Free Financial Cost Audit Review

Audit Overview | ||

Audit Date: | [MM-DD-YYYY] | |

Prepared By: | [Your Name], [Your Job Role] | |

Reviewed By: | [Reviewer's Name], [Job Role] | |

Period Covered: | [Start Date] to [End Date] | |

Methodology and Scope

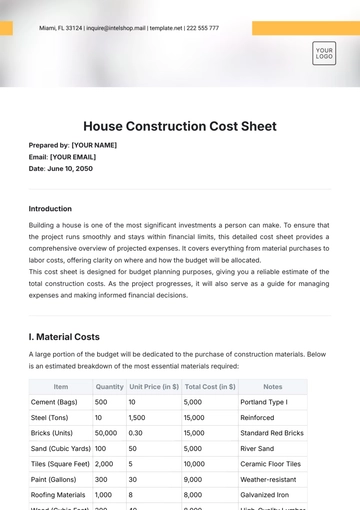

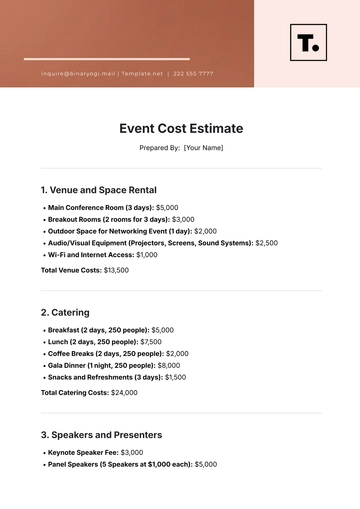

Audit Methodology: The audit was conducted using a combination of random sampling and targeted investigation. This included scrutinizing transaction records, verifying receipts, and reviewing cost allocation methodologies.

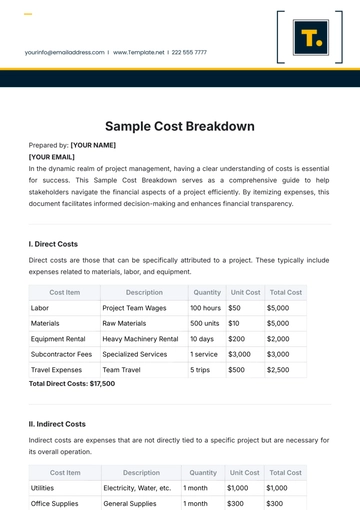

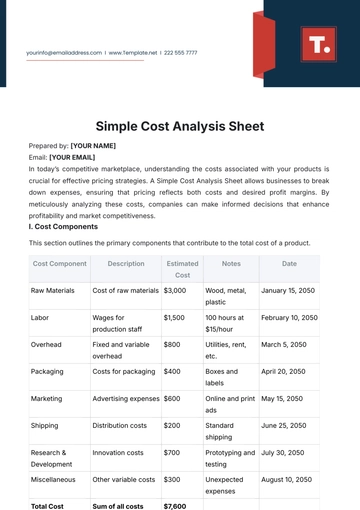

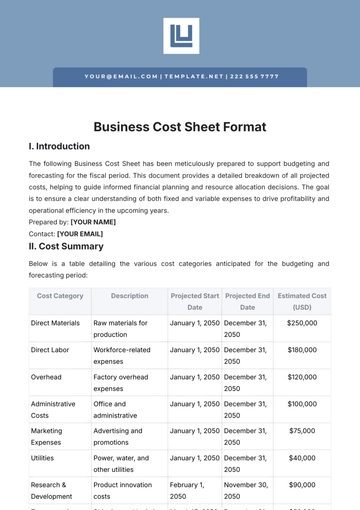

Scope of Audit: The audit covered all major financial areas for the fiscal year [FY], including direct costs such as materials and labor, indirect costs like overheads and utilities, payroll processing, and procurement procedures. Special attention was given to high-value transactions and areas with significant budget variances.

Findings and Observations

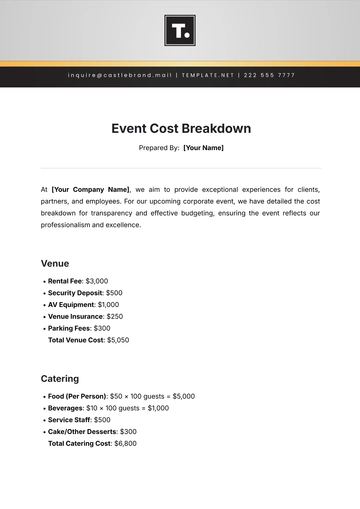

Key Findings: Discrepancies were noted in the allocation of indirect costs across departments, leading to uneven expense reporting. In payroll processing, some instances of miscalculated overtime pay were found.

Observations: The audit revealed a pattern of delayed invoice processing, particularly in the procurement department. Regular overestimations in budget forecasting for certain projects were also noted, requiring closer scrutiny in future budget preparations.

Compliance and Regulatory Review

Compliance Status: The review found substantial compliance with internal financial policies and external regulatory requirements. However, some minor deviations in tax withholding calculations were identified.

Regulatory Issues: Potential risks were identified in the form of non-compliance with updated state tax regulations, necessitating immediate corrective action to mitigate future legal and financial repercussions.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

With Template.net's Financial Cost Audit Review, editing and customization is effortless. This template offers user-friendly editable features using our Ai Editor Tool. Transform your audits with this highly customizable, editable solution from Template.net. Experience superior quality and efficiency in your financial review process now.