7+ Asset Transfer Agreement Templates – PDF, Word

People buy properties when they get enough money. Depending on their purchasing power, it could be a lot or a little. These properties have their own respective monetary value and can go even beyond that. In the event of death or disability, the property owner will be unable to manage his/her properties. Death is an inevitable part of human existence, as it is the end game to the life we have been living on earth. With the templates that are mentioned in this article, you can make the perfect agreement you need.

Agreement Template Bundle

Business Agreement Template Bundle

Asset Transfer and Sale Agreement Template

Asset Transfer and License Agreement

oversight.house.gov

oversight.house.govAsset Transfer Agreement Template

sailabilitynsw.org

sailabilitynsw.orgTo help property owners with this, an asset transfer agreement is made. This document outlines the things to do and how the asset will be transferred from one person to the other. It also defines the properties according to their category, and what happens before, during and after the transfer of assets.

Network Infrastructure Asset Transfer Agreement

northpower.com

northpower.comTransferring Assets To A Living Trust

You can’t take any of the single things you own in this world when you die. You may also see sample asset purchase agreements. You have to transfer it to someone you trust so much. If left unattended, your assets can go anywhere off the grid when you die.

You must do all of these steps when you transfer the assets:

1. Know what a living trust is.

A living trust is a legal document that outlines the transfer of all your assets in the event of your death. Your assets are placed in trust during your lifetime and will be transferred to the beneficiaries after your death. A chosen representative or your “successor trustee” will transfer these assets to the right people. You may also see equipment purchase agreements.

2. Make a list of your assets.

List your assets on a notebook or a spreadsheet. Assets fall into four categories. First is the real property. It includes your houses, secondary homes, and other real estate in several different locations. Second is the cash accounts, which include both of your savings and credit accounts. The third is the financial instruments such as your stocks and bonds in a corporation. Last is personal property, such as vehicles, furniture, antiques, and other items. Some of your property fall into more than one category and you need to sort it out. Aside from that, life insurance policies can’t be transferred to the trust.

3. Write the will.

A living trust is part of the estate plan. It does not abandon the need to write the will. However, everything must be put into formal writing when transferring assets. You may also see transfer agreement templates.

Asset Transfer-Purchase Agreement

sec.gov

sec.gov4. Select the best trustee.

You are the primary trustee in a living trust. When you are incapable of making the right decisions or you pass away too soon, you have to transfer the decision-making part to your secondary trustees. This could be your spouse or your trustworthy family members. It is advised to have a third party trustee just in case of family members die in an accident. This prevents the trust from being left hanging. The third-party trustees could be the bank, trustee company or a lawyer. Lastly, only your spouse can add additional beneficiaries to your assets.

5. List of beneficiaries.

Since you are the primary trustee, list down the beneficiaries of your assets. This could be anyone in your family who is legally able to receive the properties. Not including a family member in the beneficiary can result in a feud. There should be a clause that includes all beneficiaries to not question the inheritance they get. This leads them to be disqualified from the transfer of assets. You may also see purchase agreements.

6. Transfer the real estate.

The real estate should be transferred to your trust. In the case of mortgages, you can directly contact the mortgage company before you start the transferring process. For your homeowner insurance, contact the company that provided you with the benefit and talk it out. You may also see trust agreement templates.

7. Make a financial account.

Talk to the bank about opening a bank account for your trust. They will let you undergo legal procedures on how to make the bank accounts of the beneficiaries. You may also see commercial agreement templates.

8. Put tangible property in your trust.

Tangible properties such as furniture, antiques, and vehicles should be entrusted to your trustee. You can put it in a safe box owned by the trust in his house. You may also see exchange agreement templates.

