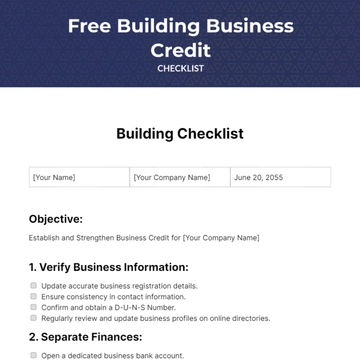

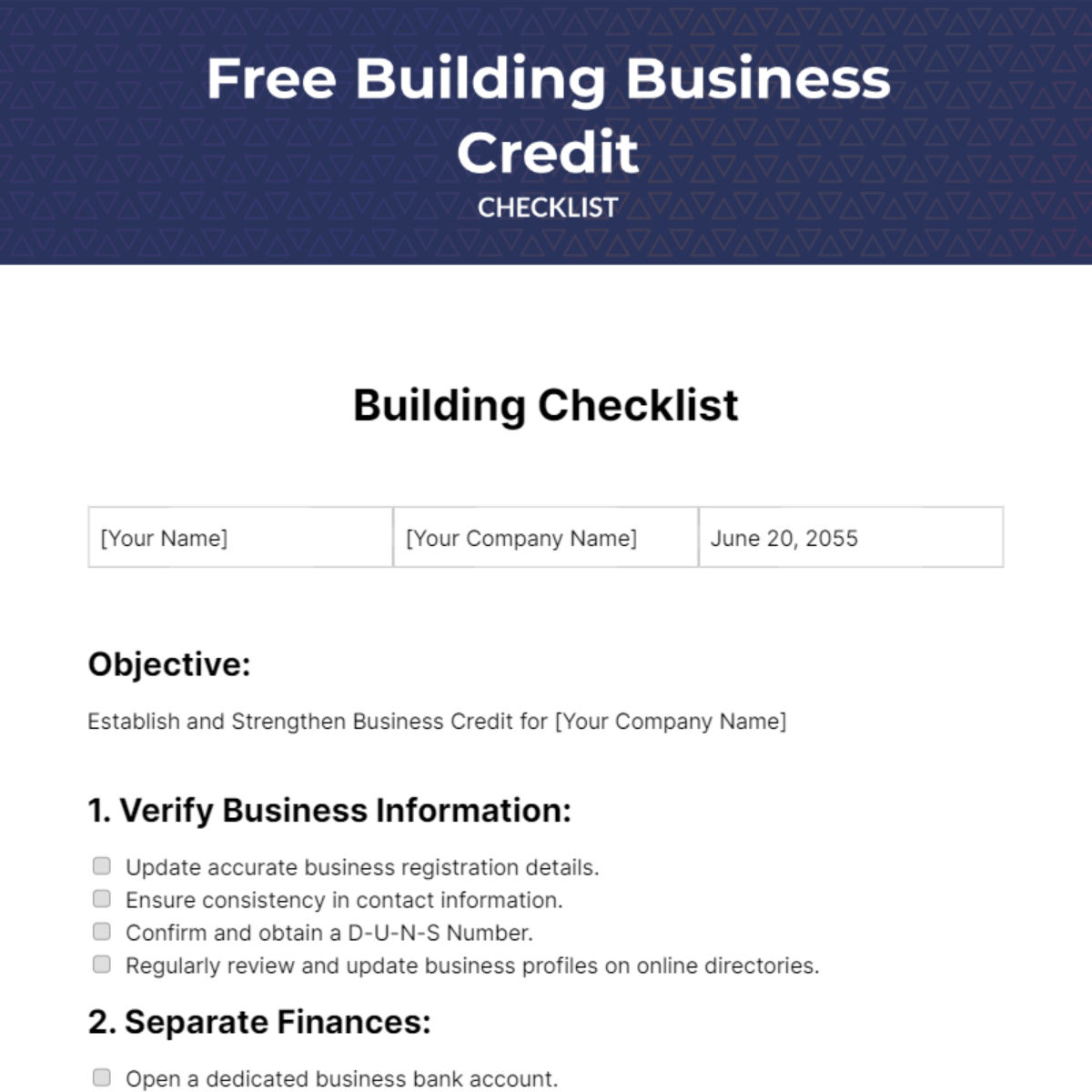

Free Building Business Credit Checklist

[Your Name] | [Your Company Name] | June 20, 2055 |

Objective:

Establish and Strengthen Business Credit for [Your Company Name]

1. Verify Business Information:

Update accurate business registration details.

Ensure consistency in contact information.

Confirm and obtain a D-U-N-S Number.

Regularly review and update business profiles on online directories.

2. Separate Finances:

Open a dedicated business bank account.

Use a business credit card exclusively.

Maintain clear financial distinctions.

Implement regular audits to ensure financial separation.

3. Build Credit Profile:

Register with credit bureaus.

Establish trade credit relationships.

Ensure timely payments.

Diversify credit sources for a well-rounded profile.

4. Monitor Credit Reports:

Regularly check for inaccuracies.

Dispute discrepancies promptly.

Monitor PAYDEX score and address issues.

Subscribe to credit monitoring services for real-time updates.

5. Responsible Credit Use:

Keep credit utilization low.

Maintain a healthy Debt-to-Income ratio.

Avoid unnecessary borrowing.

Periodically assess credit needs for optimization.

6. Positive Payment History:

Pay bills on time consistently.

Negotiate favorable payment terms.

Set up automatic payments.

Establish a contingency plan for unexpected financial challenges.

7. Secure Credit Lines:

Explore business credit options.

Build relationships with lenders.

Demonstrate responsible credit use.

Negotiate favorable interest rates on existing credit lines.

8. Network and Collaborate:

Build industry relationships.

Collaborate for a strong reputation.

Leverage positive partnerships.

Participate actively in industry associations for increased visibility.

9. Professional Financial Management:

Hire a qualified accountant.

Implement robust accounting systems.

Submit accurate financial statements.

Conduct periodic financial training for relevant staff.

10. Regularly Reassess Strategies:

Periodic reviews and adjustments.

Stay informed about credit trends.

Continuously improve creditworthiness.

Engage in regular risk assessments for proactive adjustments.

This checklist is a guide to build and maintain strong business credit. Regularly revisit for ongoing success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Establish and fortify your business credit with Template.net Building Business Credit Checklist. Downloadable, customizable, and editable using our AI Editor Tool, it guides you through strategic steps to build a robust credit profile. Optimize credit-building efforts, ensuring financial stability for your business. Elevate your credit journey with this practical, user-friendly checklist template.

You may also like

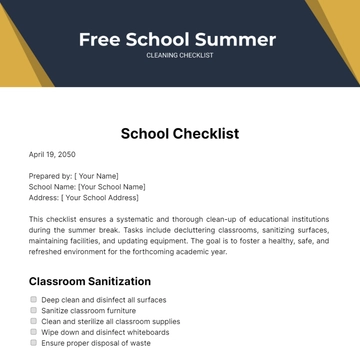

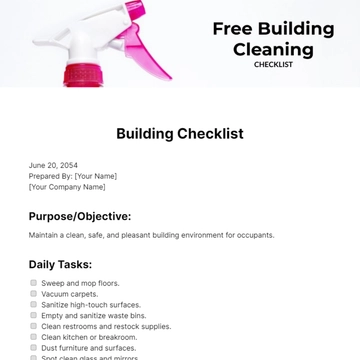

- Cleaning Checklist

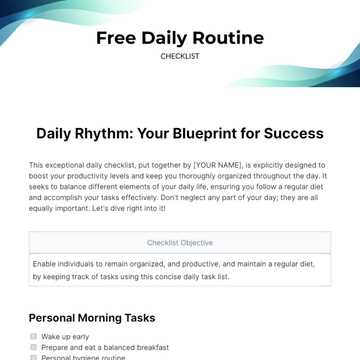

- Daily Checklist

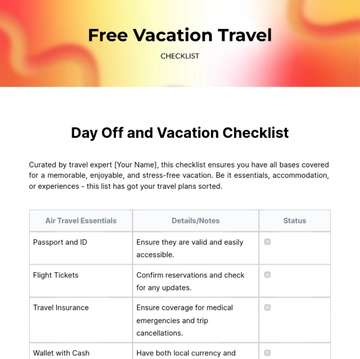

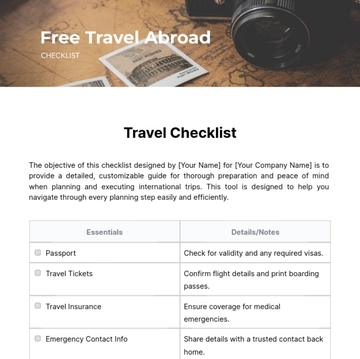

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

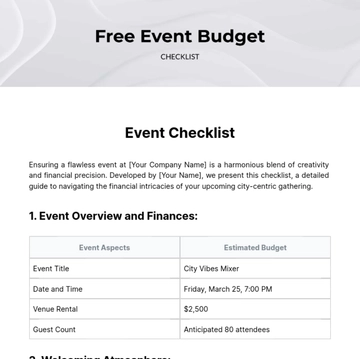

- Event Checklist

- SEO Checklist

- Assessment Checklist

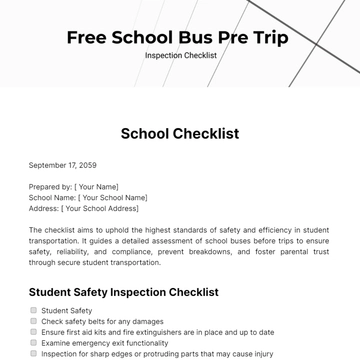

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

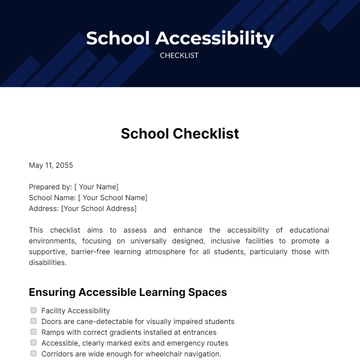

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist