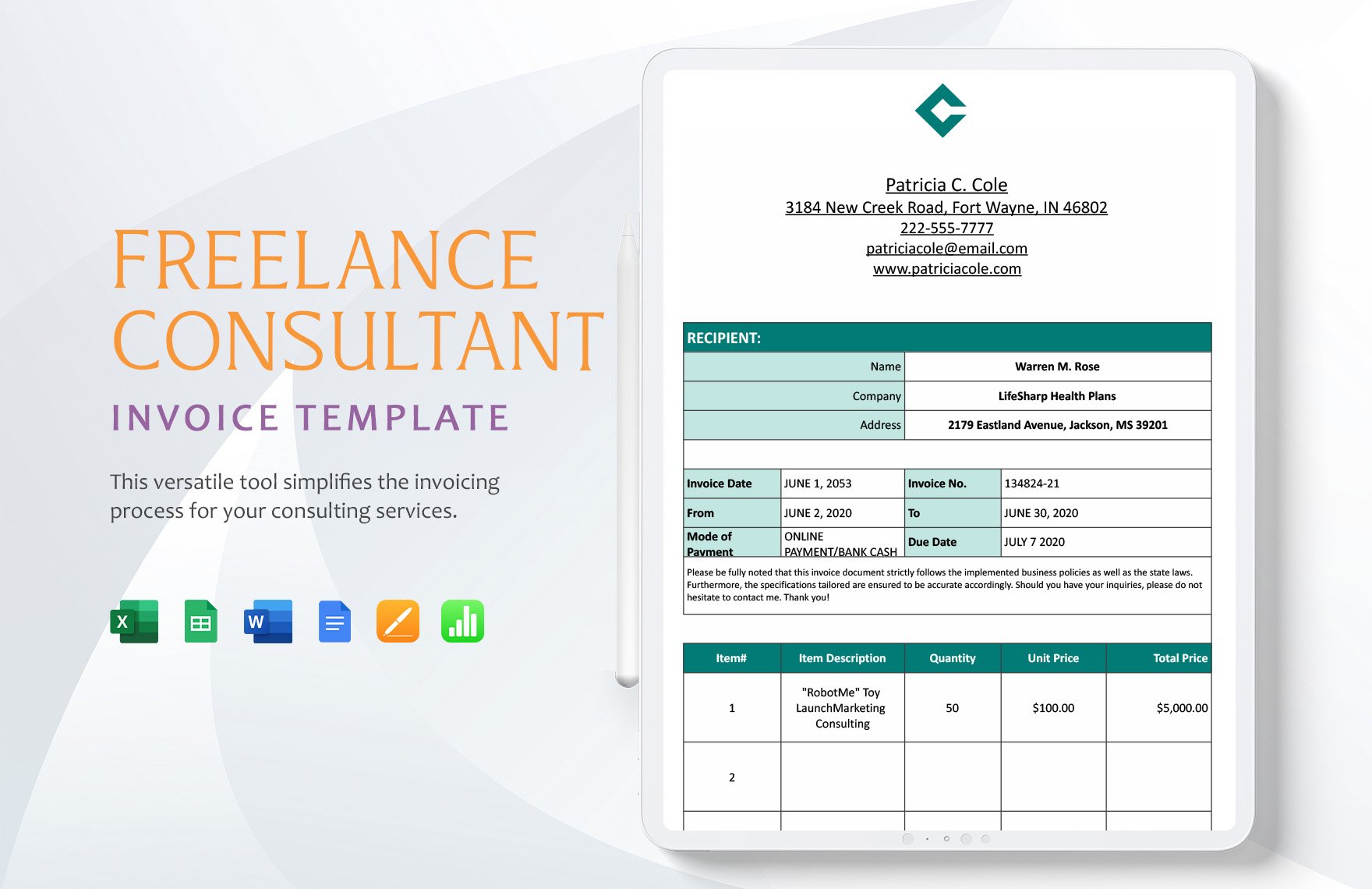

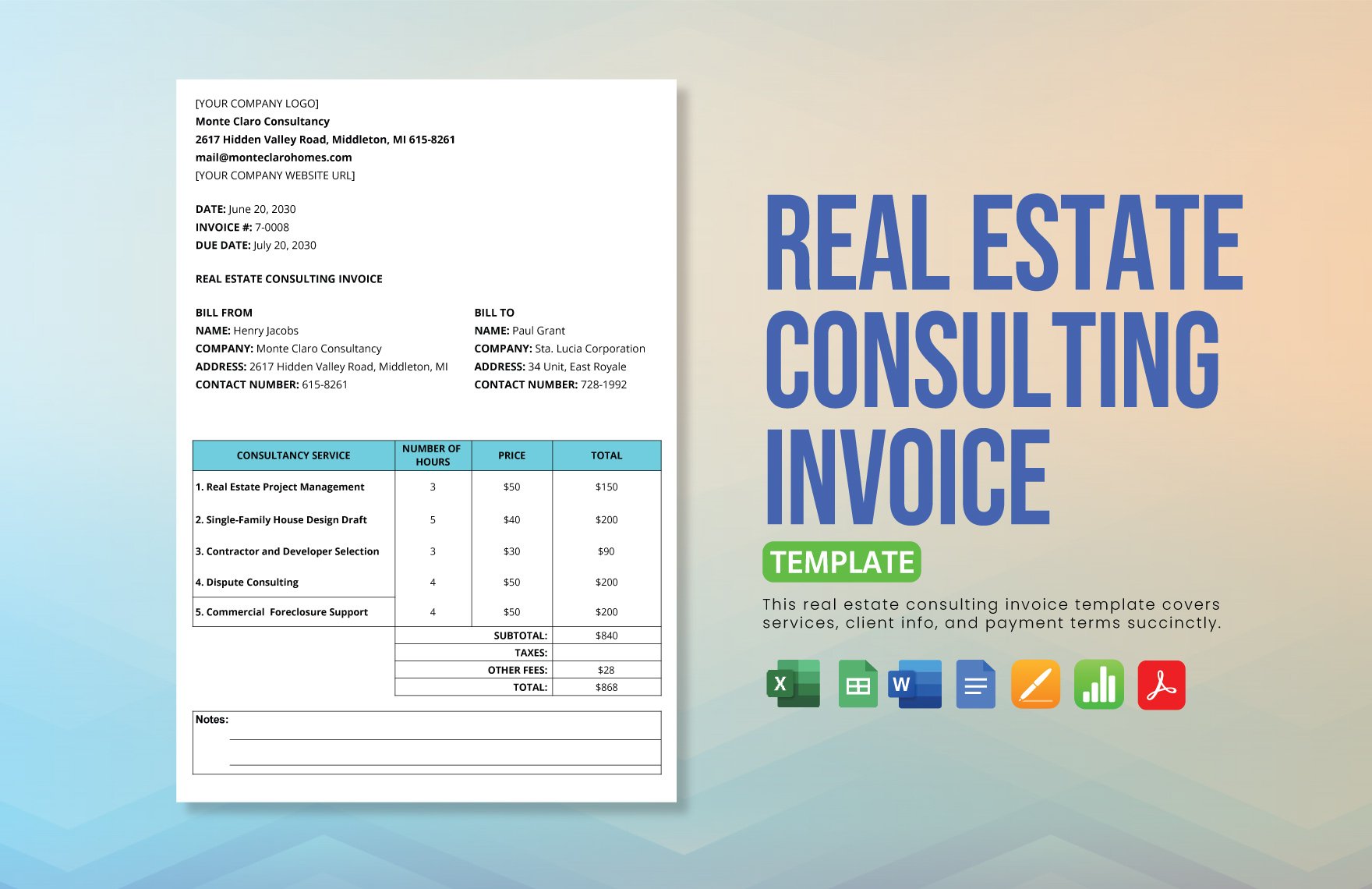

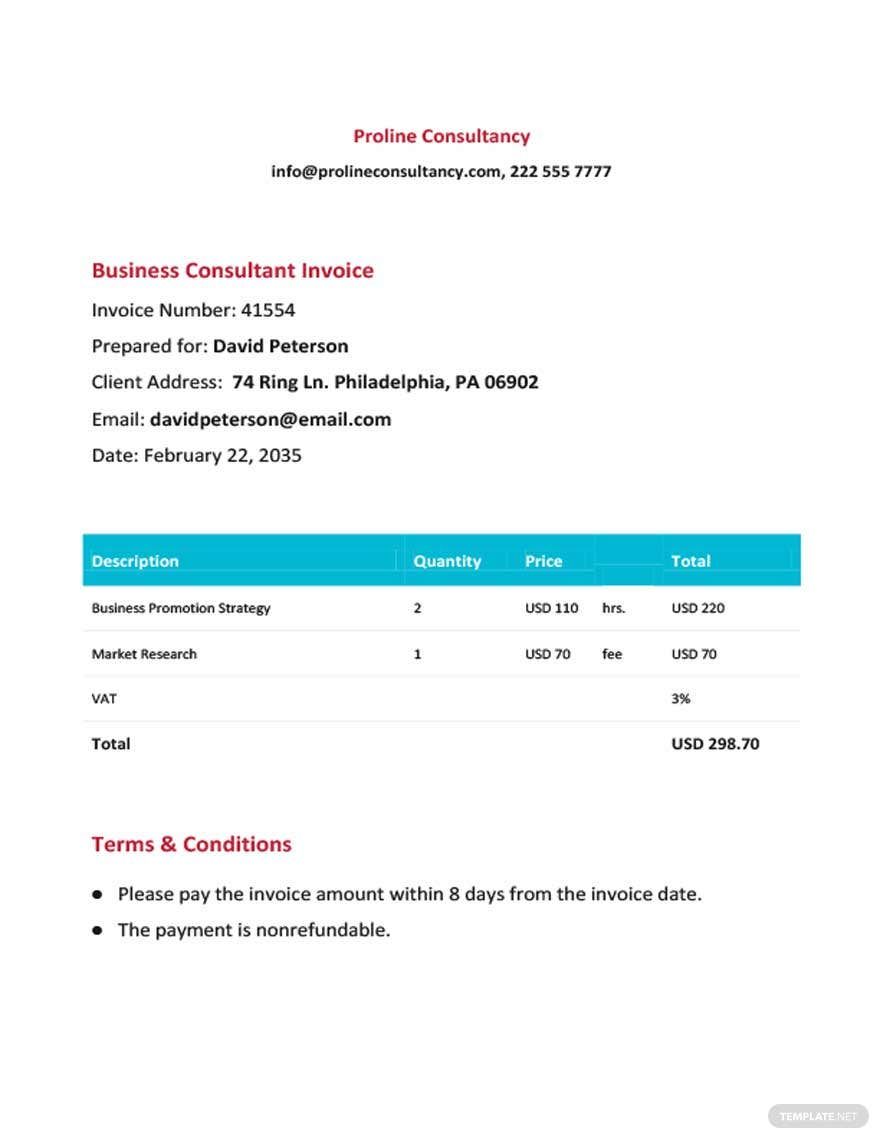

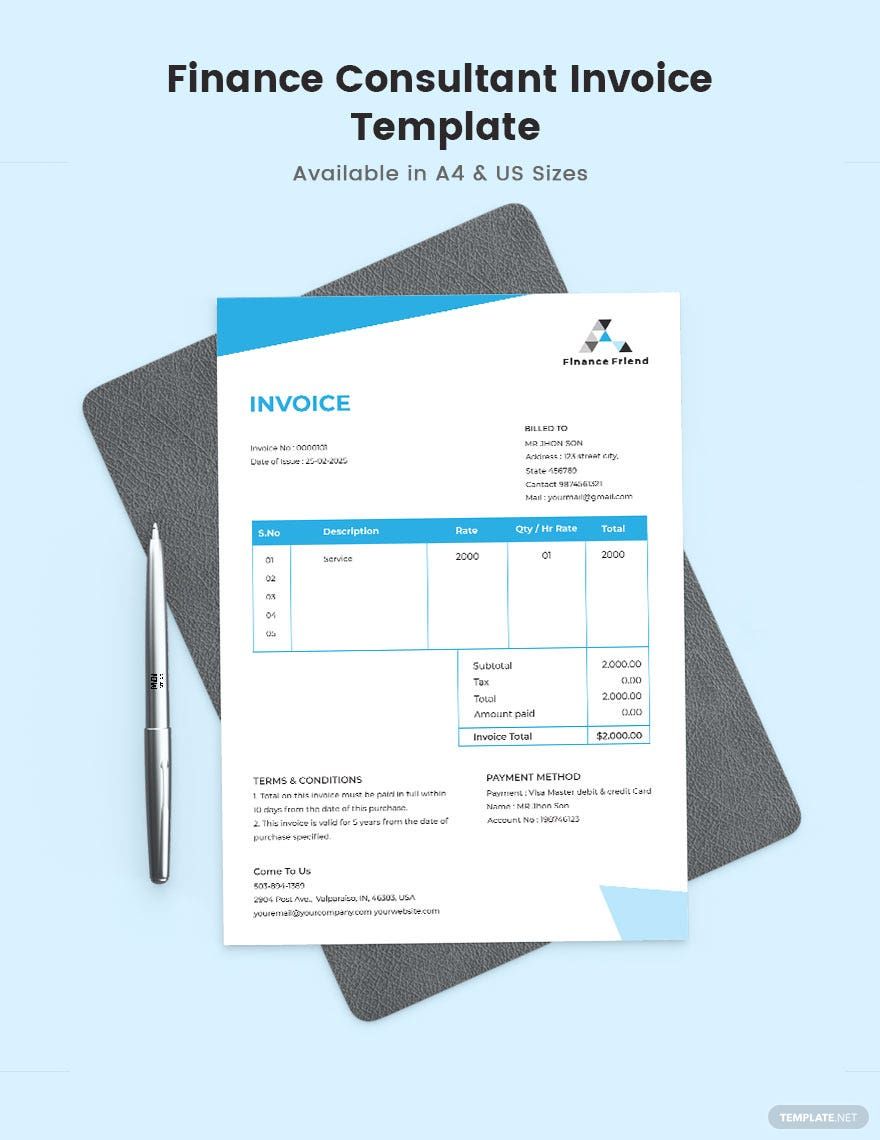

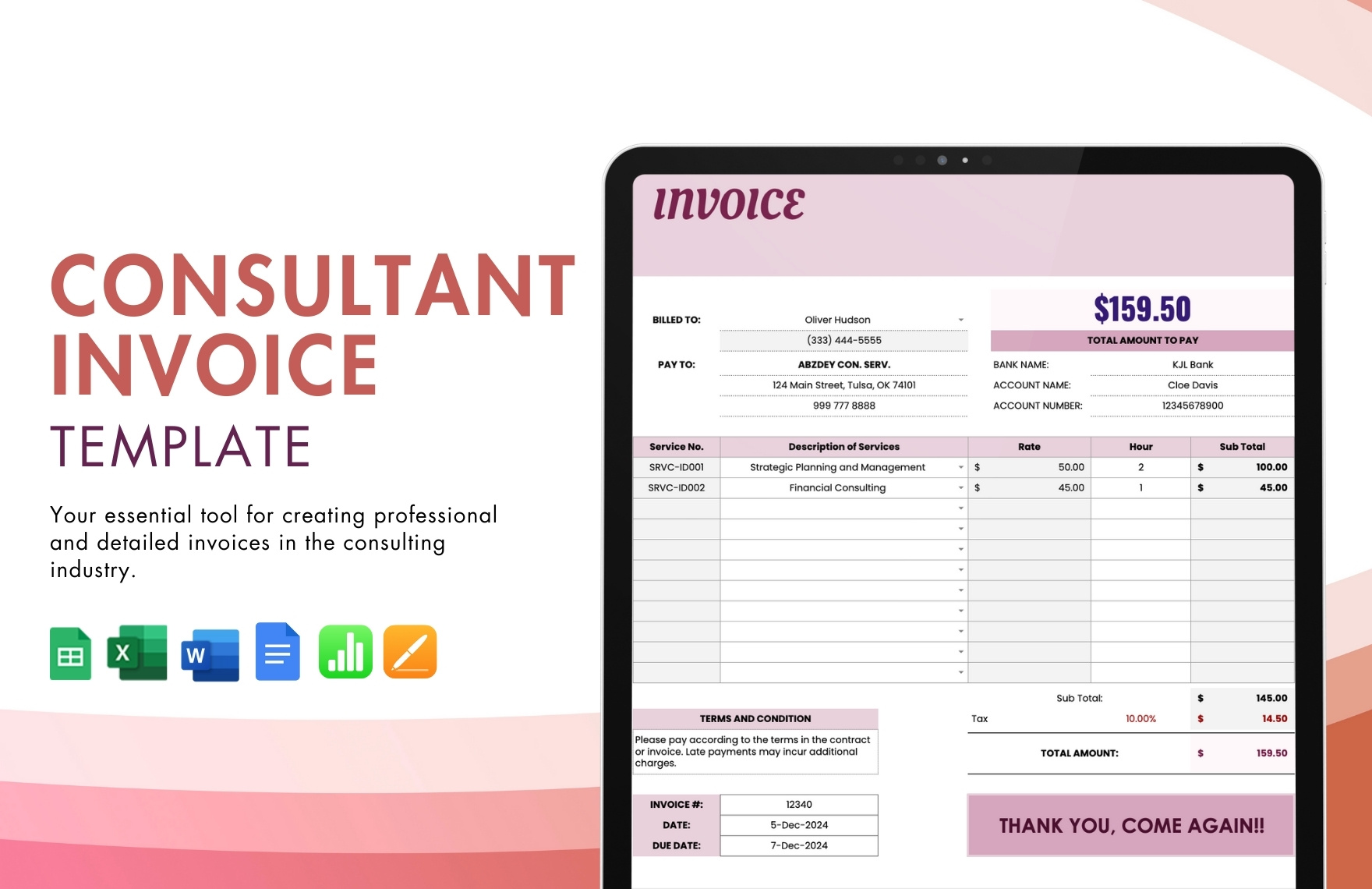

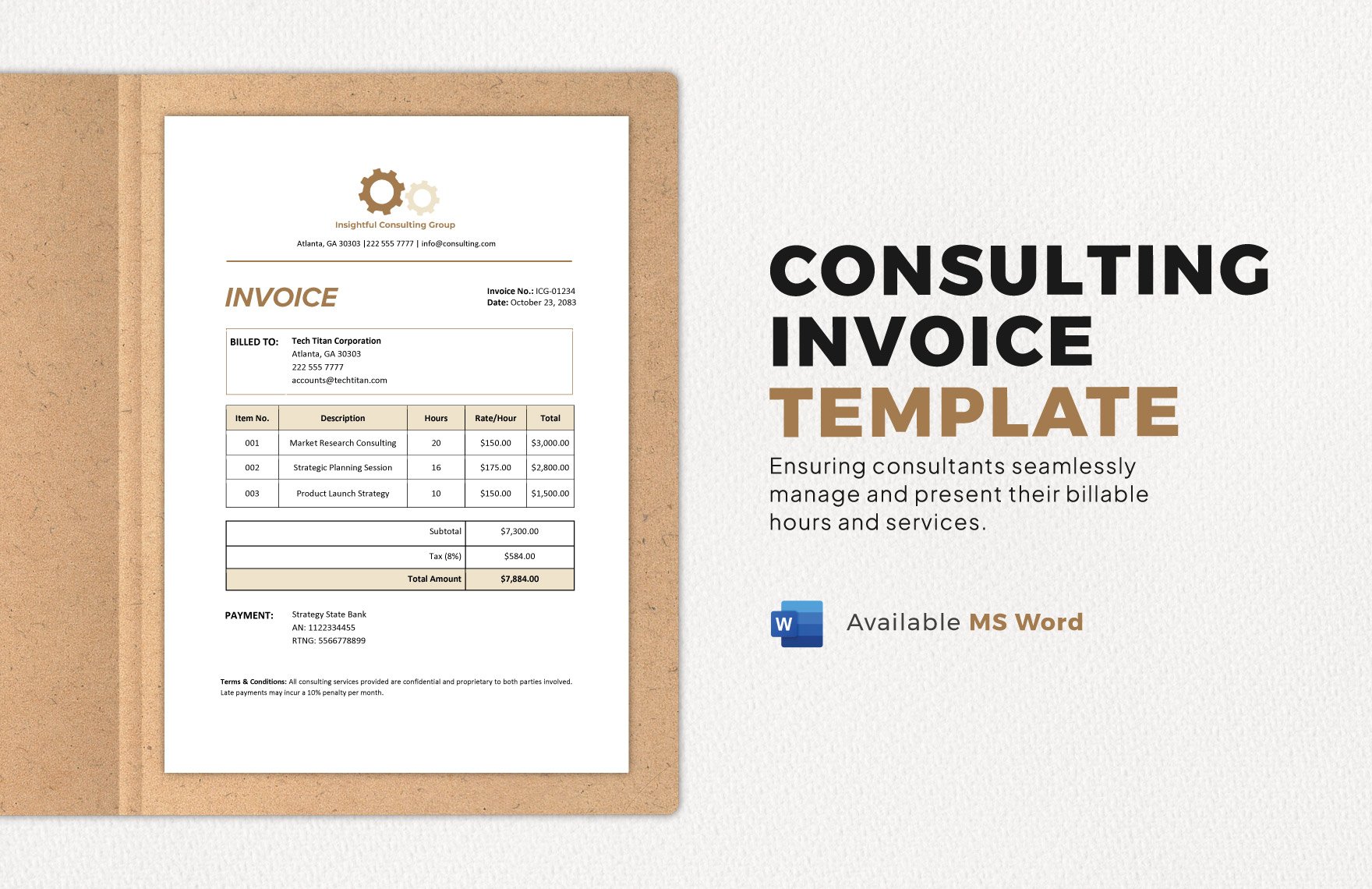

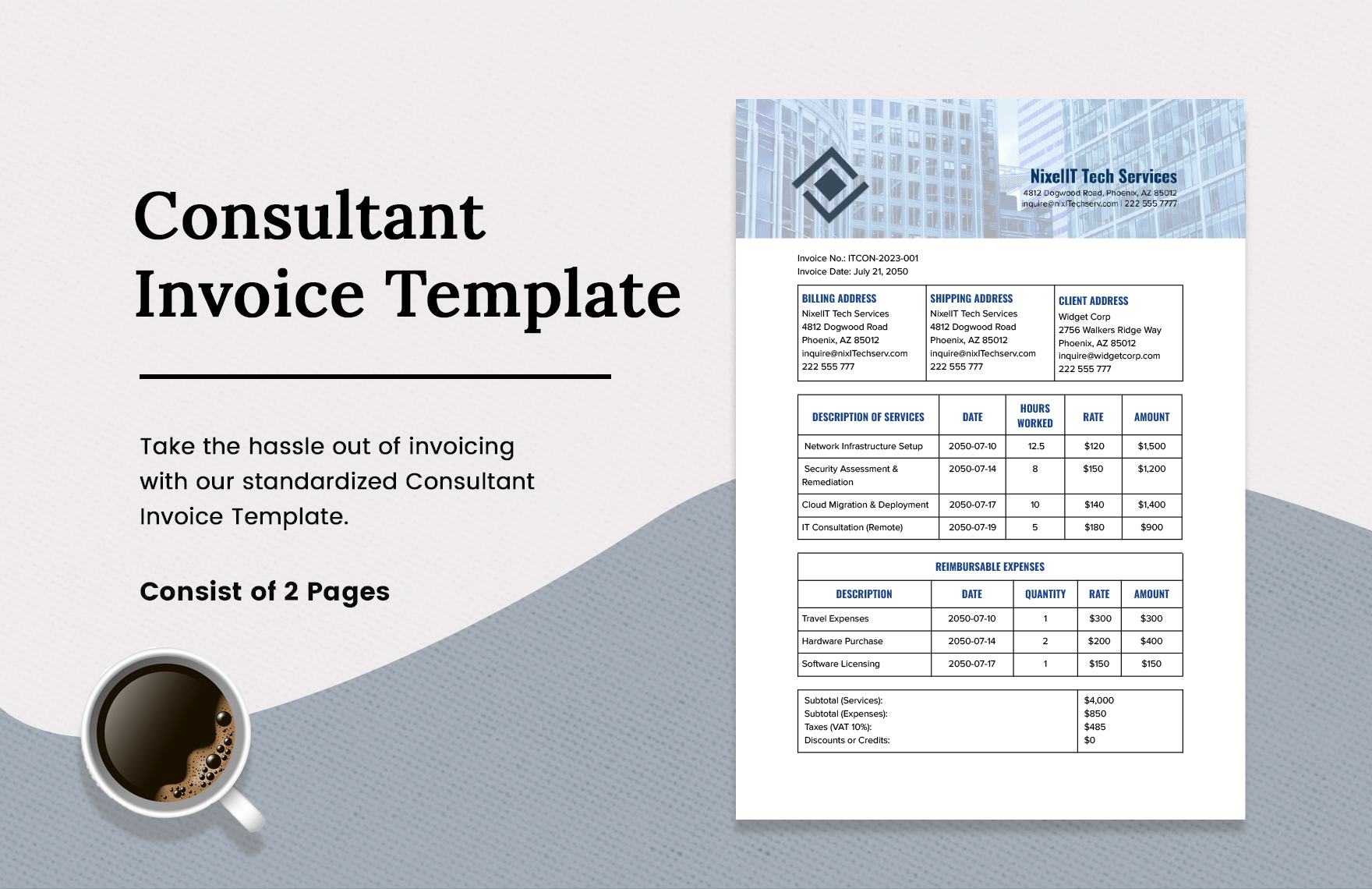

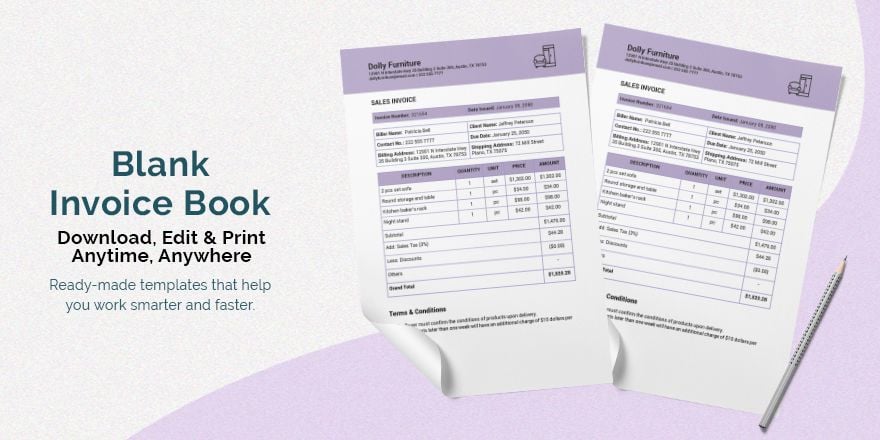

Are you new to consulting? Then you probably don't have an invoice to charge your clients yet. How you bill your clients depends on your consulting skills and agreement. Set the right amount of charges with your clients and give them the perfect consulting invoice with these ready-made consulting invoice templates. Blank consulting invoice, legal consulting invoice, consulting services invoice, consulting fee invoice, consulting timesheet invoice, and business consulting invoice, we have it all. Professionally written and editable in Google Docs, Google Sheets, MS Excel, MS Word, Numbers, and Apple Pages formats to save your time. 100% customizable to ensure an effective and satisfying content. Download now and keep track of your business's profit.

What Is a Consulting Invoice?

A consulting invoice is a document that allows professional consultants to provide consulting services to their clients. This provides an itemized statement of their services and is presented before or after the consulting services are performed.

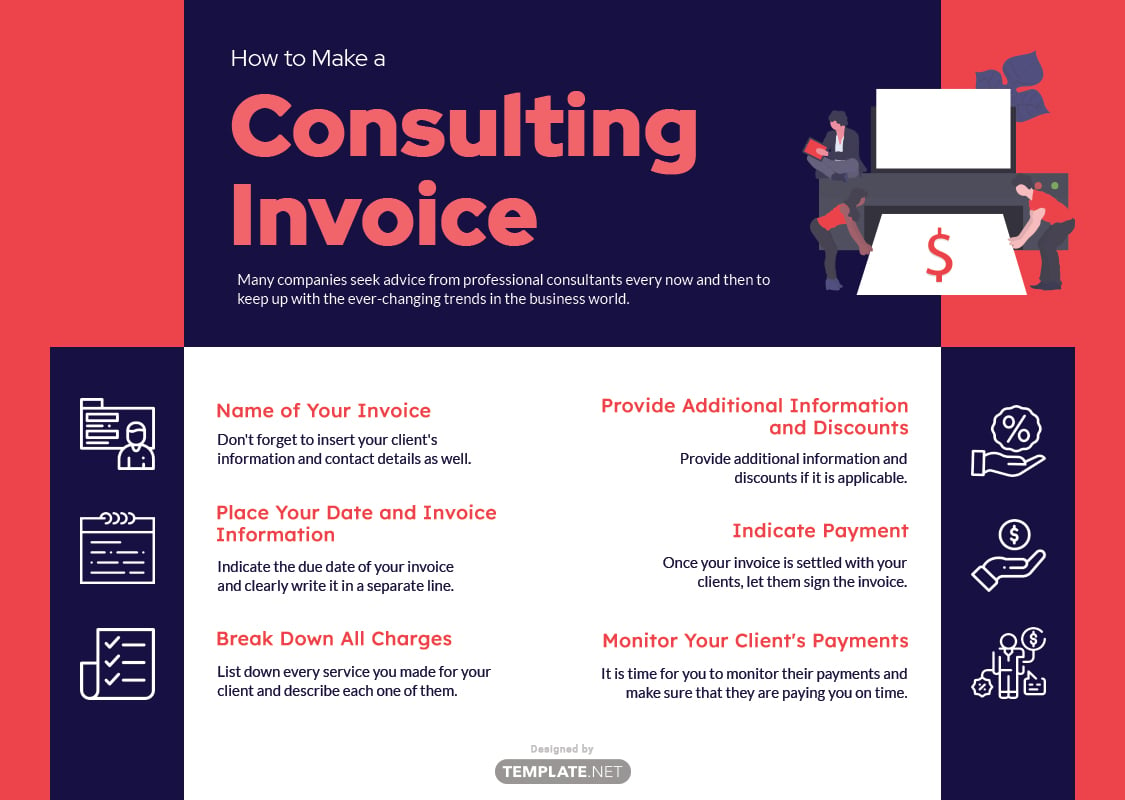

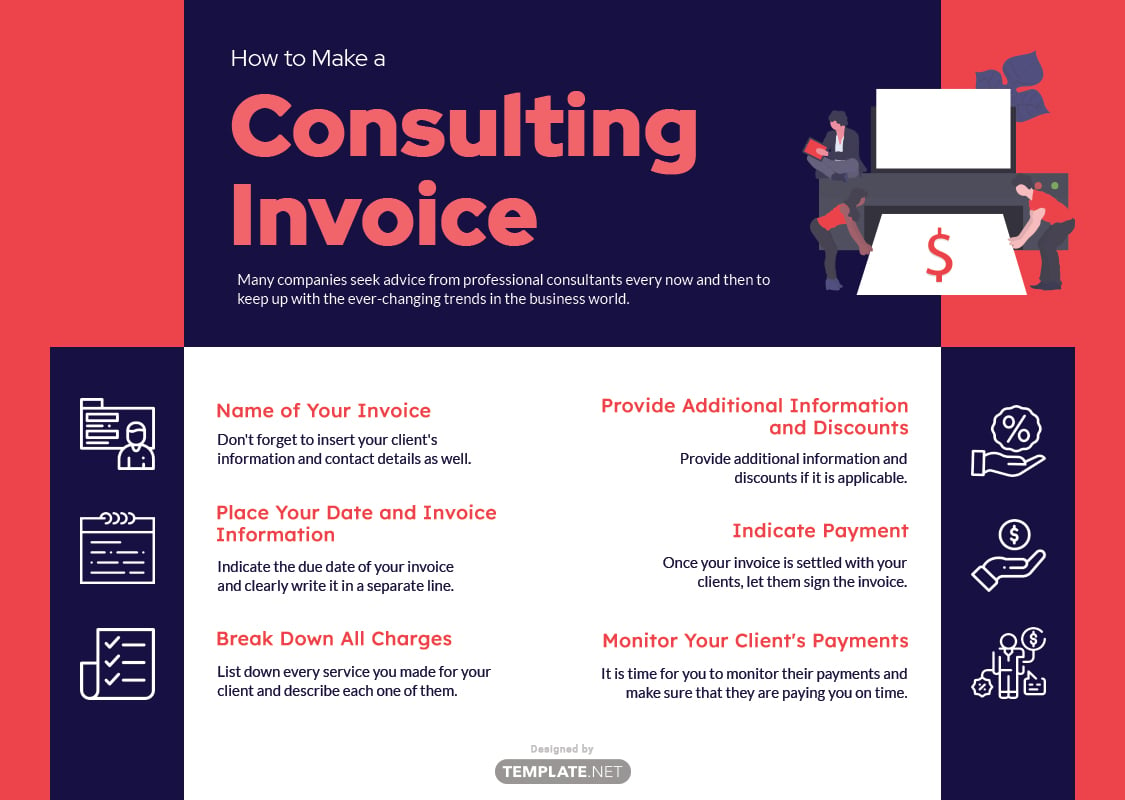

How to Make a Consulting Invoice

Many companies seek advice from professional consultants every now and then to keep up with the ever-changing trends in the business world. Industries who had business consultants had a higher chance of having a higher success rate than those who don't. For consultants like yourselves, creating an invoice is a good way to keep track of your payments.

1. Name of Your Invoice

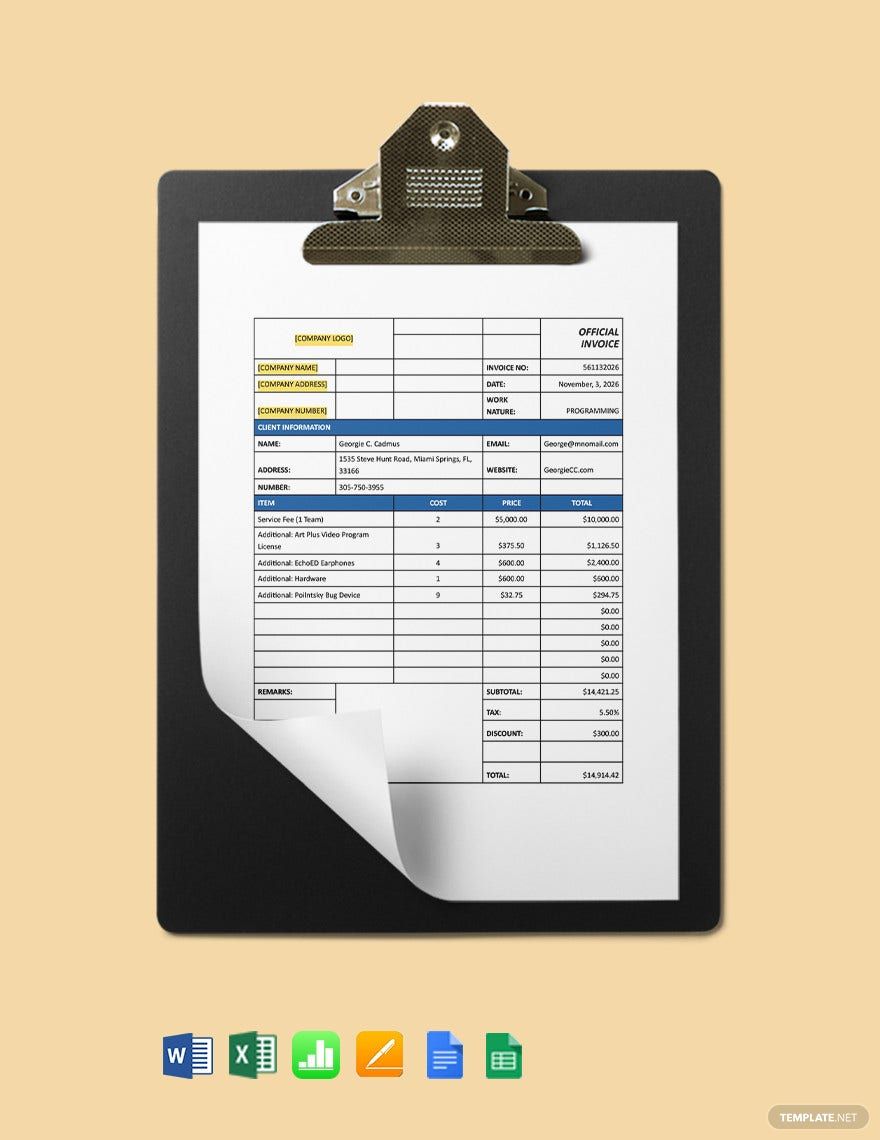

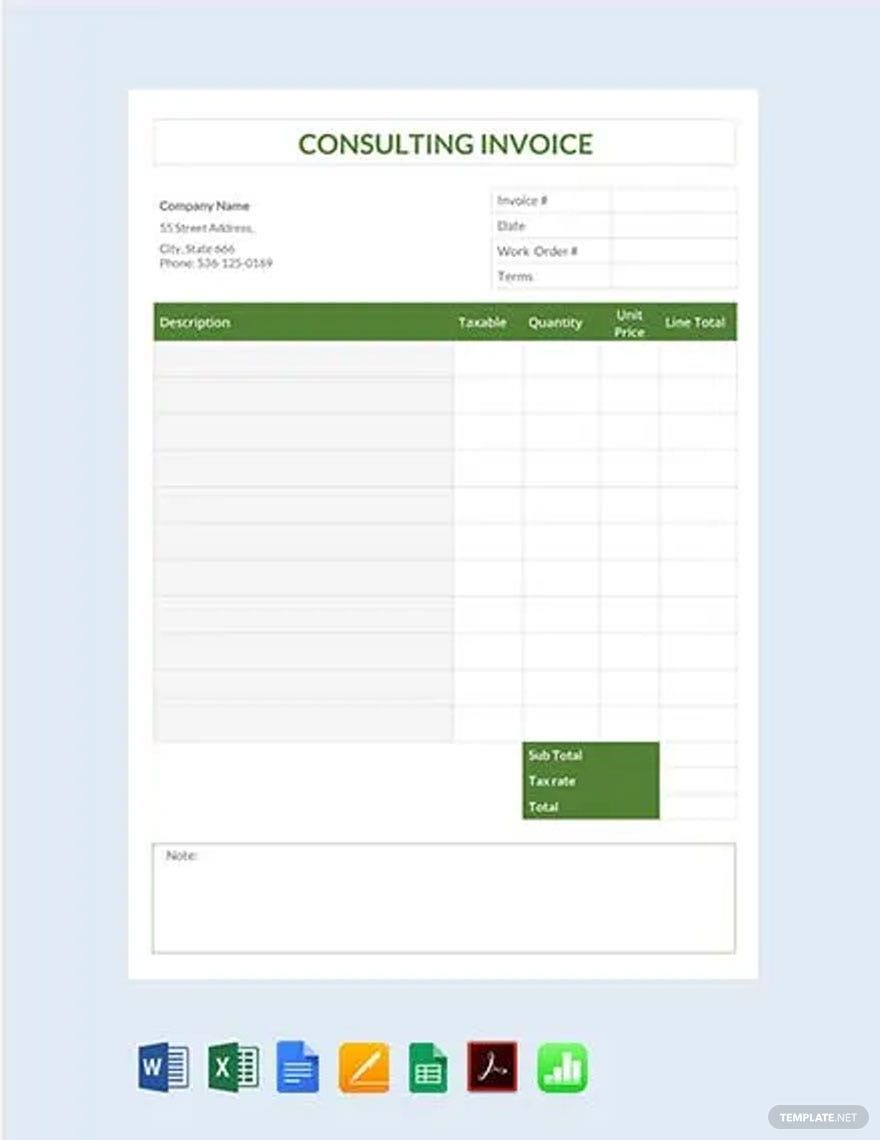

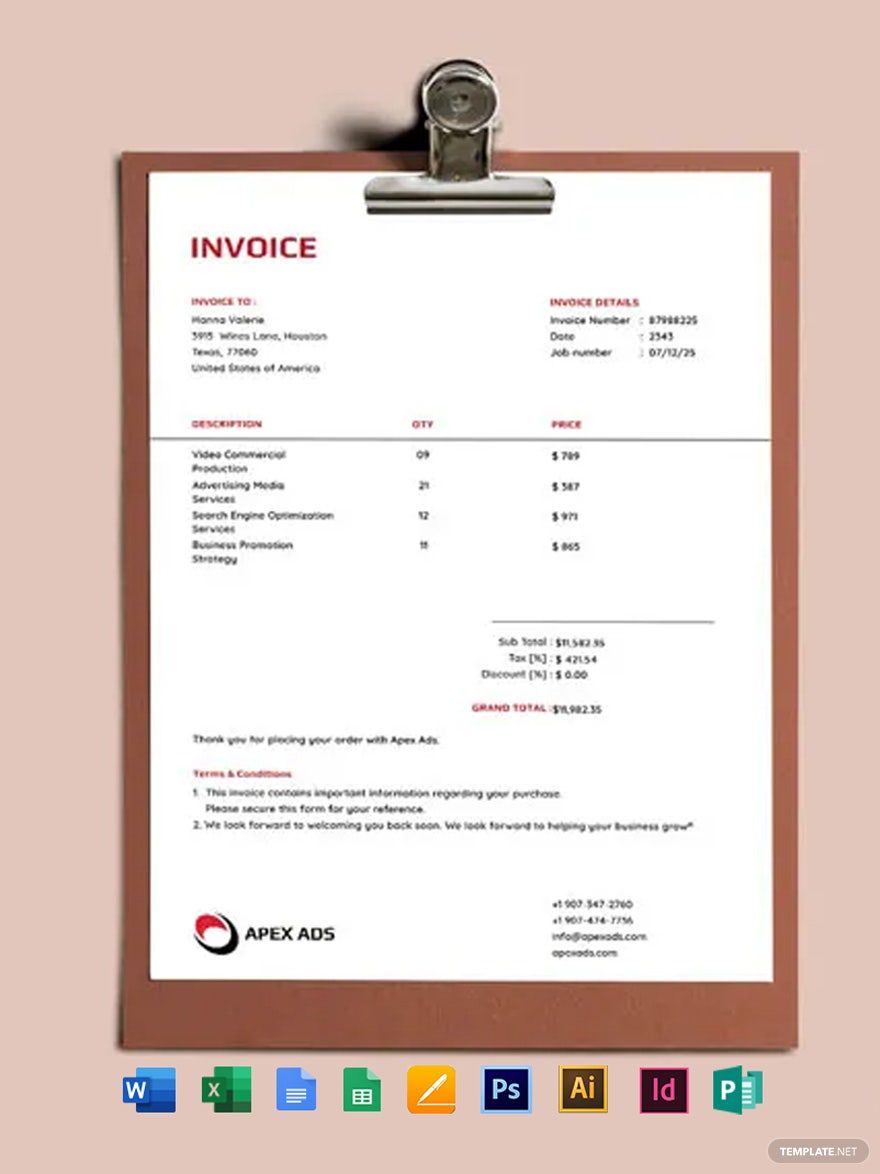

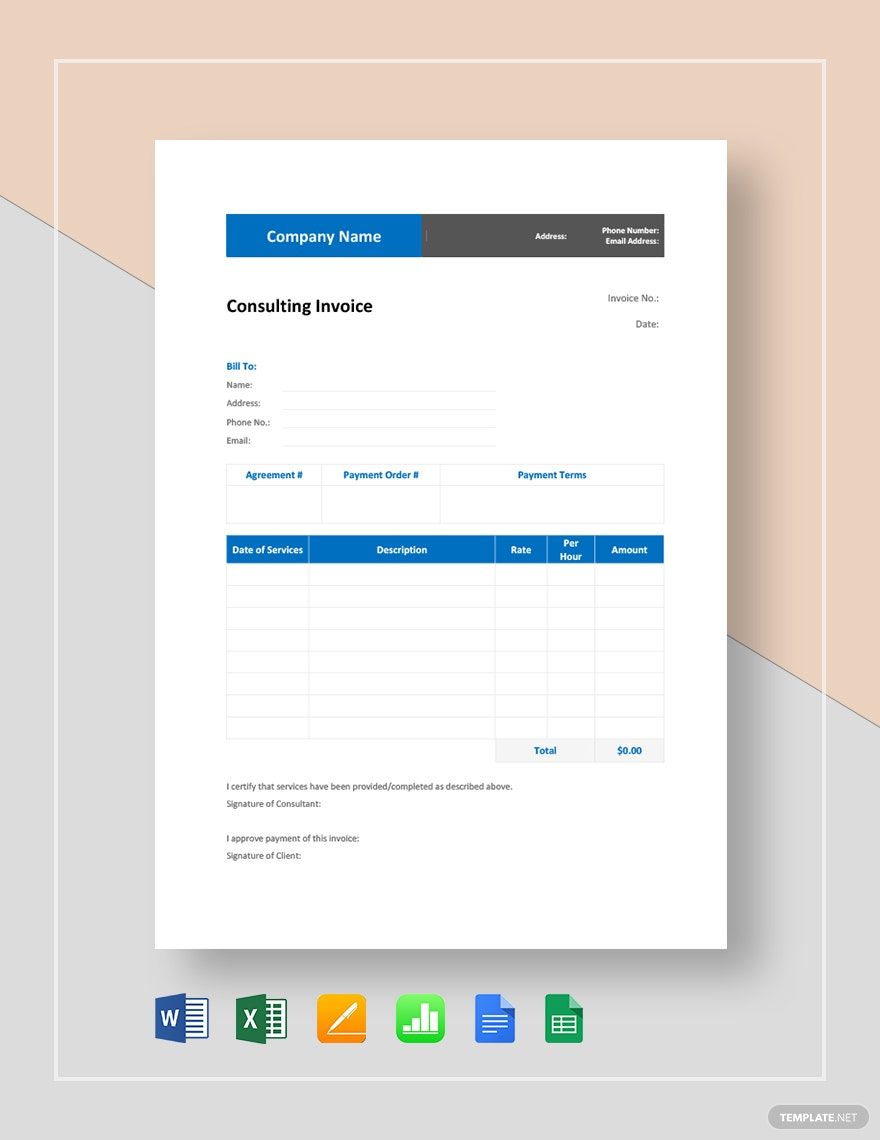

When writing your invoice, start with your header. Indicate your business name, your personal information, and contact details as the consultant. This includes your contact number, email address, and your business address. Don't forget to insert your client's information and contact details as well. If you happen to have a logo, you may indicate that to make your consulting service known to the public.

2. Place Your Date and Invoice Information

Place the date of your sales invoice at the top part of the document including the invoice number to keep track of your transactions. Indicate the due date of your invoice and clearly write it in a separate line. For your invoice number, you may follow a 6-digit numbering sequence or an 8-digit numbering sequence. That depends on your preferences.

3. Break Down All Charges

The next thing you do is to create a breakdown of all your consulting charges. List down every service you made for your client and describe each one of them. This includes your cost per hour, sales or state tax as well as additional charges. Add the cost and be sure to elaborate everything in the service invoice to avoid conflicting issues.

4. Provide Additional Information and Discounts

Provide additional information and discounts if it is applicable. Specify your terms of payments, is it in cash, checks, credit cards, or some other form of payment? Include your tax identification number and your discounts if it applies. Don't forget to add your return policy as well as your terms and conditions.

5. Indicate Payment

Calculate the total amount with or without the discount and indicate the grand total of your client's payment. You may highlight the payment to make it stand out from the rest of the numbers written in your sample invoice. Once your invoice is settled with your clients, let them sign the invoice and keep a copy for yourself.

6. Monitor Your Client's Payments

Now that you have provided your clients your consulting invoice, it is time for you to monitor their payments and make sure that they are paying you on time. If certain clients do not respond to your simple invoice, find a way to contact them and inform them once again about their due billing. If things gets rough with your clients, simply present a copy of your invoice with their signature as proof of your transaction.