Free Employee Payroll Report

Prepared by: [Your Name]

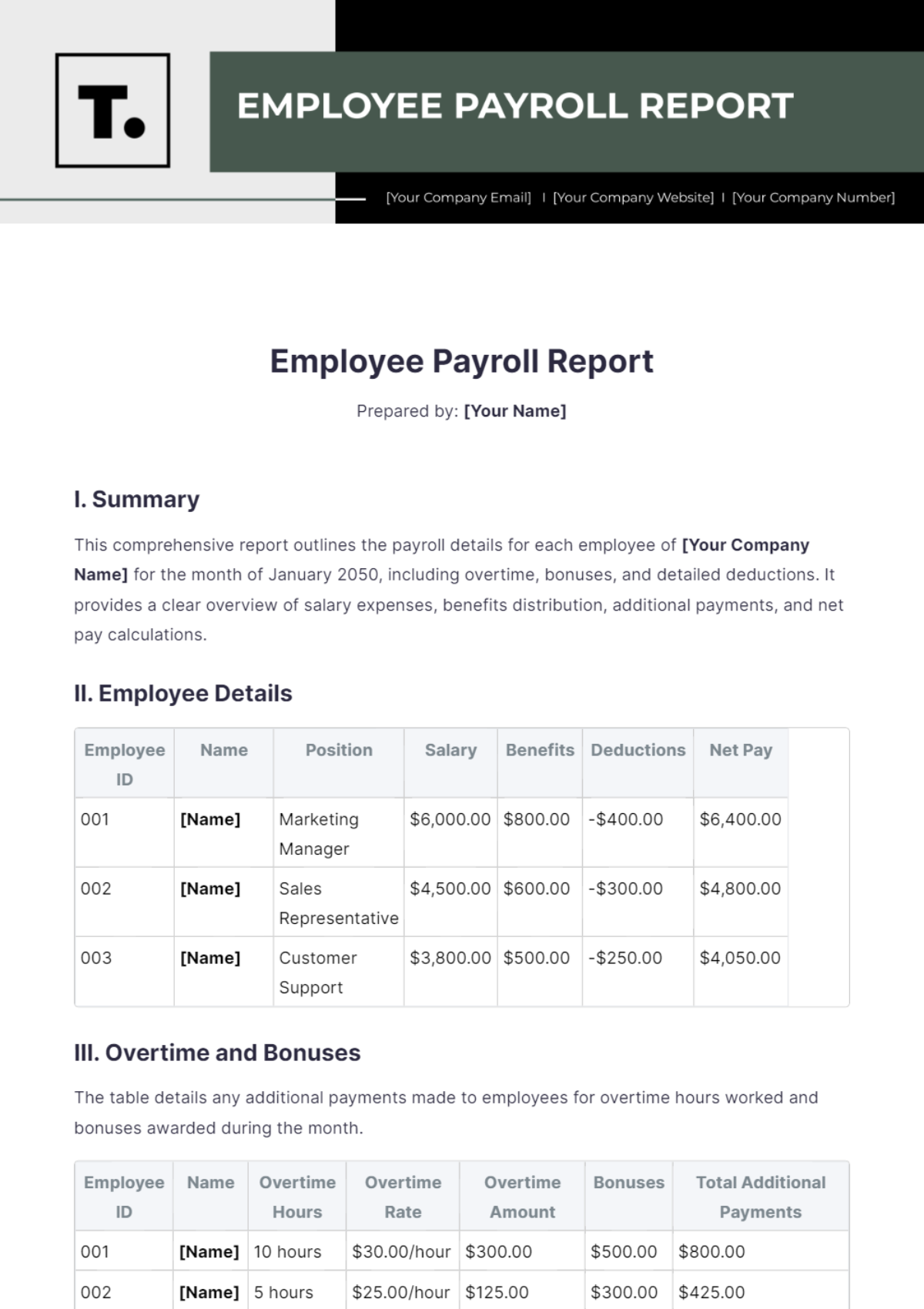

I. Summary

This comprehensive report outlines the payroll details for each employee of [Your Company Name] for the month of January 2050, including overtime, bonuses, and detailed deductions. It provides a clear overview of salary expenses, benefits distribution, additional payments, and net pay calculations.

II. Employee Details

Employee ID | Name | Position | Salary | Benefits | Deductions | Net Pay |

|---|---|---|---|---|---|---|

001 | [Name] | Marketing Manager | $6,000.00 | $800.00 | -$400.00 | $6,400.00 |

002 | [Name] | Sales Representative | $4,500.00 | $600.00 | -$300.00 | $4,800.00 |

003 | [Name] | Customer Support | $3,800.00 | $500.00 | -$250.00 | $4,050.00 |

III. Overtime and Bonuses

The table details any additional payments made to employees for overtime hours worked and bonuses awarded during the month.

Employee ID | Name | Overtime Hours | Overtime Rate | Overtime Amount | Bonuses | Total Additional Payments |

|---|---|---|---|---|---|---|

001 | [Name] | 10 hours | $30.00/hour | $300.00 | $500.00 | $800.00 |

002 | [Name] | 5 hours | $25.00/hour | $125.00 | $300.00 | $425.00 |

003 | [Name] | 8 hours | $20.00/hour | $160.00 | $200.00 | $360.00 |

IV. Deductions

The table below provides a breakdown of deductions categorized by type, including taxes, insurance premiums, and other deductions.

Employee ID | Name | Taxes | Insurance | Other Deductions | Total Deductions |

|---|---|---|---|---|---|

001 | [Name] | $800.00 | $100.00 | -$400.00 | $500.00 |

002 | [Name] | $600.00 | $75.00 | -$300.00 | $375.00 |

003 | [Name] | $500.00 | $50.00 | -$250.00 | $300.00 |

V. Totals

Total Salaries | Total Benefits | Total Additional Payments | Total Deductions | Total Net Pay |

|---|---|---|---|---|

$14,300.00 | $1,900.00 | $1,585.00 | -$1,175.00 | $15,810.00 |

VI. Analysis

The payroll analysis for January 2050 at [Your Company Name] highlights several key trends and financial insights. Salaries across the three employees total $14,300.00, with each employee's compensation reflecting their role within the company. Benefits, totaling $1,900.00, include standard benefits such as healthcare and retirement contributions, contributing to employee welfare and retention efforts.

Deductions, which amount to -$1,175.00, encompass taxes, insurance premiums, and other withholdings. This category plays a crucial role in managing compliance and employee contributions, ensuring regulatory adherence and financial responsibility.

The net pay calculation for January 2050 reveals a total distribution of $15,810.00 across the three employees, representing the amount disbursed after all deductions and withholdings. This figure not only signifies the financial commitment of [Your Company Name] to its workforce but also underscores the importance of accurate payroll management in maintaining employee satisfaction and operational efficiency.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Keep your payroll processes seamless with the Employee Payroll Report Template by Template.net. This customizable and downloadable template helps you organize individual payroll details efficiently. It’s editable in our AI Editor Tool, allowing for personalized adjustments, and printable for easy distribution. Ideal for businesses that prioritize clarity and precision in payroll management.

You may also like

- Employee Letter

- Employee ID Card

- Employee Checklist

- Employee Certificate

- Employee Report

- Employee Training Checklist

- Employee Agreement

- Employee Contract

- Employee Training Plan

- Employee Incident Report

- Employee Survey

- Employee of the Month Certificate

- Employee Development Plan

- Employee Action Plan

- Employee Roadmap

- Employee Poster

- Employee Form

- Employee Engagement Survey