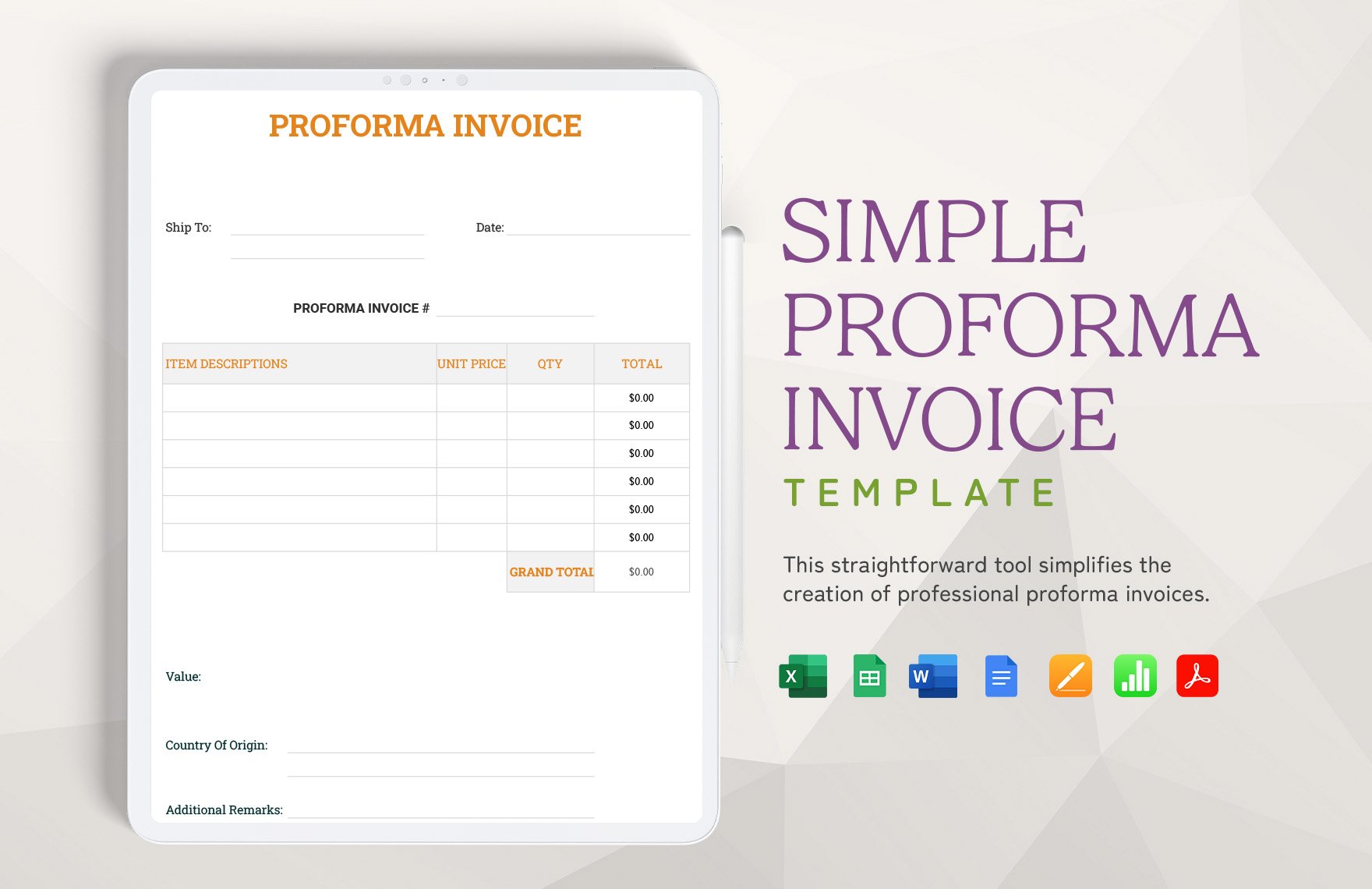

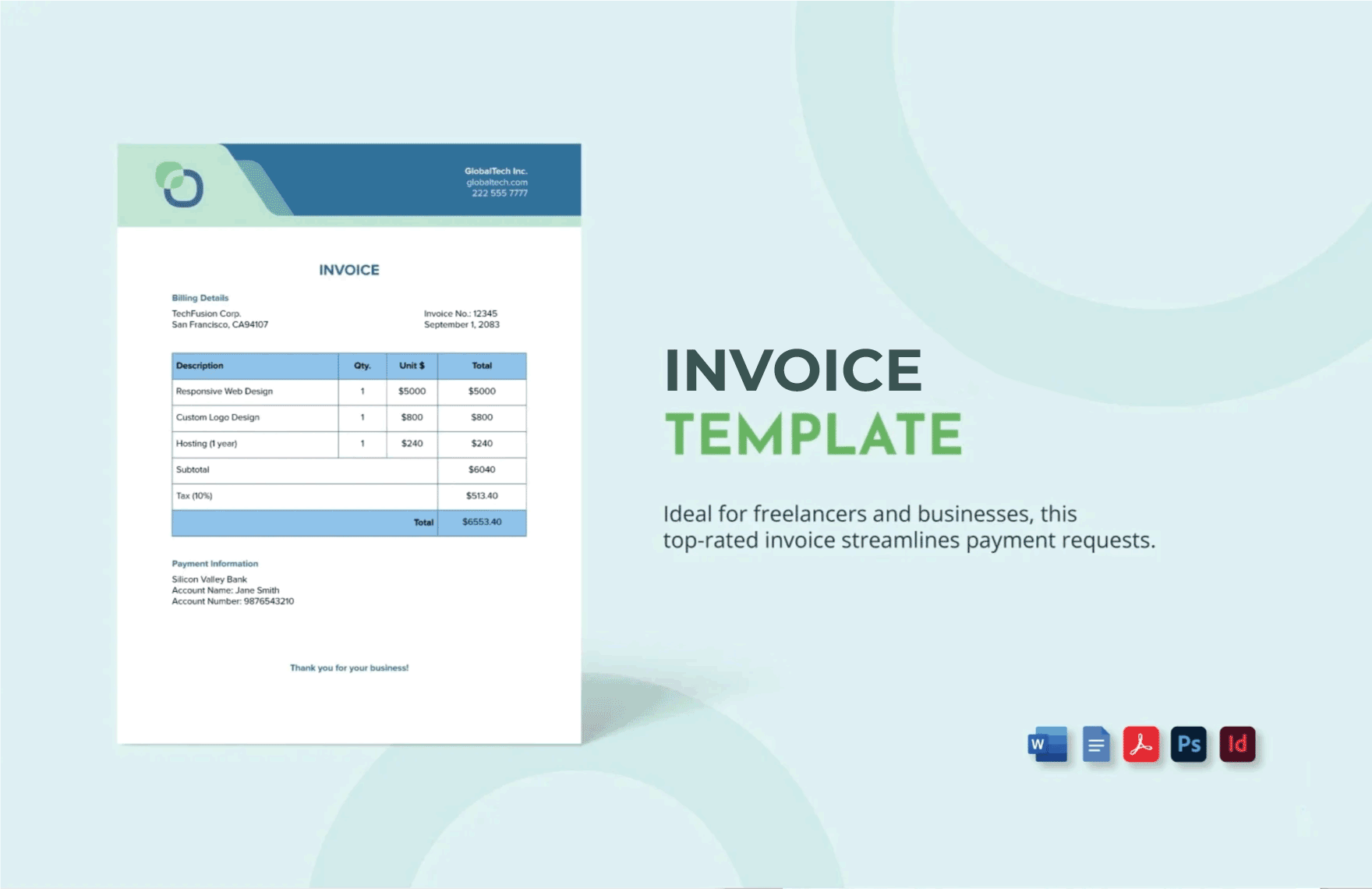

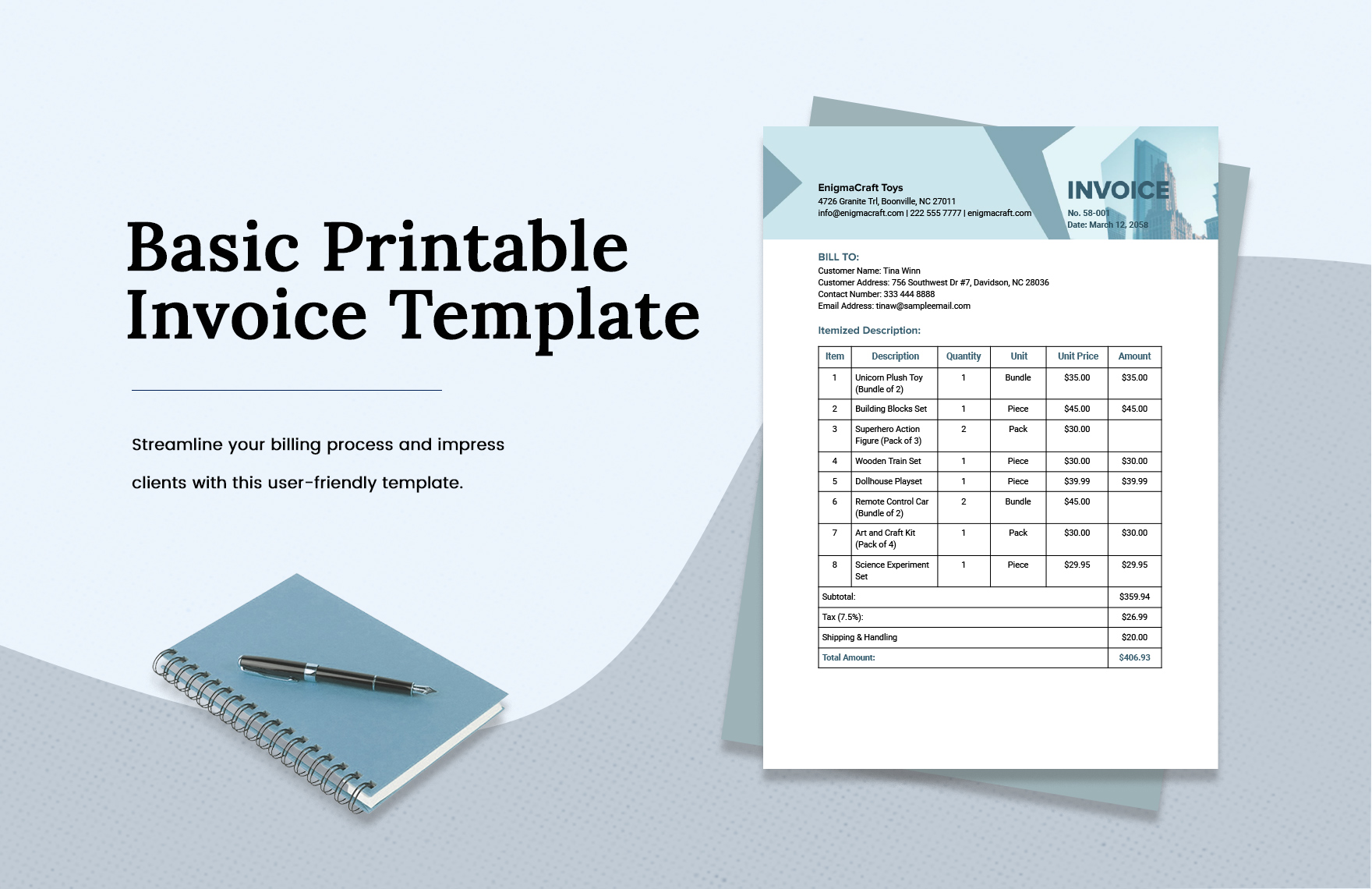

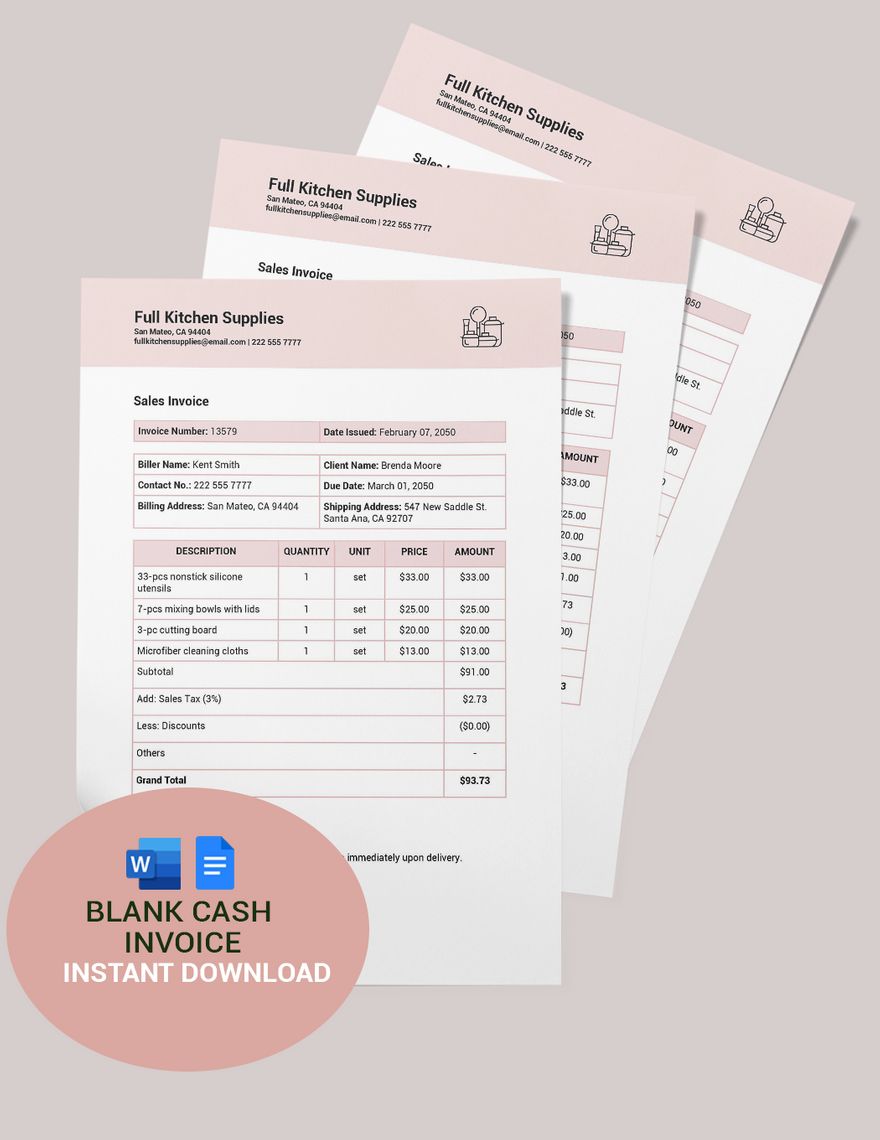

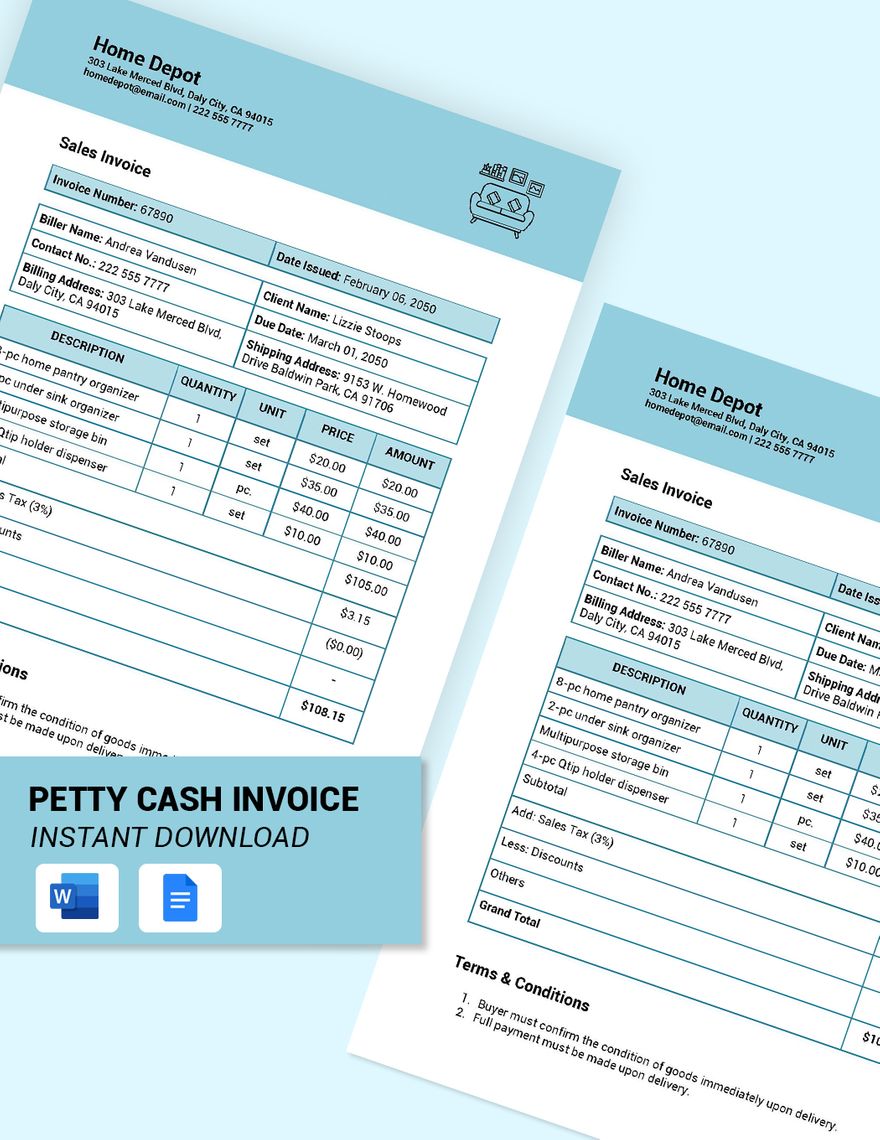

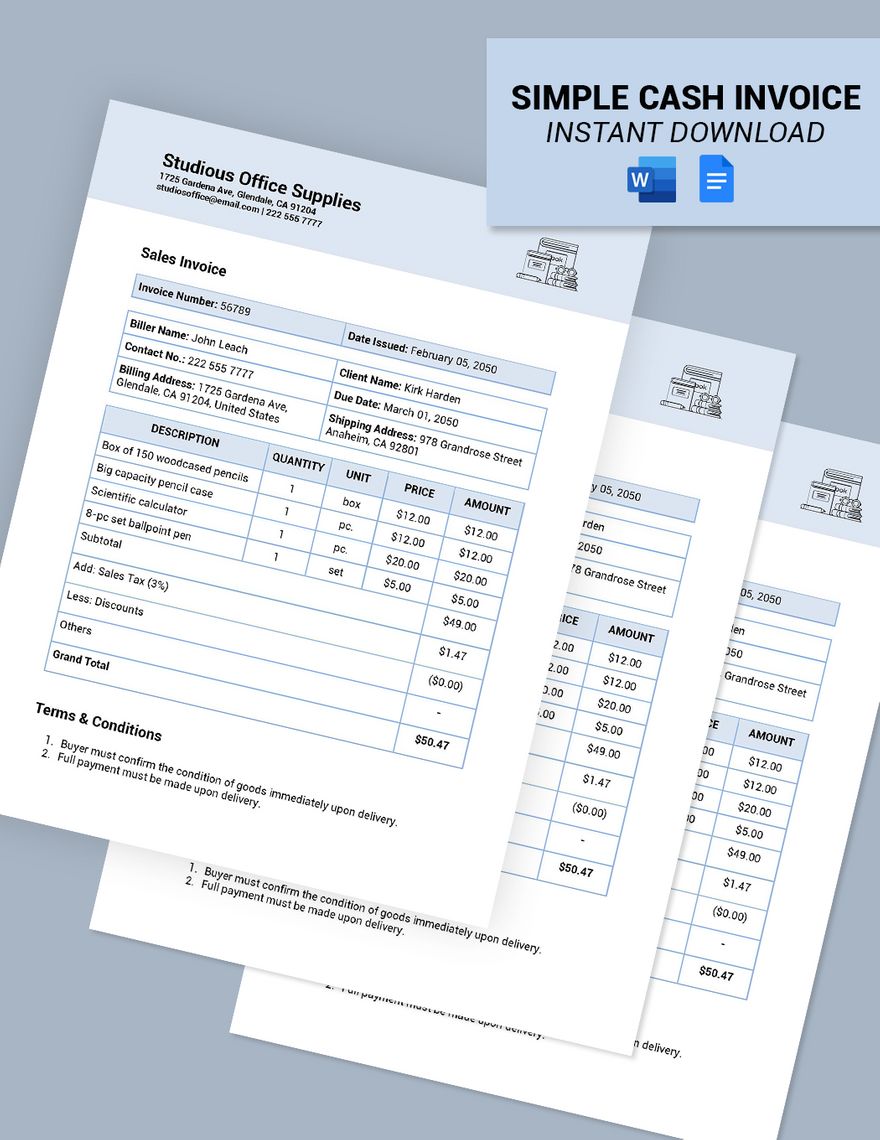

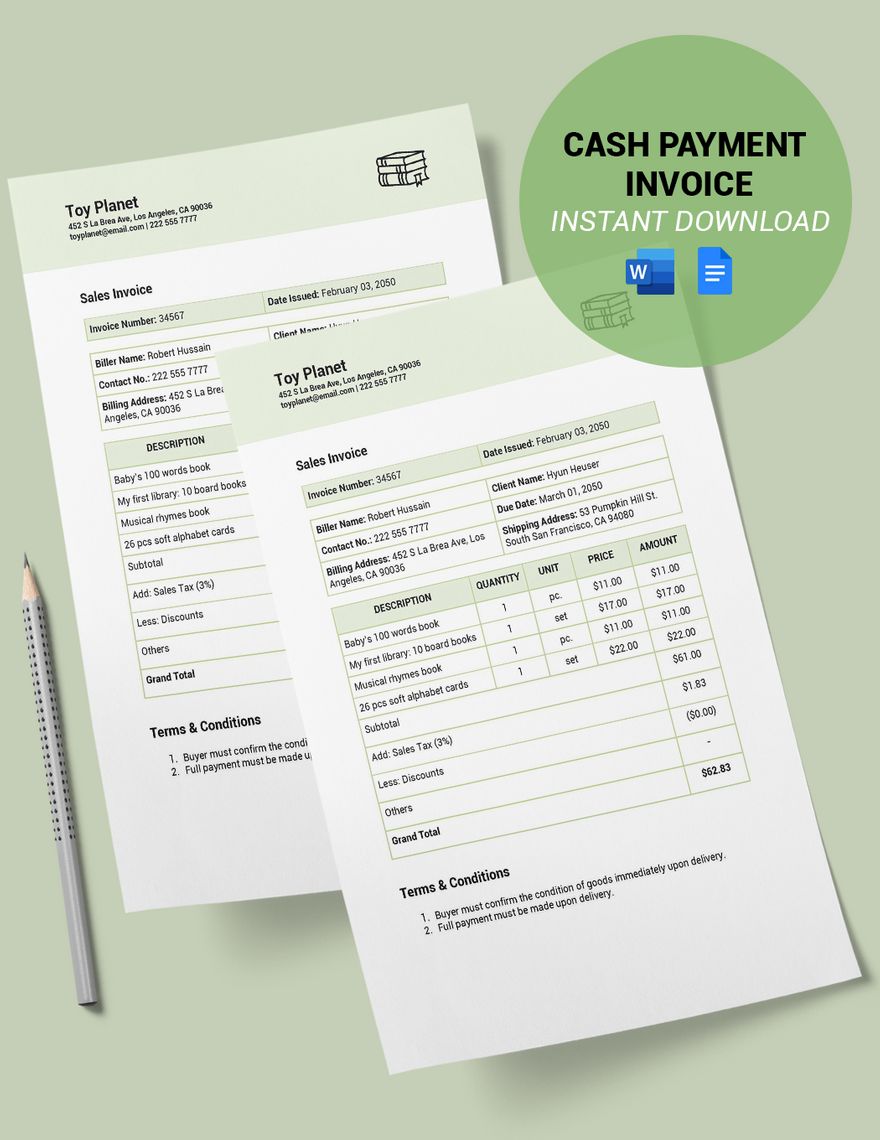

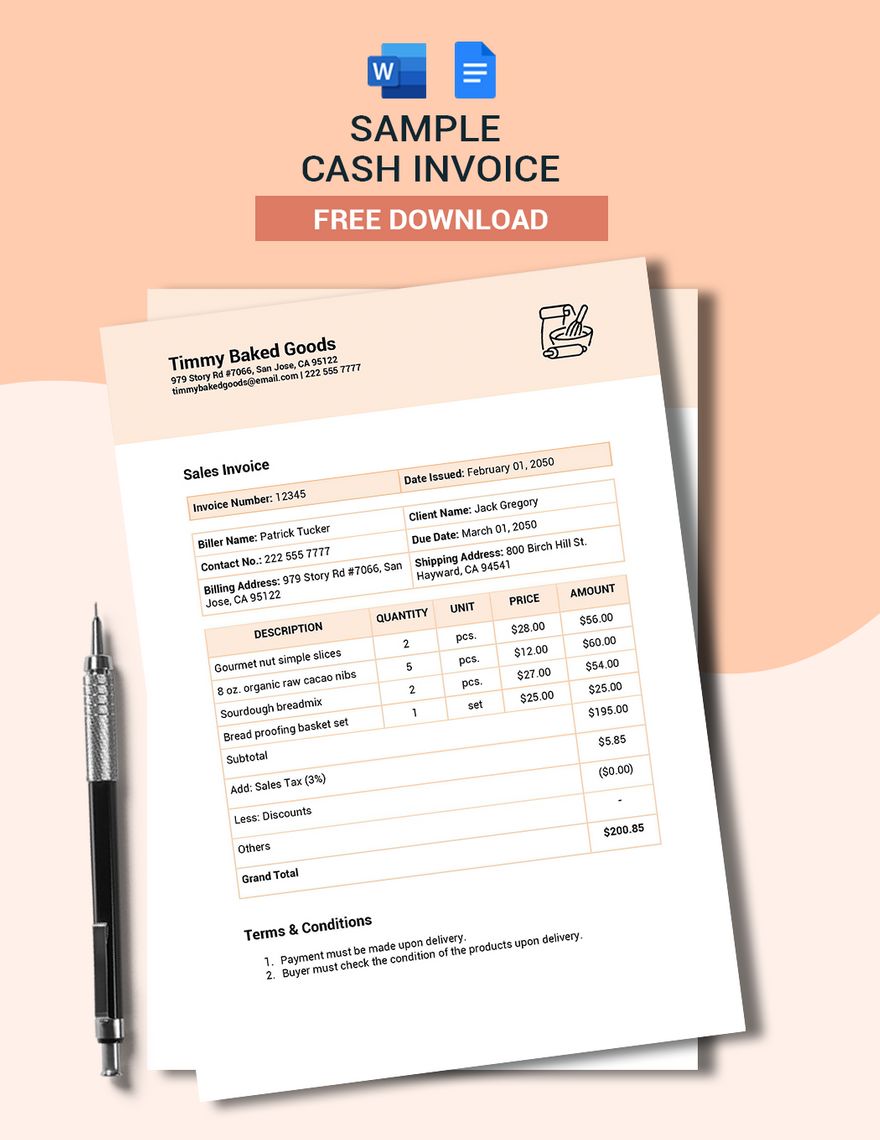

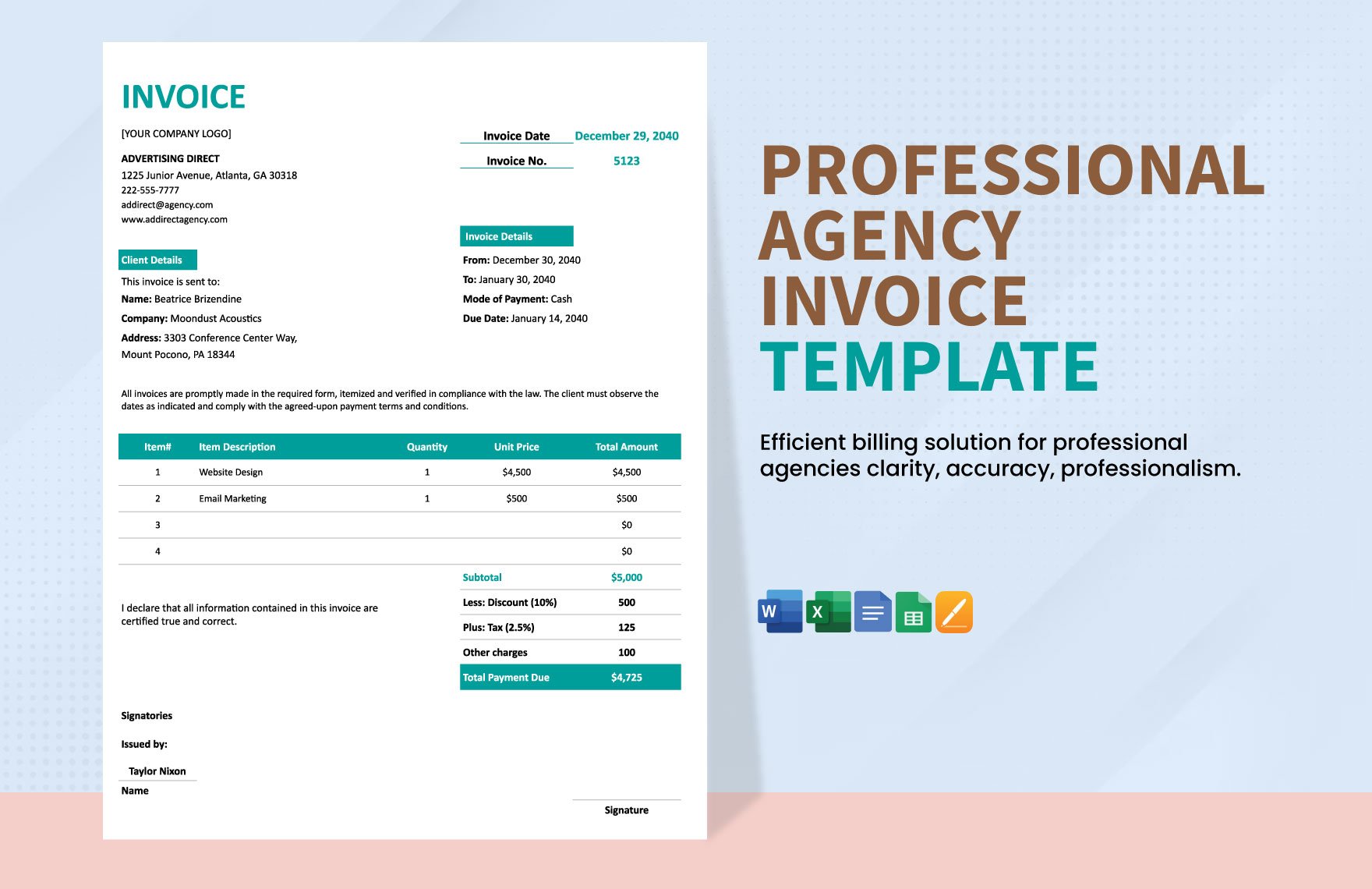

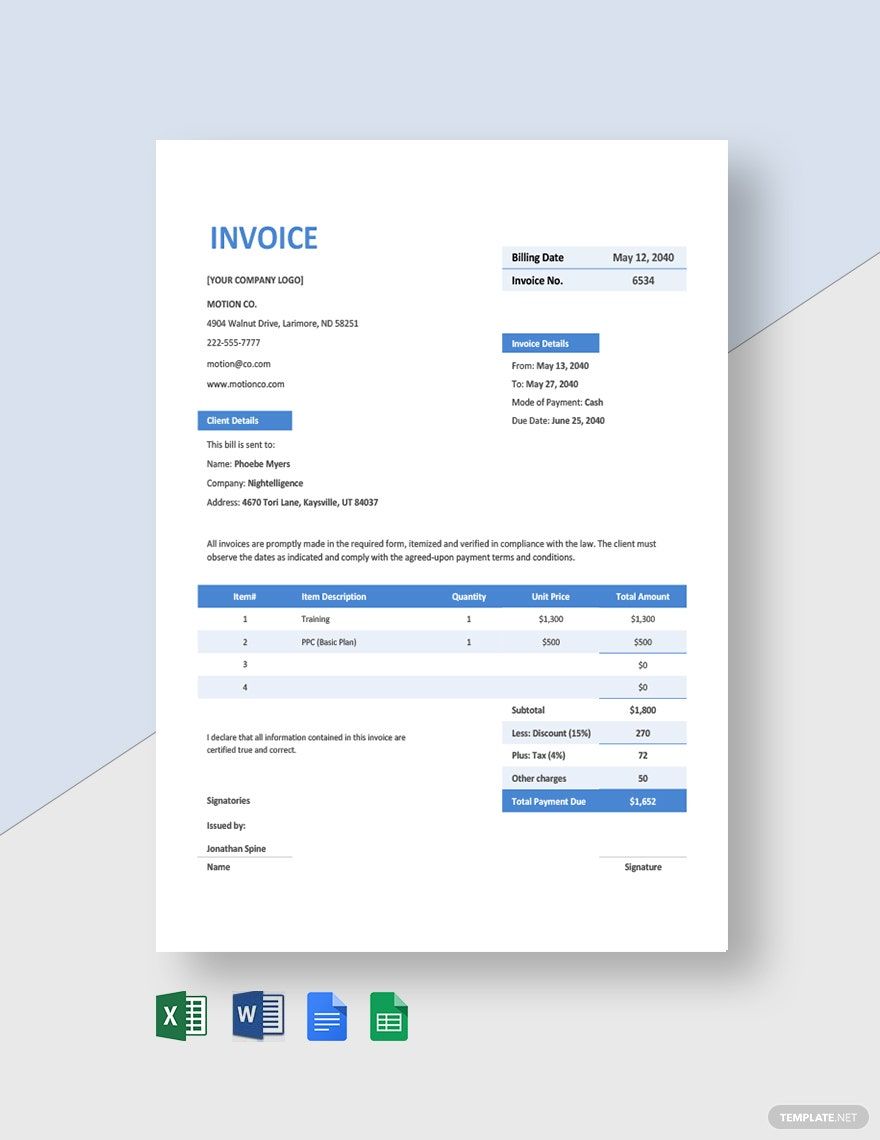

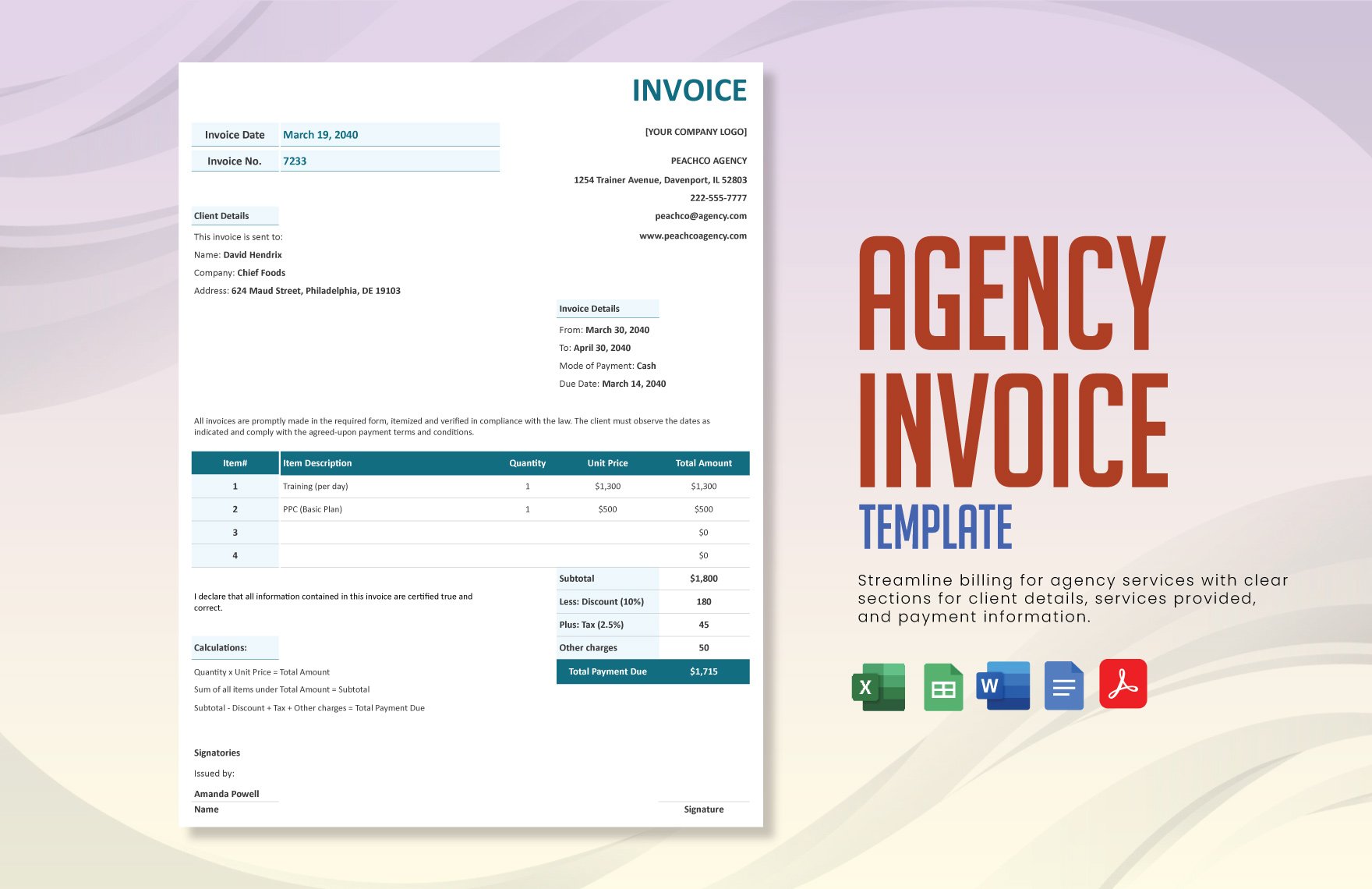

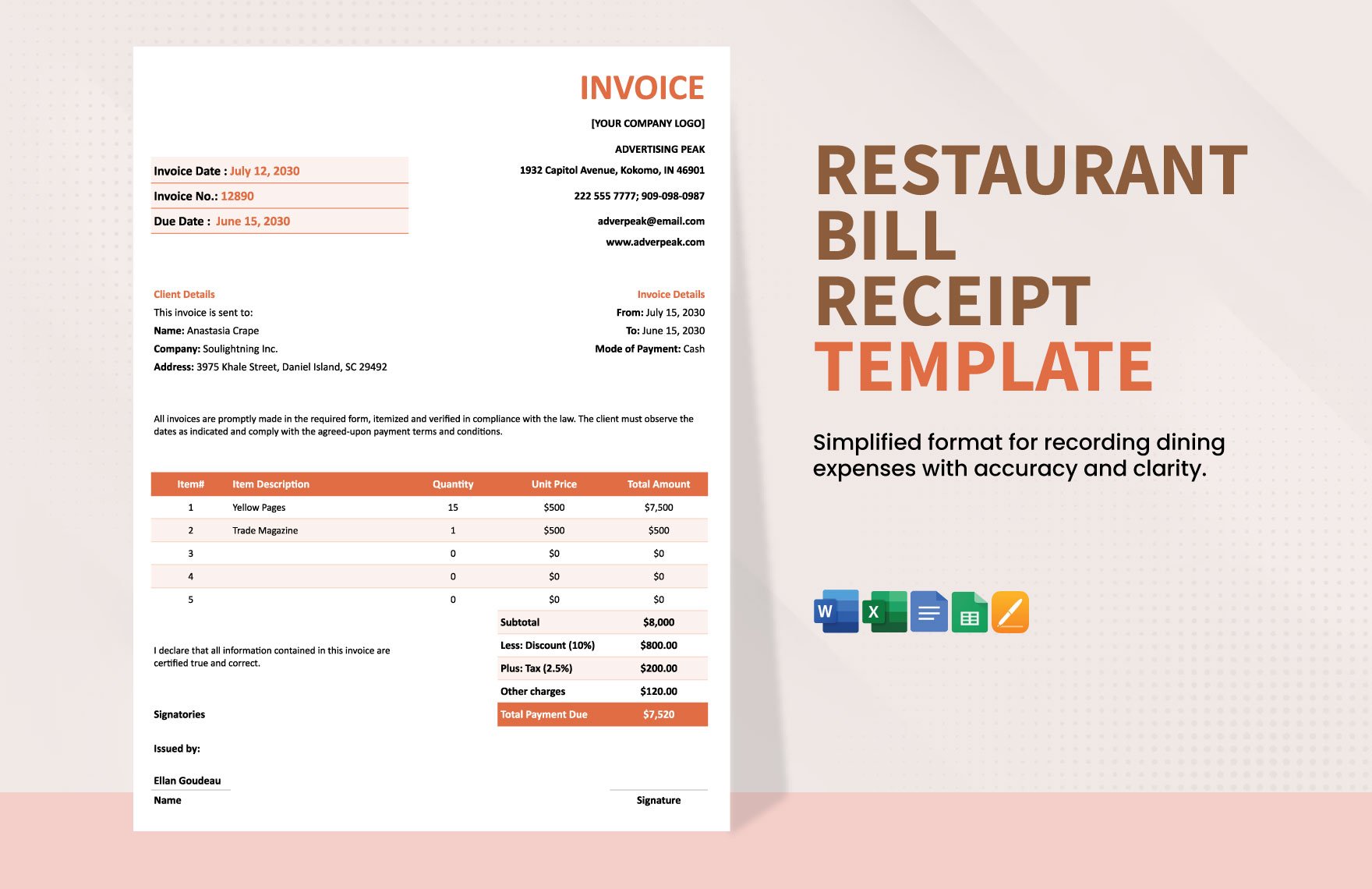

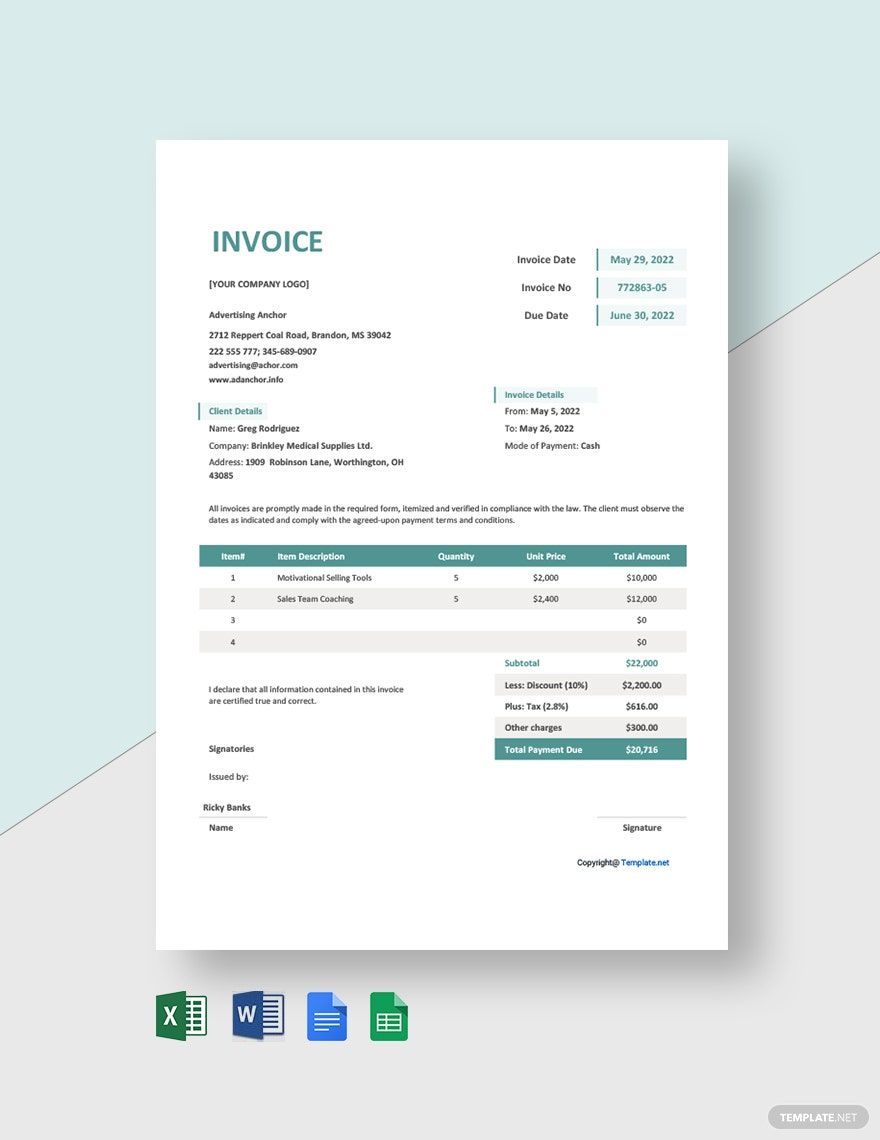

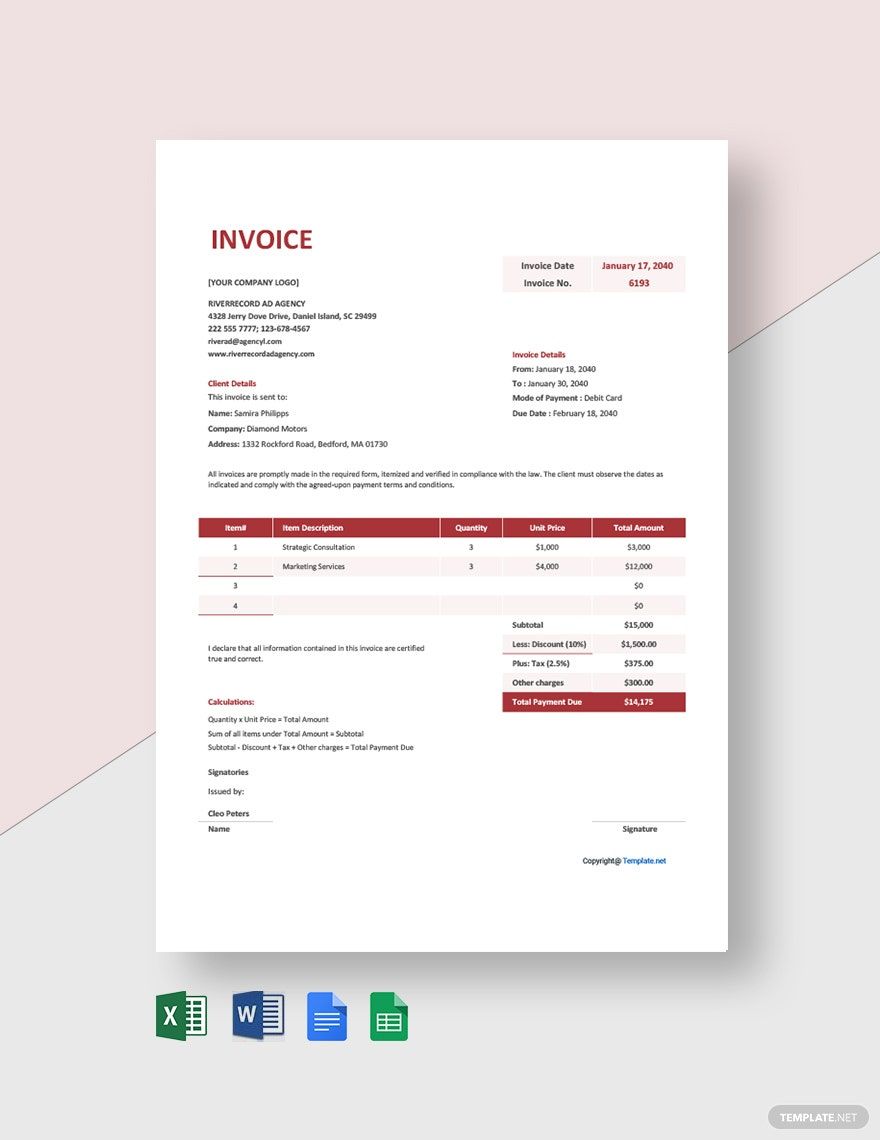

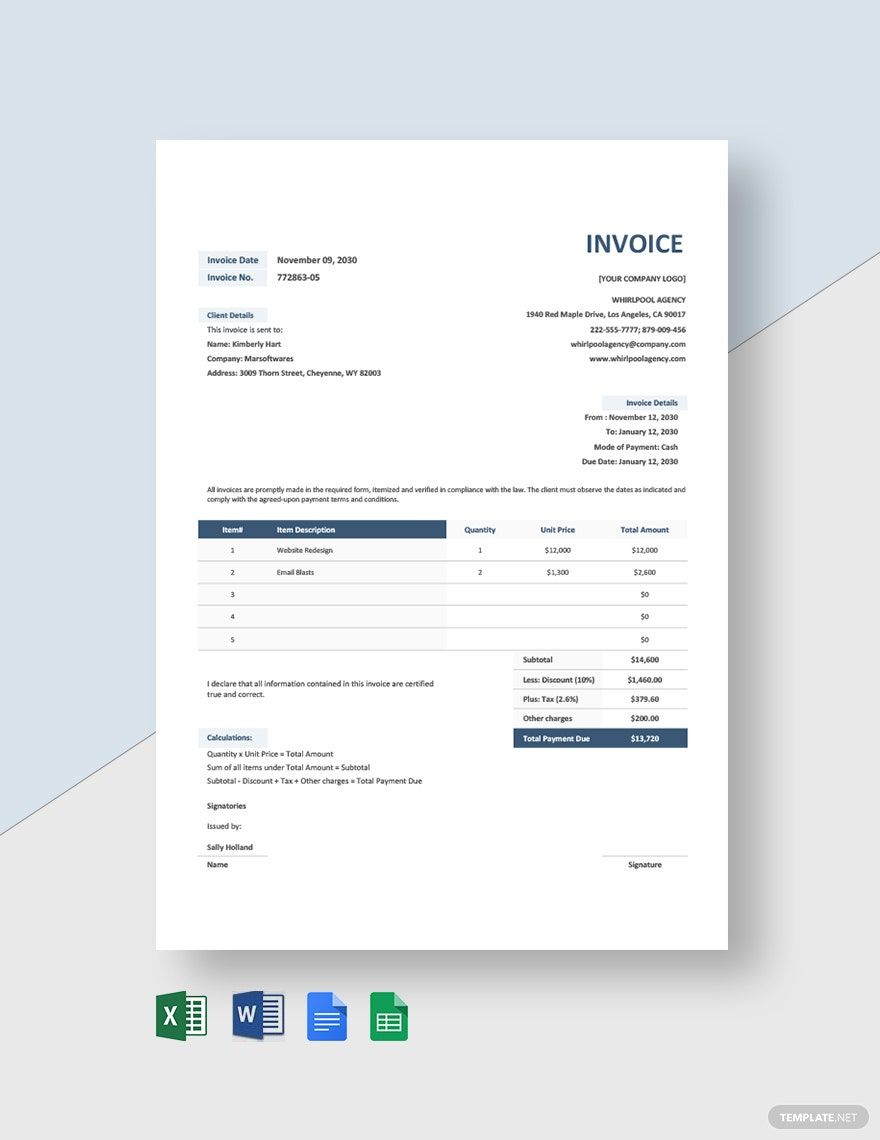

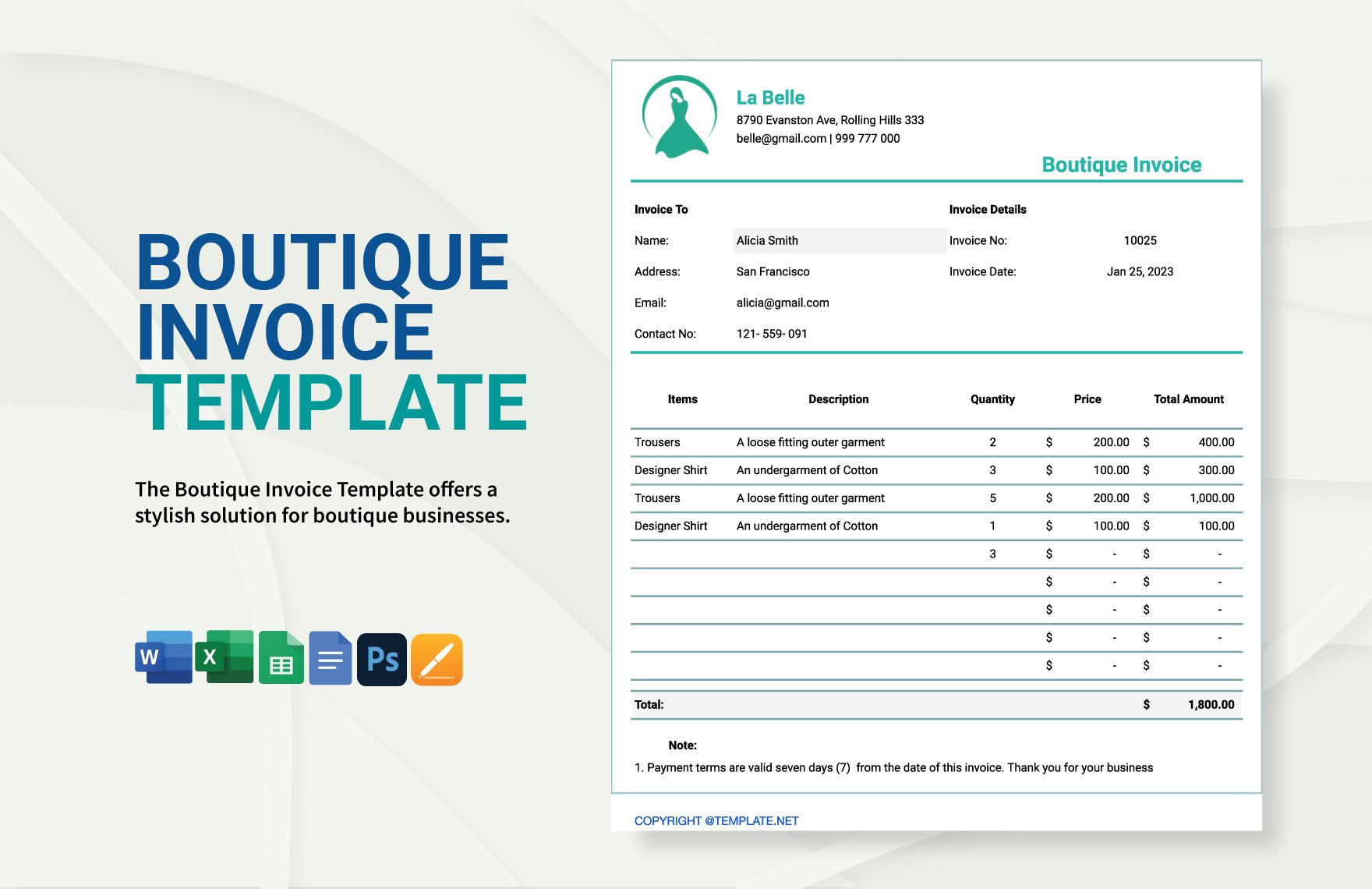

Complaints from customers are an inevitable scenario in most businesses—usually, these complaints rooted in misleading receipts or faulty bills. In order to avoid this kind of complaint, as a responsible business owner, you need to document every business transaction. One way to eliminate this dispute between the business and clients, you have to send a Simple Invoice Template that contains payment information. With an invoice, your clients will know that they owe a specific amount of money. Not only that. It helps in keeping positive cash flow in your company. If you want to maintain a good compensation from your clients or customers, here is a ready-made, 100% customizable, easily editable, high-quality, and printable Simple Invoice Template that you can instantly download from our website.

How to Make a Simple Invoice in Microsoft Office Word

As much as possible, you want to be efficient in your business operations, try to cut costs, and save valuable time. You would probably wonder how to get these things done all at once. According to Forbes Magazine, your business will highly benefit if you would do every transaction through electronics. That said, sending out electronic invoices will likely reduce clutter and the influx of emails.

If you want your business to succeed, you have to be equipped. So, we made a list to help you make a simple invoice in Microsoft Office Word. Read below and get started with your invoice.

