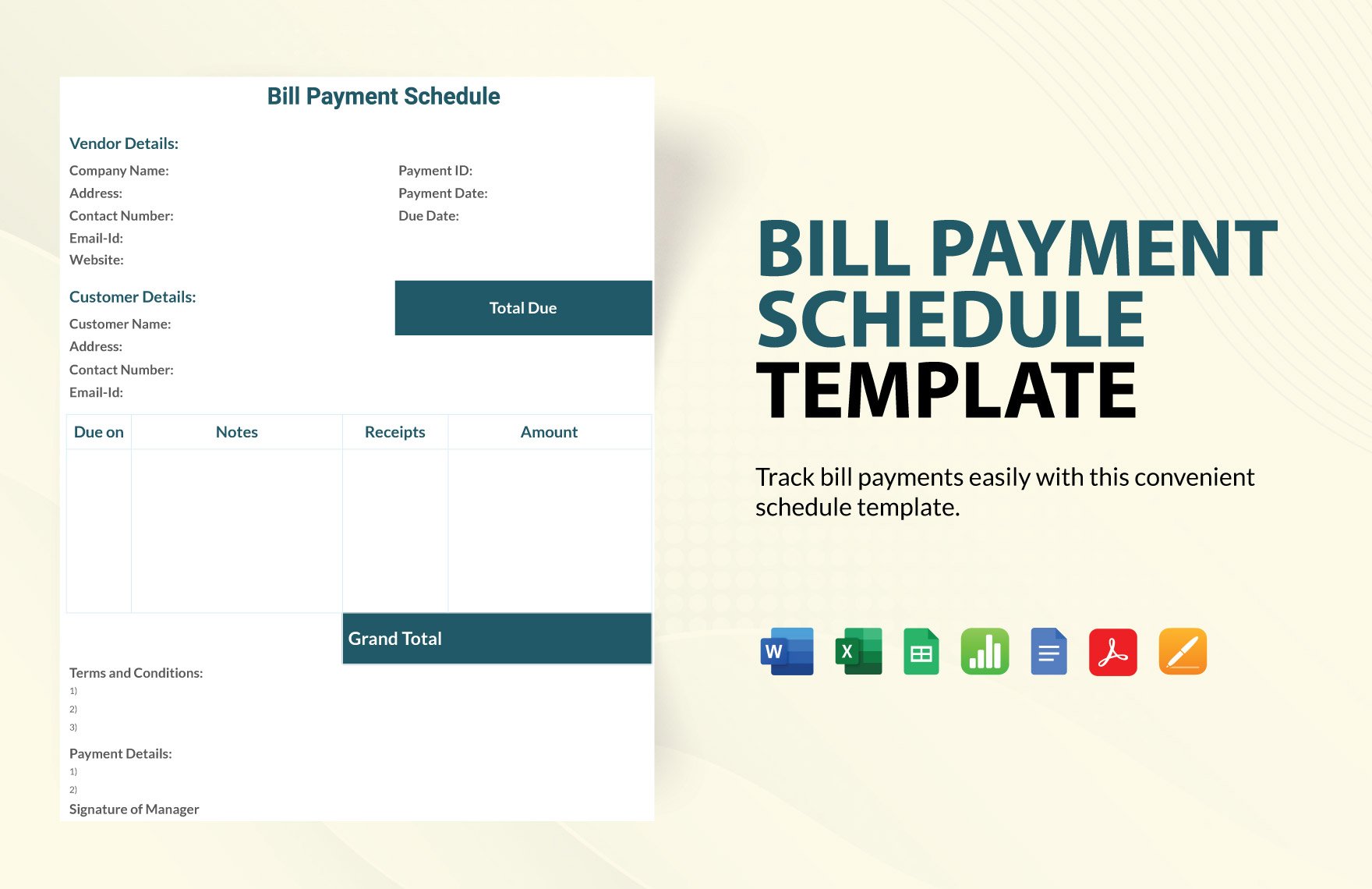

