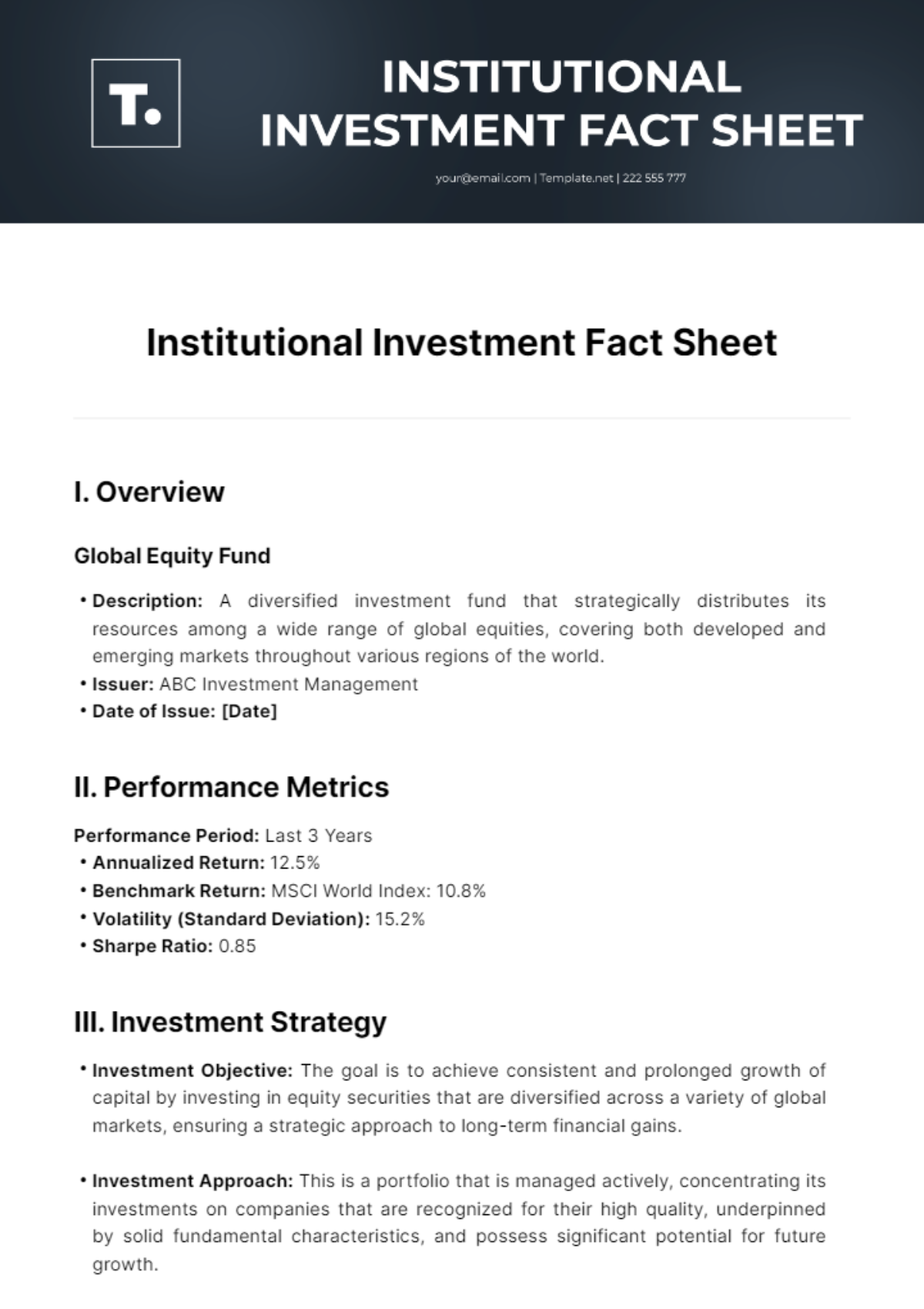

Free Institutional Investment Fact Sheet

I. Overview

Global Equity Fund

Description: A diversified investment fund that strategically distributes its resources among a wide range of global equities, covering both developed and emerging markets throughout various regions of the world.