1. Begin with the Basics

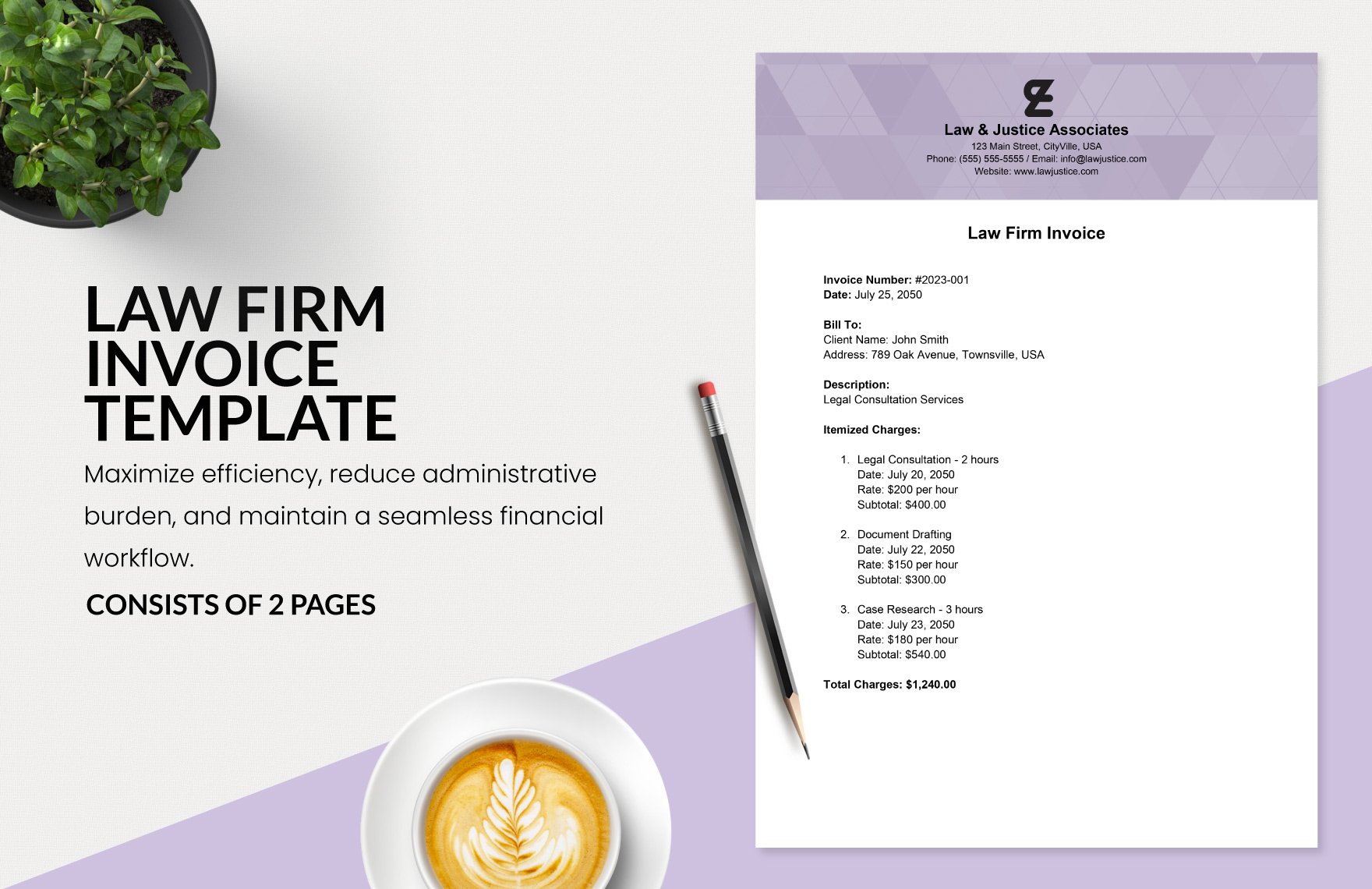

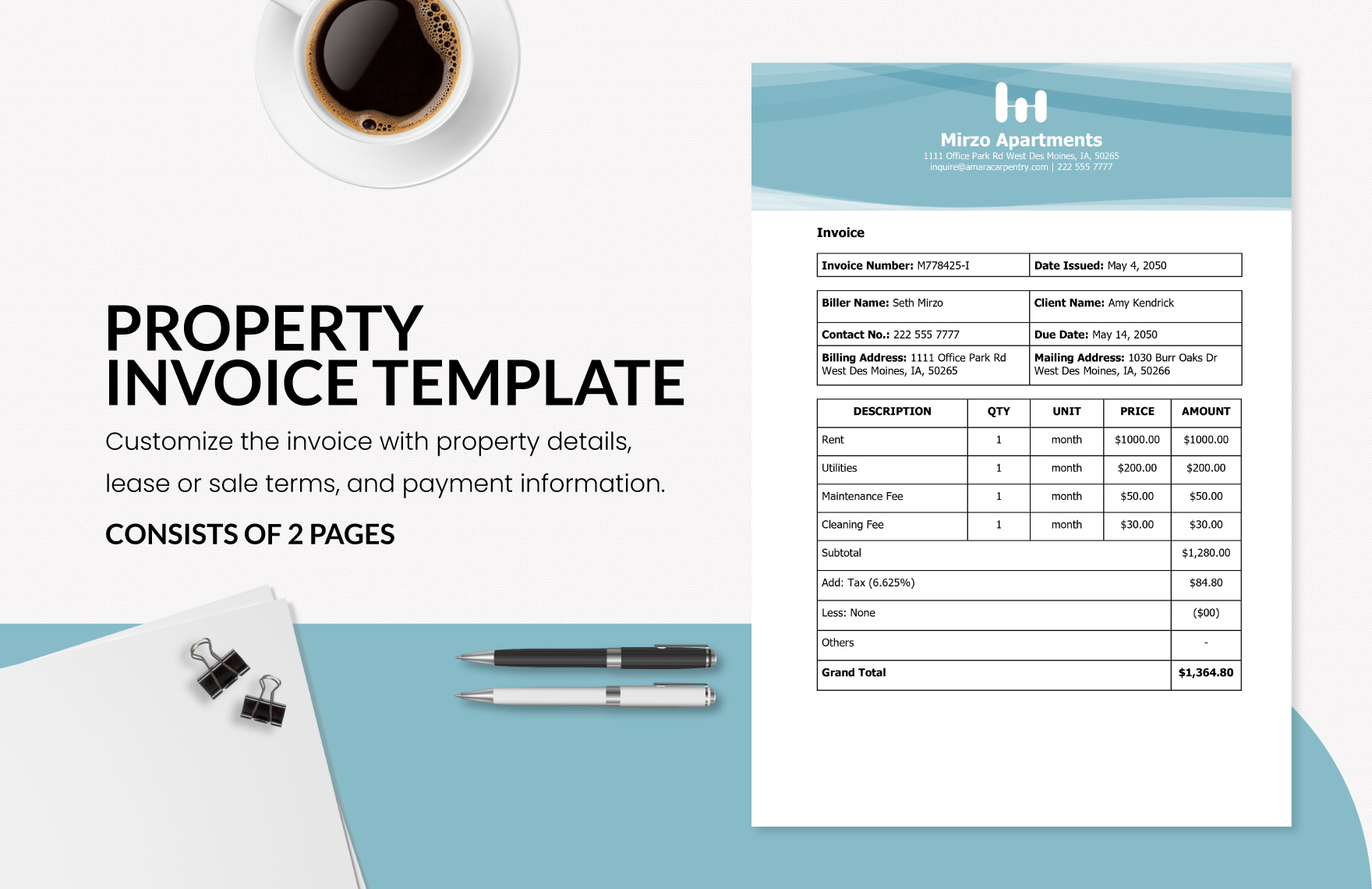

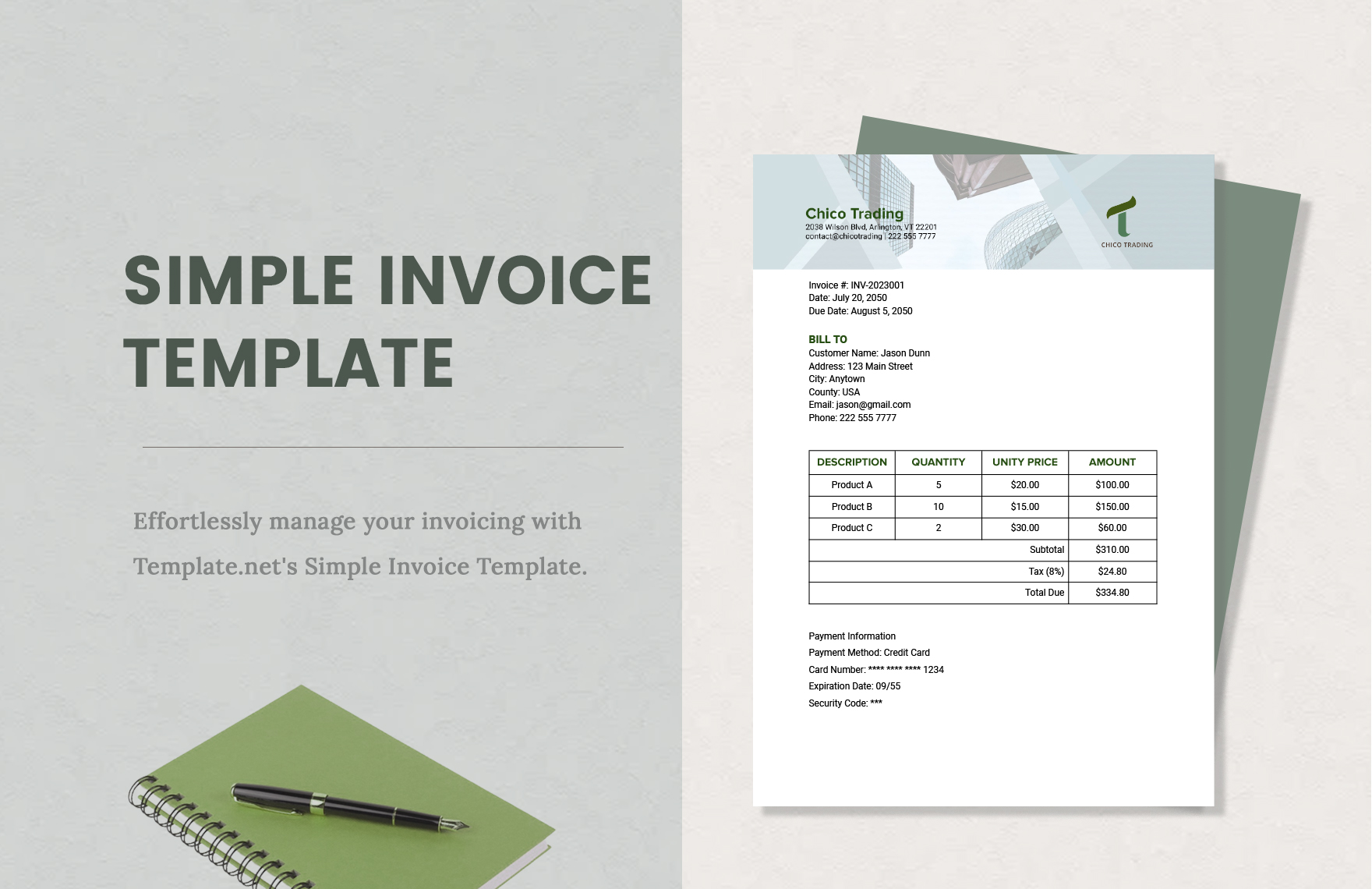

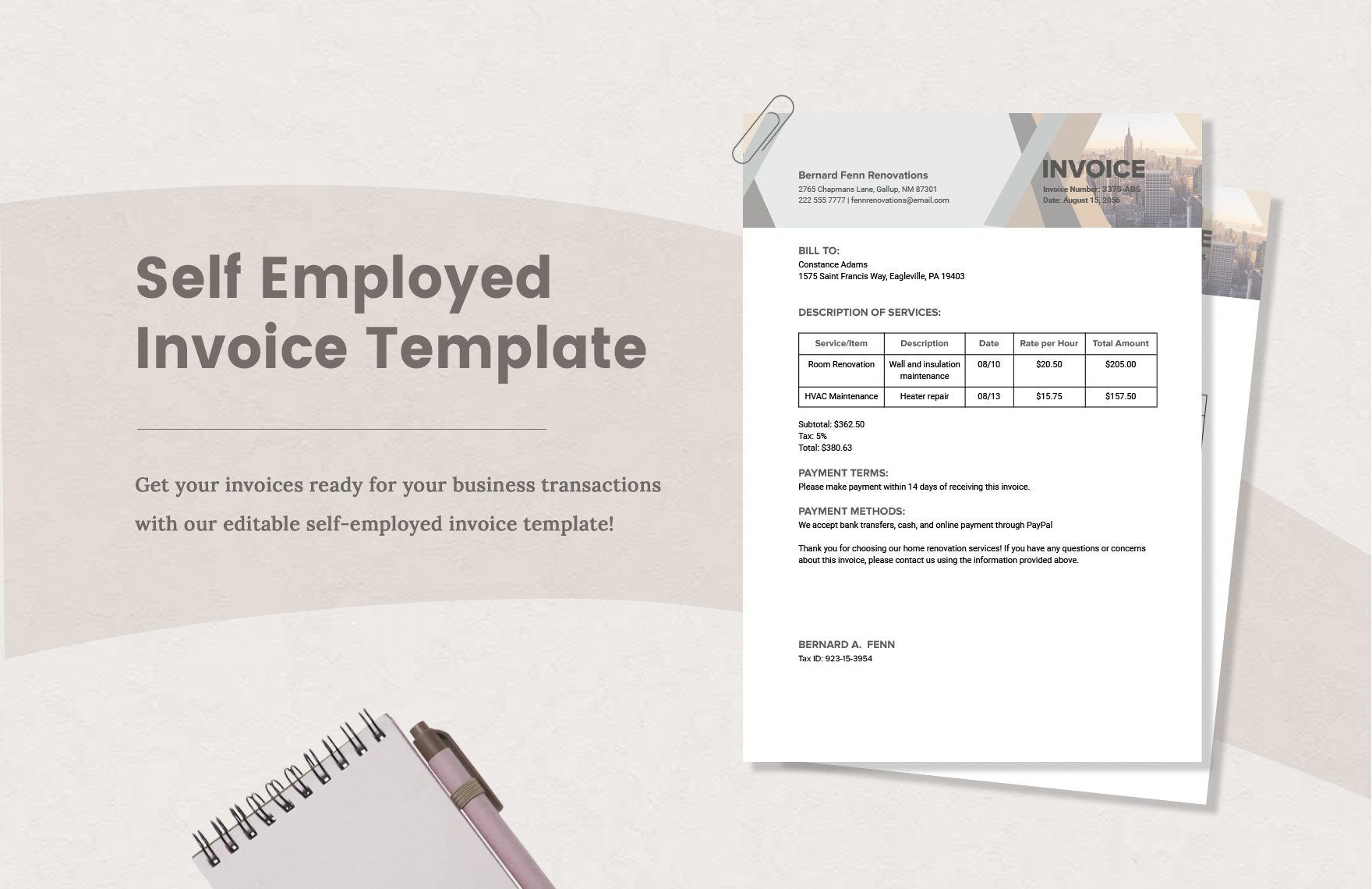

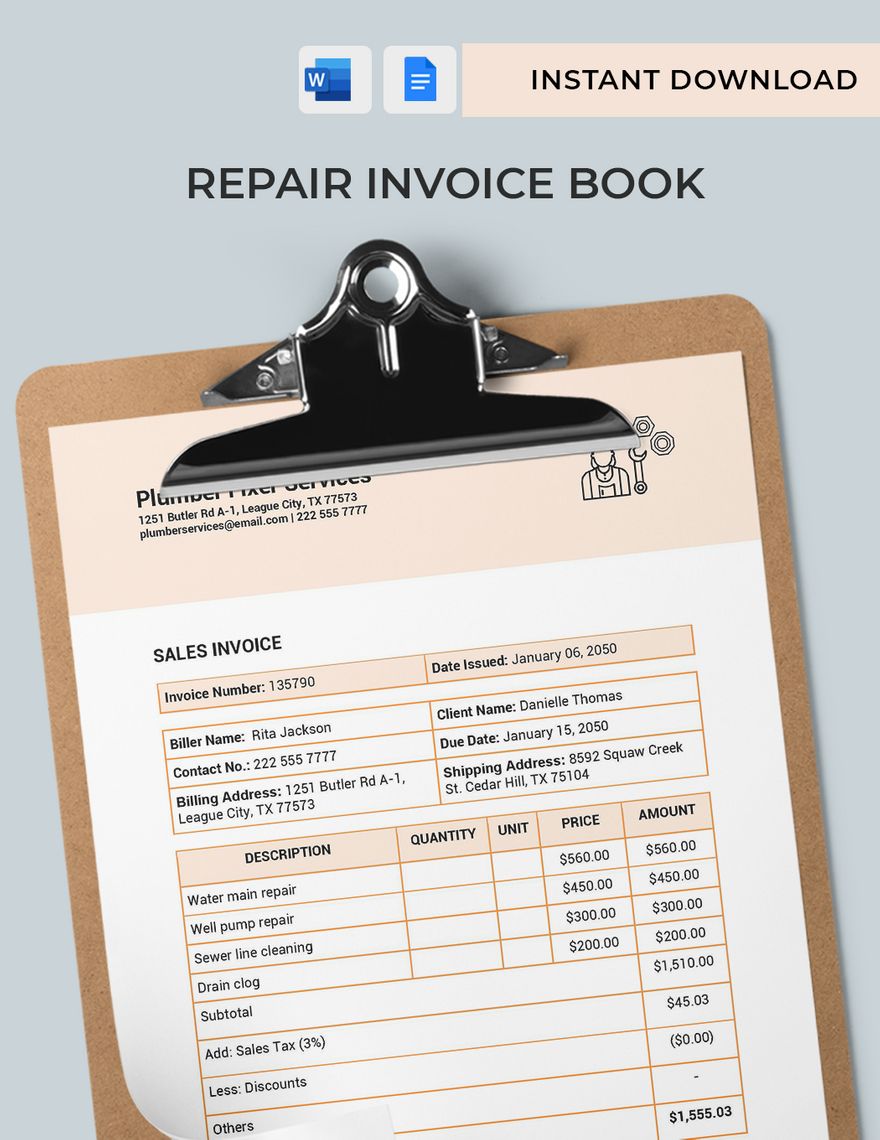

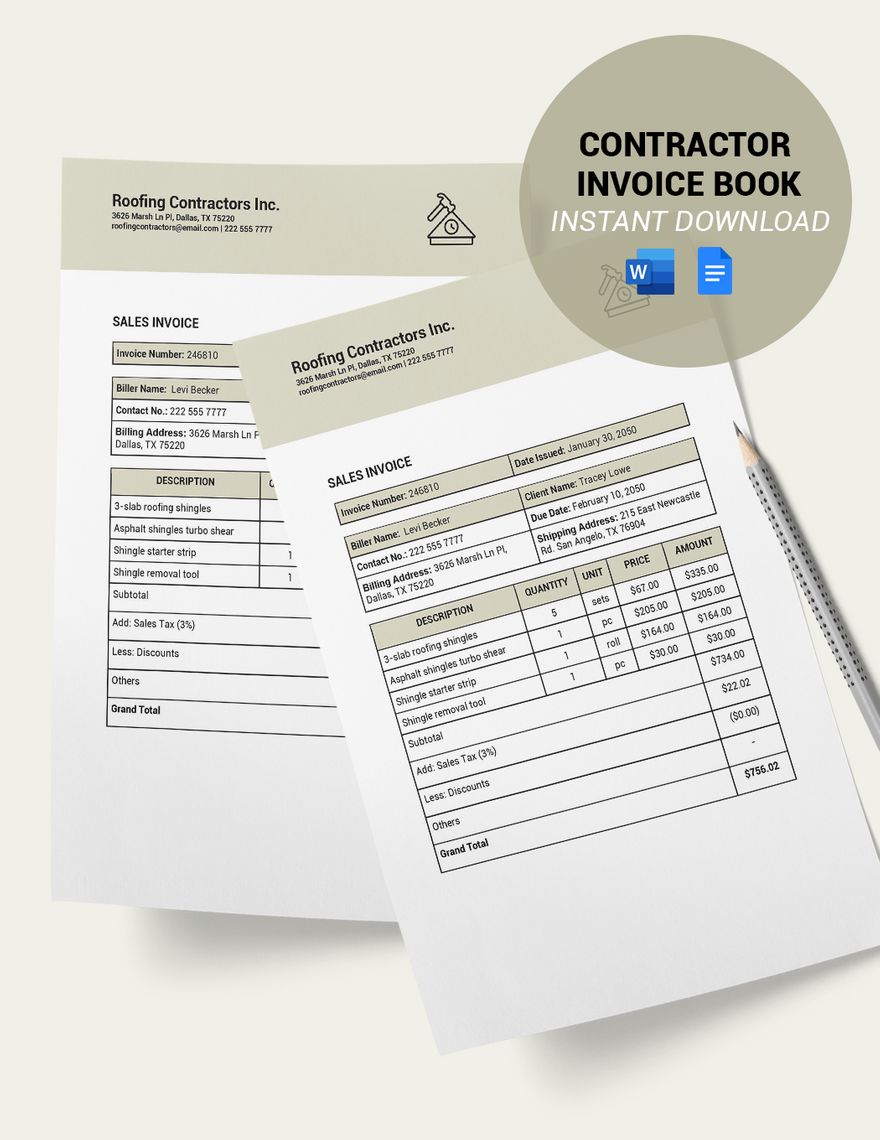

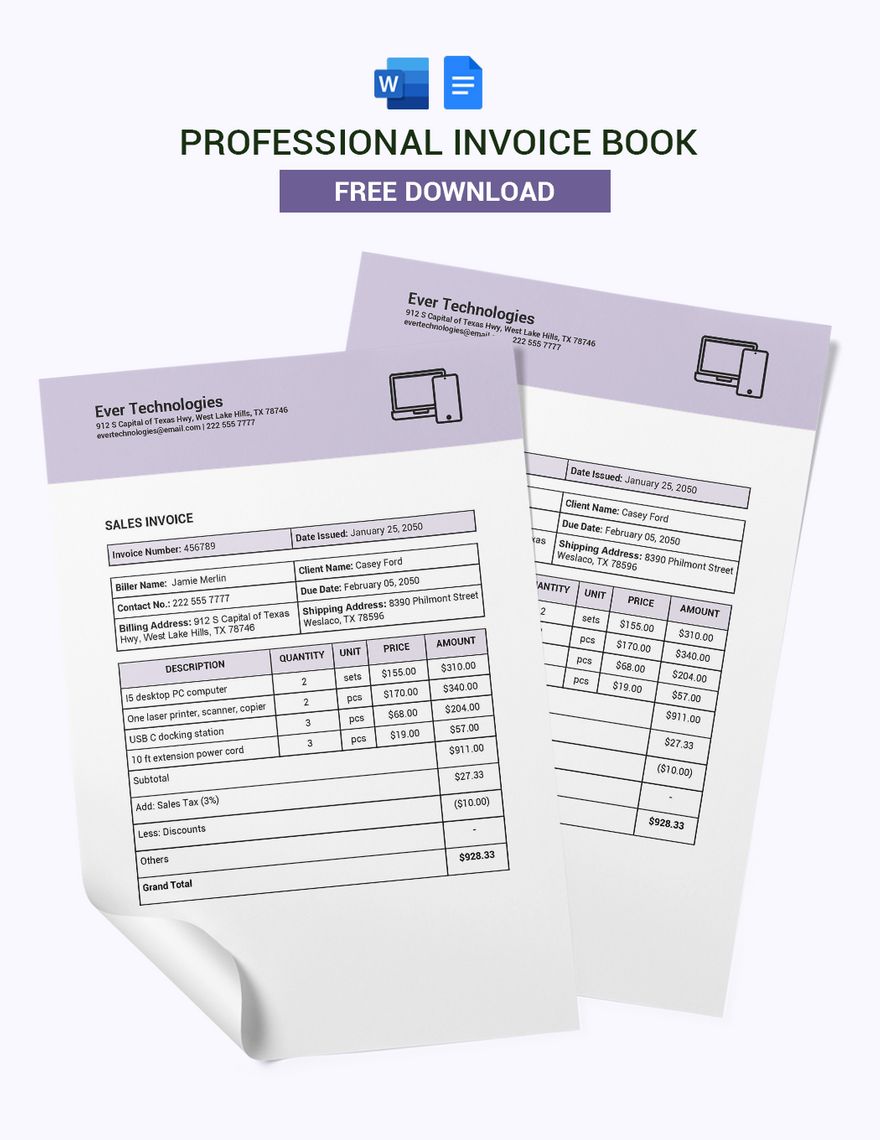

