Free Business Income Expense Tracker

I. Overview

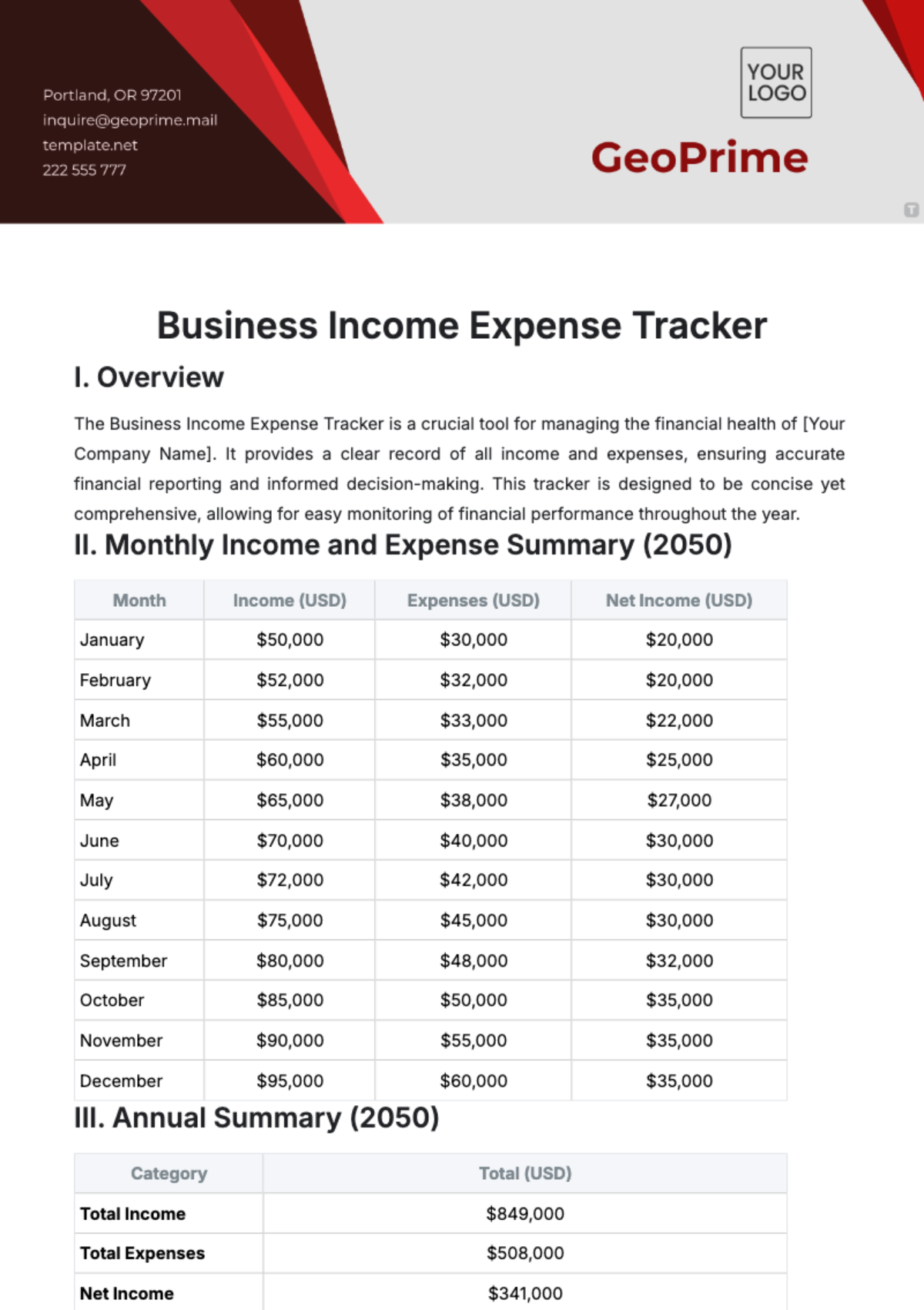

The Business Income Expense Tracker is a crucial tool for managing the financial health of [Your Company Name]. It provides a clear record of all income and expenses, ensuring accurate financial reporting and informed decision-making. This tracker is designed to be concise yet comprehensive, allowing for easy monitoring of financial performance throughout the year.

II. Monthly Income and Expense Summary (2050)

Month | Income (USD) | Expenses (USD) | Net Income (USD) |

|---|---|---|---|

January | $50,000 | $30,000 | $20,000 |

February | $52,000 | $32,000 | $20,000 |

March | $55,000 | $33,000 | $22,000 |

April | $60,000 | $35,000 | $25,000 |

May | $65,000 | $38,000 | $27,000 |

June | $70,000 | $40,000 | $30,000 |

July | $72,000 | $42,000 | $30,000 |

August | $75,000 | $45,000 | $30,000 |

September | $80,000 | $48,000 | $32,000 |

October | $85,000 | $50,000 | $35,000 |

November | $90,000 | $55,000 | $35,000 |

December | $95,000 | $60,000 | $35,000 |

III. Annual Summary (2050)

Category | Total (USD) |

|---|---|

Total Income | $849,000 |

Total Expenses | $508,000 |

Net Income | $341,000 |

IV. Key Insights

Revenue Growth: The company has shown consistent growth in revenue throughout 2050, with a peak in December.

Expense Management: Expenses have been relatively stable, with slight increases in the latter half of the year due to higher operational costs and marketing efforts.

Profitability: The net income for 2050 indicates a strong financial position, with a total profit of $341,000, reflecting efficient management of resources.

V. Recommendations

Expense Optimization: Review operational and marketing expenses to identify areas where costs can be reduced without compromising quality.

Investment in Growth: Consider reinvesting a portion of the net income into strategic initiatives, such as technology upgrades or market expansion, to sustain growth in the coming years.

Regular Monitoring: Continue using this tracker monthly to ensure ongoing financial health and to make timely adjustments as needed.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Monitor your business’s financial performance with the Business Income Expense Tracker Template available on Template.net. This editable template allows you to record and analyze your income and expenses systematically. Editable in our AI Editor Tool, it helps you stay on top of your financial health. Download now and keep your finances in check!