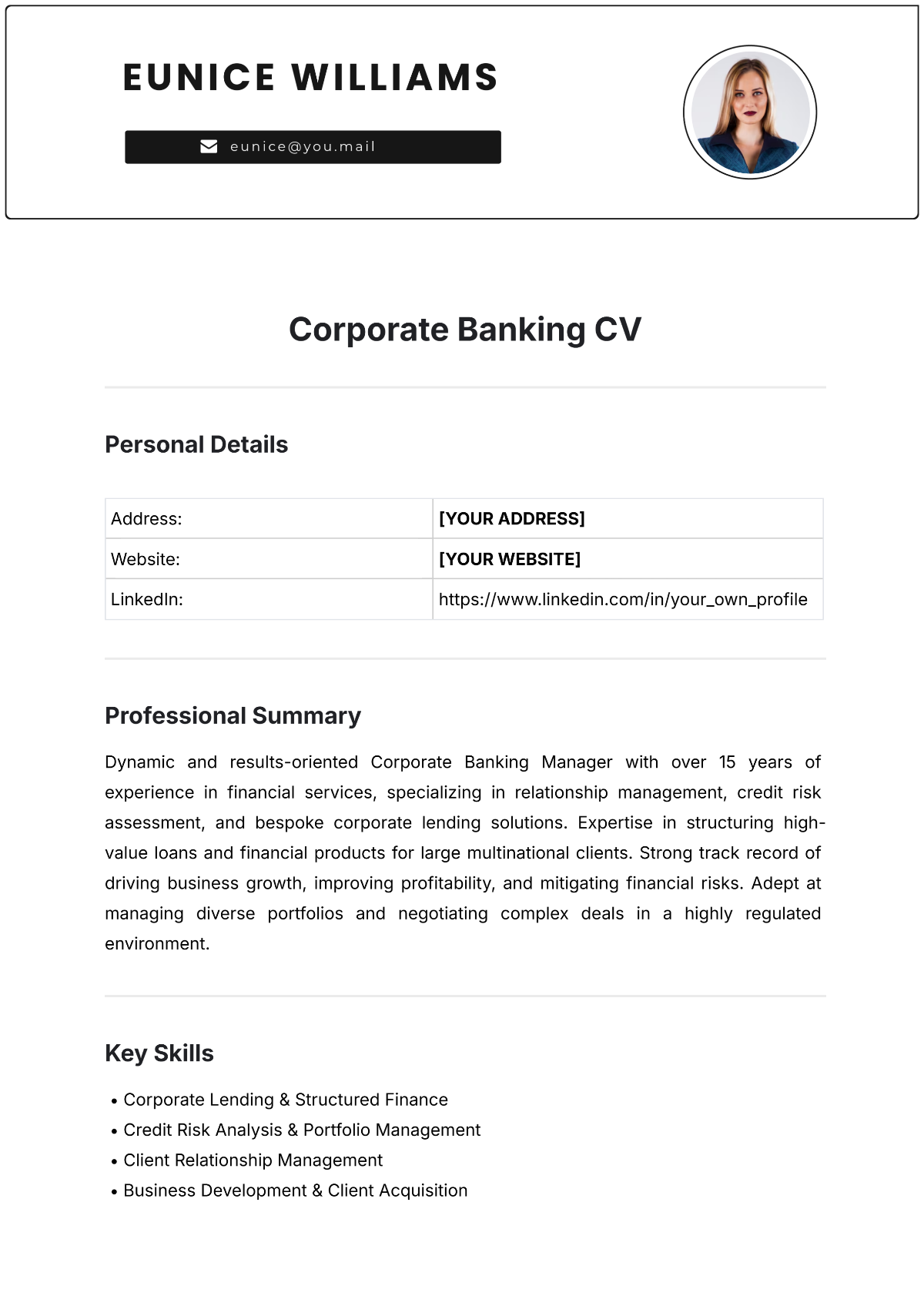

Free Corporate Banking CV

Personal Details

Address: | [YOUR ADDRESS] |

Website: | [YOUR WEBSITE] |

LinkedIn: | https://www.linkedin.com/in/your_own_profile |

Professional Summary

Dynamic and results-oriented Corporate Banking Manager with over 15 years of experience in financial services, specializing in relationship management, credit risk assessment, and bespoke corporate lending solutions. Expertise in structuring high-value loans and financial products for large multinational clients. Strong track record of driving business growth, improving profitability, and mitigating financial risks. Adept at managing diverse portfolios and negotiating complex deals in a highly regulated environment.

Key Skills

Corporate Lending & Structured Finance

Credit Risk Analysis & Portfolio Management

Client Relationship Management

Business Development & Client Acquisition

Financial Modeling & Forecasting

Debt Syndication & Negotiation

Regulatory Compliance & Risk Mitigation

Cross-functional Team Leadership

Professional Experience

Senior Corporate Banking Relationship Manager

Global Trust Bank, New York, USA

January 2045 – April 2052

Lead a team managing a portfolio of over 100 corporate clients with total loan assets exceeding $2.5 billion.

Develop customized lending solutions, including revolving credit lines, trade finance, and term loans for multinational corporations in various industries such as technology, manufacturing, and energy.

Analyze financial statements, market trends, and economic conditions to assess creditworthiness and ensure compliance with internal risk frameworks.

Drive client acquisition efforts, resulting in a 30% increase in the number of new corporate clients over the last 5 years.

Successfully negotiated and closed syndicated financing deals worth up to $500 million, ensuring favorable terms for both the bank and clients.

Collaborate with cross-functional teams, including legal, risk, and treasury, to deliver end-to-end banking solutions.

Key Achievements:

Structured a $350 million syndicated loan for a renewable energy firm, expanding the bank’s footprint in sustainable projects.

Spearheaded the implementation of a new credit risk management system, reducing loan approval time by 25% and increasing team efficiency.

Corporate Banking Associate

Capital Partners Bank, New York, USA

June 2037 – December 2044

Assisted senior relationship managers in managing a portfolio of mid-market corporate clients, analyzing credit risk, and structuring financial products such as working capital facilities and trade finance.

Conducted financial due diligence, credit reviews, and market research for corporate clients seeking new loans or refinancing existing debt.

Monitored loan performance and assisted in risk mitigation strategies, helping to reduce non-performing loans by 15% within 2 years.

Provided advisory support to clients on debt restructuring and financial optimization strategies.

Key Achievements:

Played a key role in a $200 million debt restructuring deal for a large manufacturing company, resulting in a more sustainable financial outlook for the client and reducing the bank's exposure to risk.

Recognized with the “Rising Star” award for consistent performance and contribution to the bank’s corporate portfolio growth.

Education

Master of Business Administration (MBA), Finance

Harvard Business School, Boston, USA

Graduated: June 2037

Bachelor of Science in Economics

University of California, Berkeley, Berkeley, USA

Graduated: May 2034

Certifications

Chartered Financial Analyst (CFA), Level III

Certified Corporate Banker (CCB)

Financial Risk Manager (FRM)

Technical Skills

Financial Analysis Software: Bloomberg Terminal, FactSet

Customer Relationship Management (CRM) Tools: Salesforce, Microsoft Dynamics

Microsoft Excel (Advanced), PowerPoint, Word

Programming: Python (for financial modeling)

Languages

English (Fluent)

Spanish (Proficient)

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Excel in banking roles with Template.net’s Corporate Banking CV Template. Customizable and editable, it highlights financial expertise, experience, and key achievements. Editable in our AI Editor Tool, this template ensures a professional and impactful presentation. Download now to impress corporate recruiters.