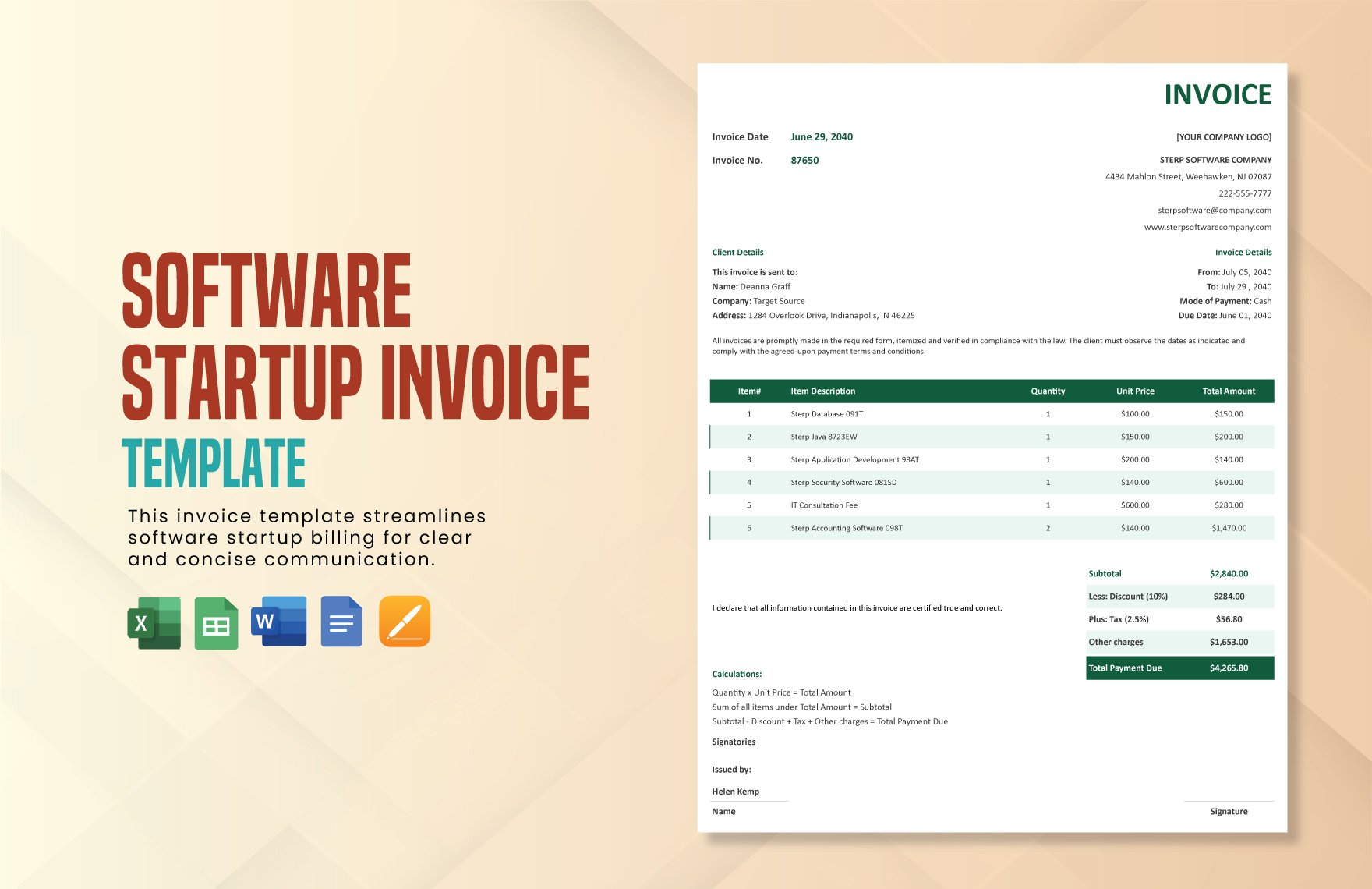

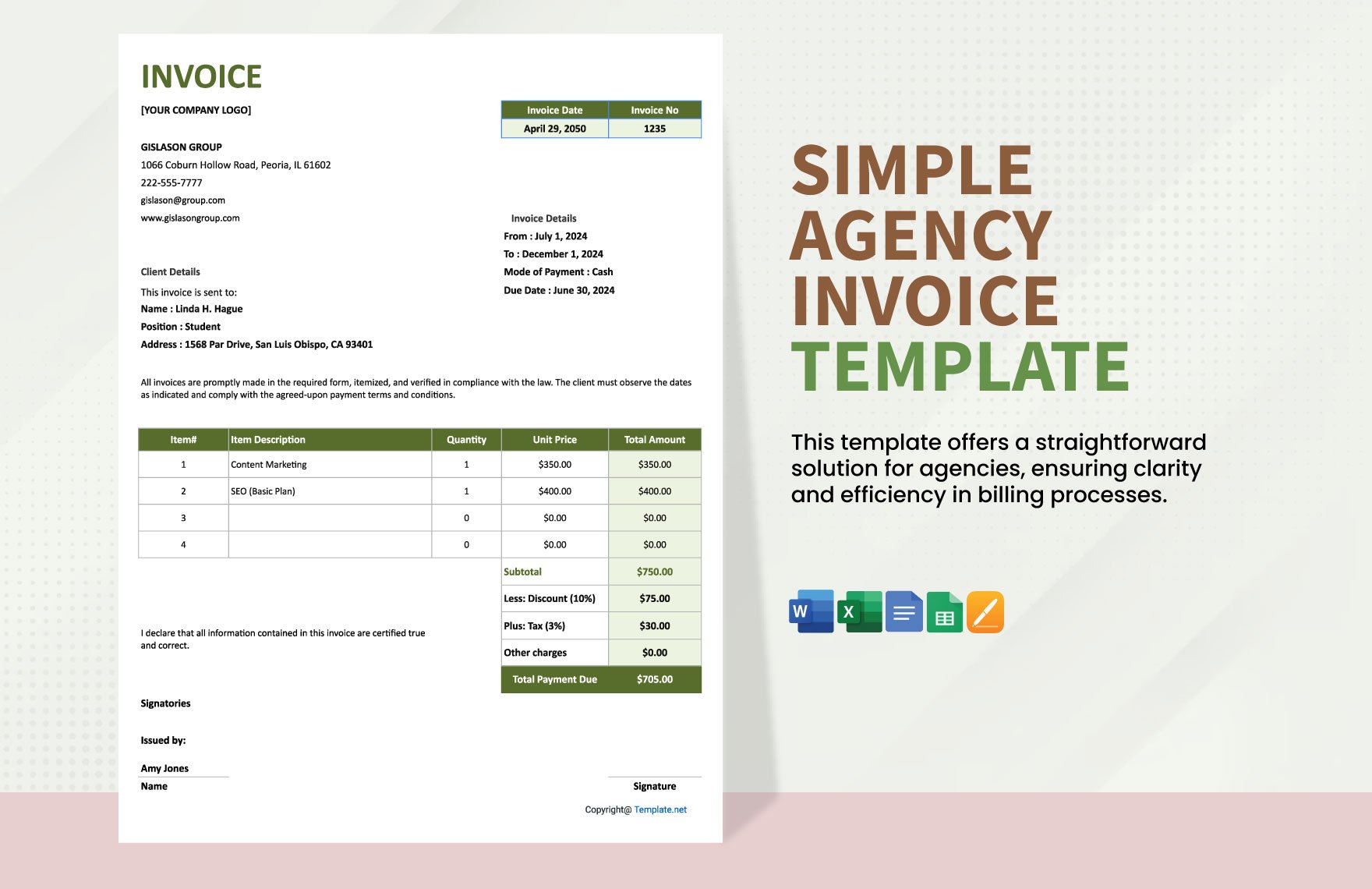

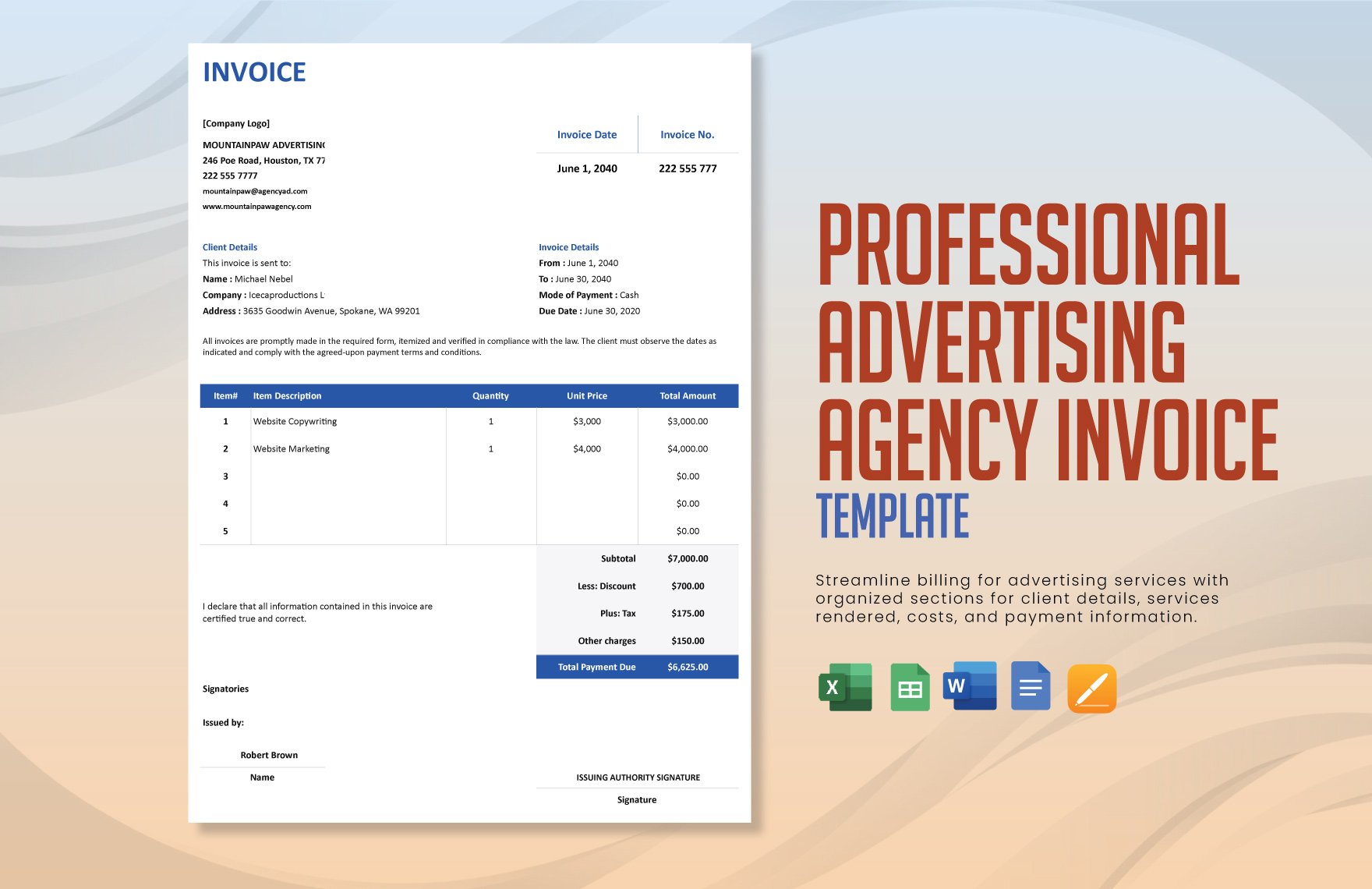

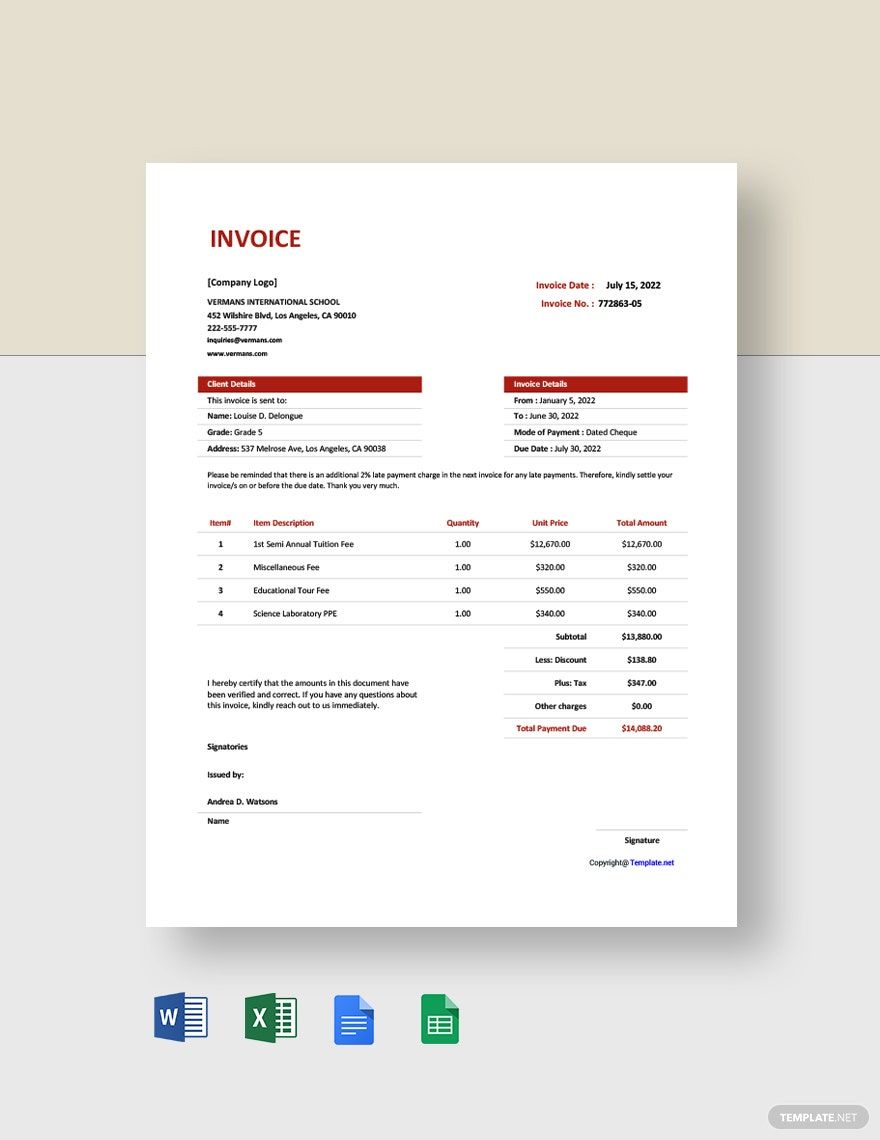

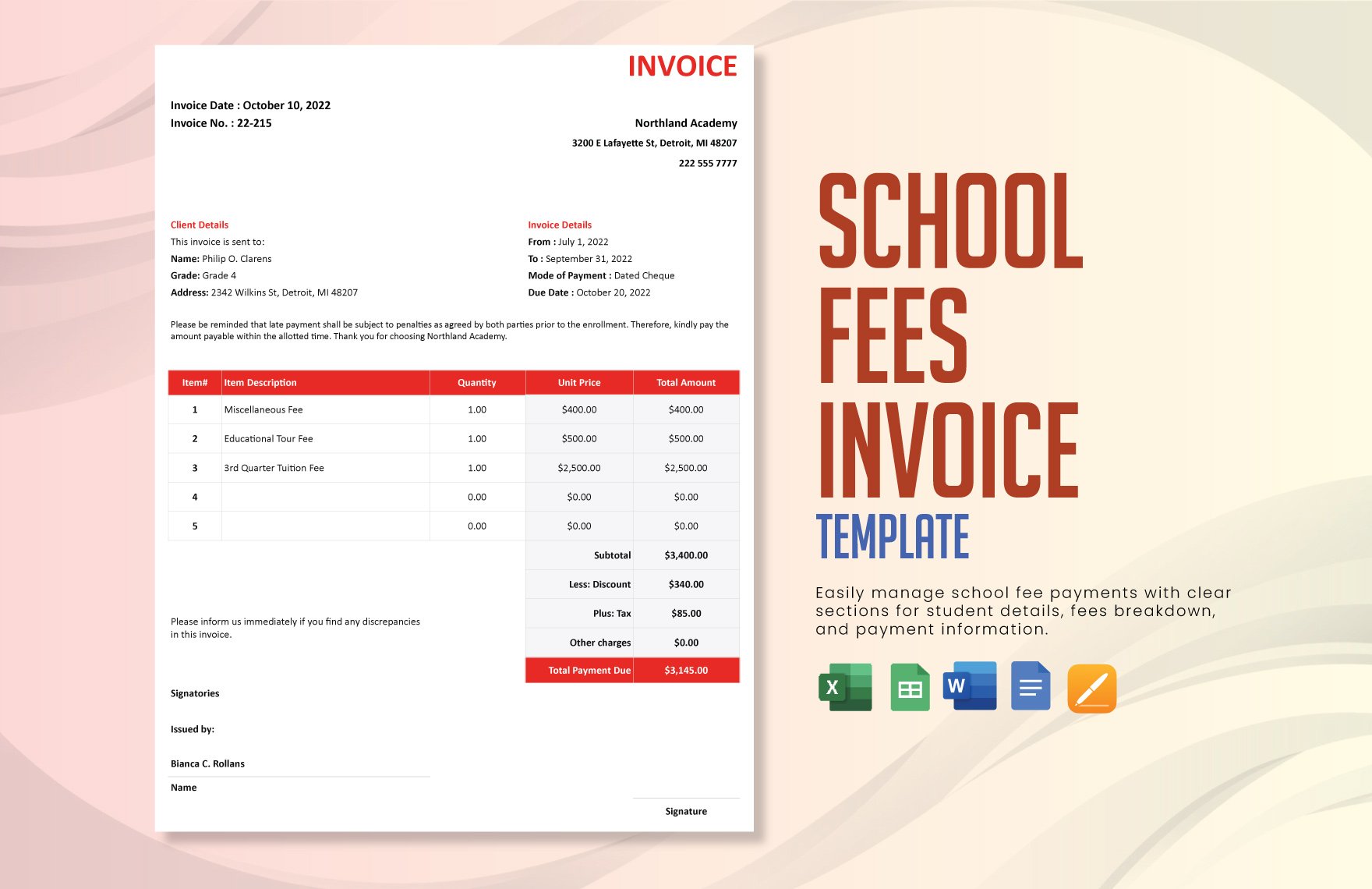

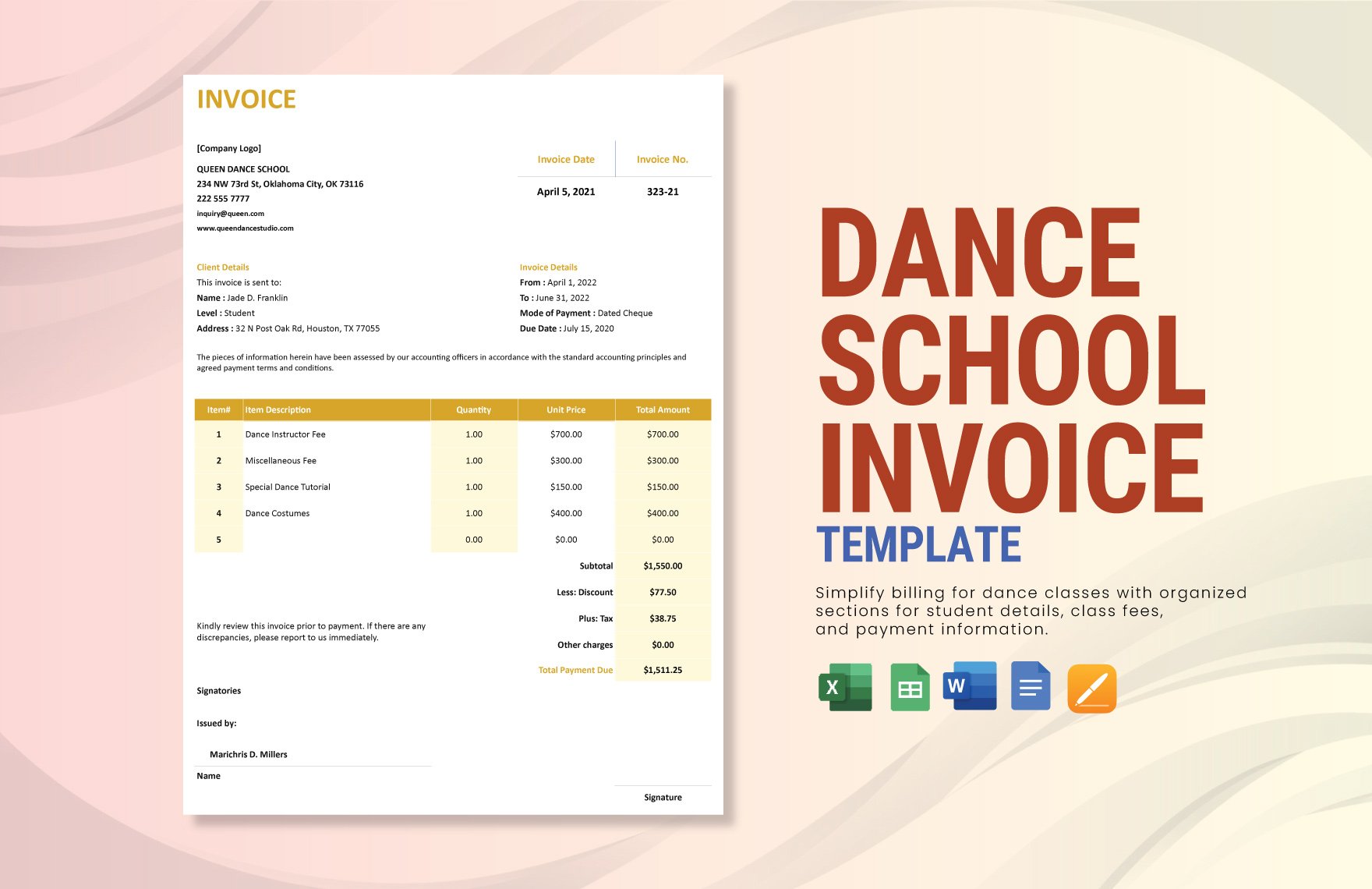

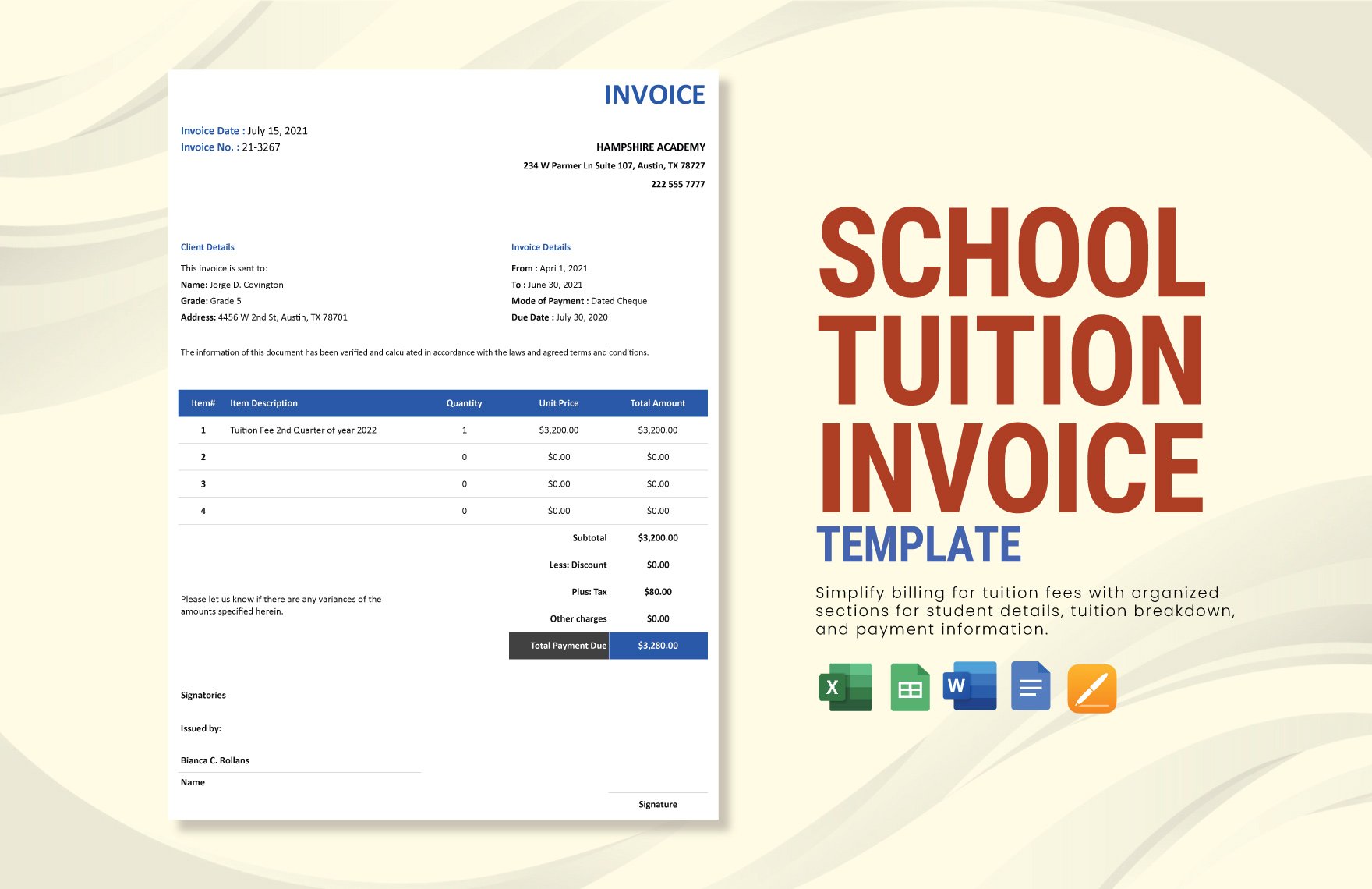

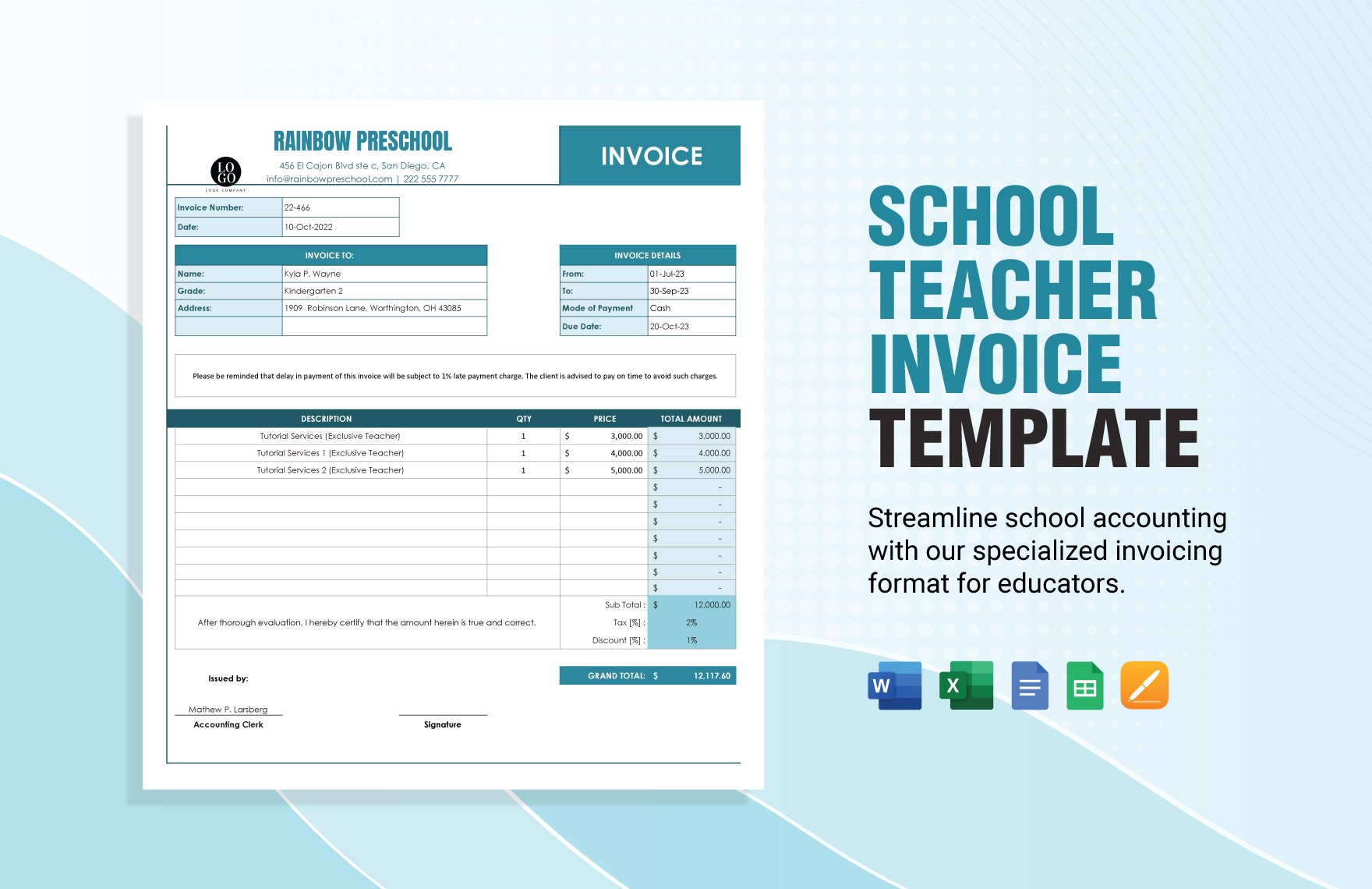

