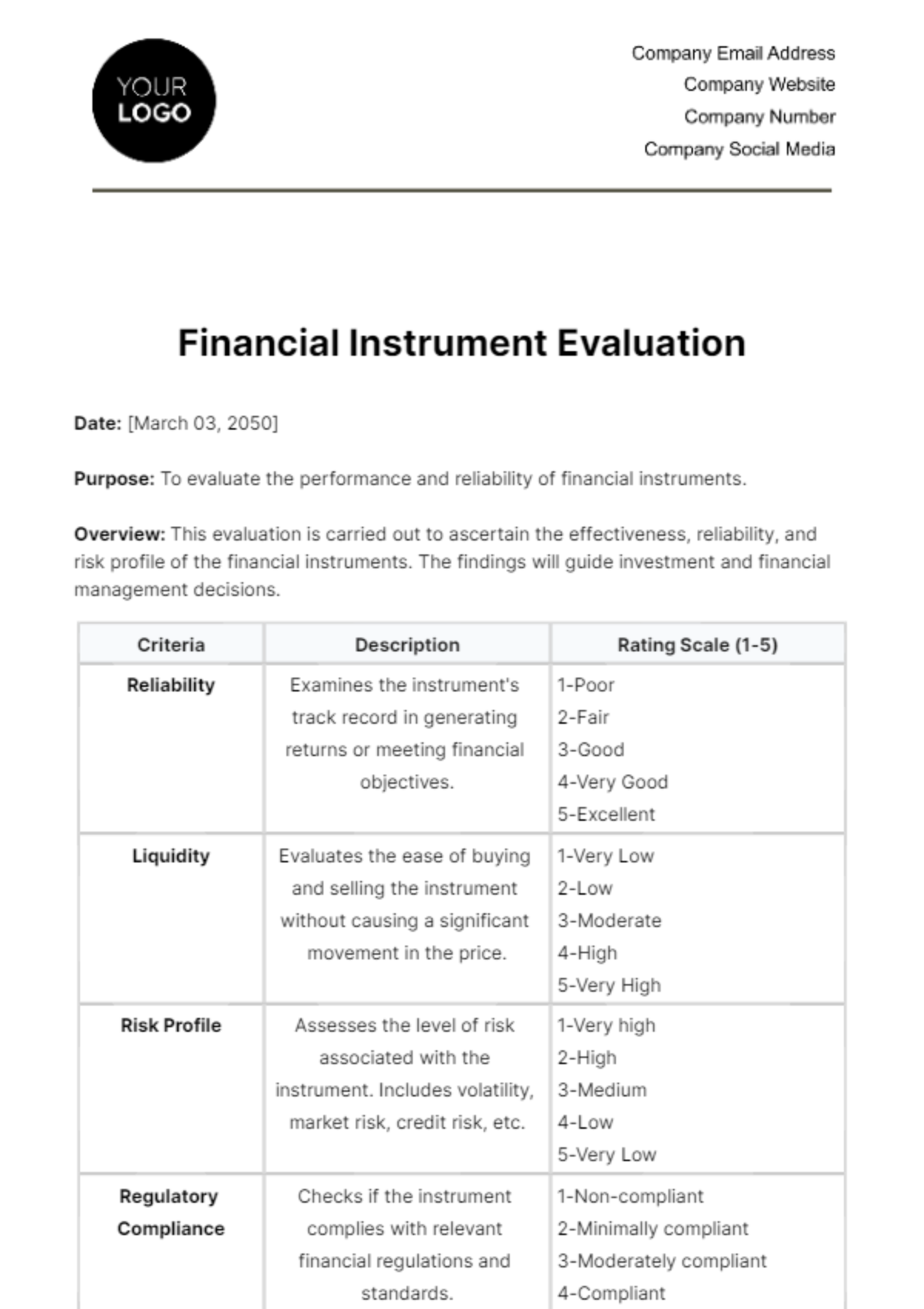

Financial Instrument Evaluation

Date: [March 03, 2050]

Purpose: To evaluate the performance and reliability of financial instruments.

Overview: This evaluation is carried out to ascertain the effectiveness, reliability, and risk profile of the financial instruments. The findings will guide investment and financial management decisions.

Criteria | Description | Rating Scale (1-5) |

|---|

Reliability | Examines the instrument's track record in generating returns or meeting financial objectives. | 1-Poor 2-Fair 3-Good 4-Very Good 5-Excellent |

Liquidity | Evaluates the ease of buying and selling the instrument without causing a significant movement in the price. | 1-Very Low 2-Low 3-Moderate 4-High 5-Very High |

Risk Profile | Assesses the level of risk associated with the instrument. Includes volatility, market risk, credit risk, etc. | 1-Very high 2-High 3-Medium 4-Low 5-Very Low |

Regulatory Compliance | Checks if the instrument complies with relevant financial regulations and standards. | 1-Non-compliant 2-Minimally compliant 3-Moderately compliant 4-Compliant 5-Exemplary compliance |

Market Sentiment | Evaluates the public's perception or attitude towards the financial instrument. | 1-Very Negative 2-Negative 3-Neutral 4-Positive 5-Very Positive |

Additional Comments:

Please provide any additional insights or observations about the financial instrument being evaluated that have not been covered in the above sections.

Finance Templates @ Template.net