Free Architecture Financial Evaluation

[YOUR COMPANY NAME]

Date: [Date]

Introduction

This evaluation document is designed to provide a structured assessment of the financial aspects of architectural projects within [Your Company Name]. Its primary aim is to ensure financial stability and feasibility across all projects by systematically analyzing various financial criteria.

Overview

The evaluation covers multiple financial criteria to provide a comprehensive financial analysis of our architectural projects. Each criterion is rated on a standardized scale to assist in decision-making and to identify areas for improvement. This process is crucial for maintaining financial discipline and enhancing the profitability and sustainability of our projects.

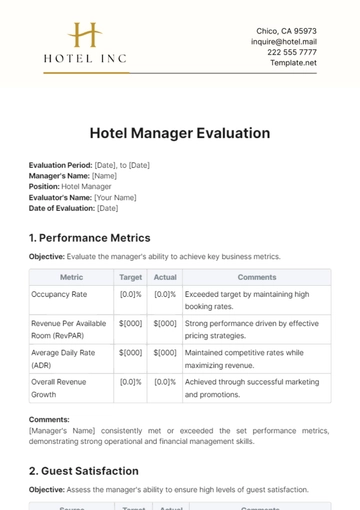

Evaluation Criteria

Cost Estimation Accuracy: Evaluates the precision of cost estimations compared to actual costs. This criterion checks the accuracy of initial project cost forecasts against actual expenses incurred.

Budget Allocation: Assesses the appropriateness of budget distribution across various project components. It examines whether funds are allocated efficiently and effectively to meet project needs without overspending.

Financial Viability: Measures the overall financial soundness and profitability of the project. This involves analyzing the project’s potential to generate financial benefits relative to its costs.

Return on Investment (ROI): Calculates the expected financial returns versus the investment made. This ratio is crucial for assessing the economic success of a project.

Expense Management: Checks how well the project manages its expenses and adheres to the budget. Effective expense management is key to avoiding cost overruns and maintaining profitability.

Funding and Cash Flow: Assesses the stability and sufficiency of funding and cash flow through the project's lifecycle. It ensures there are adequate funds available at all times to support project activities.

Risk Management: Evaluates the effectiveness of identifying and mitigating financial risks. This includes the ability to foresee financial uncertainties and implement strategies to mitigate their impact.

Detailed Evaluation Table

Criteria | Description | Rating (1-5) | Comments |

|---|---|---|---|

Cost Estimation Accuracy | Precision of cost estimations compared to actual costs. | ||

Budget Allocation | Appropriateness of budget distribution across various project components. | ||

Financial Viability | Overall financial soundness and profitability of the project. | ||

Return on Investment (ROI) | Expected financial returns versus the investment made. | ||

Expense Management | Management of project expenses and adherence to the budget. | ||

Funding and Cash Flow | Stability and sufficiency of funding and cash flow throughout the project's lifecycle. | ||

Risk Management | Effectiveness in identifying and mitigating financial risks. |

Additional Comments and Notes:

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unveil the Architecture Financial Evaluation Template, exclusively on Template.net! This comprehensive tool empowers you to analyze and assess the financial aspects of your architectural projects with precision. Easily track expenses, budget allocations, and ROI with this user-friendly template. Customizable with our AI editor tool, tailor it to suit your specific needs. Streamline your financial evaluation process and make informed decisions with ease using Template.net!