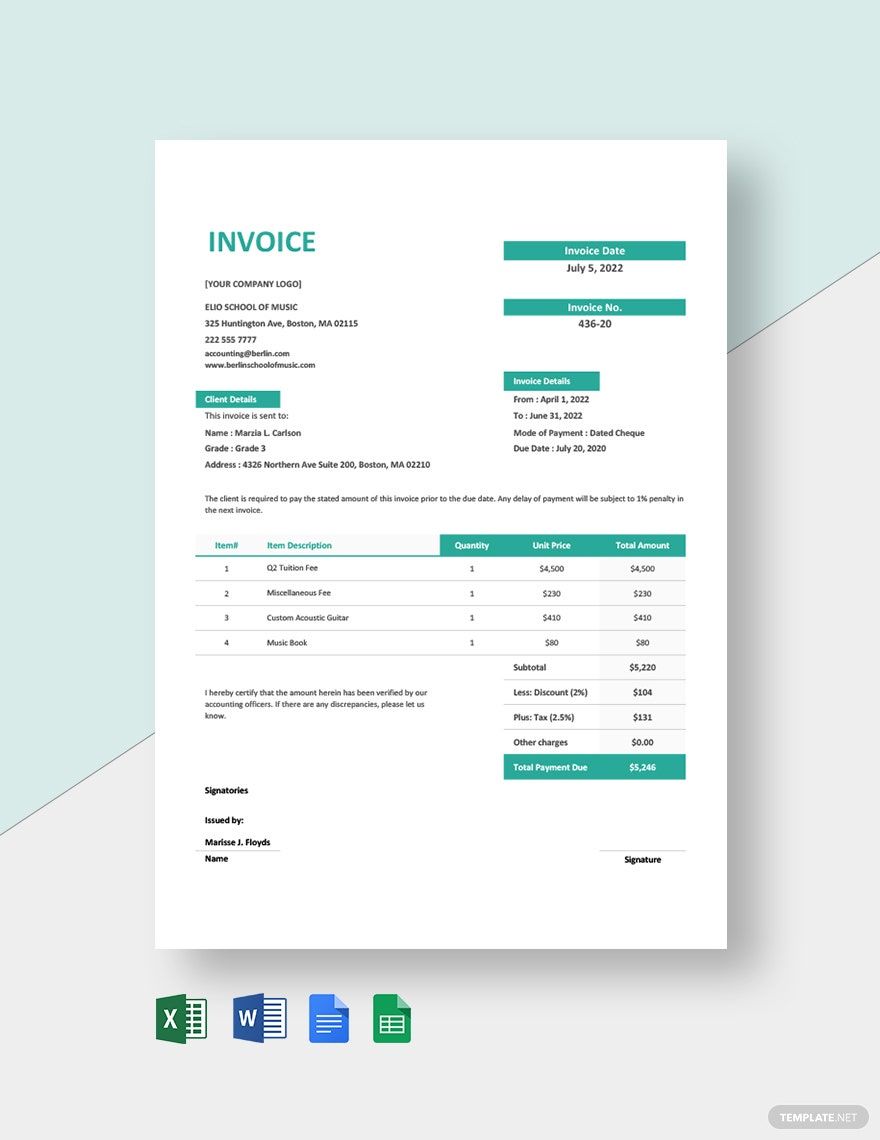

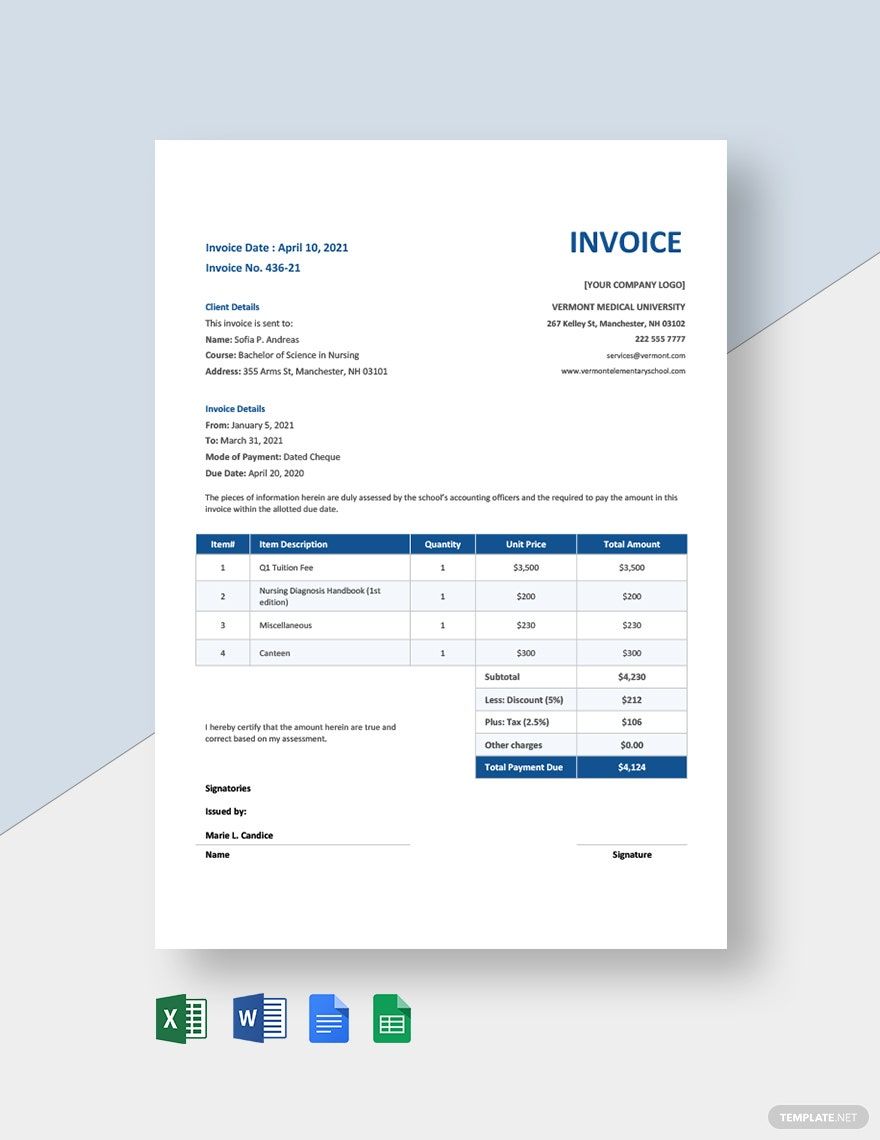

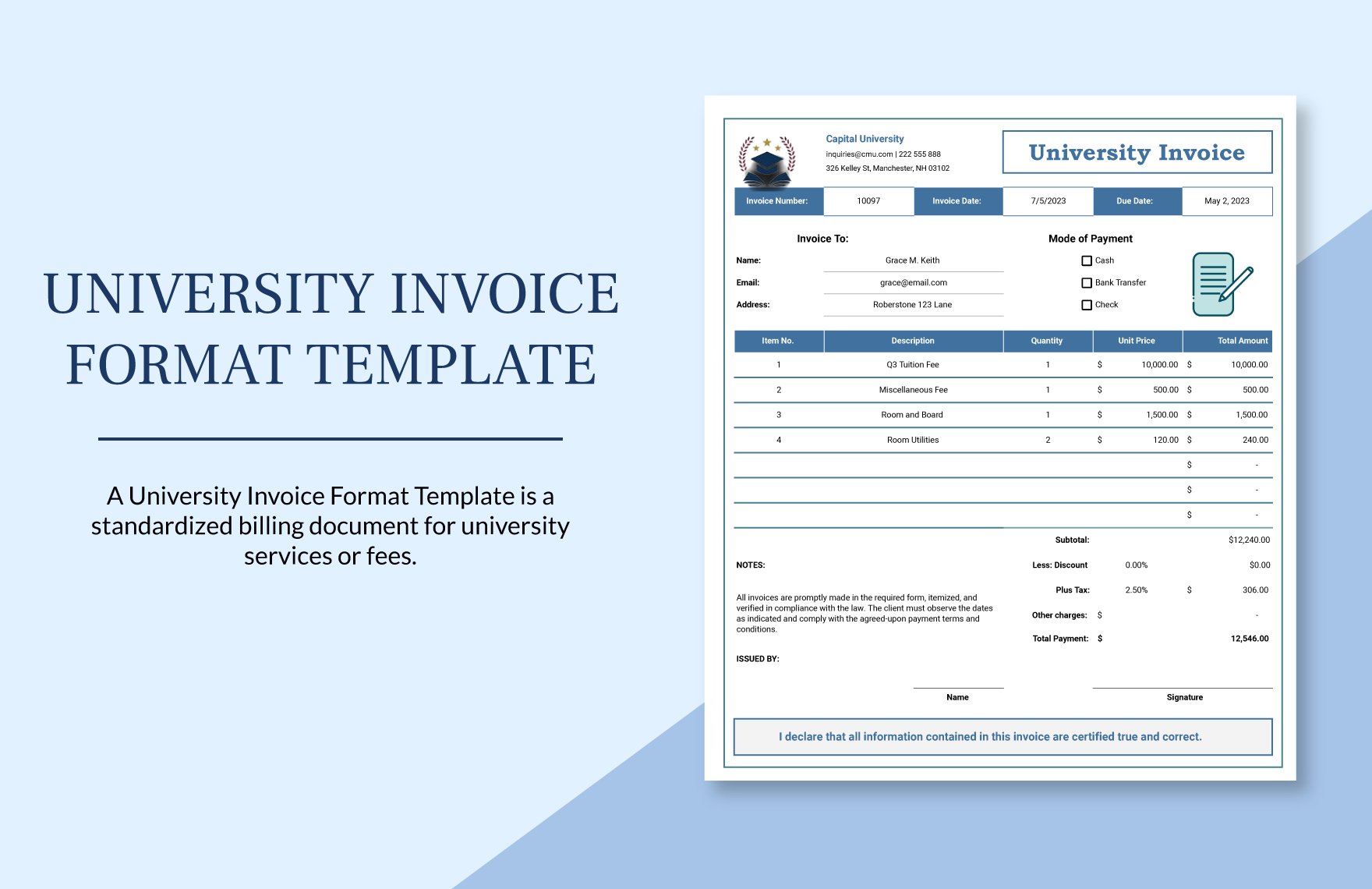

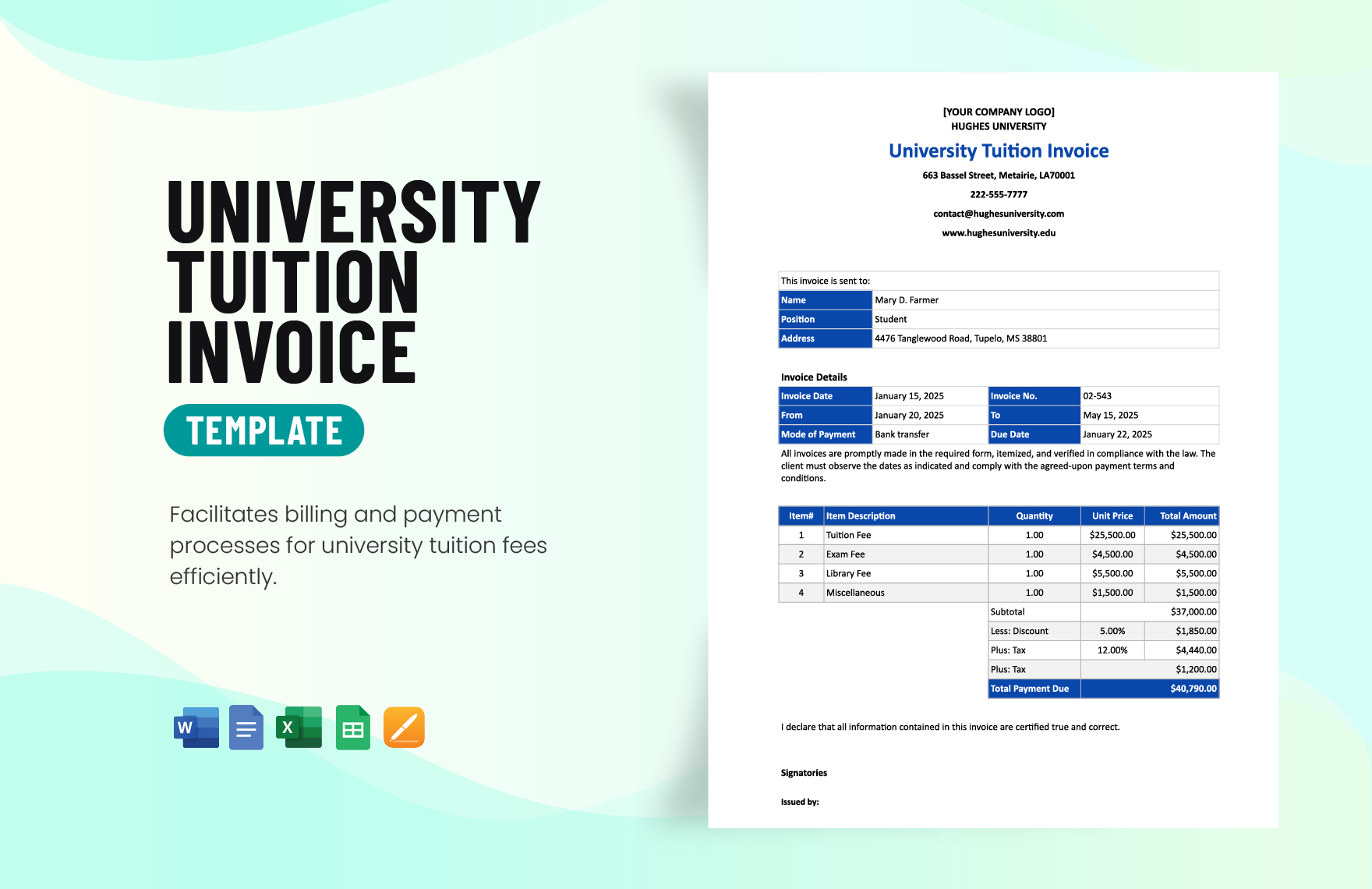

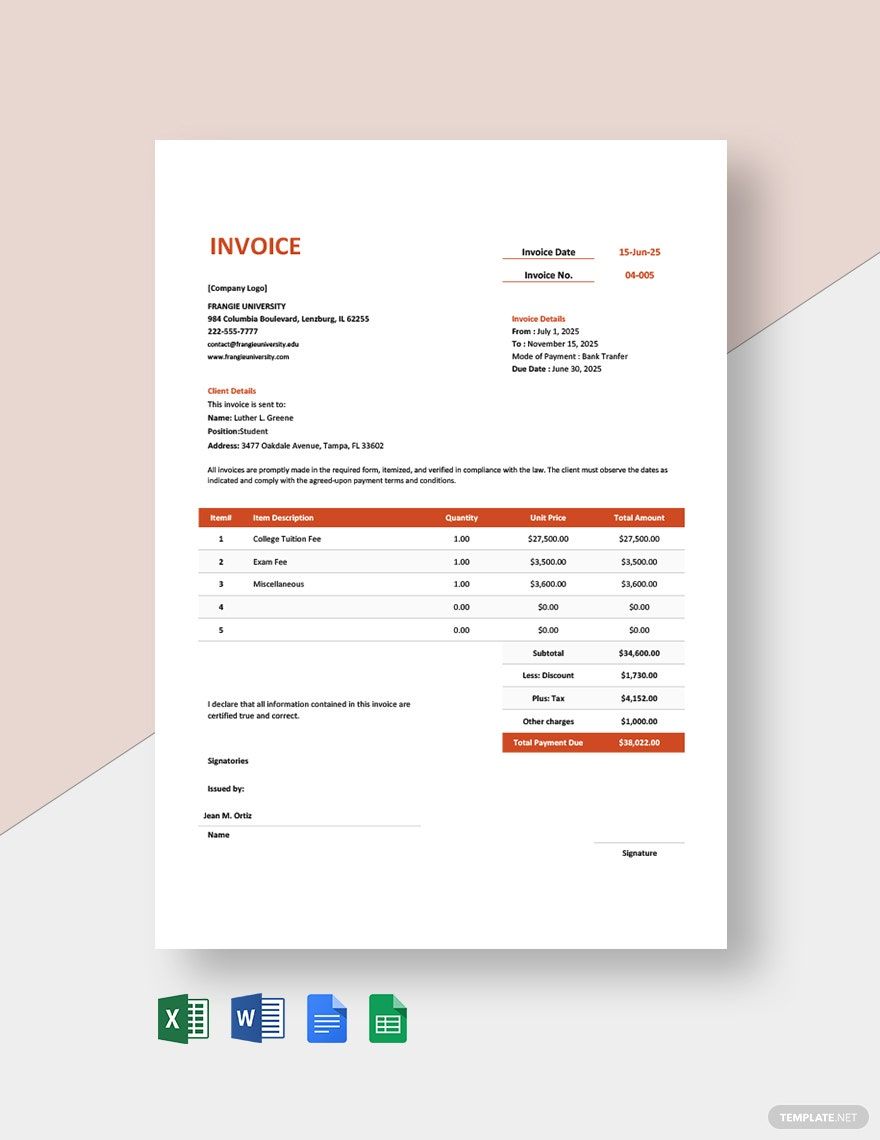

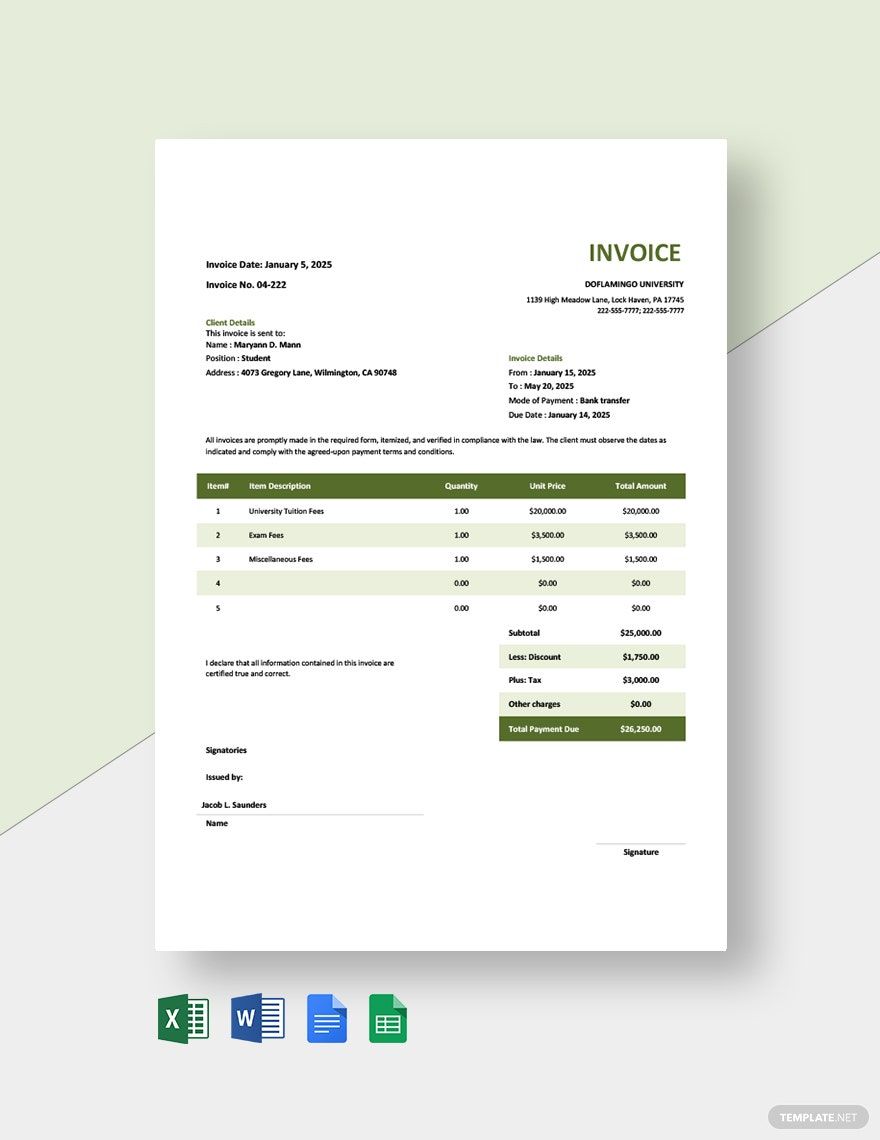

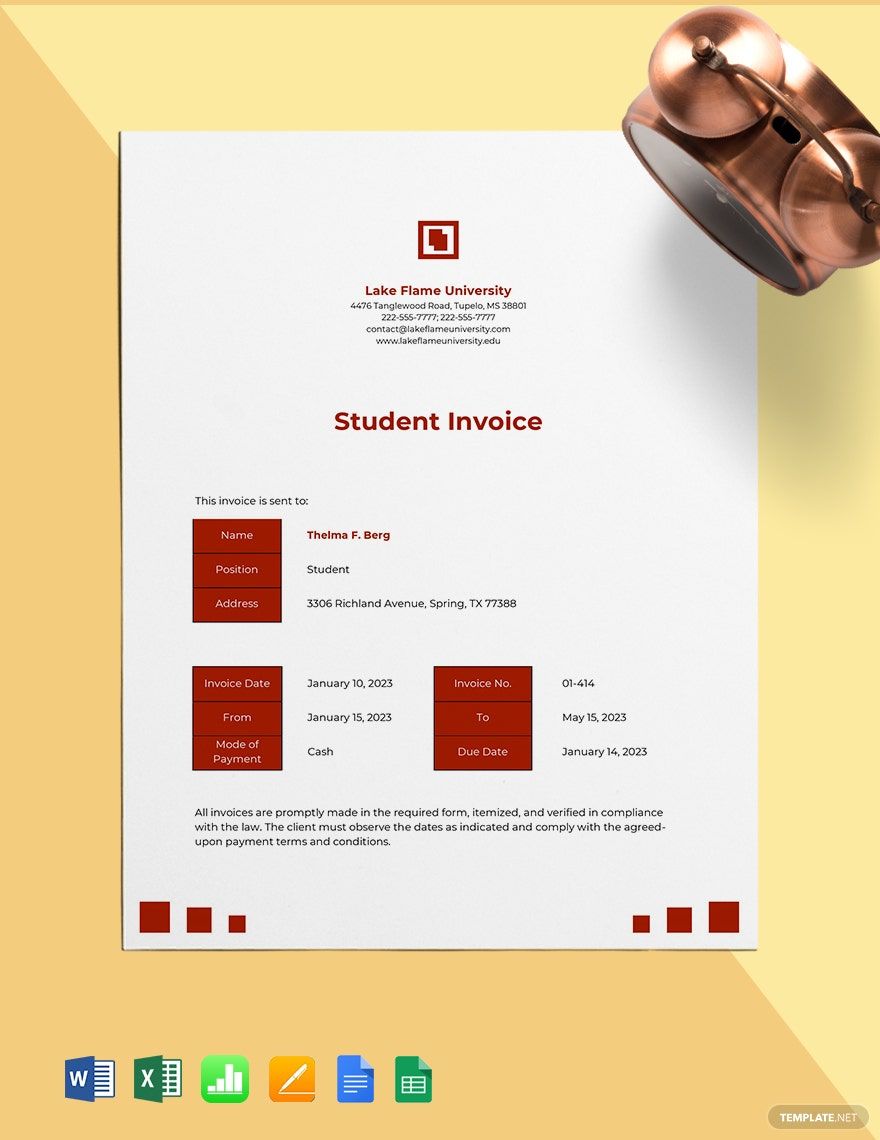

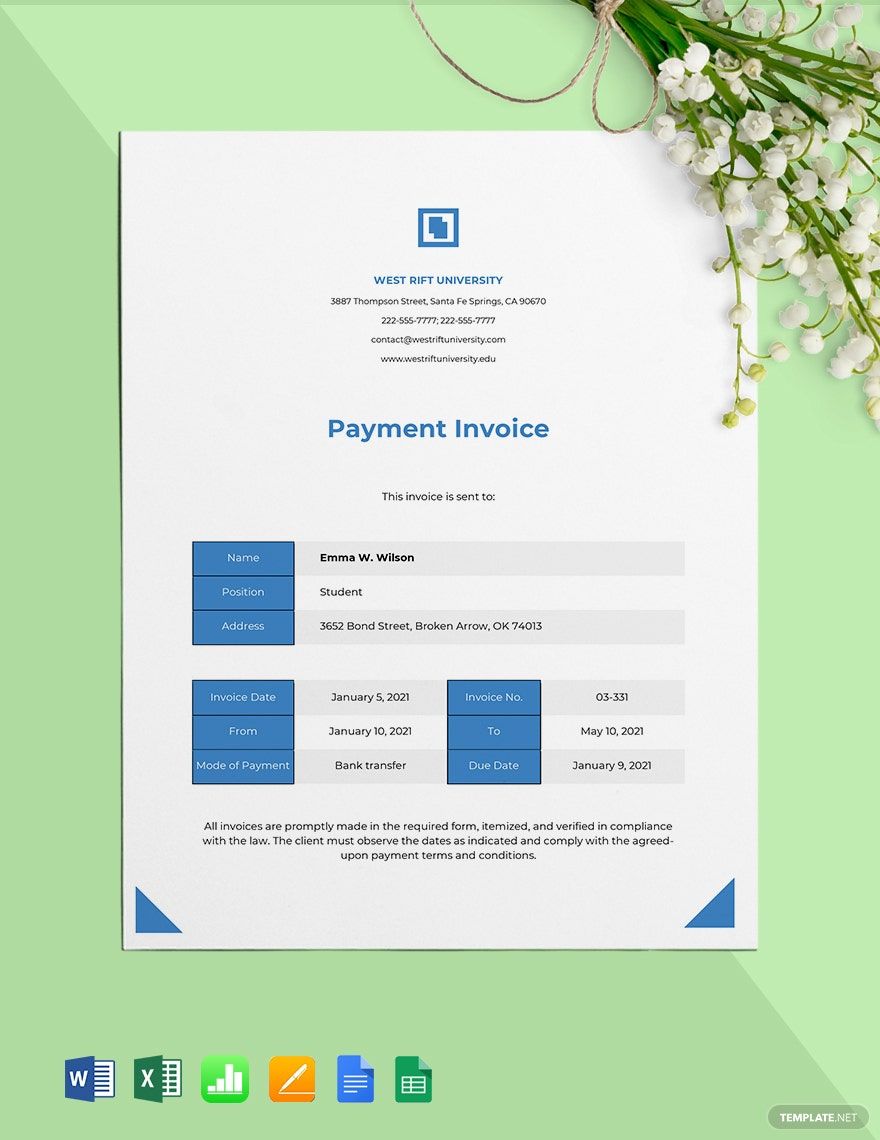

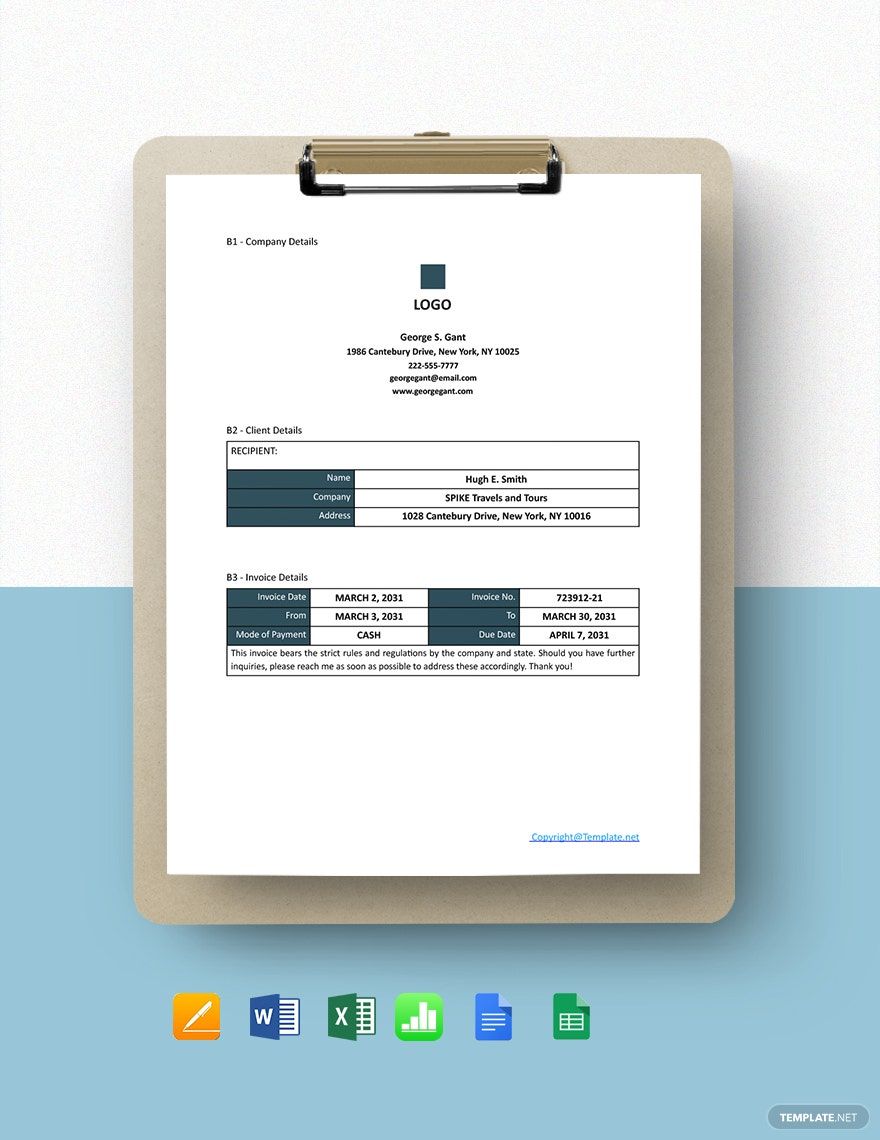

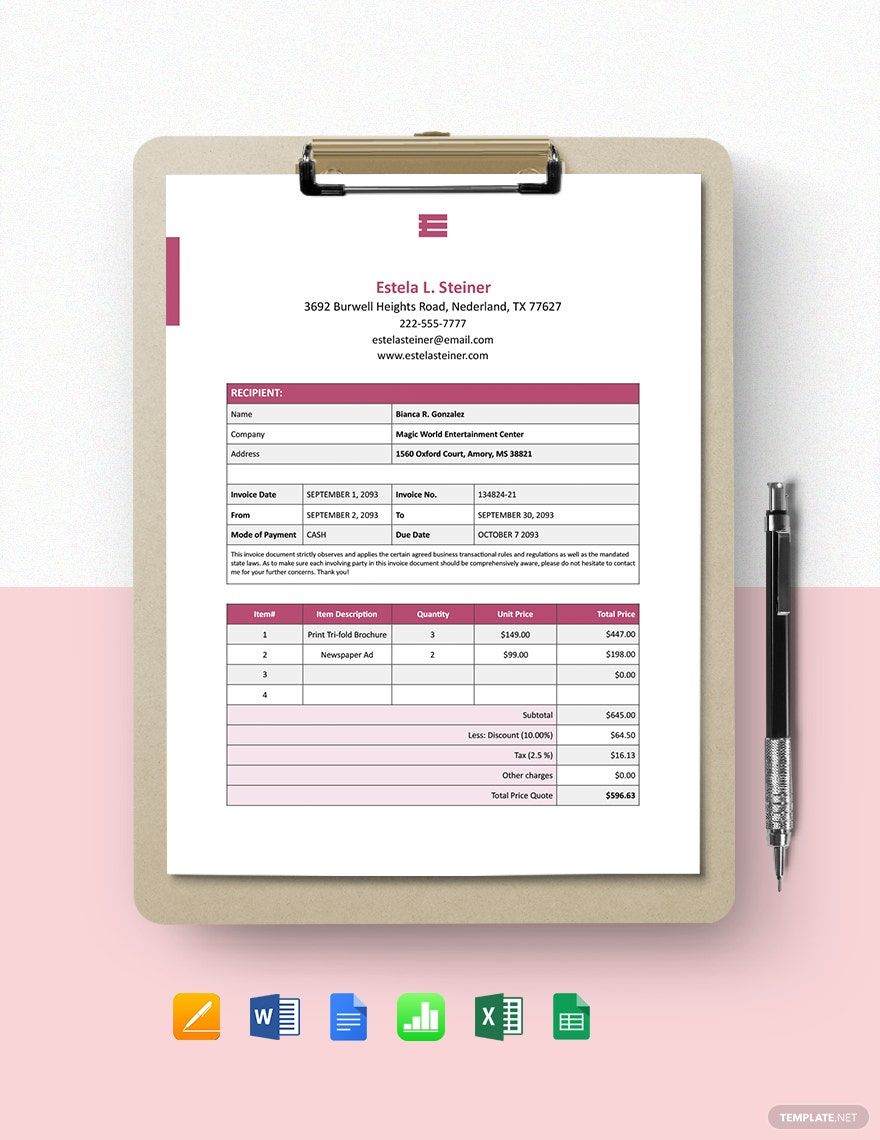

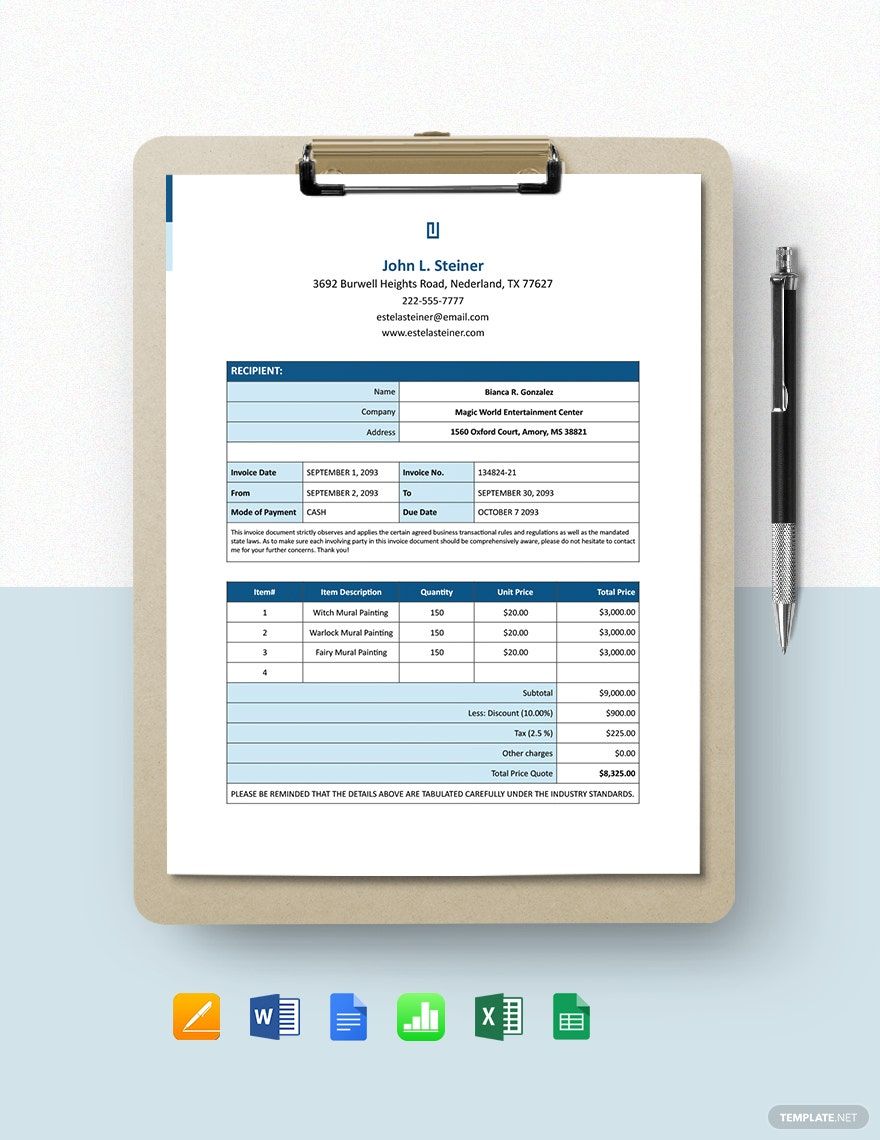

Primary information such as your business name, contact information, and invoice number are important parts of the document. Include these details makes your invoice looks professional. Also, you can insert your company logo.