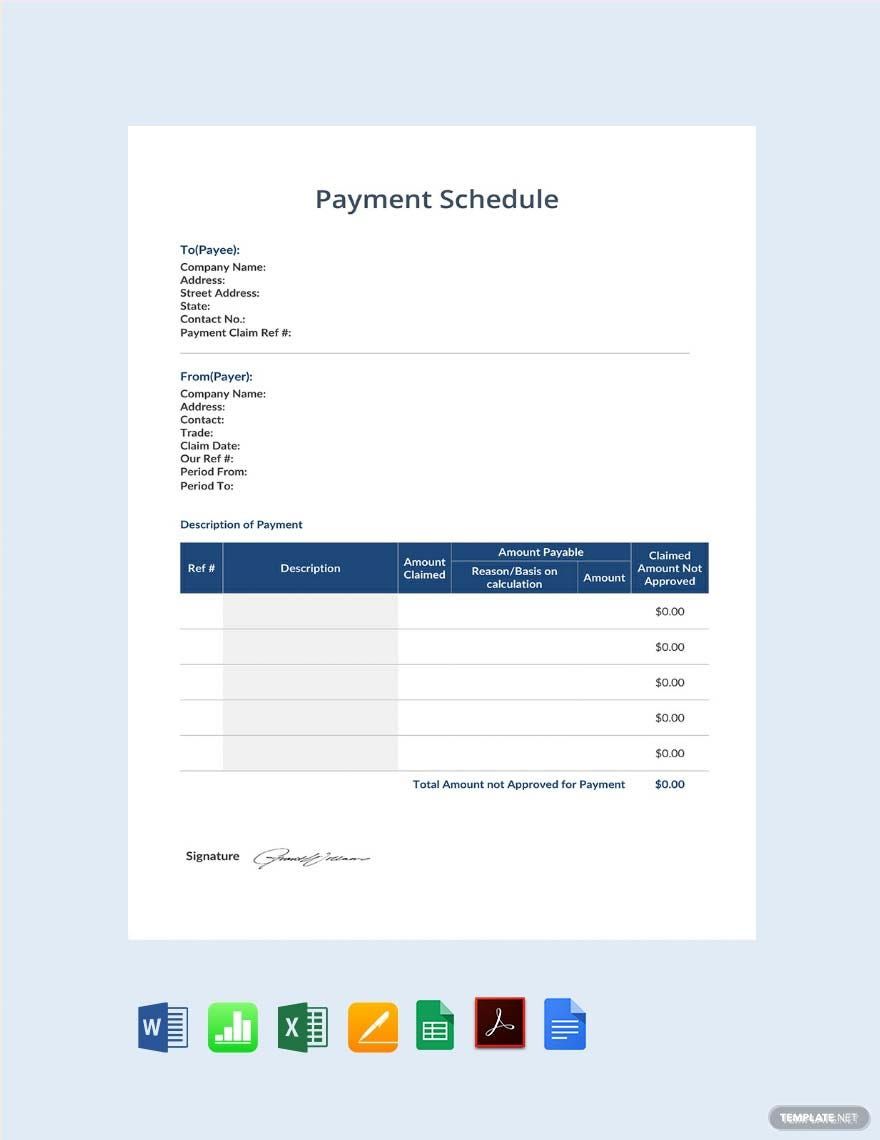

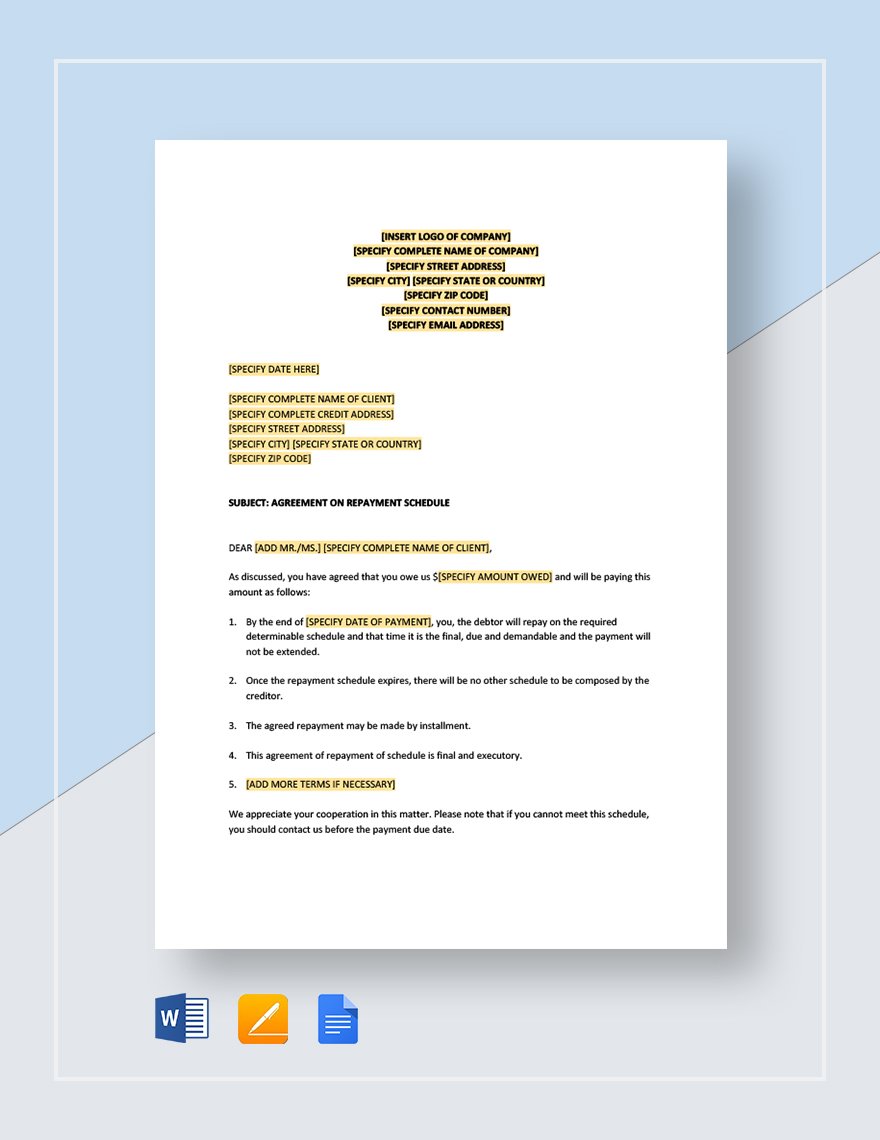

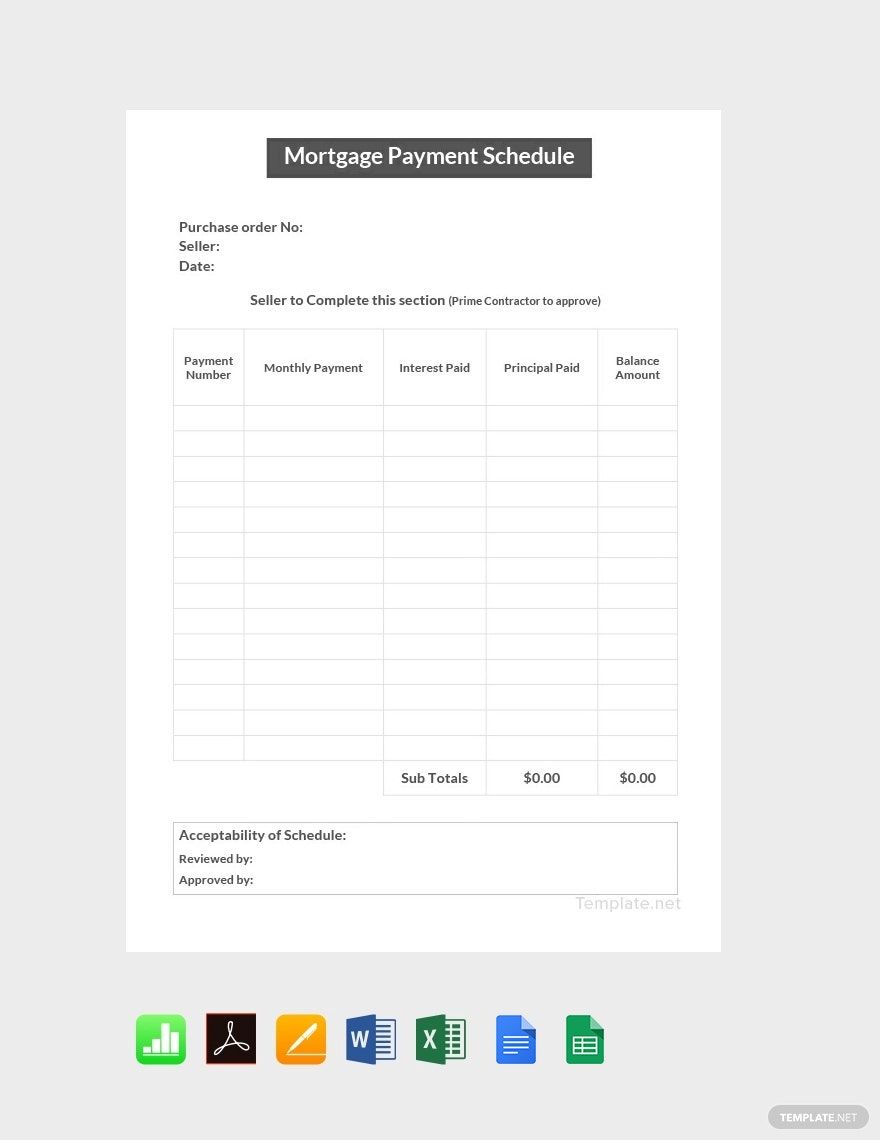

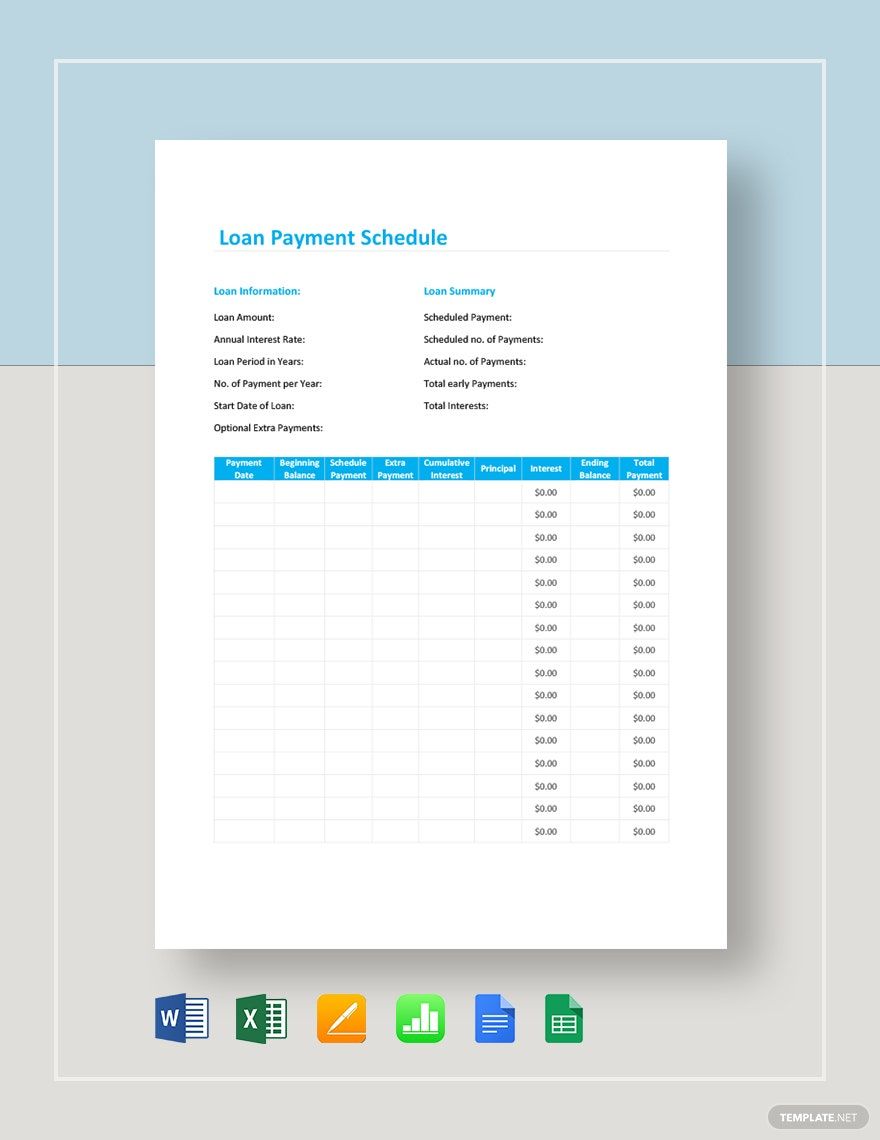

