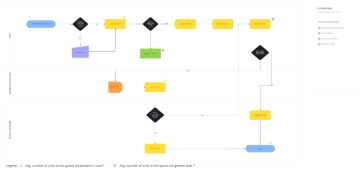

Free Tax Collection Flow Chart

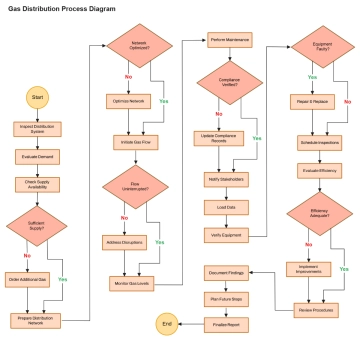

The Tax Collection Flow Chart provides a structured, compliance-oriented pathway for managing tax filings and determining liabilities. It begins with the receipt of a tax filing, followed by an initial check for completeness. If the filing is incomplete, the system prompts a request for additional information, ensuring that all required data is captured before proceeding. Once complete, the filing is assessed for accuracy. A second decision point evaluates whether the calculations are correct; if errors are found, a warning is issued to prompt correction. Only after these validations does the process advance to the final step—calculating the tax liability. This flowchart transforms tax administration into a transparent, step-by-step system that reinforces accuracy, accountability, and procedural integrity at every stage.