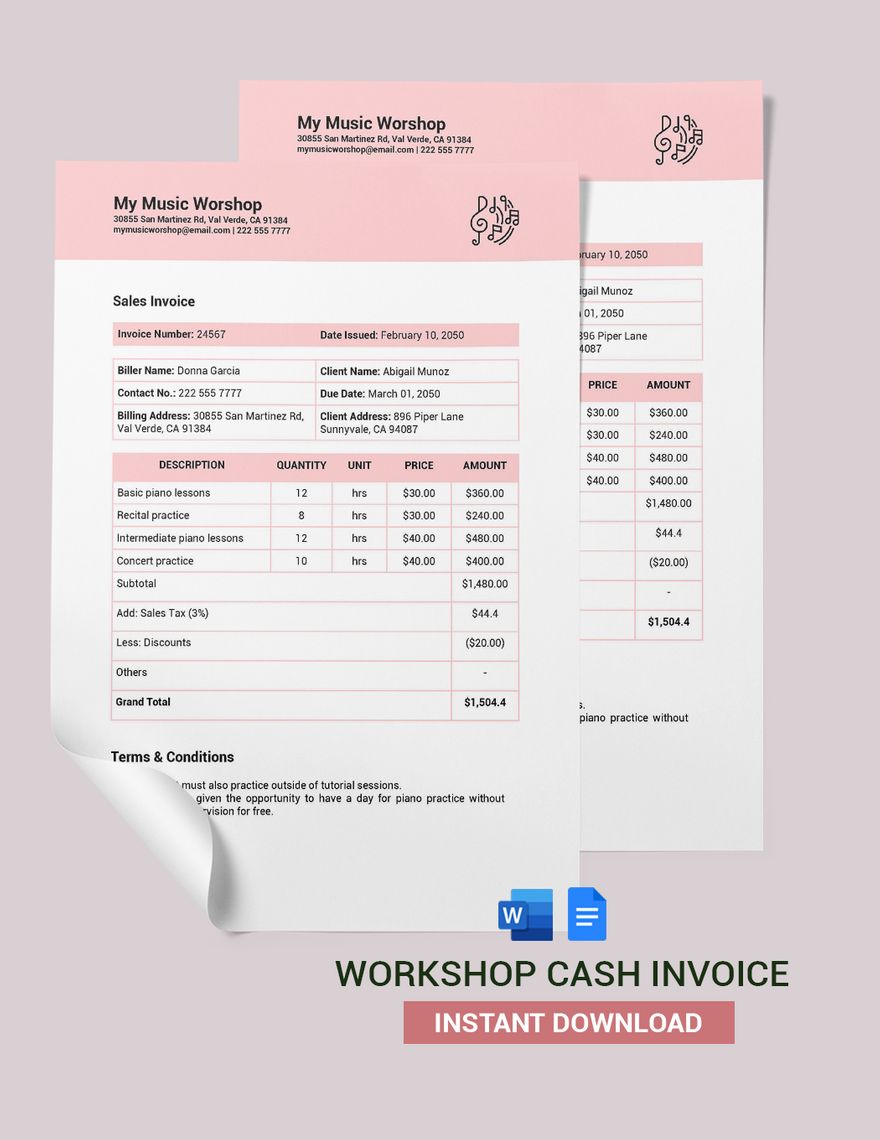

2. Include Payment Terms

The compensation from your clients or customers may depend on the type of payment term your business uses. Before incorporating a payment method, make sure you research about the three main types of payment terms. Choose a payment term and include it in the simple invoice.

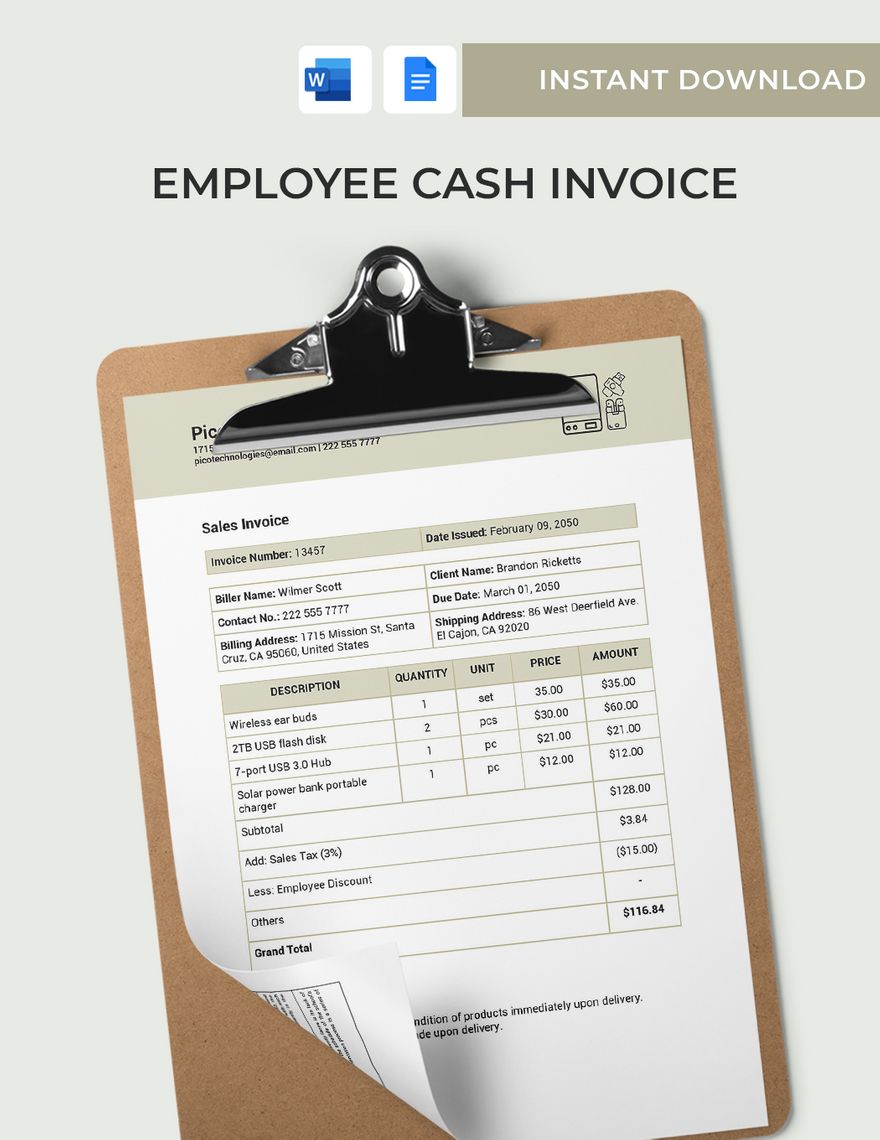

3. Provide the Product or Service Details

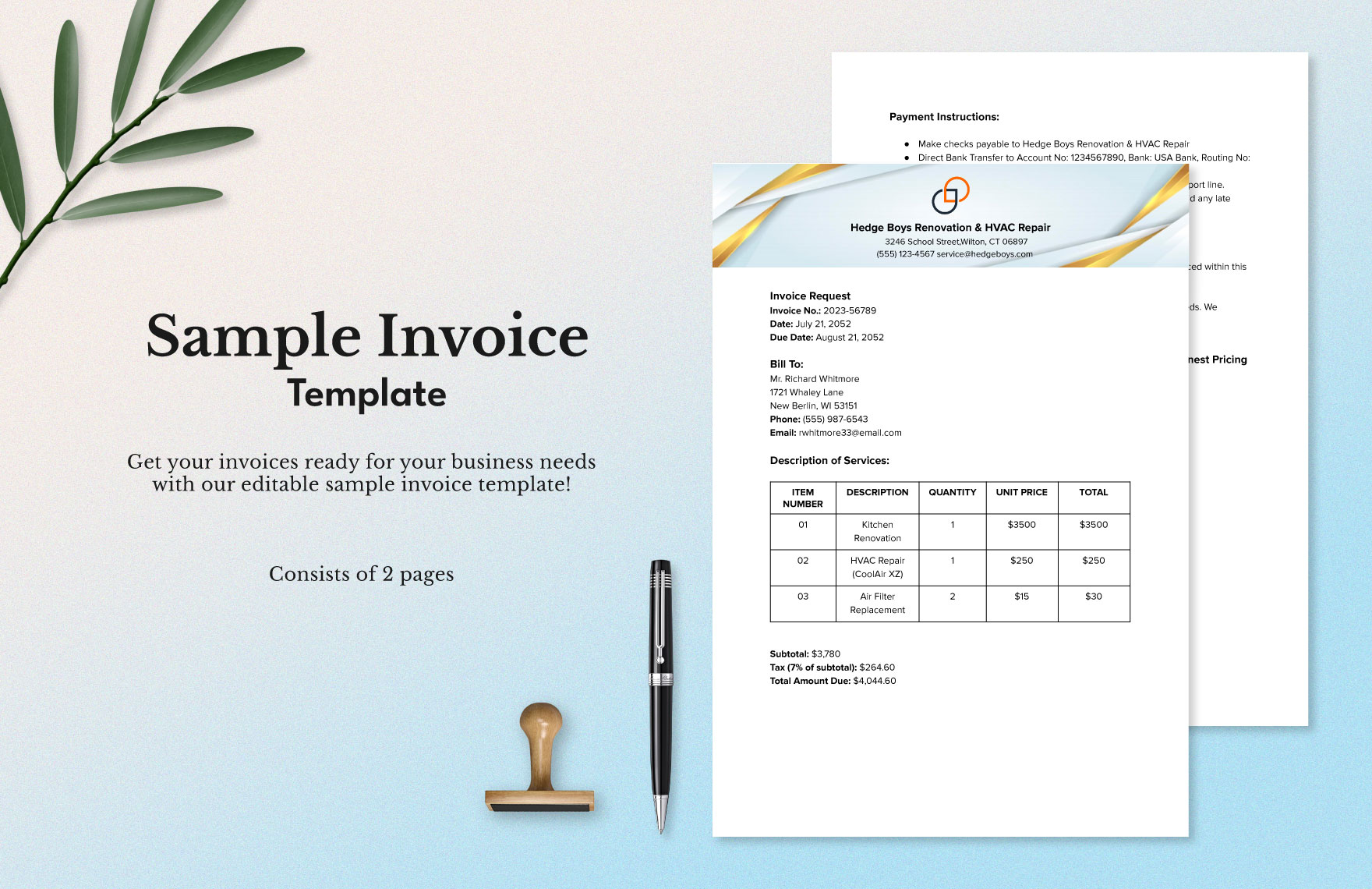

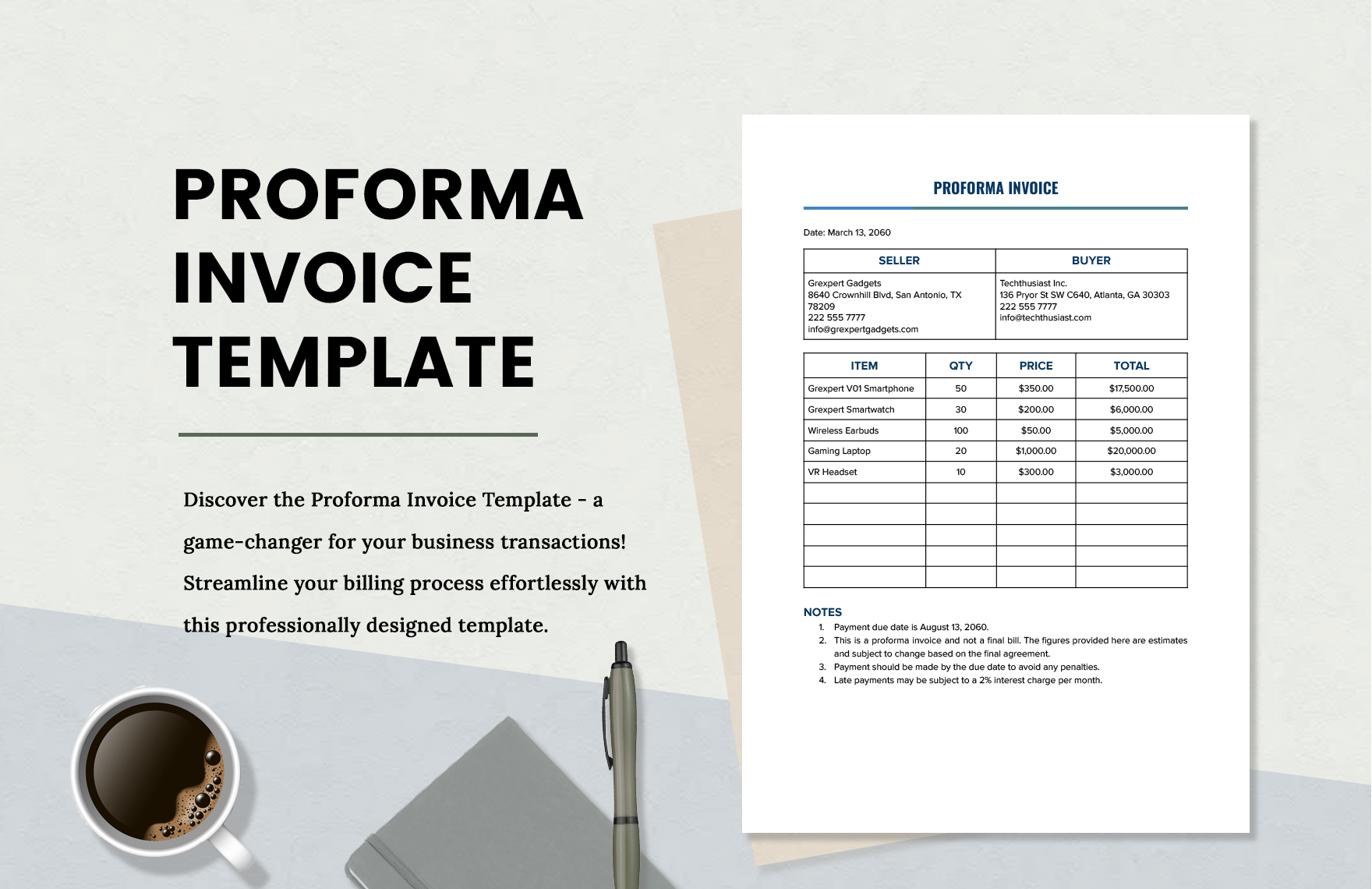

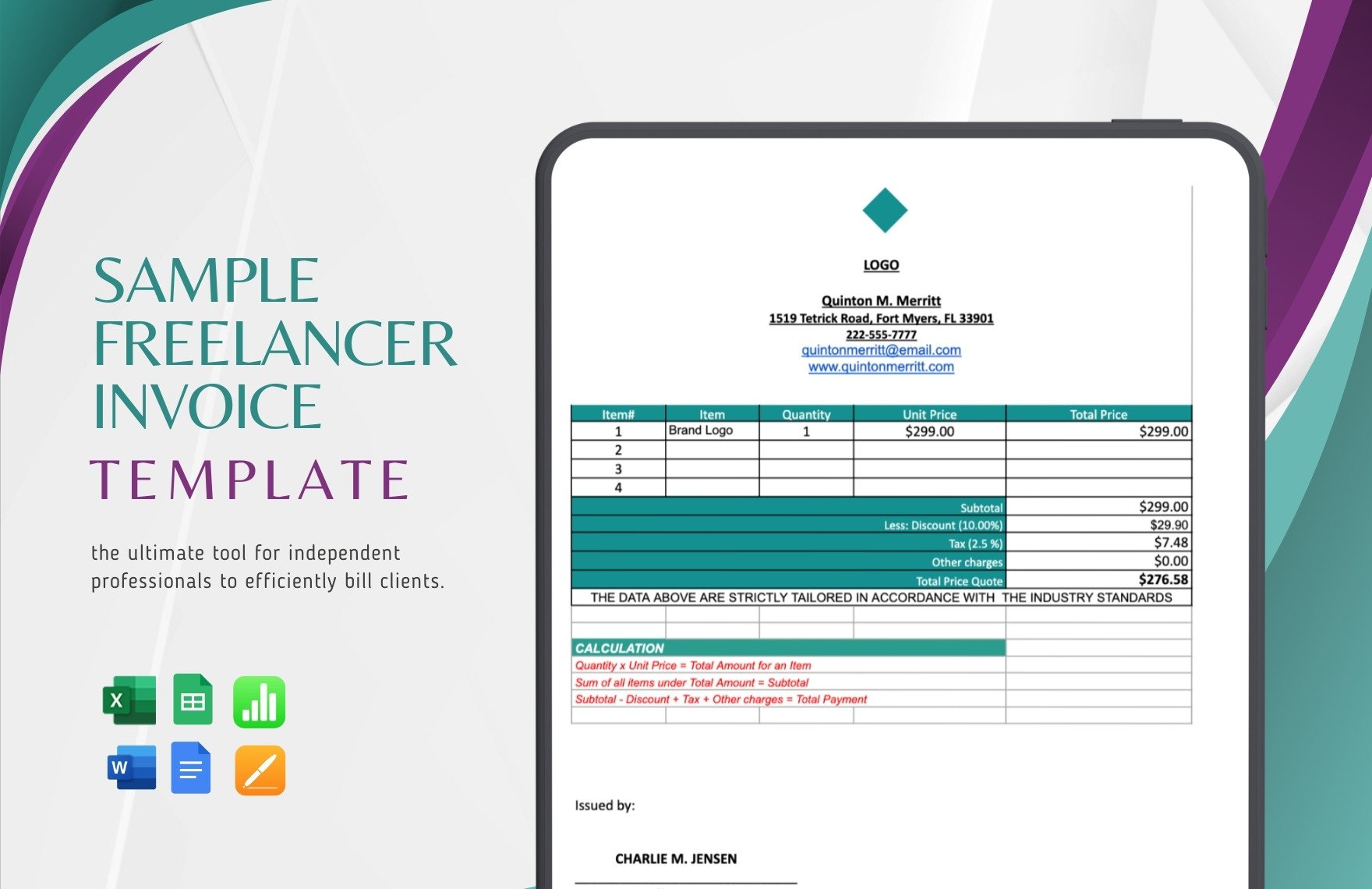

To avoid confusing your clients or customer about how much money they owe you, make sure to be specific with the description, quantity, rate, amount, and subtotal of the products and services. A complete invoice is a better sample invoice, so make sure to include as many relevant details as possible.

4. Add Notes

Adding personalized notes for your receiver can be a small gesture, but it can create a bigger impact. Making notes for your clients will likely make the invoice paid faster. Also, you can provide relevant instructions, information, or details for the invoice.