Issuer: ABC Investment Management

Date of Issue: [Date]

II. Performance Metrics

Performance Period: Last 3 Years

Annualized Return: 12.5%

Benchmark Return: MSCI World Index: 10.8%

Volatility (Standard Deviation): 15.2%

Sharpe Ratio: 0.85

III. Investment Strategy

Investment Objective: The goal is to achieve consistent and prolonged growth of capital by investing in equity securities that are diversified across a variety of global markets, ensuring a strategic approach to long-term financial gains.

Investment Approach: This is a portfolio that is managed actively, concentrating its investments on companies that are recognized for their high quality, underpinned by solid fundamental characteristics, and possess significant potential for future growth.

Portfolio Allocation:

Equities: 85%

Fixed Income: 10%

Alternatives: 3%

Cash & Equivalents: 2%

IV. Portfolio Holdings

Top Holdings:

Apple Inc.: AAPL, 5.2%

Microsoft Corporation: MSFT, 4.8%

AMAZON.COM Inc.: AMZN, 3.9%

Sector Allocation:

Technology: 25%

Financials: 20%

Consumer Discretionary: 15%

Healthcare: 12%

Industrials: 10%

Others: 18%

V. Fees and Expenses

Management Fees:

Annual Management Fee: 1.0%

Performance Fee: None

Other Expenses:

Custodian Fees: 0.15%

Administrative Expenses: 0.25%

Total Expense Ratio (TER): 1.4%

VI. Risk Factors

Market Risk: Exposure to the fluctuations of global markets and the cyclical nature of economic conditions.

Credit Risk: Limited exposure to credit risk due to focus on high-quality companies.

Liquidity Risk: Moderate liquidity risk due to some investments in less liquid markets.

VII. Legal and Compliance Information

This document is not to be considered as constituting an offer to sell or a solicitation of an offer to purchase any form of securities. Investors are advised to thoroughly assess and take into careful consideration the investment objectives, associated risks, charges, and expenses before making any investment decisions.

VIII. Contact Information

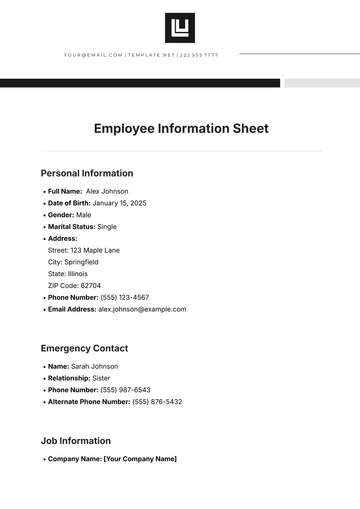

Company Name: [Your Company Name]

Name: [Your Name]

Address: [Your Address]

Phone Number: [Your Phone Number]

Email Address: [Email Address]

Website: [Your Company Website]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance your institutional investment reporting with Template.net’s Institutional Investment Fact Sheet Template. Crafted for professionalism and detail, this editable and customizable template seamlessly integrates with our Ai Editor Tool. Present institutional investment data with precision and clarity, fostering trust and confidence among stakeholders. Streamline your reporting process to deliver comprehensive insights and strategic analysis that drive informed decision-making

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

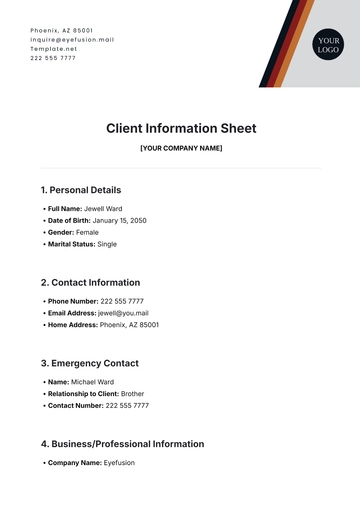

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet