Free Real Estate Mileage Log

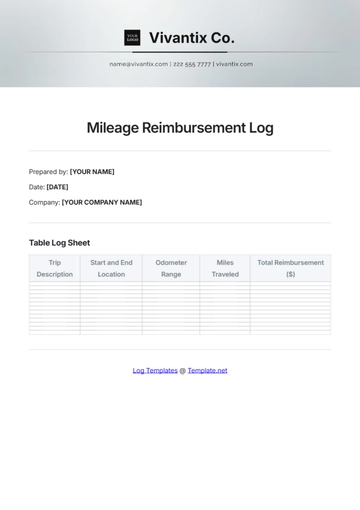

This log is intended to assist real estate professionals in tracking travel mileage for business-related tasks. It helps in accurate record keeping for tax and reimbursement purposes.

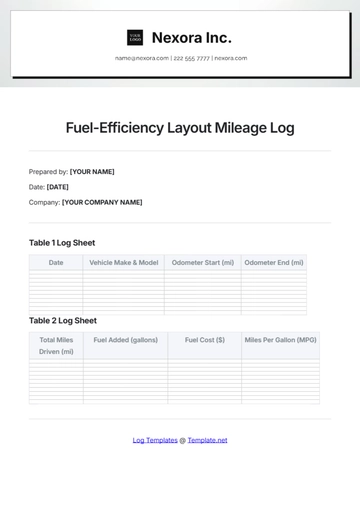

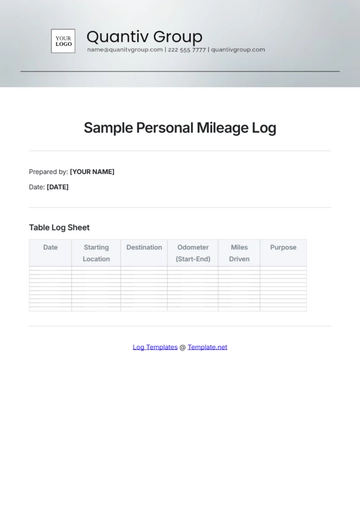

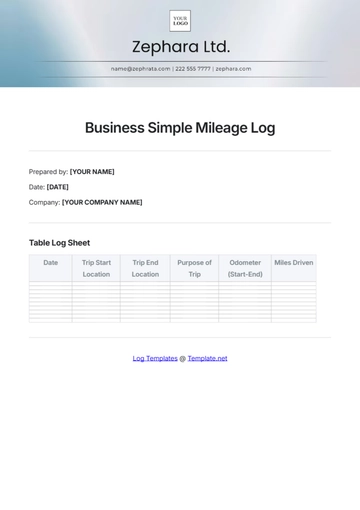

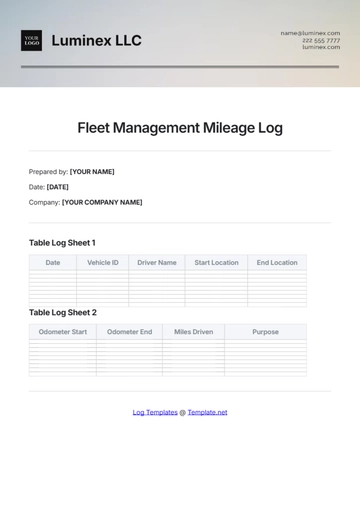

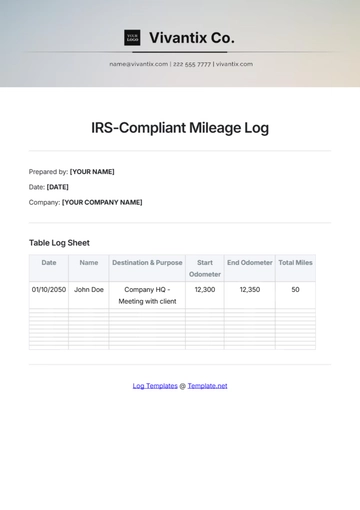

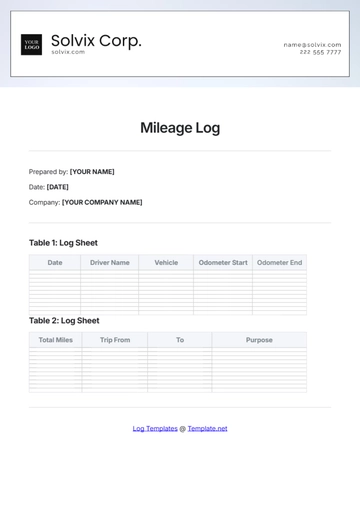