Asset Transfer Agreement Example for Businesses

ackordscentralen.se

ackordscentralen.seBusiness and Asset Transfer Agreement

nic-bank.com

nic-bank.comSimple Asset Transfer Agreement

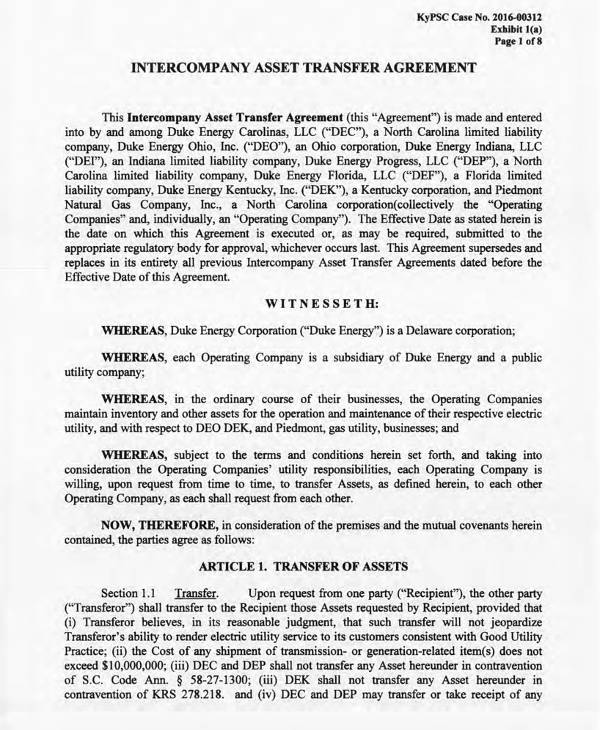

psc.ky.gov

psc.ky.govPurchased Asset Transfer Agreement

jolleylaw.com

jolleylaw.comMaking A List On Your Assets

Listing your assets consumes so much time, regardless of how much or how little you own. Each property must fall on their respective category. It is a big help when you want to plan for an asset distribution. You may also see lease trasfer letters. Listing your assets can be done in as easy as these steps:

1. Have a record keeping system.

Record keeping can be done in a notebook or a spreadsheet on your computer. When you use a spreadsheet, it keeps the records more organized. The advantage of using a notebook in record-keeping is it is directly accessible anytime and can be kept in a safe place. Either way, your record-keeping should be organized and easy to follow. You may also see agreement letter templates.

2. Set tangible and intangible assets apart.

Tangible assets include your home, land properties, clothes, vehicles, and automobiles. Your intangible assets are your bank accounts, shares in a corporation and other properties that cannot be touched. Once you get through this, you would be able to make the listing more convenient. You may also see concession agreement templates.

3. Add personal information.

Put your personal information on your inventory list. It should be a whole lot of a good one. It attaches you to your assets in the documentation. You may also see loan agreement templates.

4. Describe each item in the inventory.

The description of each item is only applicable to your tangible assets. It keeps the list straight and more comprehensive. Describe the color, height, weight, size, and notable features of each item. Brands can be named to further specify the item and distinguish it from everything else. Include special conditions on some items. You may also see purchase and sale agreement templates.

5. Give evidence of ownership.

Provide backup documents pertaining to the ownership of the items. Secure receipts and contracts for bigger items. Make copies of each document for backup purposes in the future. You may also see shareholder agreement templates.

6. Finish the list.

After providing details for each item, organize the list and finish them up. Make sure everything is complete from the item description, location information, and the relevant documents that should be attached. You may also see mortgage contract templates.

7. Add a list of people.

The list of people you add in the document is the ones who can do the errands of processing the documents whenever you are busy. Make sure these people are trustworthy enough since these are all your assets and stuff. You may also see framework agreement templates.

8. Make copies of the inventory.

Photocopy several copies of the inventory and put them in a safe place. The place should be accessible and safe with all the locks and passwords. You will need these in the future. And do not forget to keep the information in your inventory up to date. You just don’t stop purchasing assets in your lifetime. It continues on and on, and you have to list them down. You may also see sample legal agreements.

Conclusion

Transferring assets is a must since everything that happens in our life are unexpected. No one can foresee what happens next. It is a preparation for unexpected death and disability. The agreement serves as proof for your properties to be properly distributed to the right people. Check the business agreement templates that are available online to make the agreement you need for your business.

General FAQs

1. What is an Asset Transfer Agreement?

An asset transfer agreement can be defined as an agreement between the issuer and one or more sellers. Asset transfer is a process that allows a community organization to take over property that is publicly owned, in a way that it recognizes the benefits of the public.

2. When does an Asset Transfer occur?

Asset transfer occurs when one person gives the ownership of an asset to someone else. Life insurance policies can be used to transfer assets to the beneficiaries of the owner or the buyer.

3. What is an Asset Purchase Agreement?

An asset purchase agreement is an agreement that is signed between a buyer and seller that finalizes the terms and conditions that are related to the purchase or selling of the assets of a certain company.

4. Can you transfer Assets from one company to another?

You can sell and transfer assets for a fair market value from one company to the other. It depends on the type of company you have, as to how you will do the transfer. Without proper paperwork and details as to why you are doing so in the first place, you cannot transfer assets.

5. What should be included in an Asset Transfer Agreement?

The following points should be included in an asset transfer agreement:

- Details of the companies involved

- The details of the assets that are being transferred

- The “whereas” clause

- Warranties and other legal terms and conditions

- Undertaking and obligation clauses

- Termination terms and conditions

- Signatures of the parties involved.