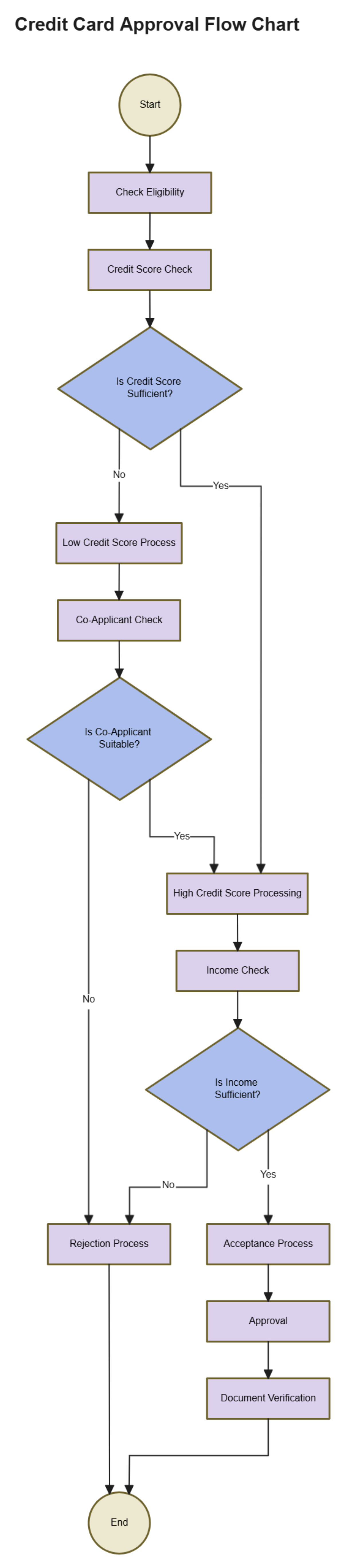

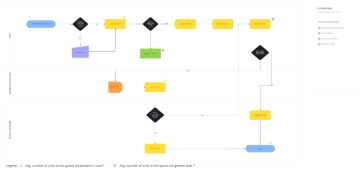

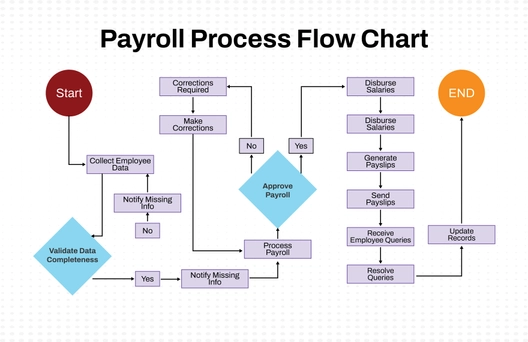

Free Credit Card Approval Flow Chart

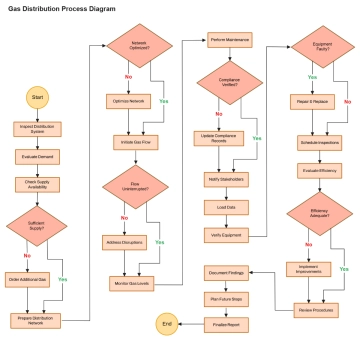

The Credit Card Approval Flow Chart outlines the step-by-step process of evaluating and approving a credit card application. It begins with checking the applicant’s eligibility, followed by a credit score assessment. If the credit score is sufficient, the process moves directly to high credit score processing and an income check. However, if the credit score is low, the applicant enters the low credit score process, which involves evaluating a co-applicant’s suitability. Once a co-applicant is deemed suitable, the process continues to income verification. The applicant’s income is then reviewed to determine whether it meets the bank’s required standards. If income is sufficient, the application proceeds to the acceptance process, leading to approval and document verification. Conversely, if the credit score, co-applicant status, or income fails to meet requirements, the application enters the rejection process. This structured approach ensures that all applications undergo a fair and thorough assessment based on financial stability and creditworthiness.