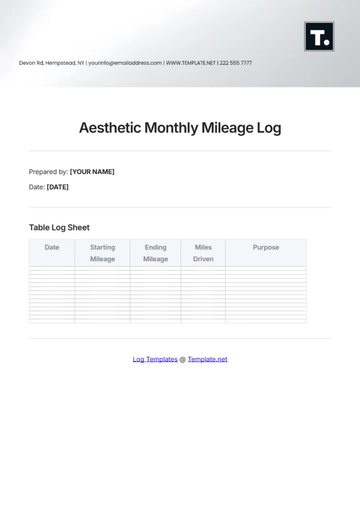

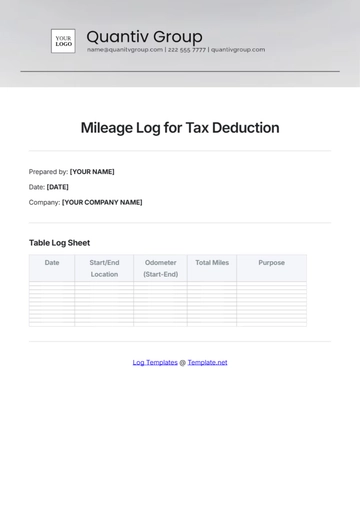

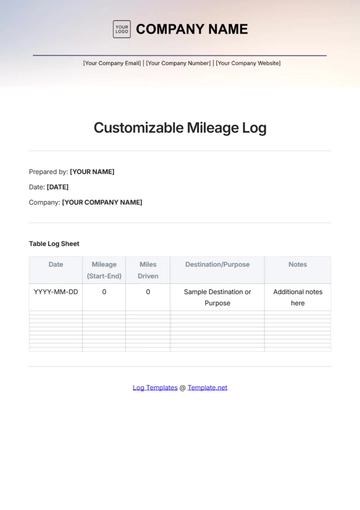

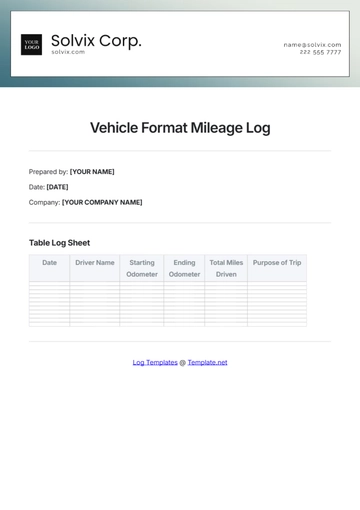

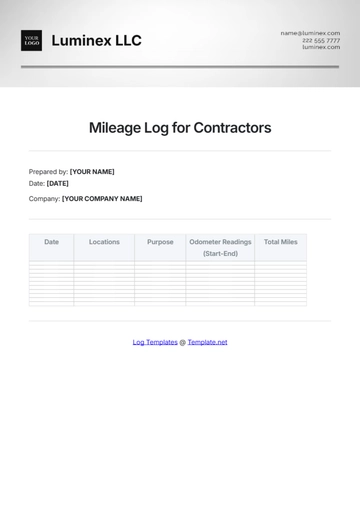

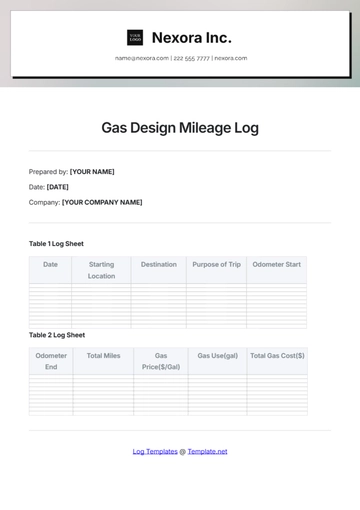

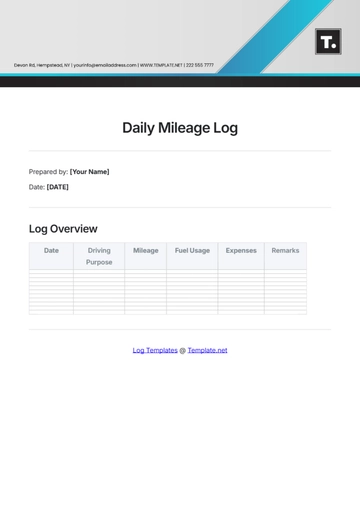

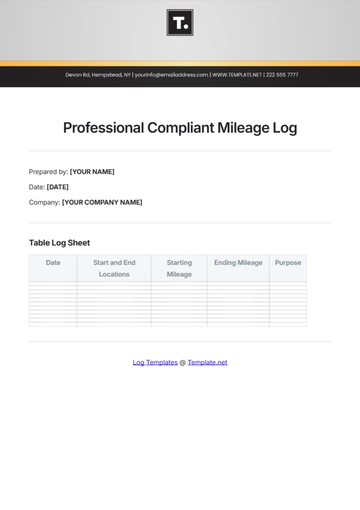

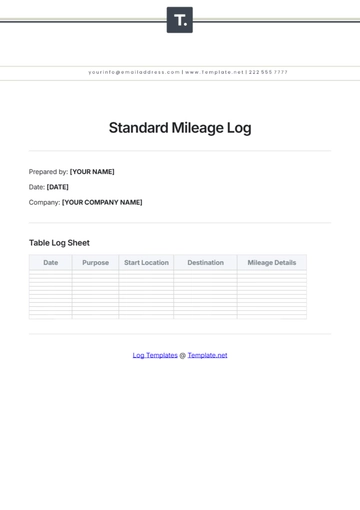

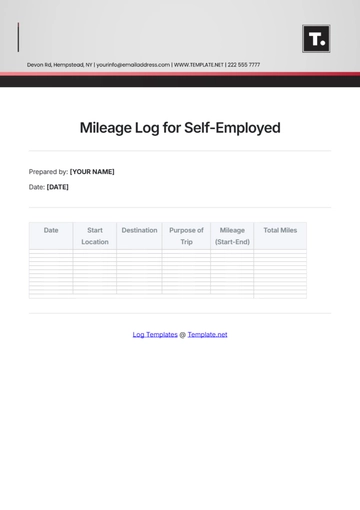

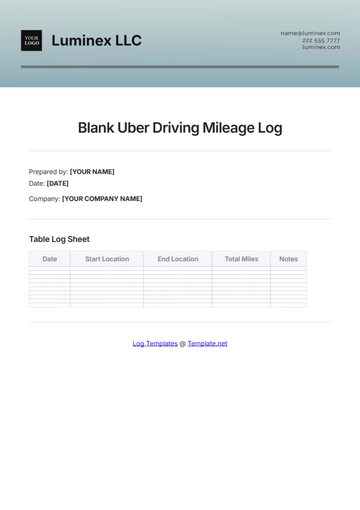

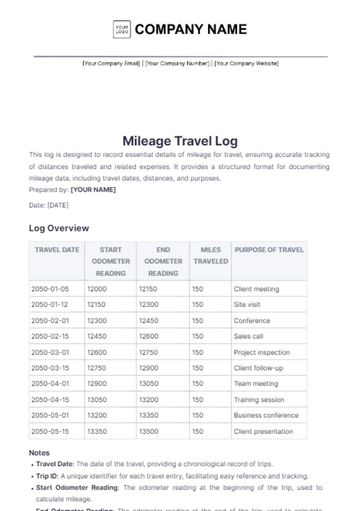

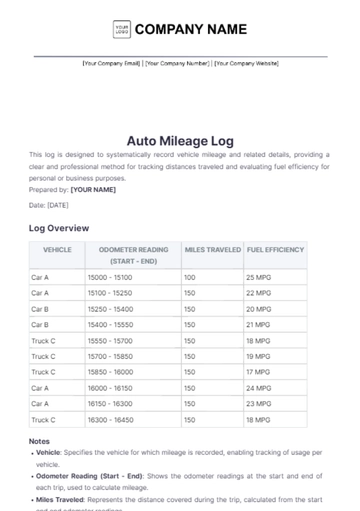

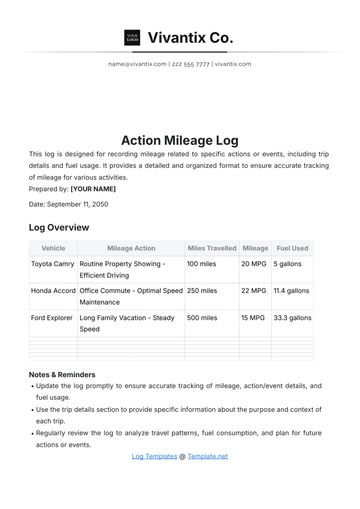

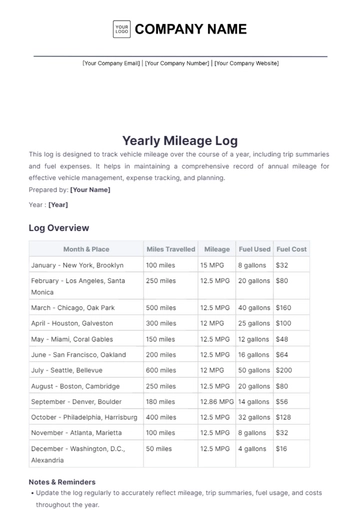

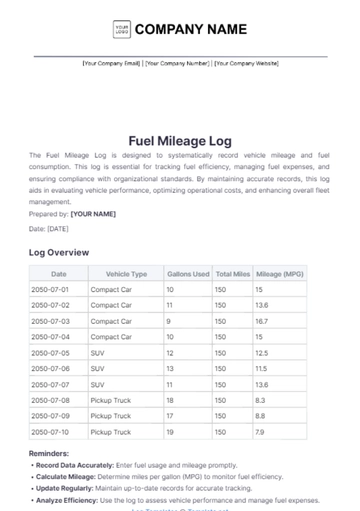

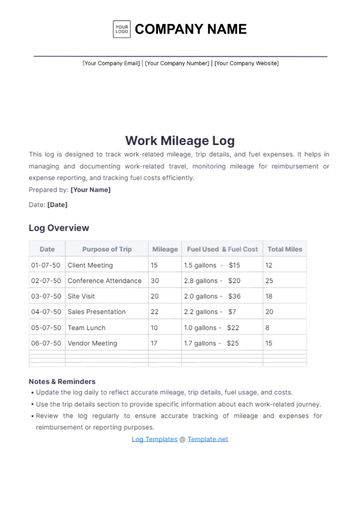

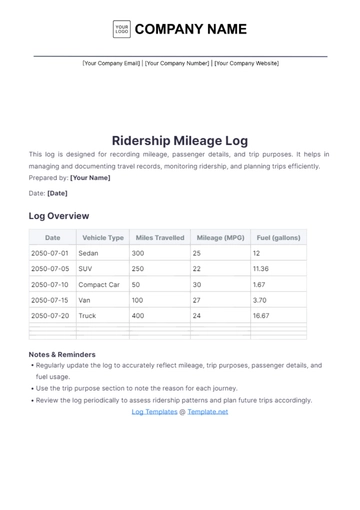

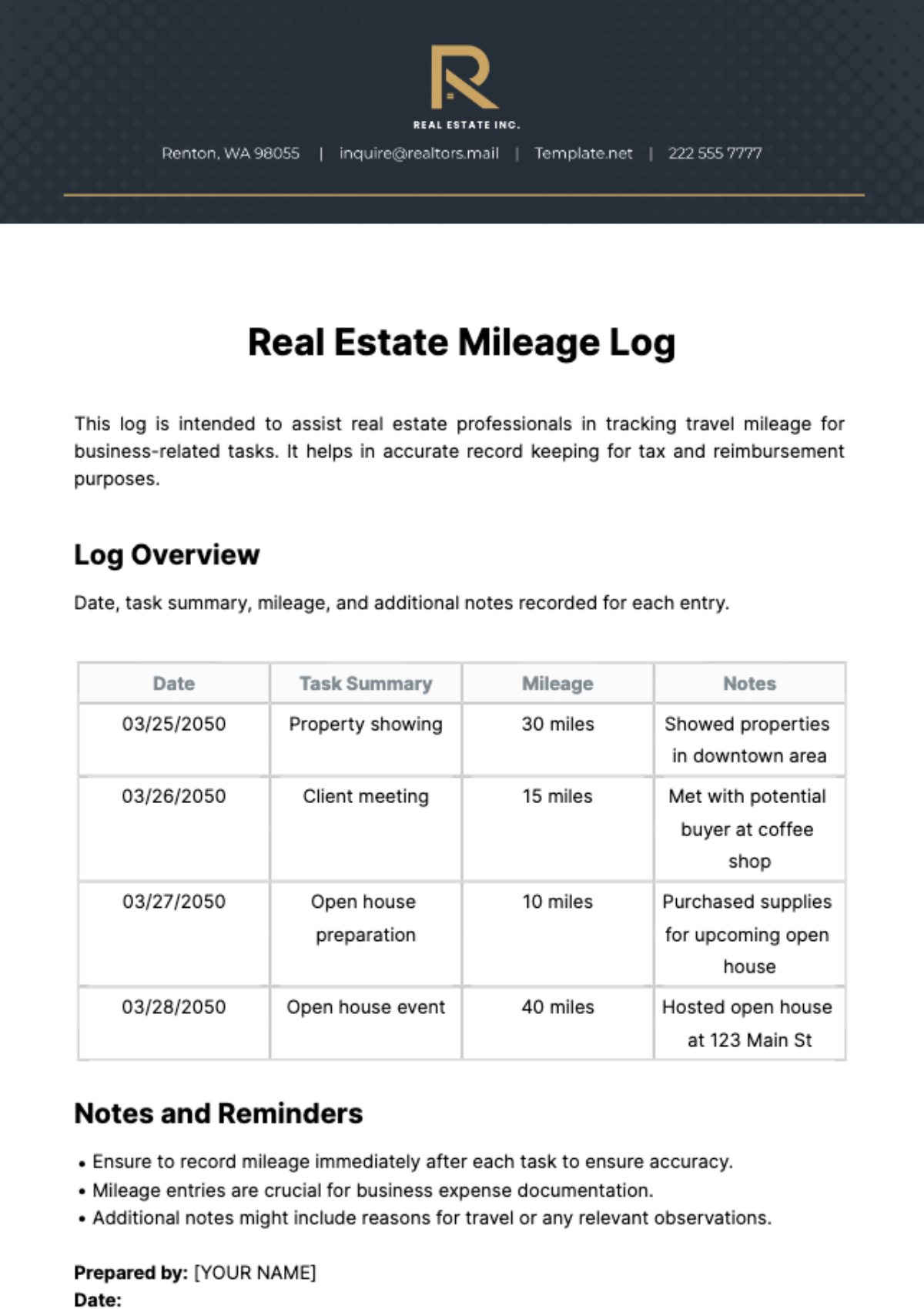

Log Overview

Date, task summary, mileage, and additional notes recorded for each entry.

Date | Task Summary | Mileage | Notes |

|---|---|---|---|

03/25/2050 | Property showing | 30 miles | Showed properties in downtown area |

03/26/2050 | Client meeting | 15 miles | Met with potential buyer at coffee shop |

03/27/2050 | Open house preparation | 10 miles | Purchased supplies for upcoming open house |

03/28/2050 | Open house event | 40 miles | Hosted open house at 123 Main St |

Notes and Reminders

Ensure to record mileage immediately after each task to ensure accuracy.

Mileage entries are crucial for business expense documentation.

Additional notes might include reasons for travel or any relevant observations.

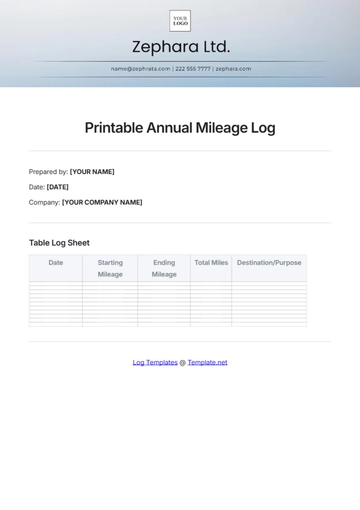

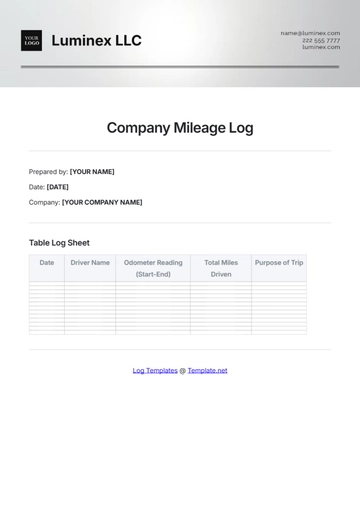

Prepared by: [YOUR NAME]

Date:

Company: [YOUR COMPANY NAME]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your real estate business with the Real Estate Mileage Log Template from Template.net. Designed for convenience, this customizable template simplifies mileage tracking for all your property-related journeys. With our AI editor tool, effortlessly personalize the log to suit your specific needs. Streamline your record-keeping and ensure accurate mileage documentation with ease.