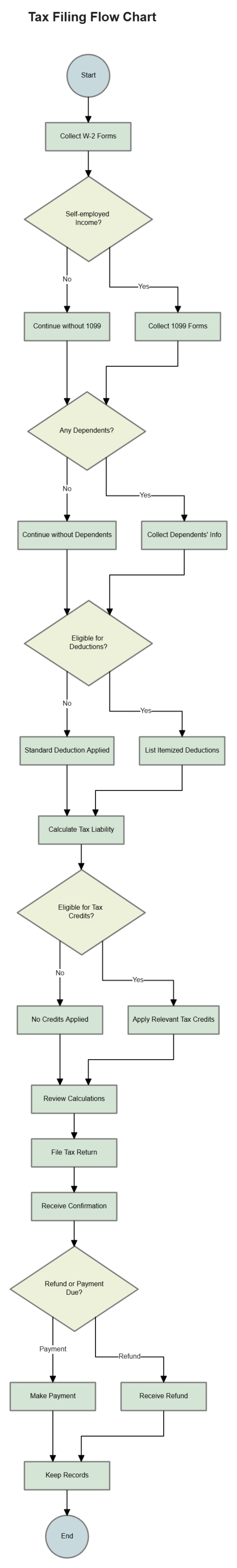

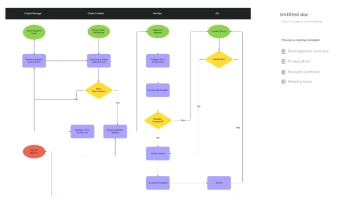

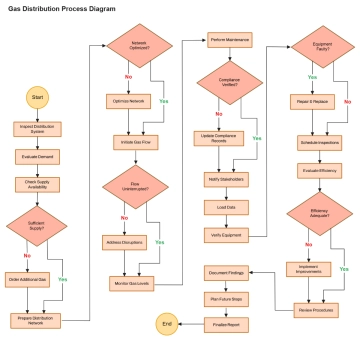

Free Tax Filing Flow Chart

The Tax Filing Flow Chart provides a comprehensive and easy-to-follow visual guide for managing personal tax preparation from start to finish. It walks users through each essential step—beginning with the collection of income documents such as W-2s and 1099s, followed by determining filing status and dependent eligibility. The flow continues with evaluating deductions, whether standard or itemized, and calculating overall tax liability. Eligible tax credits are then applied before reviewing and submitting the final return. A concluding decision point identifies whether a refund or payment is due, leading to disbursement or settlement, and ends with organized recordkeeping. Emphasizing clarity, accuracy, and compliance, this flowchart simplifies the tax filing process, ensuring individuals can navigate each stage with confidence and efficiency.