Free Simple Valuation

I. Executive Summary

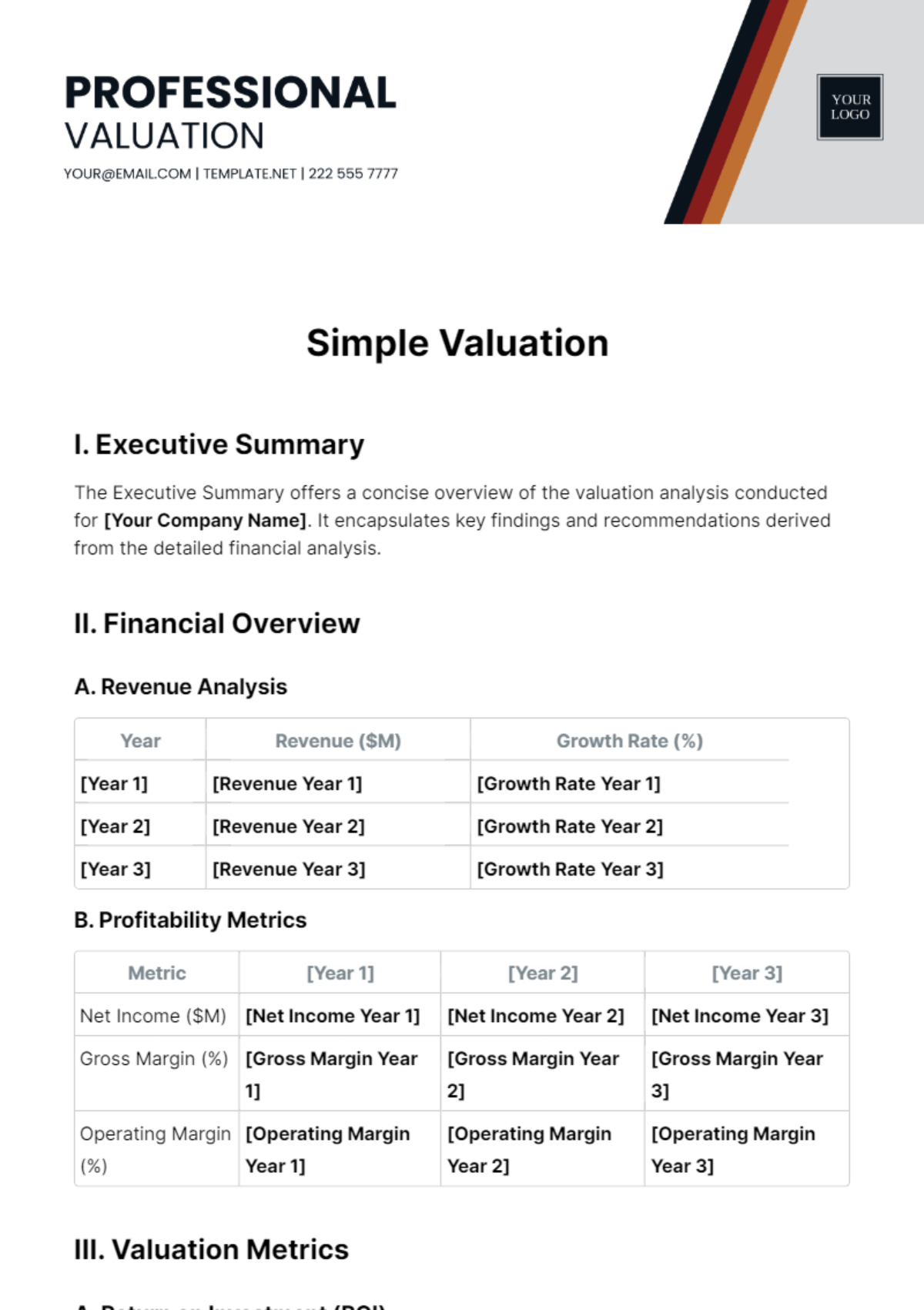

The Executive Summary offers a concise overview of the valuation analysis conducted for [Your Company Name]. It encapsulates key findings and recommendations derived from the detailed financial analysis.

II. Financial Overview

A. Revenue Analysis

Year | Revenue ($M) | Growth Rate (%) |

|---|---|---|

[Year 1] | [Revenue Year 1] | [Growth Rate Year 1] |

[Year 2] | [Revenue Year 2] | [Growth Rate Year 2] |

[Year 3] | [Revenue Year 3] | [Growth Rate Year 3] |

B. Profitability Metrics

Metric | [Year 1] | [Year 2] | [Year 3] |

|---|---|---|---|

Net Income ($M) | [Net Income Year 1] | [Net Income Year 2] | [Net Income Year 3] |

Gross Margin (%) | [Gross Margin Year 1] | [Gross Margin Year 2] | [Gross Margin Year 3] |

Operating Margin (%) | [Operating Margin Year 1] | [Operating Margin Year 2] | [Operating Margin Year 3] |

III. Valuation Metrics

A. Return on Investment (ROI)

Year | ROI (%) |

|---|---|

[Year 1] | [ROI Year 1] |

[Year 2] | [ROI Year 2] |

[Year 3] | [ROI Year 3] |

B. Growth Potential

Metric | [Year 1] | [Year 2] | [Year 3] |

|---|---|---|---|

Earnings Growth Rate (%) | [Growth Rate Year 1] | [Growth Rate Year 2] | [Growth Rate Year 3] |

Revenue Growth Rate (%) | [Revenue Growth Rate Year 1] | [Revenue Growth Rate Year 2] | [Revenue Growth Rate Year 3] |

IV. Investment Decision

The Investment Decision section synthesizes the findings from the valuation analysis to guide decision-making. It provides a comprehensive evaluation of [Your Company Name]'s financial performance and growth prospects, facilitating informed investment decisions.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor