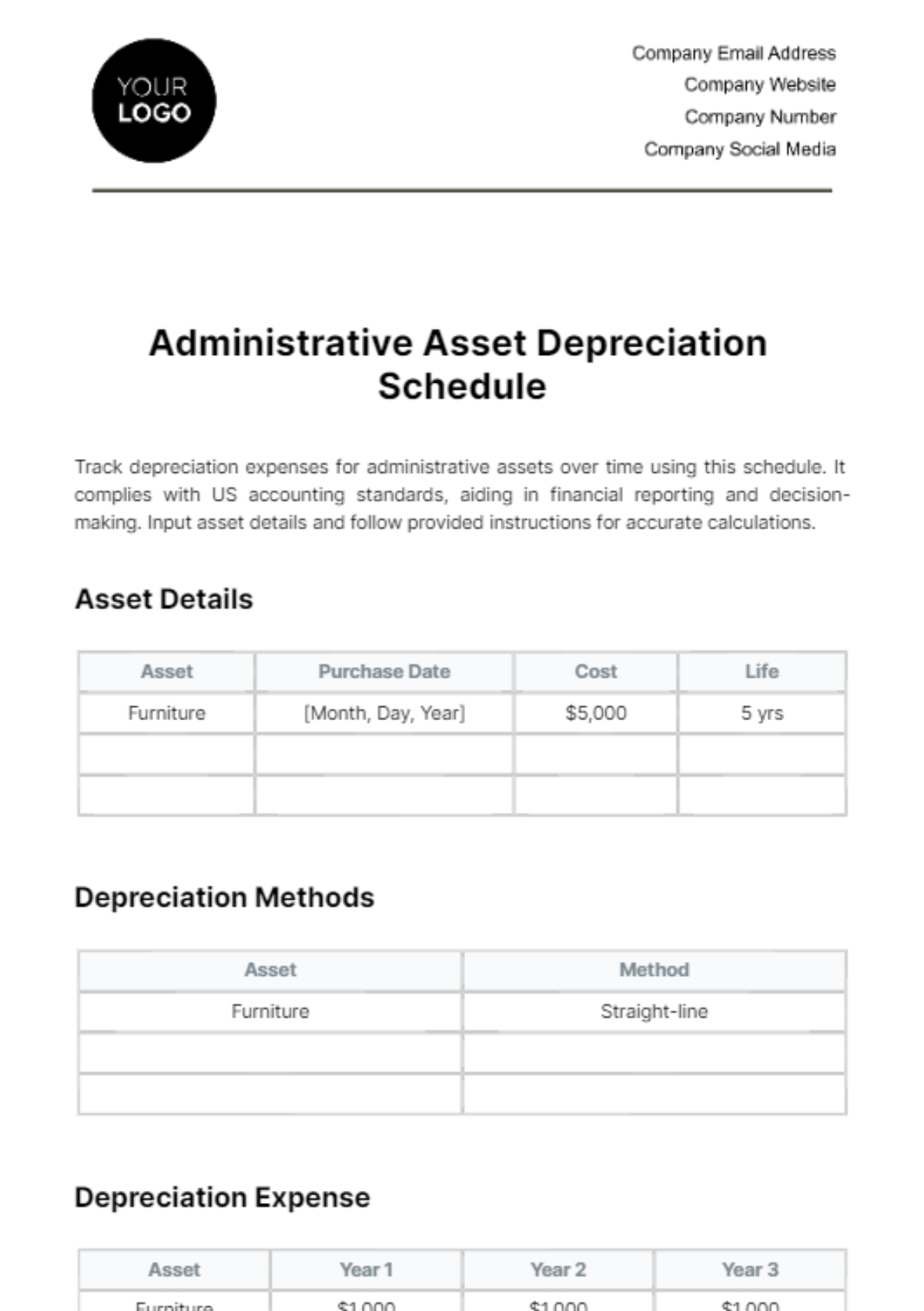

Free Administration Asset Depreciation Schedule

Track depreciation expenses for administrative assets over time using this schedule. It complies with US accounting standards, aiding in financial reporting and decision-making. Input asset details and follow provided instructions for accurate calculations.

Asset Details

Asset | Purchase Date | Cost | Life |

|---|---|---|---|

Furniture | [Month, Day, Year] | $5,000 | 5 yrs |

Depreciation Methods

Asset | Method |

|---|---|

Furniture | Straight-line |

Depreciation Expense

Asset | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

Furniture | $1,000 | $1,000 | $1,000 |

Accumulated Depreciation

Asset | Year 1 | Year 2 |

|---|---|---|

Furniture | $1,000 | $2,000 |

Book Value

Asset | Year 1 | Year 2 |

|---|---|---|

Furniture | $4,000 | $3,000 |

Periodic Reporting

Reporting Period: | Yearly |

Reporting

This schedule is prepared in accordance with Generally Accepted Accounting Principles (GAAP) and complies with US tax regulations. It serves as documentation for financial reporting purposes.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize asset management efficiency with the Administration Asset Depreciation Schedule Template from Template.net. This editable and customizable template enables accurate tracking of asset depreciation, supporting strategic financial planning and reporting. Easily adjustable in our Ai Editor Tool, it provides a clear overview of asset values over time, facilitating informed decision-making and compliance with accounting standards.

You may also like

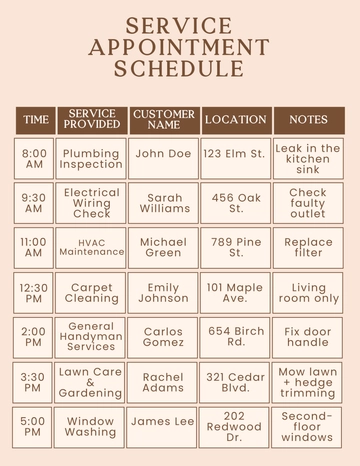

- Schedule Appointment

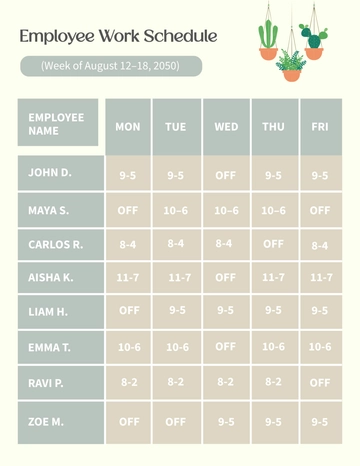

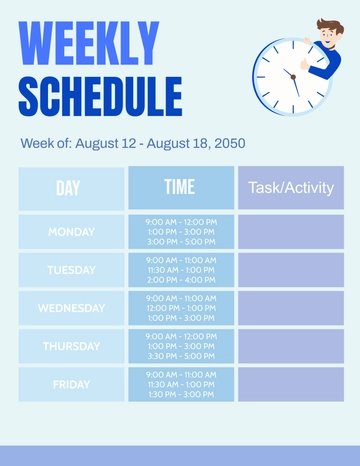

- Work Schedule

- Weekly Schedule

- Cleaning Schedule

- Payment Schedule

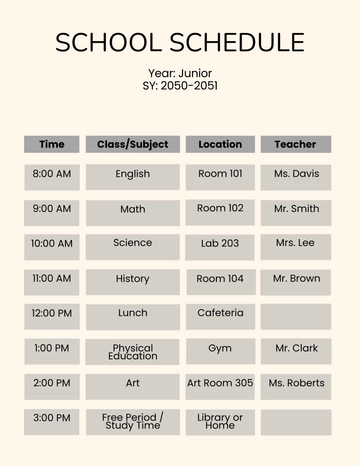

- School Schedule

- Maintenance Schedule

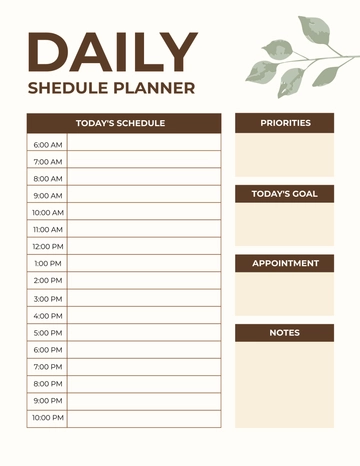

- Daily Schedule

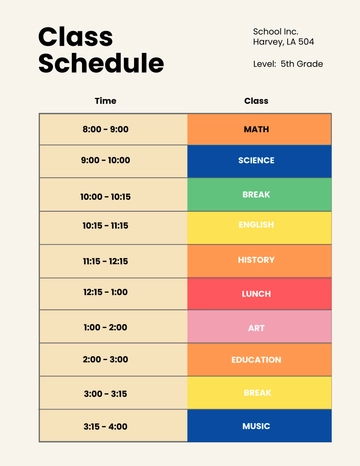

- Class Schedule

- Workout Schedule

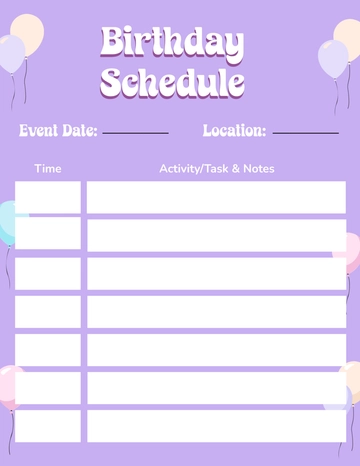

- Event Schedule

- Marketing Schedule

- Weekly Cleaning Schedule

- Work From Home Schedule

- Payroll Schedule

- Restaurant Schedule

- Kitchen Cleaning Schedule

- Schedule of Values

- Hourly Schedule

- Study Schedule

- University Schedule

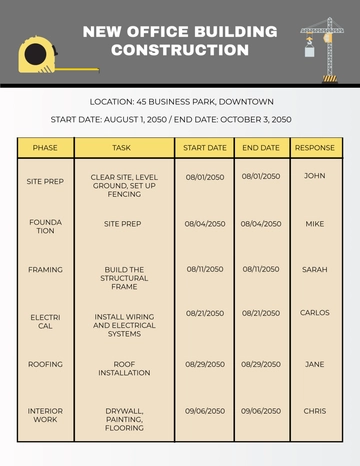

- Construction Schedule

- Preventive Maintenance Schedule

- Fitness Schedule

- Education Schedule

- Training Schedule

- Agency Schedule

- Panel Schedule

- Monthly Schedule

- Nursing Home Schedule

- Project Schedule

- Real Estate Schedule

- Freelancer Schedule

- Medication Schedule

- IT and Software Schedule

- Interior Design Schedule

- Travel Schedule

- Travel Agency Schedule

- Hotel Schedule

- Wedding Schedule

- Camp Schedule