Free Mortgage Flow Chart

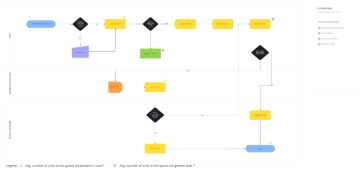

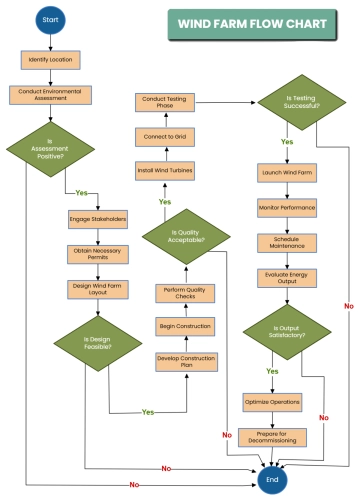

The Mortgage Flow Chart illustrates the complete process of obtaining a mortgage loan, from application to final approval. It begins with the applicant starting the process and having their credit score checked. If the credit score is above 700, the loan moves forward to pre-approval, financial document review, and property value assessment. Should the property meet value requirements, loan terms are finalized, and agreements are signed before funds are disbursed. If issues arise, such as incomplete applications or insufficient information, revisions and resubmissions are required. The process continues with underwriting and loan officer reviews before submission to the lender. The lender then assesses whether the property and application meet all criteria. If approved, the process concludes with a final inspection; otherwise, the application may be corrected or denied. This flow ensures a thorough evaluation of both the applicant’s financial stability and property value before loan approval.