Free Financial Cost Reduction Software User Guide

I. Introduction to the Software

Overview of Software’s Purpose and Capabilities

The Financial Cost Reduction Software is a cutting-edge tool tailored to empower your business in the art of financial prudence. Its comprehensive suite of features includes robust expense tracking, dynamic budget creation, in-depth financial analysis, and insightful cost-saving recommendations. Designed with user experience in mind, it offers an interactive dashboard, customizable reports, and seamless integrations with existing financial systems. Whether you're a small business owner or a finance manager in a large corporation, this software is your ally in navigating the complexities of cost management, turning data into actionable insights to enhance your company's financial health.

System Requirements and Installation Guide

To get started with the Financial Cost Reduction Software, ensure your system meets these requirements: Windows 10 or later, at least 4GB of RAM, and a minimum of 500MB free disk space. Installation is straightforward: download the installer from our official website, execute the file, and follow the prompts. The setup wizard will guide you through each step. Once installed, enter the provided license key to activate your software. You’re now ready to embark on a journey of efficient cost management, with powerful tools at your fingertips to streamline your financial operations.

II. Getting Started with the Software

This section guides new users through the initial setup process, familiarizing them with the software's user interface and providing basic navigation tips for a smooth start.

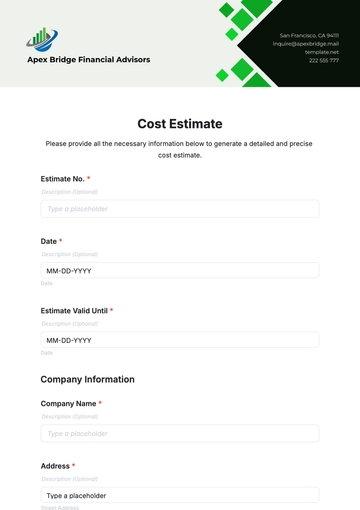

A. Account Setup and Login Procedures

Account creation allows you to securely store your data and ensures a personal experience while using our software. Follow the on-screen instructions to set up your account, verify your email, and complete the setup. Be prepared with your business’s financial information to maximize the benefits of the software.

Step | Action | Description |

Sign Up | Click ‘Sign Up’ on the software's homepage. | Enter business details such as name, email, and contact information. |

Password Creation | Set up a secure password. | Create a strong password for account security. |

Account Verification | Verify your email address. | Click on the verification link sent to your email. |

Login | Use your credentials to log in. | Enter your email and password on the login page. |

B. User Interface Overview

The main dashboard provides a snapshot of your financial status, including recent expenses, budget summaries, and alerts. The navigation bar at the top allows you to access different sections like Expenses, Budgets, Reports, and Settings.

Feature | Location | Functionality |

Dashboard | Main screen after login. | Displays financial overview including expenses, budget summary, and alerts. |

Expenses Tab | Top navigation bar. | Track and categorize business expenses. |

Budgets Tab | Top navigation bar. | Create and manage financial budgets. |

Reports Tab | Top navigation bar. | Generate detailed financial reports. |

Settings | Top navigation bar. | Customize account settings and preferences. |

C. Basic Navigation Tips

Use the top navigation bar to move between different modules. Hover over any icon for a tooltip description. For detailed information about any section, refer to the ‘Help’ icon located in the upper right corner.

Tip | How to Use | Purpose |

Module Navigation | Use the top navigation bar. | To move between different sections like Expenses, Budgets, and Reports. |

Tooltips | Hover over icons. | To get quick information about each icon’s function. |

Help Access | Click the ‘Help’ icon in the upper right. | For detailed guidance on software features and usage. |

Quick Access Menu | Use the side panel on the dashboard. | For shortcuts to commonly used features and settings |

Search Function | Located at the top of the dashboard. | To quickly find specific features or information within the software. |

III. Core Features and Functionalities

This section details the core features of the Financial Cost Reduction Software, focusing on its capabilities in expense tracking, budgeting, and reporting, which are integral for efficient financial management.

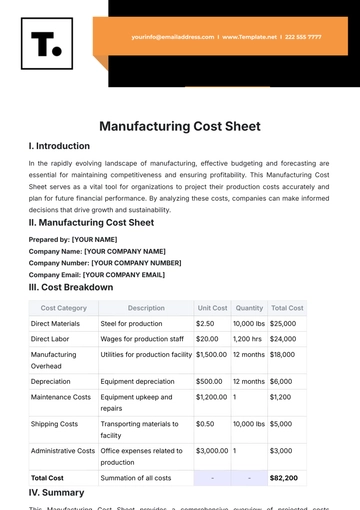

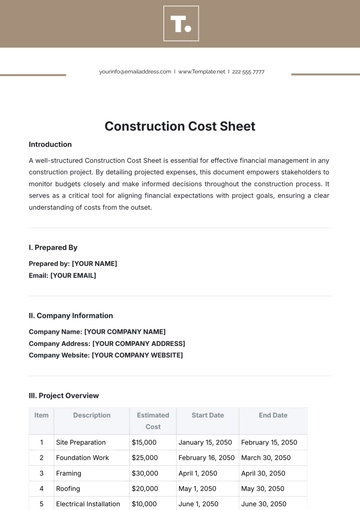

A. Expense Tracking

The 'Expenses' tab is your go-to resource for meticulous expense management. Here, you can effortlessly log and categorize every business expenditure, ensuring nothing slips through the cracks. The software offers the flexibility to manually enter expenses or streamline the process by importing data directly from connected bank accounts or spreadsheet files. Each expense can be categorized, making it simpler to track specific types of spending.

Additionally, the software provides the capability to attach receipts and notes to each entry, facilitating a comprehensive and auditable record of all financial transactions.

B. Budgeting Tools

In the 'Budgets' section, users are empowered to establish and oversee their financial plans effectively. This tool allows you to create detailed budgets for different categories, such as marketing, R&D, or general operational costs. You can set financial limits for each category, and the software provides real-time tracking of your expenditures against these predetermined limits.

This feature not only helps in maintaining financial discipline but also in identifying potential overspending early. With visual representations like graphs and charts, the budgeting tool makes it easy to understand spending trends and make necessary adjustments to stay on financial course.

C. Reporting Capabilities

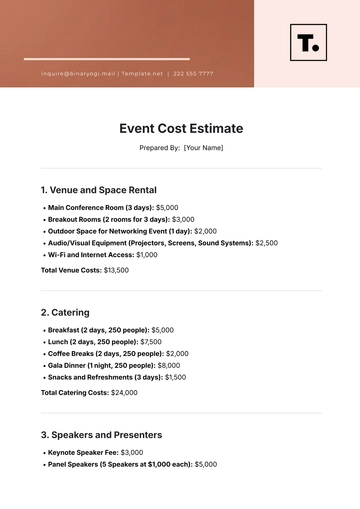

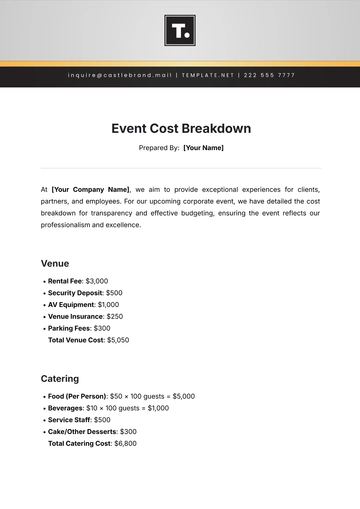

The 'Reports' section is a powerful feature that enables users to generate comprehensive financial reports. These reports can be tailored to meet specific needs by customizing various parameters such as date range, expense category, or department. The software offers a range of report types, from detailed expense reports to summary financial overviews, providing valuable insights into your company’s spending patterns and financial health.

These reports can be used for internal analysis, strategic planning, or even for external purposes like presentations to stakeholders. The ability to export these reports into different formats, such as PDF or Excel, adds to the convenience and versatility of the software.

IV. Advanced Tools and Customization

This section covers the sophisticated forecasting models, customization options, and integration capabilities of the Financial Cost Reduction Software, designed to enhance user experience and provide tailored financial management solutions.

A. Forecasting Models

The software's forecasting models are a cornerstone feature for forward-looking financial planning. These tools enable users to project future spending and income by analyzing historical data and current financial trends. Users can input various parameters such as expected revenue growth, anticipated changes in operating costs, or market variables to simulate different financial scenarios.

This functionality is invaluable for strategic planning, helping businesses prepare for various financial landscapes and make informed decisions. For instance, you can see how increasing marketing expenses or expanding your workforce will impact your bottom line in the coming quarters, allowing you to adjust strategies proactively.

B. Customization Options

Customization lies at the heart of the software's user-centric design. Users can personalize their dashboard to display the most relevant financial data front and center. This could include customizing the layout, choosing which widgets to display, or even setting color-coded categories for quick visual reference.

Moreover, the software allows for the creation of custom expense categories, aligning with the unique structure and needs of your business. Setting up alerts for budget thresholds or specific financial events ensures you stay informed and in control of your finances at all times. These customization options transform the software into a tool that truly resonates with your specific business requirements and preferences.

C. Integration with Business Systems

In today's interconnected business environment, the software's ability to integrate seamlessly with various accounting and business systems is a game-changer. Under the 'Settings' > 'Integrations' section, users can establish connections with a range of external systems, from accounting software like QuickBooks or Xero to CRM platforms and ERP systems.

This integration enables the automatic synchronization of financial data across different business functions, ensuring accuracy and saving time on data entry. The integrations are designed to be secure and straightforward, facilitating a unified and efficient approach to financial management across all your business tools.

V. Troubleshooting and Support

This section is dedicated to helping users navigate and resolve common issues, understand the software update process, and access customer support for further assistance.

A. Common Issues and Solutions

The software's 'FAQ' section, accessible under the 'Help' tab, is a comprehensive resource for troubleshooting common issues. For instance, if you encounter login problems, the FAQ provides step-by-step guidance on resetting your password and checking your network settings.

For data synchronization errors, it offers checks and solutions, such as verifying account integrations or refreshing data connections. This self-help resource is continuously updated based on user feedback and emerging issues, ensuring that you have the latest information and solutions at your fingertips.

B. Software Updates and Upgrades

Staying current with software updates is crucial for the optimal performance and security of the Financial Cost Reduction Software. The software is designed to automatically notify you of available updates, ensuring that you always have access to the latest features and security enhancements.

These updates might include new functionalities, improvements in existing features, bug fixes, and security patches. Upgrading is made simple with clear on-screen instructions, allowing for seamless installation without disrupting your ongoing work. Regular updates ensure that the software remains a robust and reliable tool for your financial management needs.

C. Customer Support

Our dedicated customer support team is available to provide personalized assistance beyond the scope of the FAQ section. You can reach out to them via email at [Your Company Email] for any software-related inquiries or issues.

Additionally, a support hotline at [Your Company Number] is available for immediate assistance, where our trained professionals can guide you through more complex issues or provide detailed instructions. Whether you need help with advanced features, have questions about integration, or face any unexpected challenges, our support team is committed to providing timely and effective solutions.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Leverage cost efficiencies with Template.net's Financial Cost Reduction Software User Guide. This completely customizable guide, packed with appealing, editable features, can be effortlessly tailored in our Ai Editor Tool. Offering ease of use and impactful strategies, it's the key to unlocking financial streamlining that fascinates. Embrace controlled spending today.