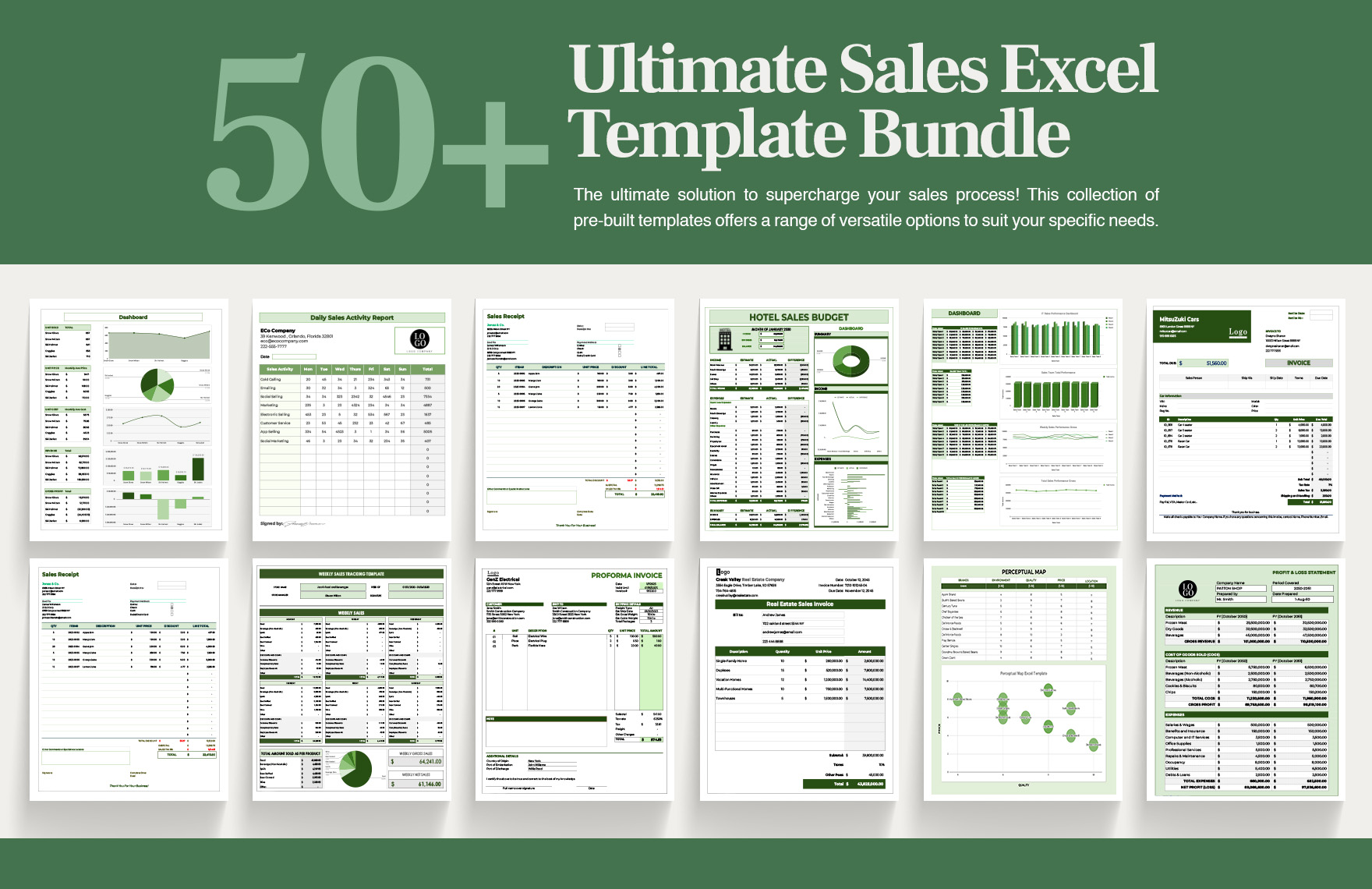

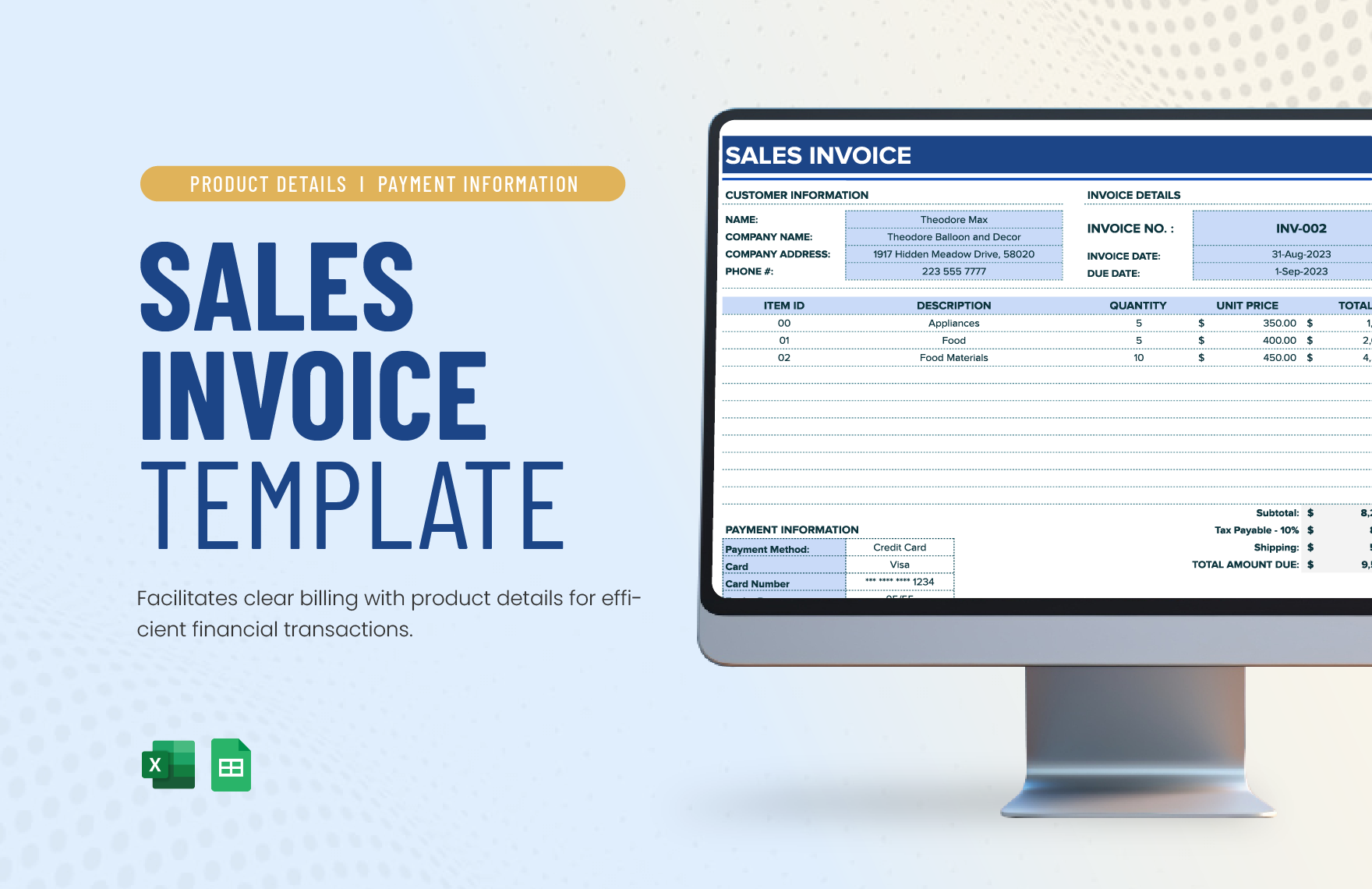

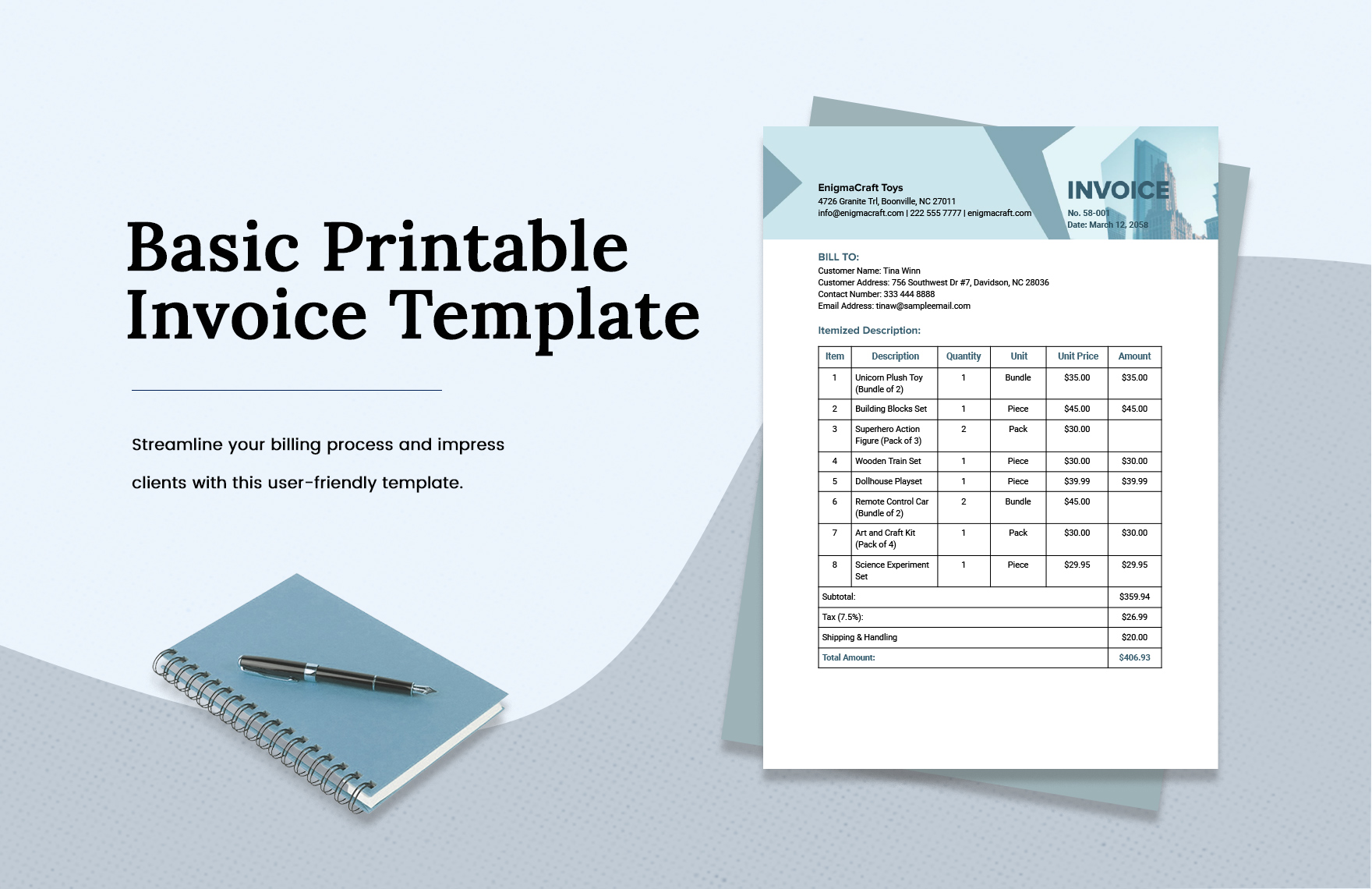

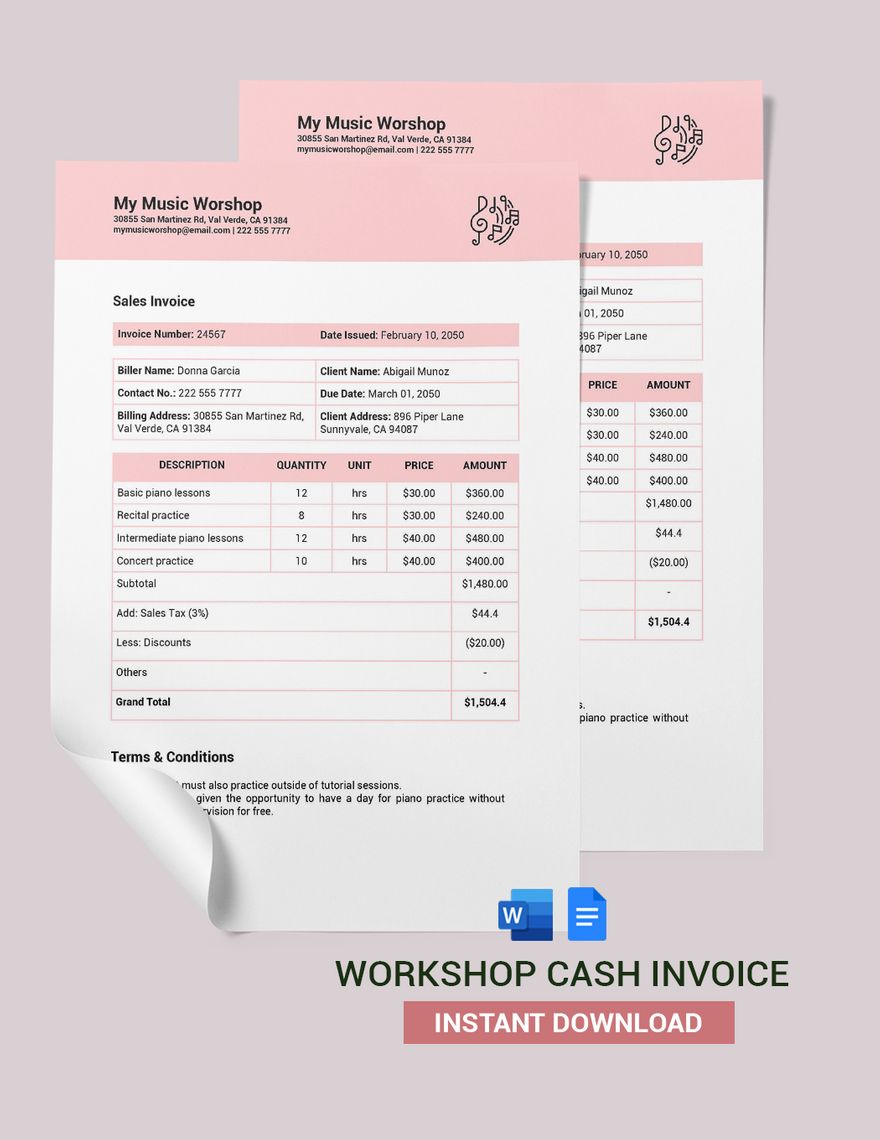

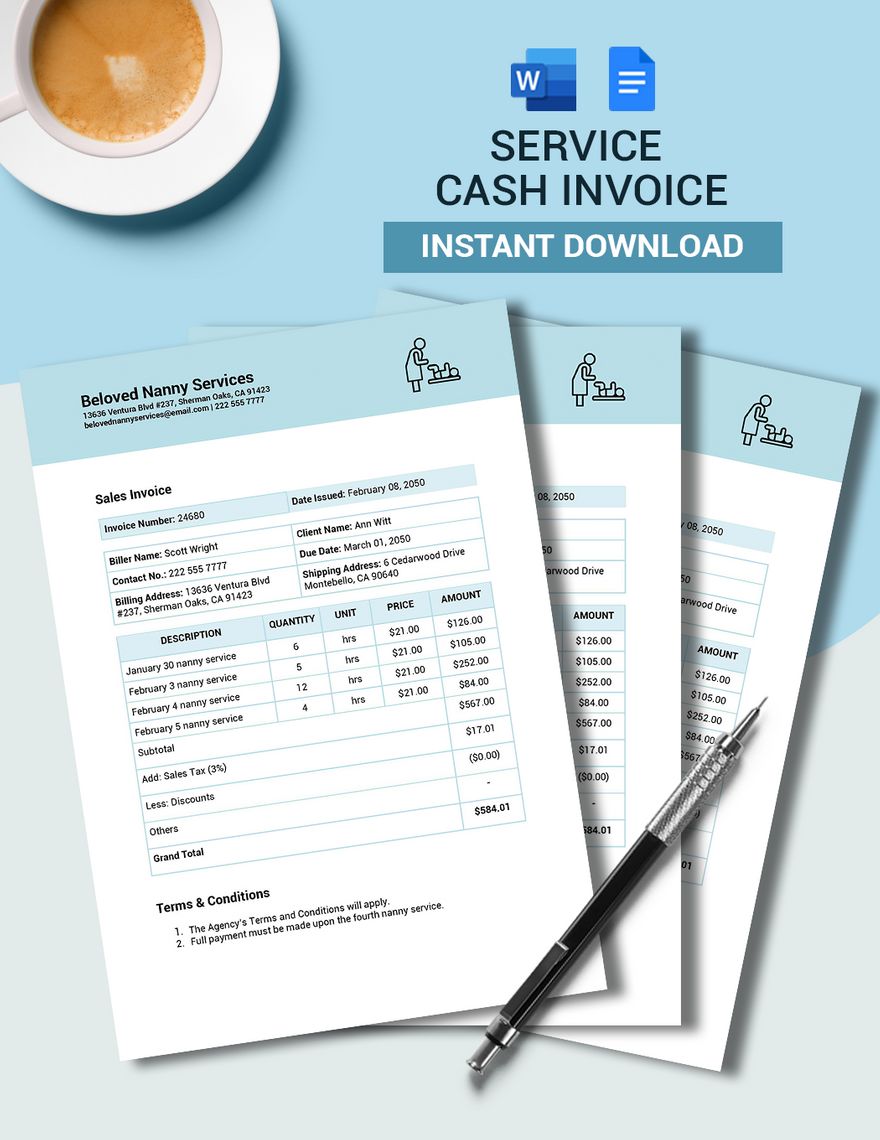

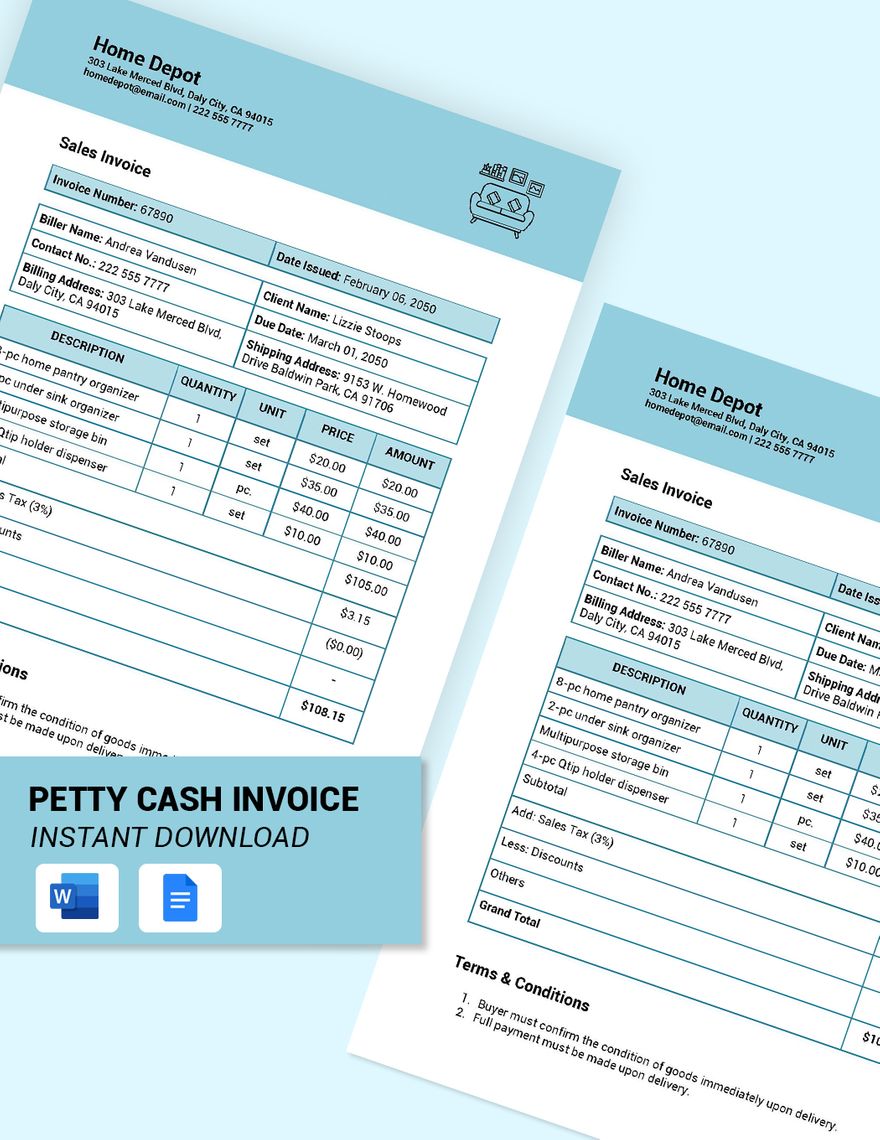

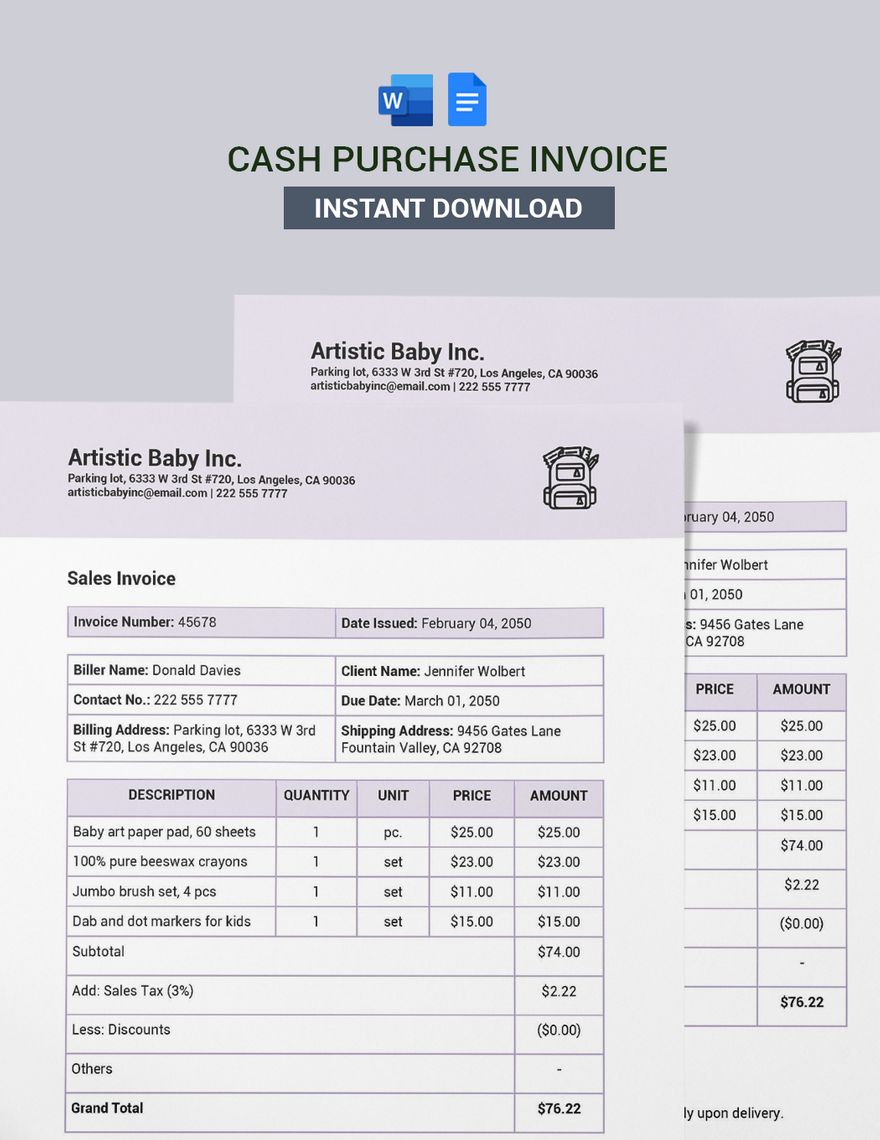

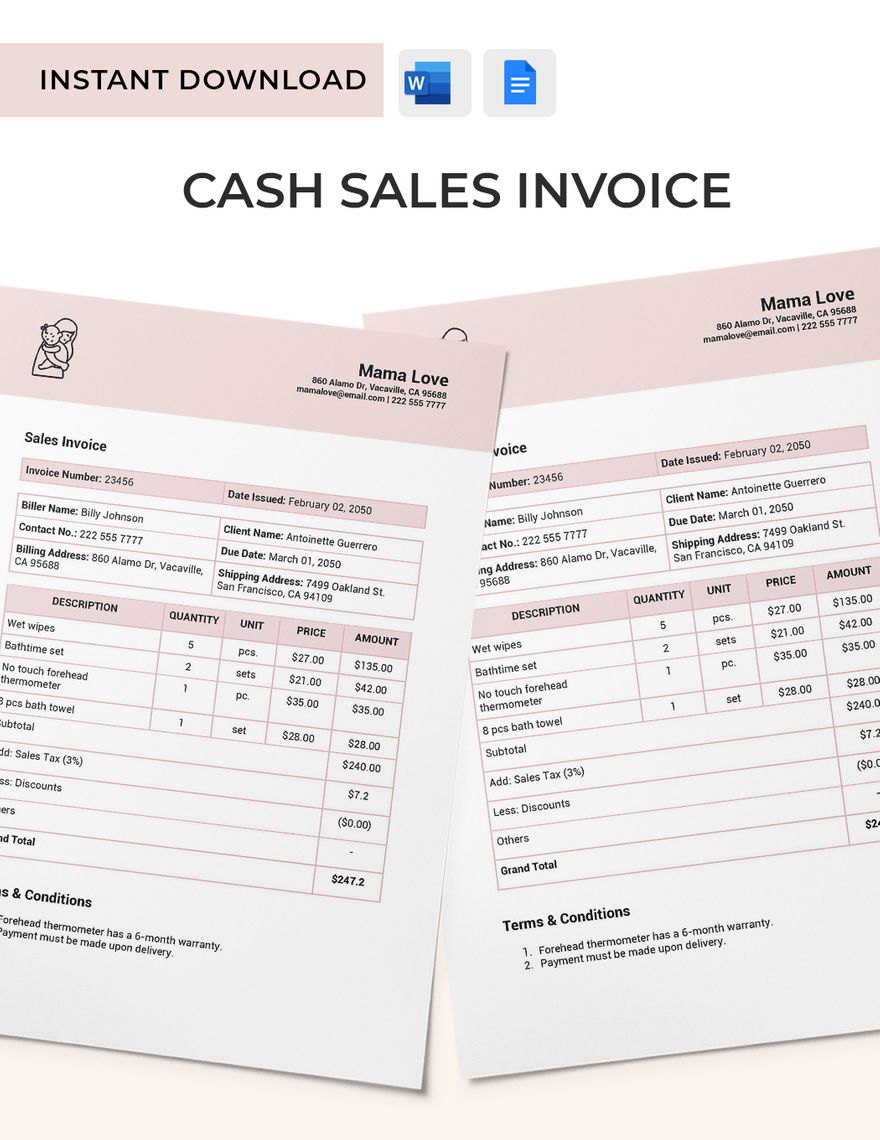

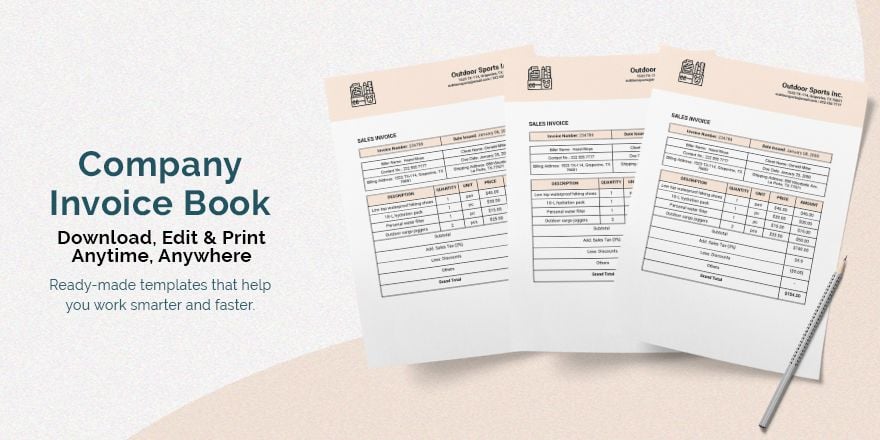

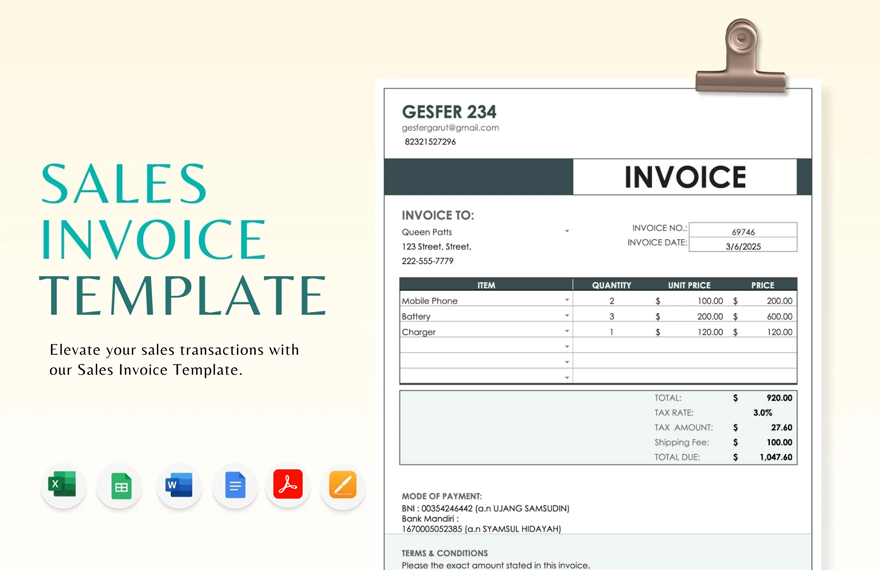

Collecting payments from your clients have been made easy by issuing a sales invoice. Because auditing particulars can be a daunting task, invoices are used to record transactions. Here in Template.net, our ready-made Sales Invoice Templates can help you do the task! Everything is 100% customizable, editable and can be downloaded immediately using different file formats in different sizes. With professional and minimal designs, our Sales Invoice Templates will help you transact faster and profit quickly! Hurry and download now!

What Is a Sales Invoice?

An invoice works as a notice when a purchase has been made and when a buyer still owes the seller payment. It is a billing statement that informs buyers when to pay and is very different from a receipt.

How to Make a Sales Invoice

An invoice is used to track the sales you've made, the products you dispensed and the services you've rendered with payment terms. You need to keep it simple and clean. To make a sales invoice, you only need a template that will accommodate your needs and the tips below:

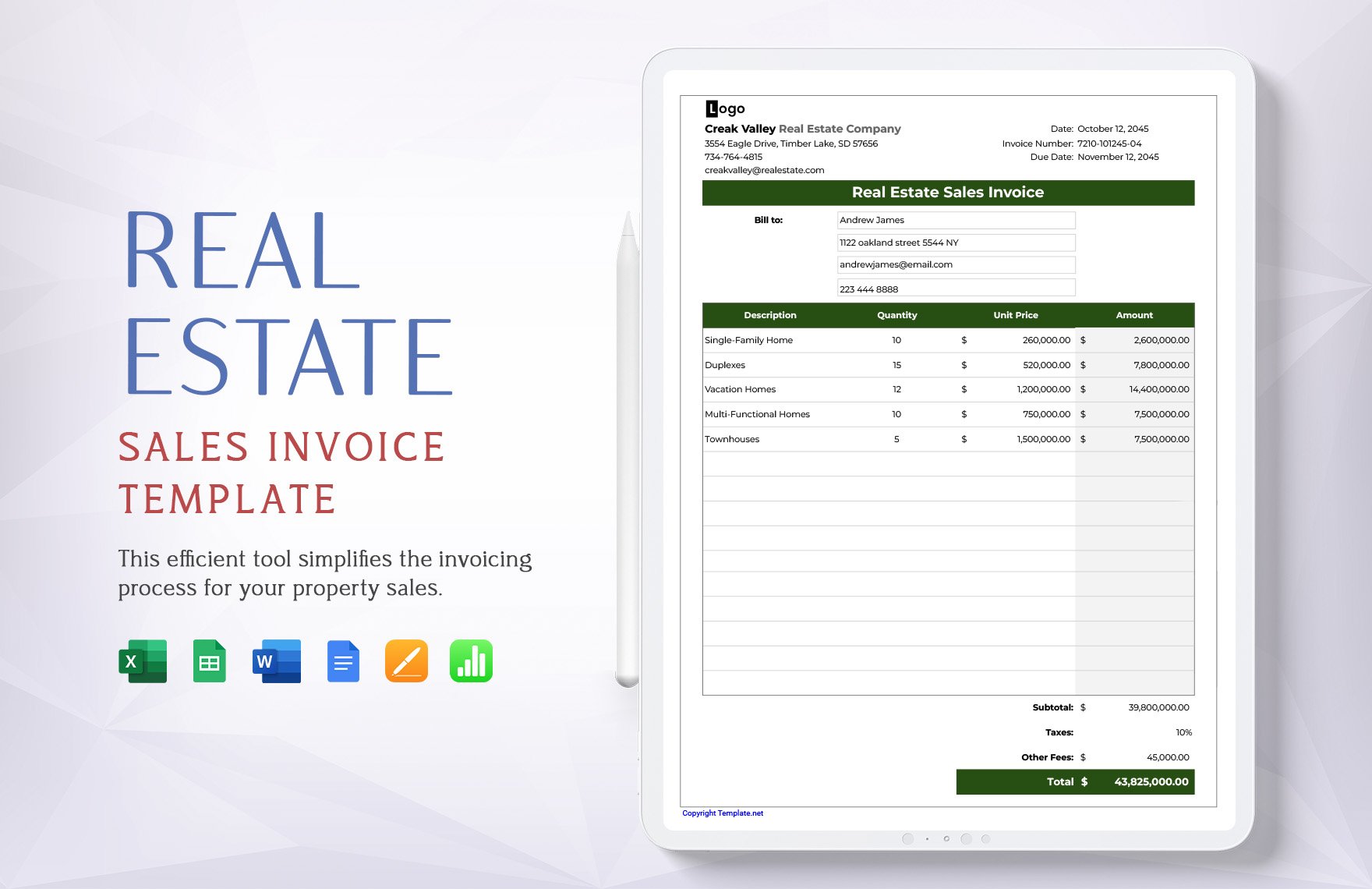

1. Know the Types of Invoices

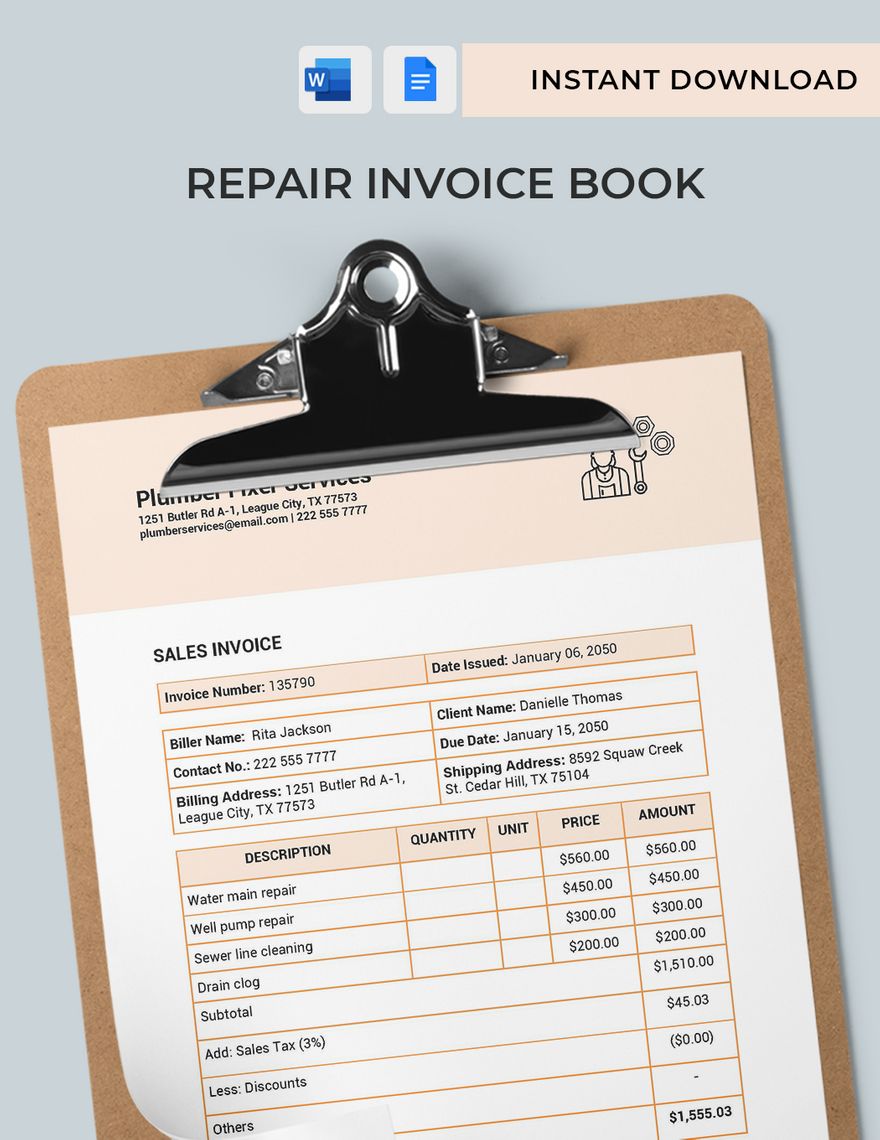

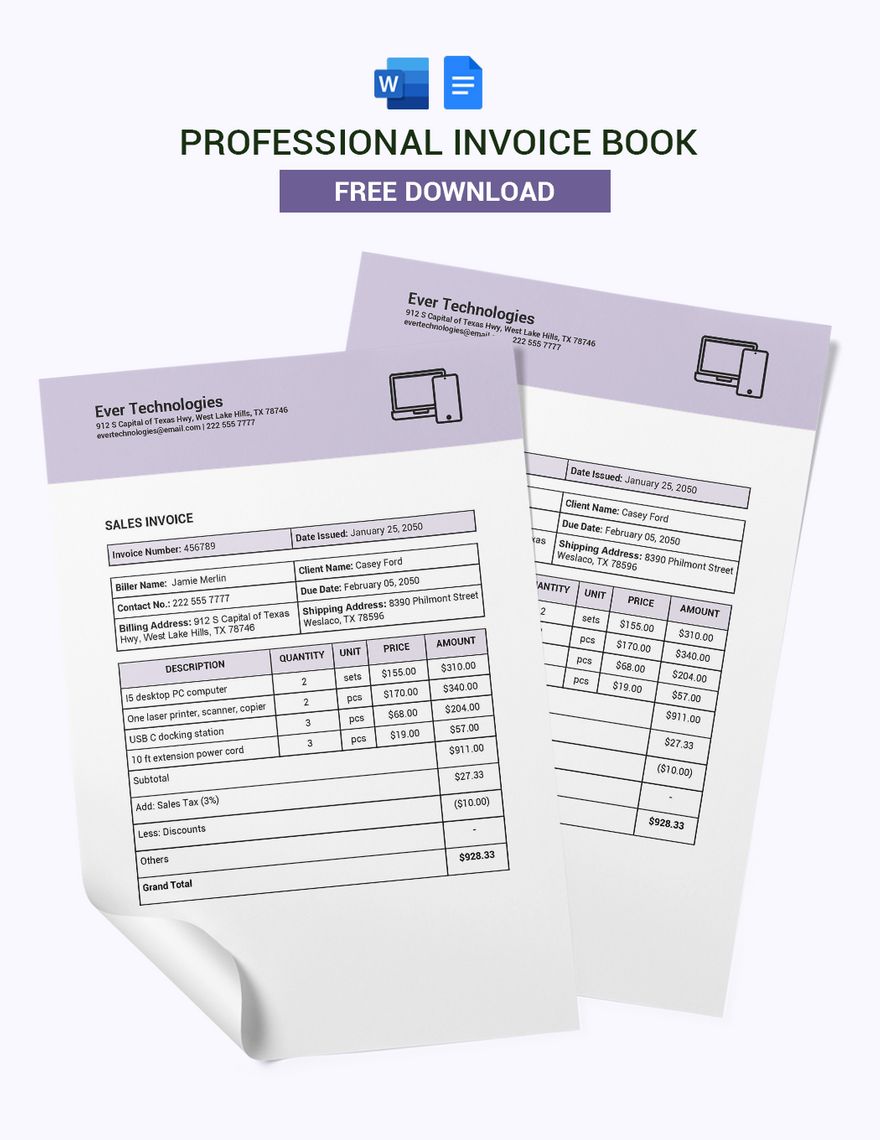

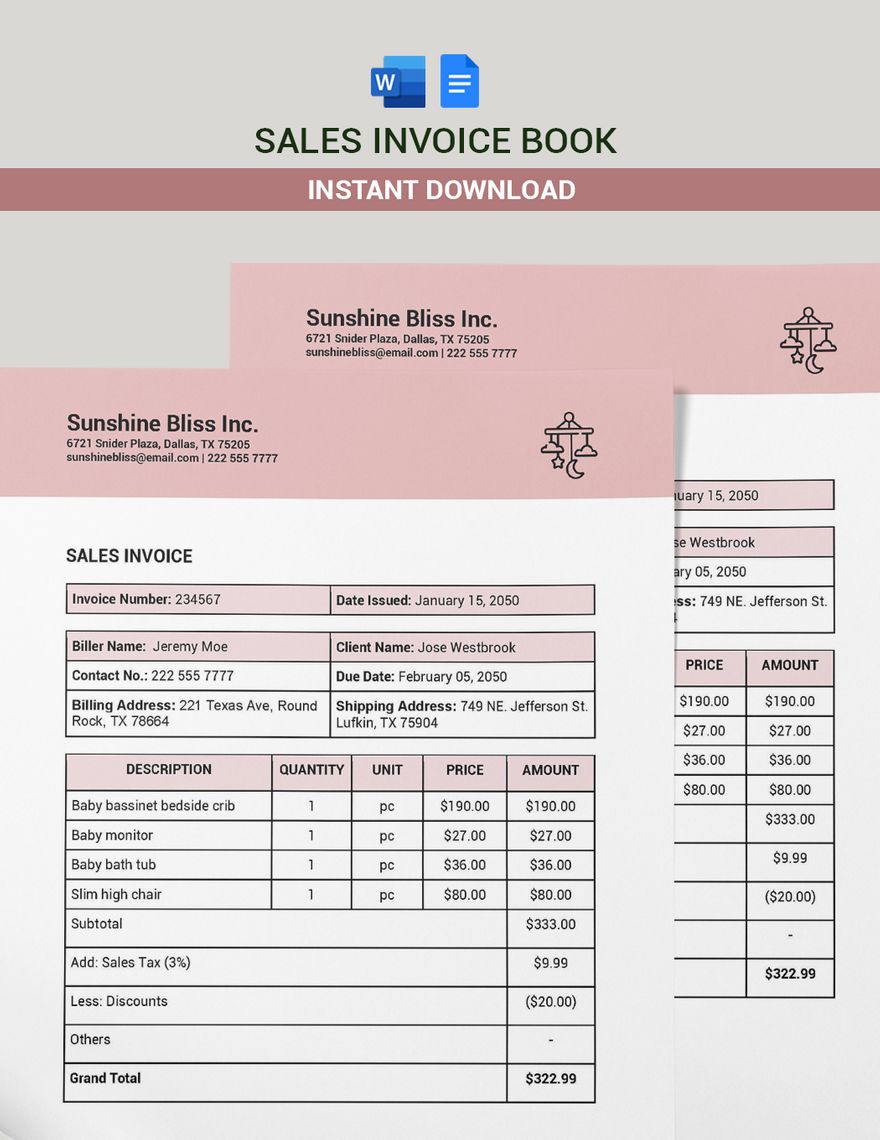

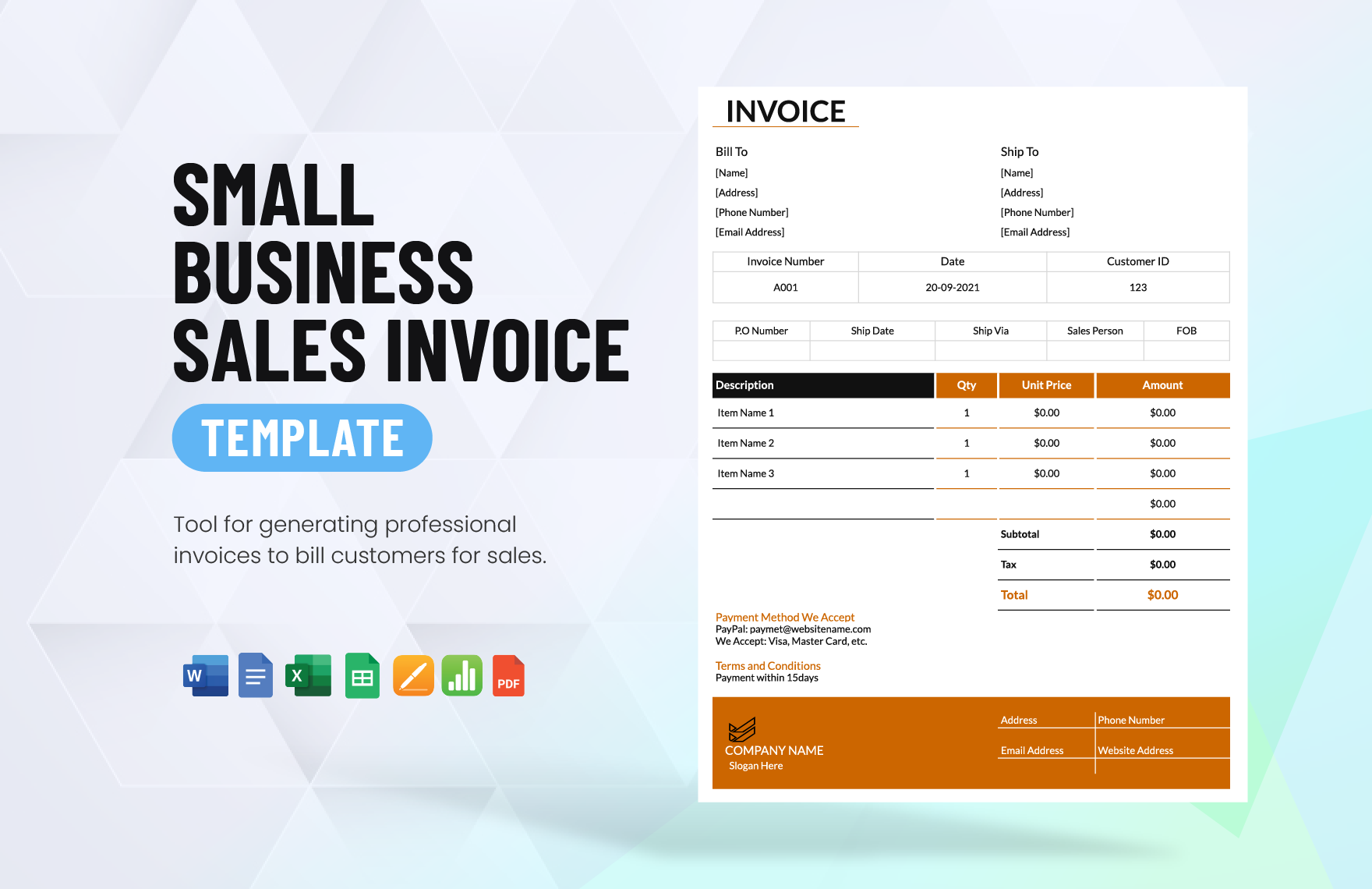

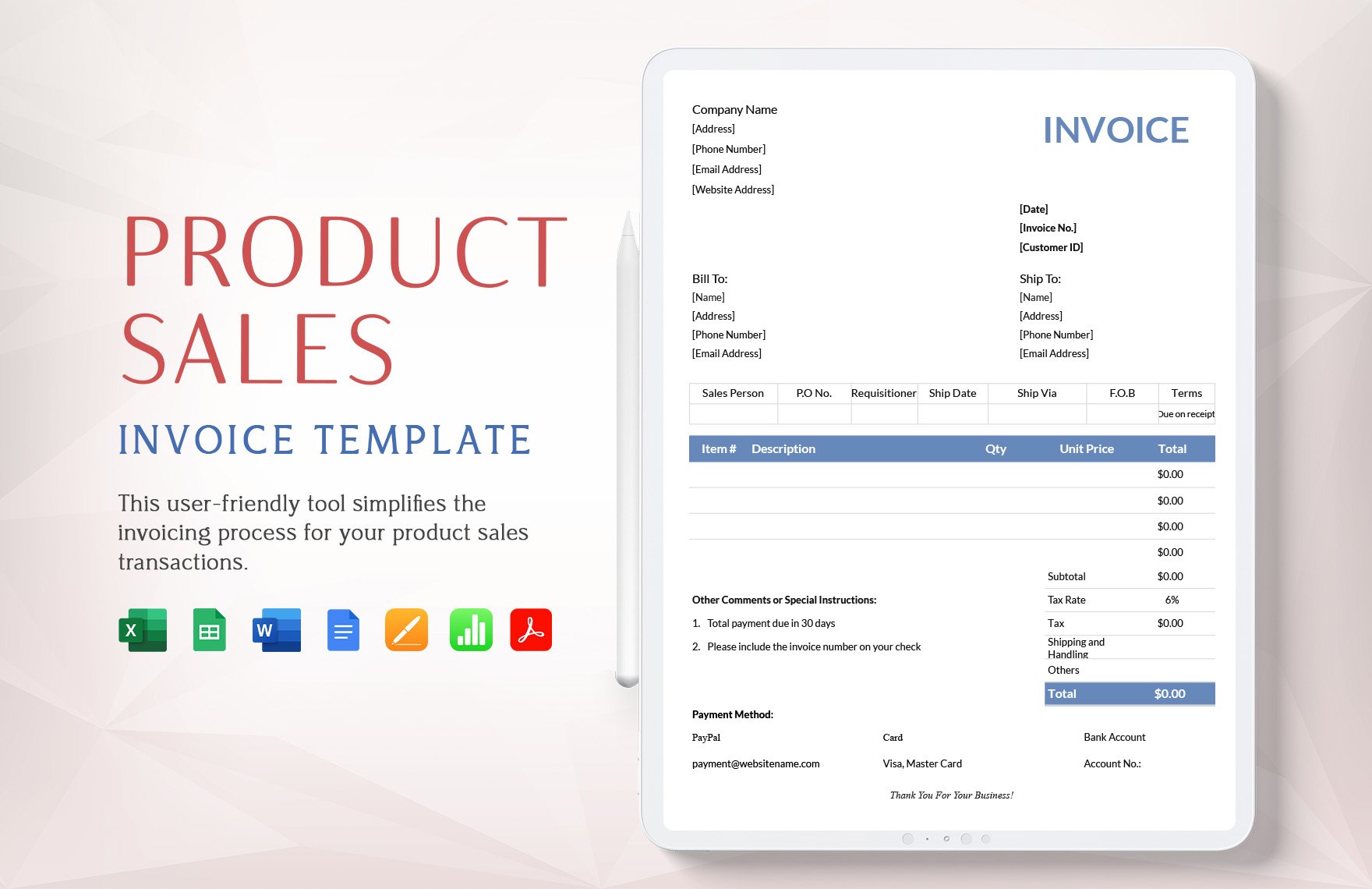

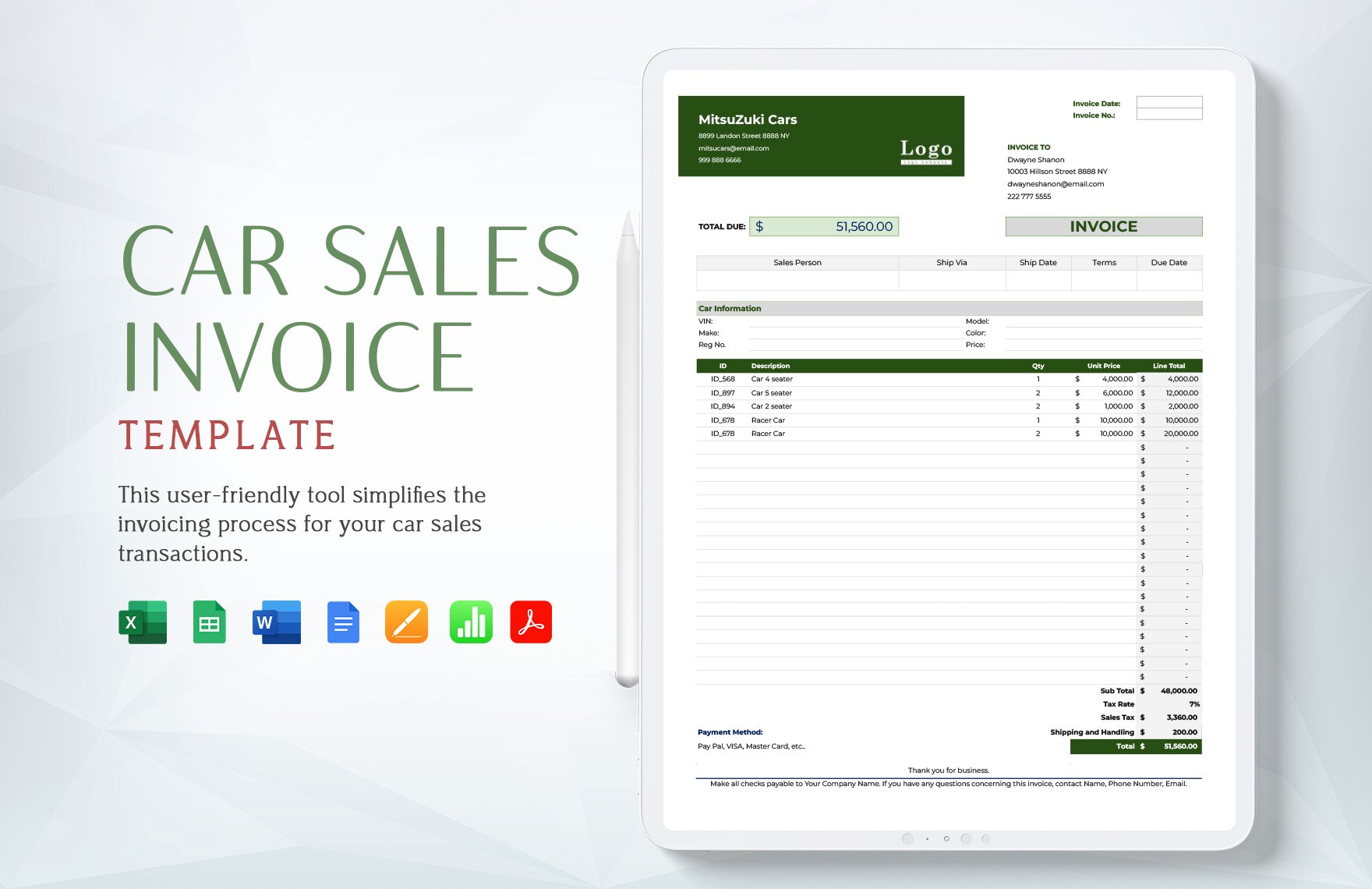

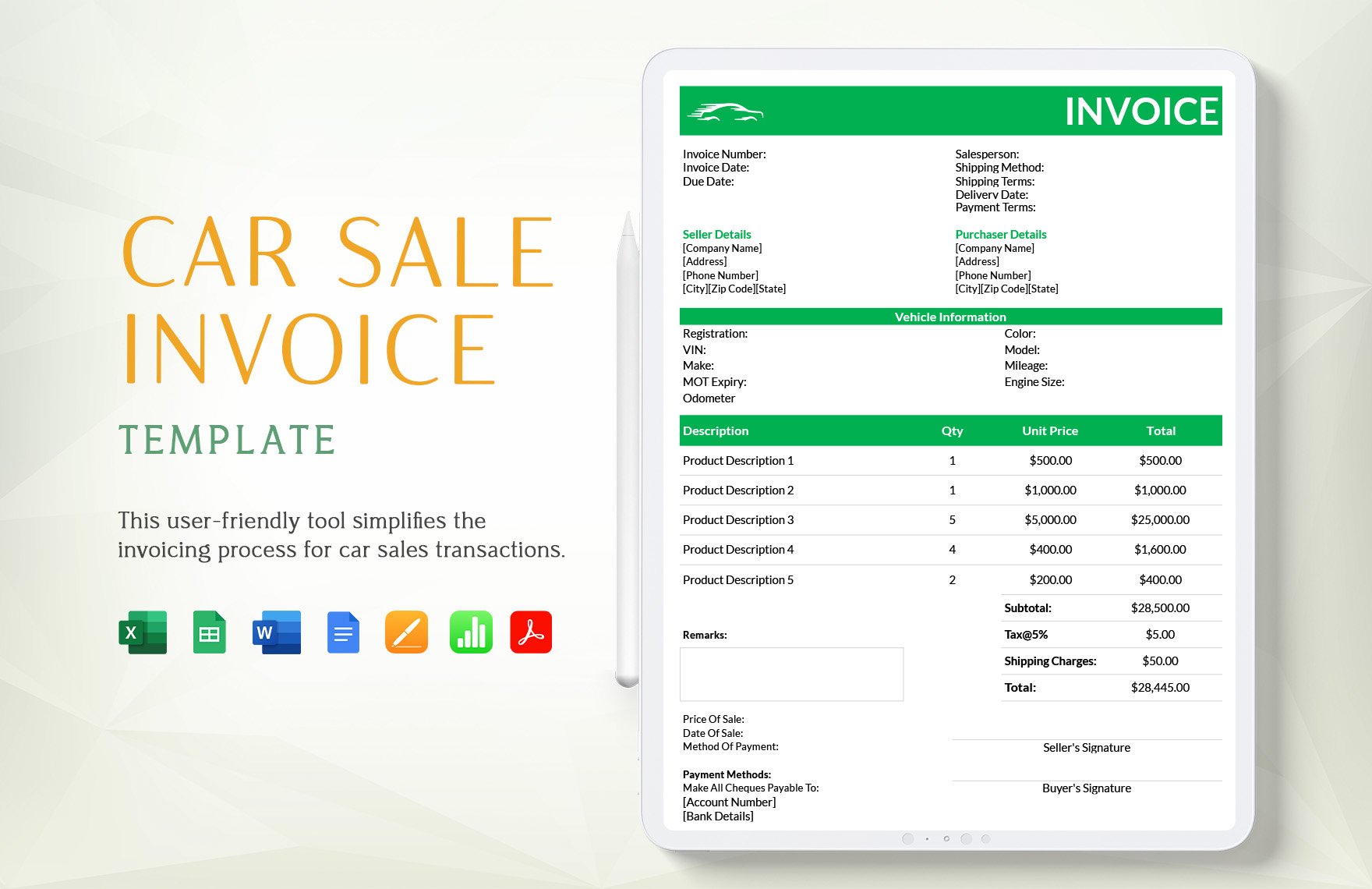

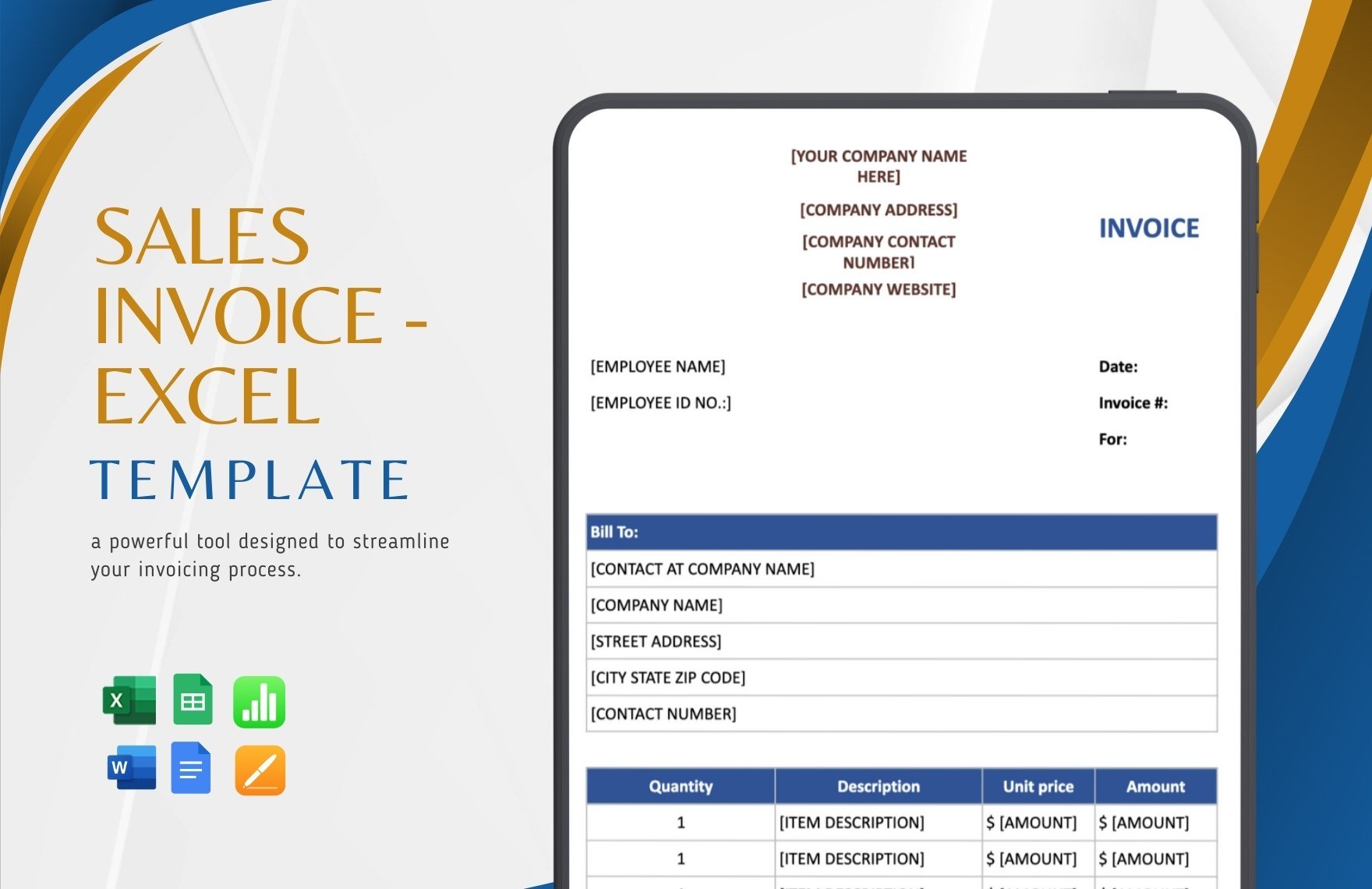

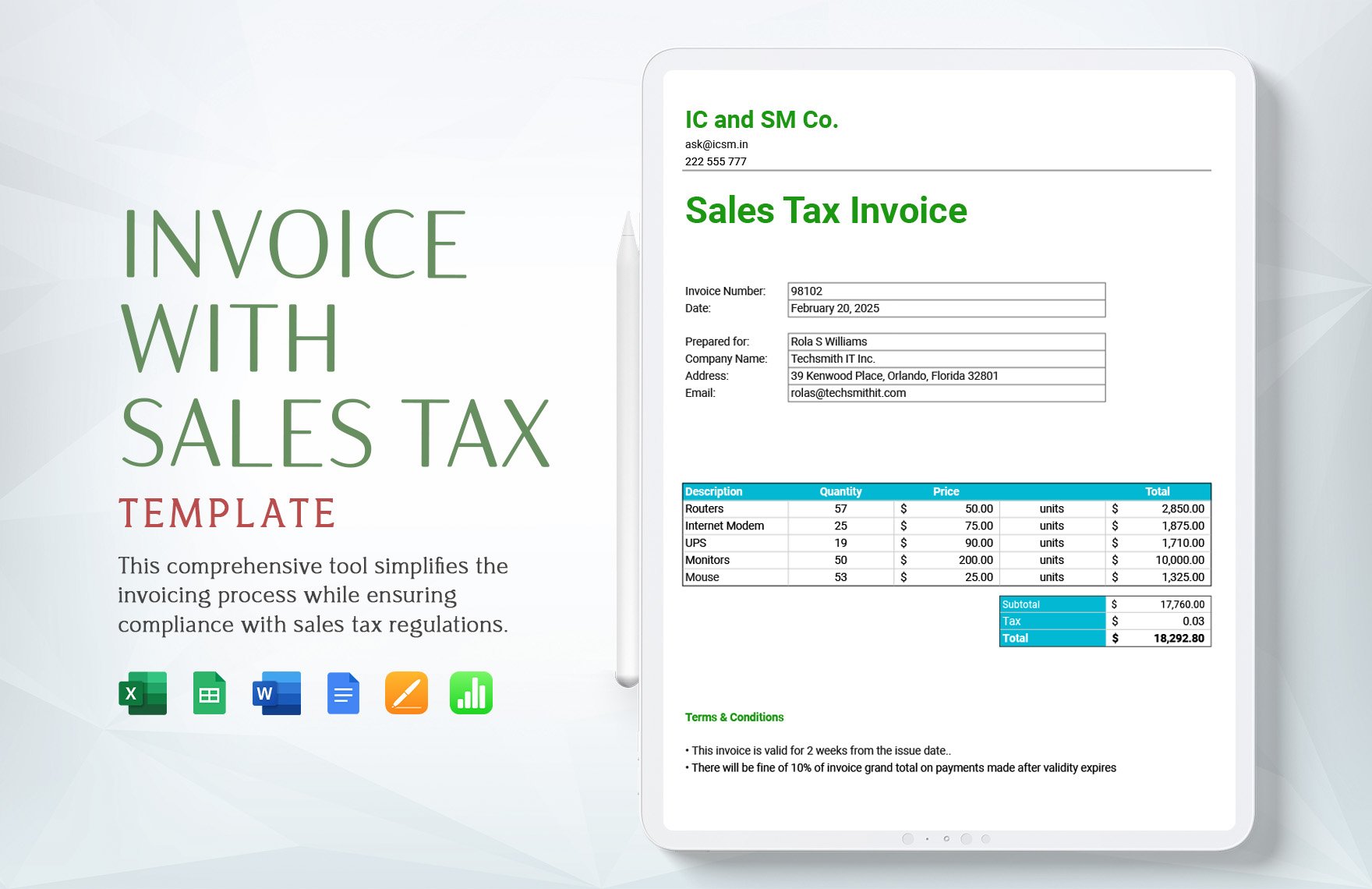

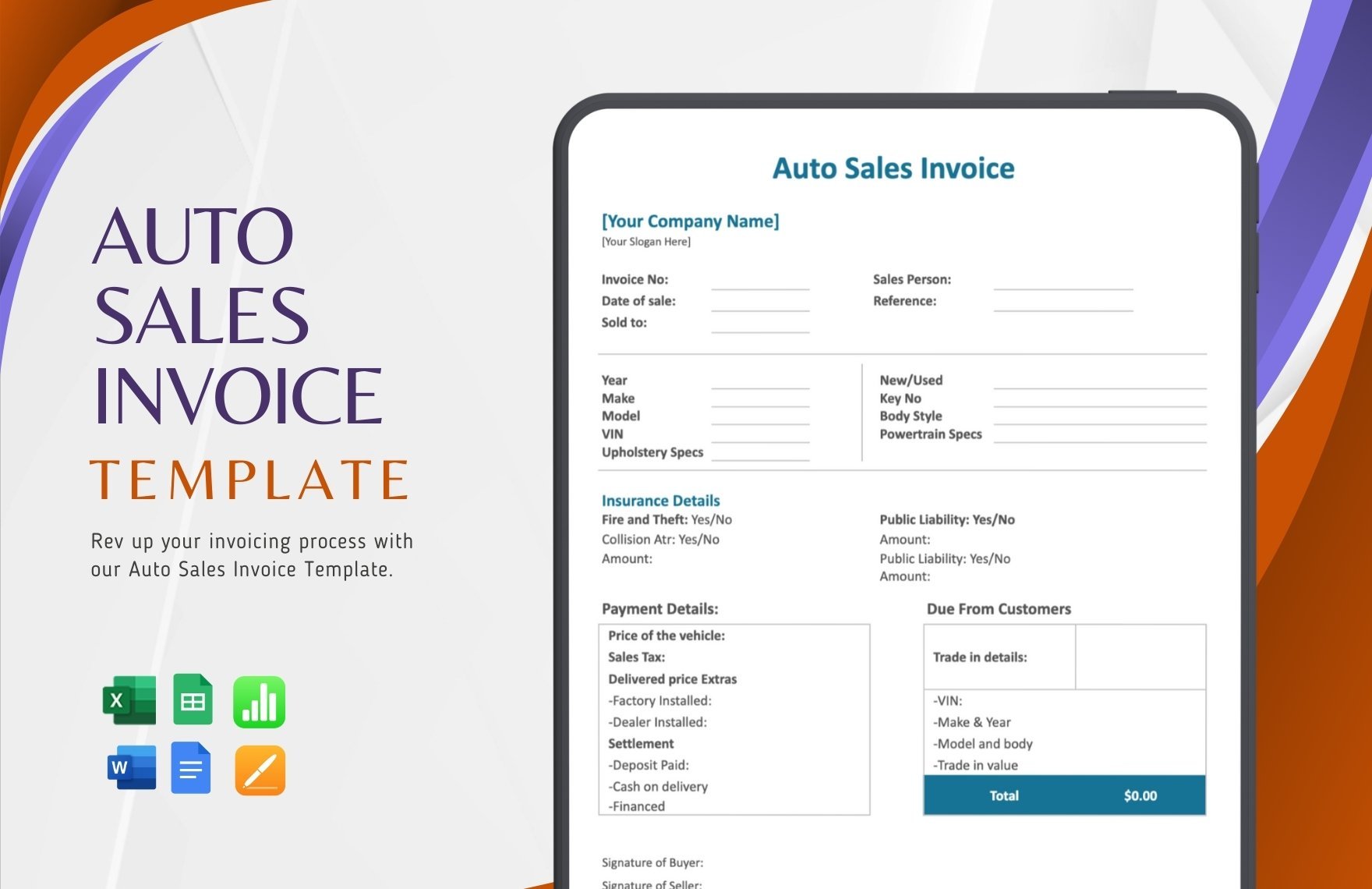

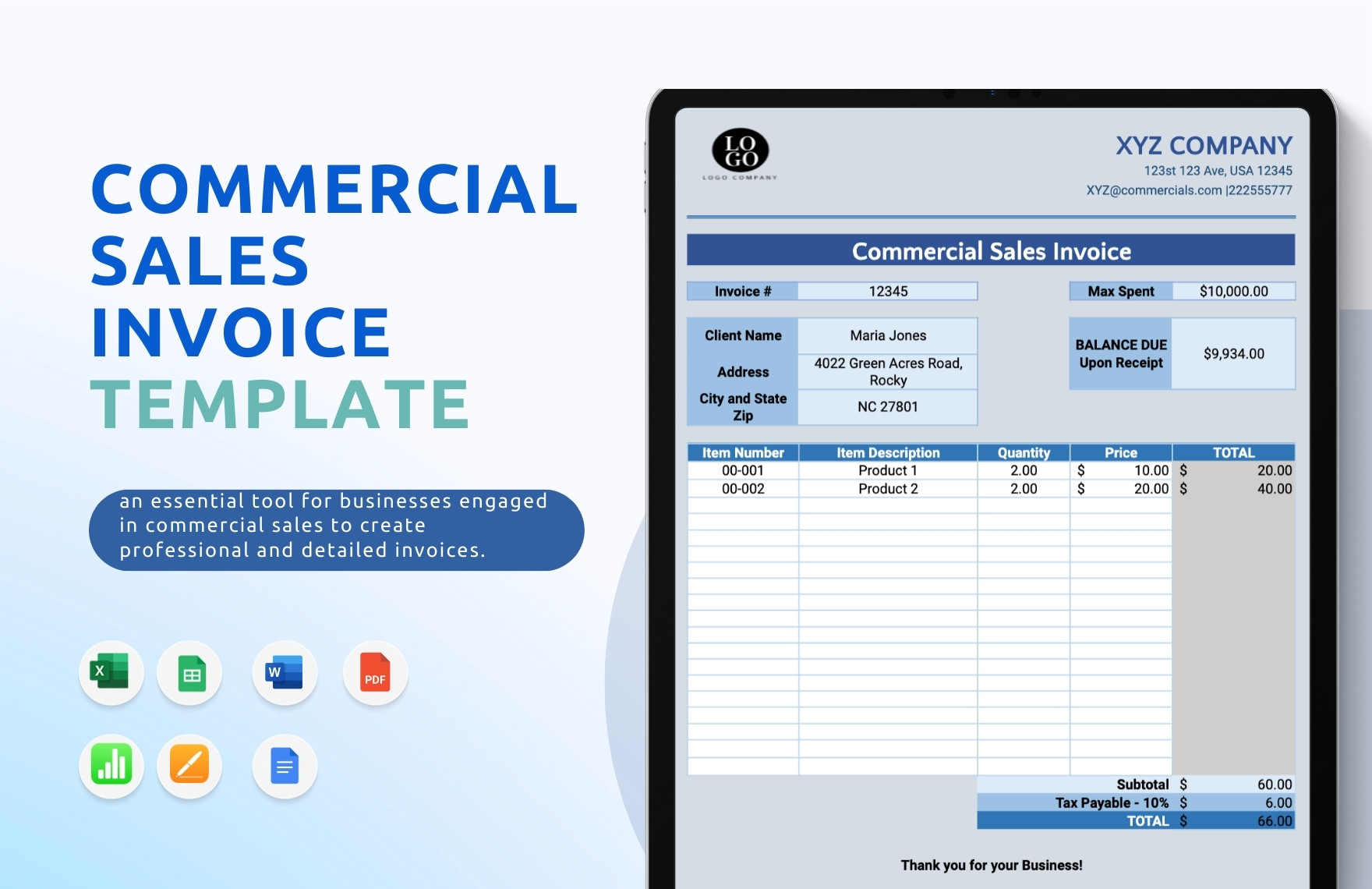

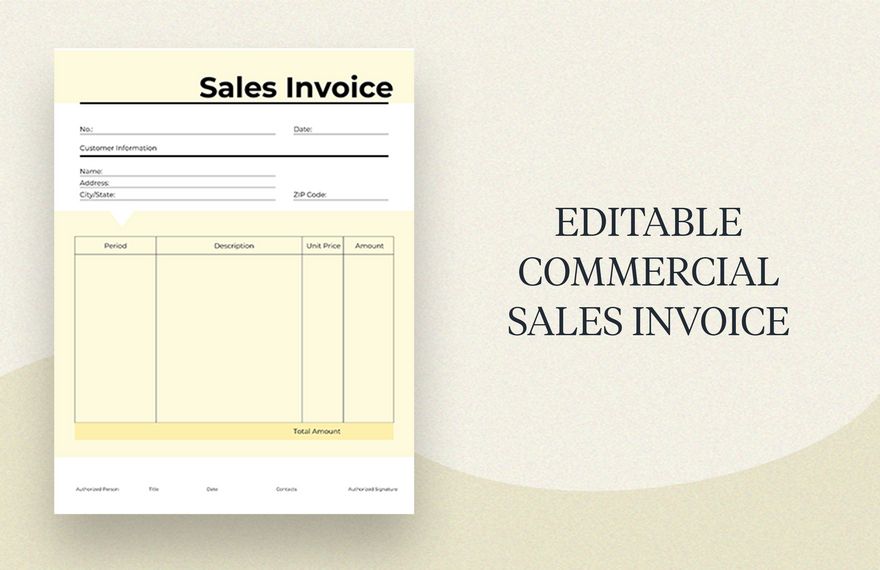

Before you make a sales invoice, plan a draft and find out what kind of invoices will work for your business. The usual sales invoices have very simple structures and design so you only have to fill a tabulated one at most, including product quantity, description, unit prices and total amount in general. A commercial tax invoice or product sales invoice may have the same format but it has a space for tax rate amount. For a car sales invoice, it could be more detailed because an automotive business may sell cars, car parts or services.

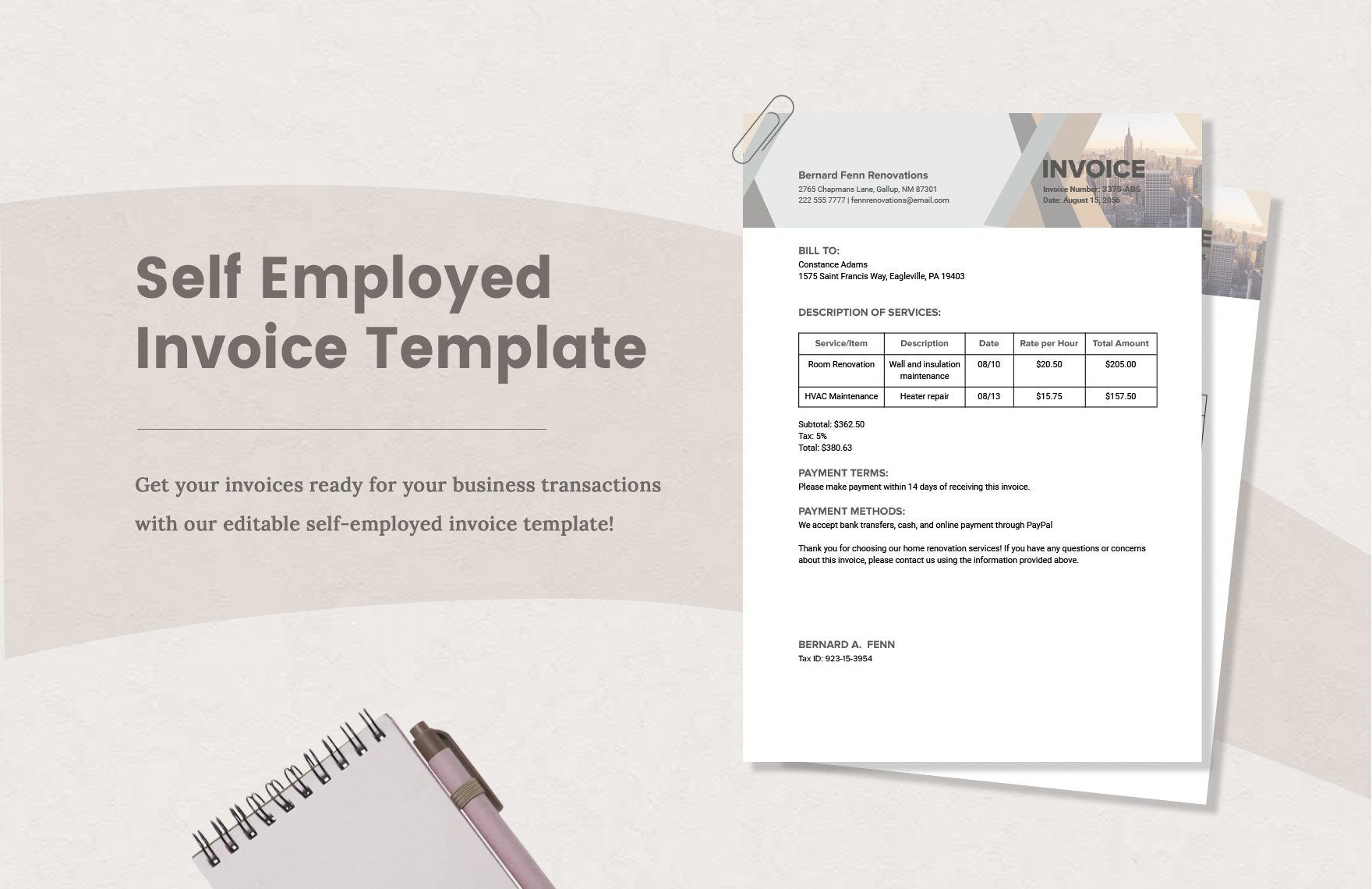

2. Company and Recipient Information

Your sales invoice is a legitimate accounting tool that is very crucial to your business. When making an sample invoice, see to it that both client and company information are included. Add your company name, logo, address and phone numbers at the top of the invoice that may serve as a header. The customer's name should also have the same information as well, and if the client is working as a part of a company, then include his position and the company's name that he or she is representing for proper identification.

3. Write Specifics Correctly

Your quantity of products should be counted precisely or else you will risk the chance of overcharging the customer. Likewise, write descriptions of products accurately and include descriptions. For automotive business, record down the vehicle's make, plate number, model and what services were engaged in the case for repair or upgrade. Also, do write down the invoice number properly and clearly.

4. Calculate the Amount Carefully

After putting down specifics, it is time for you to write the prices of every product or service and calculate the total amount. You should do this part meticulously because you are already dealing with money and even an unaccounted cent will affect your sales. If you are making a sales invoice that includes tallying taxes, then you should be aware of the rules of calculating VAT and how it's done. Double-check everything; if in doubt, calculate again. Do not rush this part.

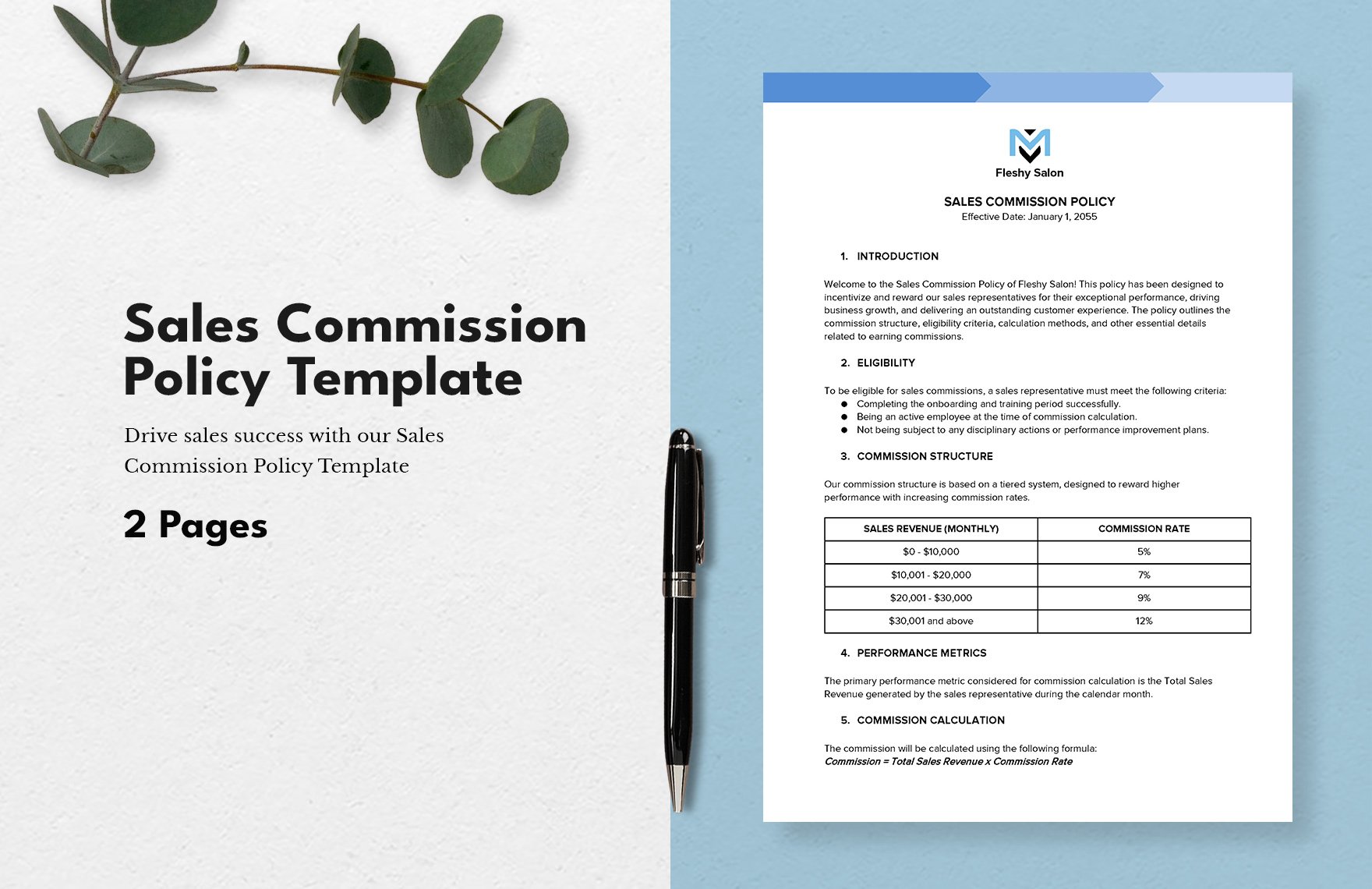

5. Set Conditions

Before shipping, have the buyer sign your copy of the invoice as an acknowledgment that he has already read it and accepted the terms set on paper. If you want the transaction payment cashless and straight to the bank or the company auditing department, direct the buyer how and where to pay. You should also include the payment dates and when they are due. Besides, you can also demand an additional charge if the buyer fails to pay the amount on time.

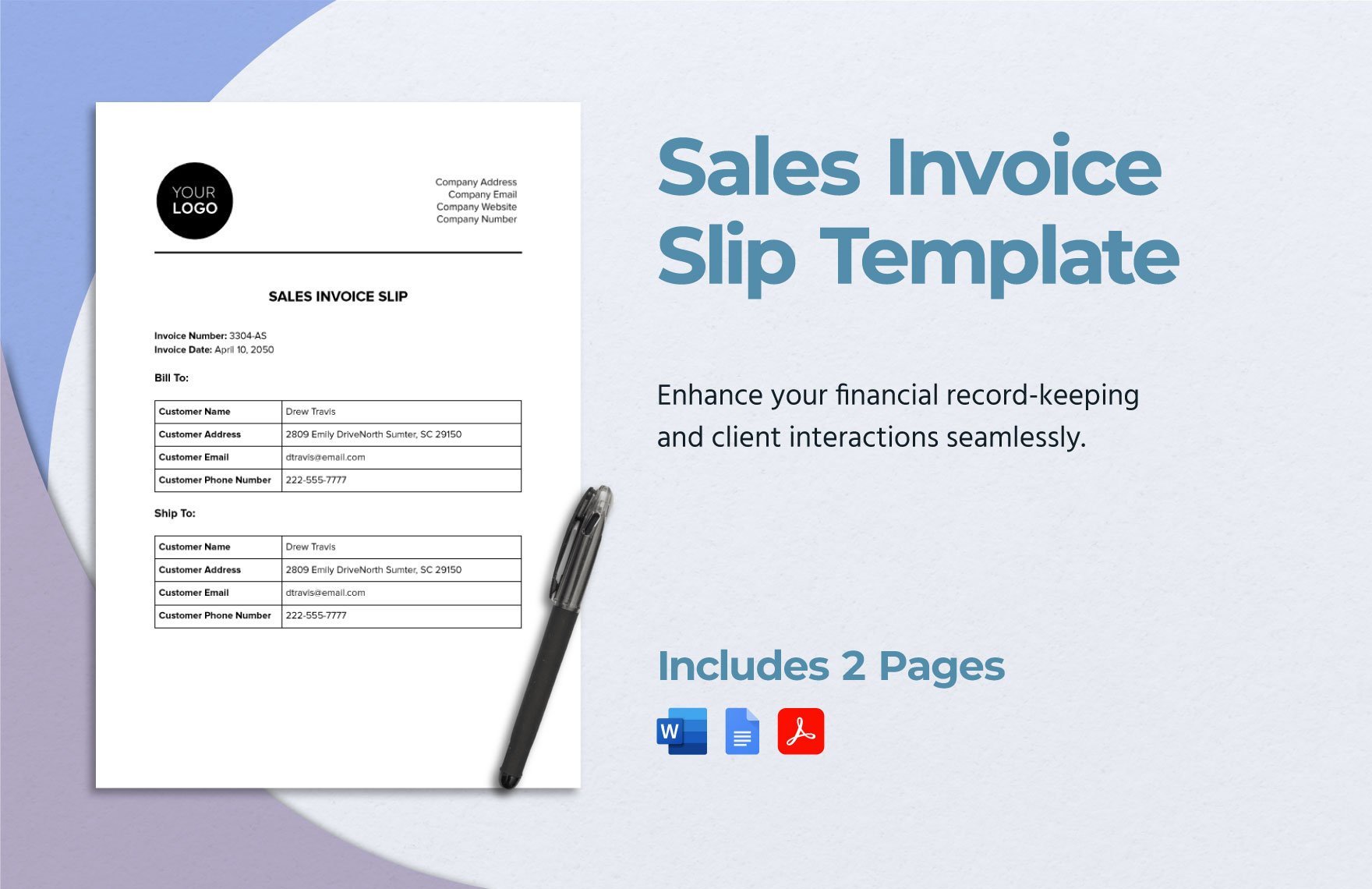

6. File and Save

If you have issued several invoices in the same period, file all of them according to dates and make a list. This way, you will be able to track down every sale you've done. If you need to submit all of these documents to the auditing department, keep a physical copy and a digital one for safety. Keep them all in one spot for easy access.