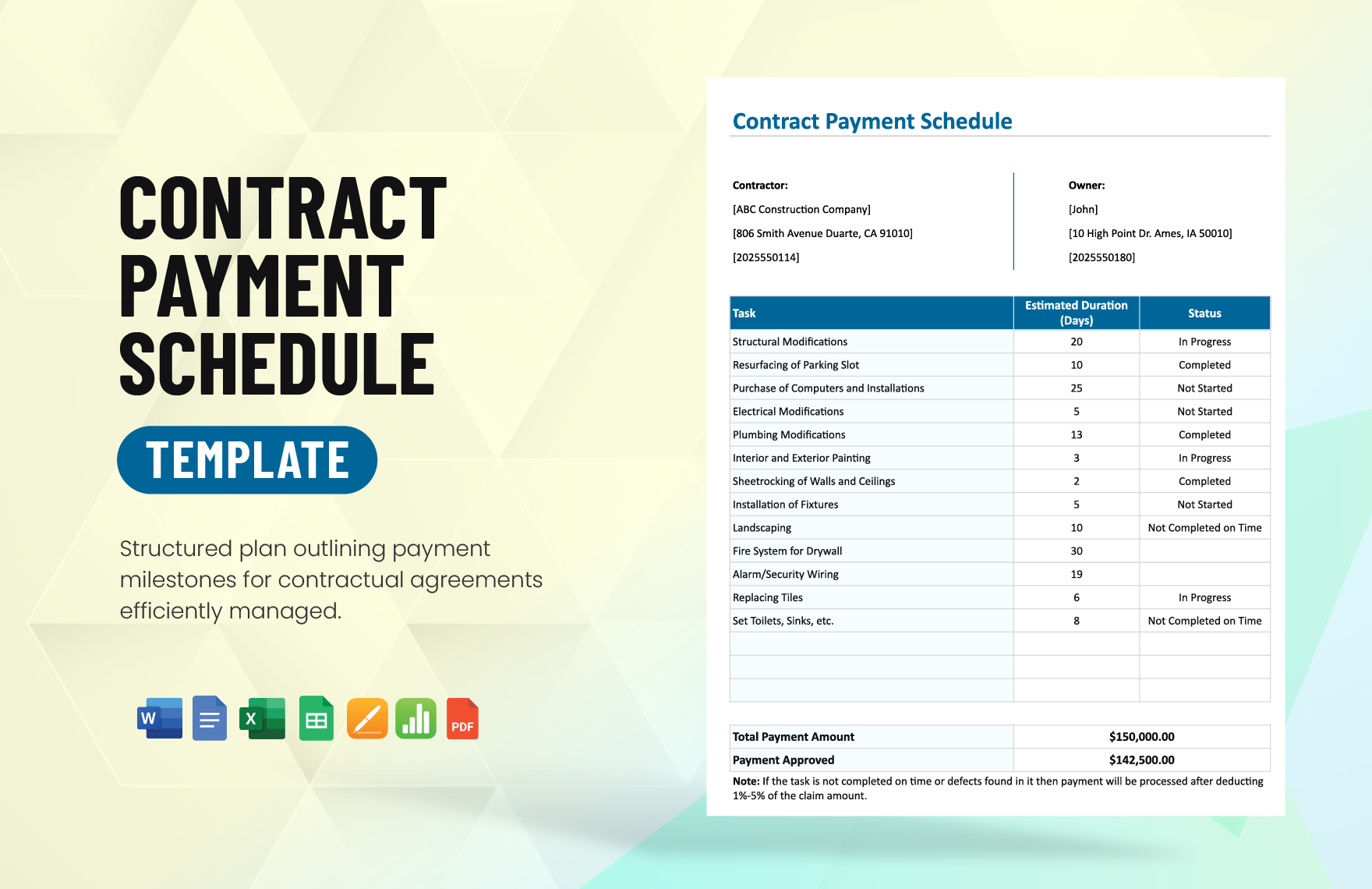

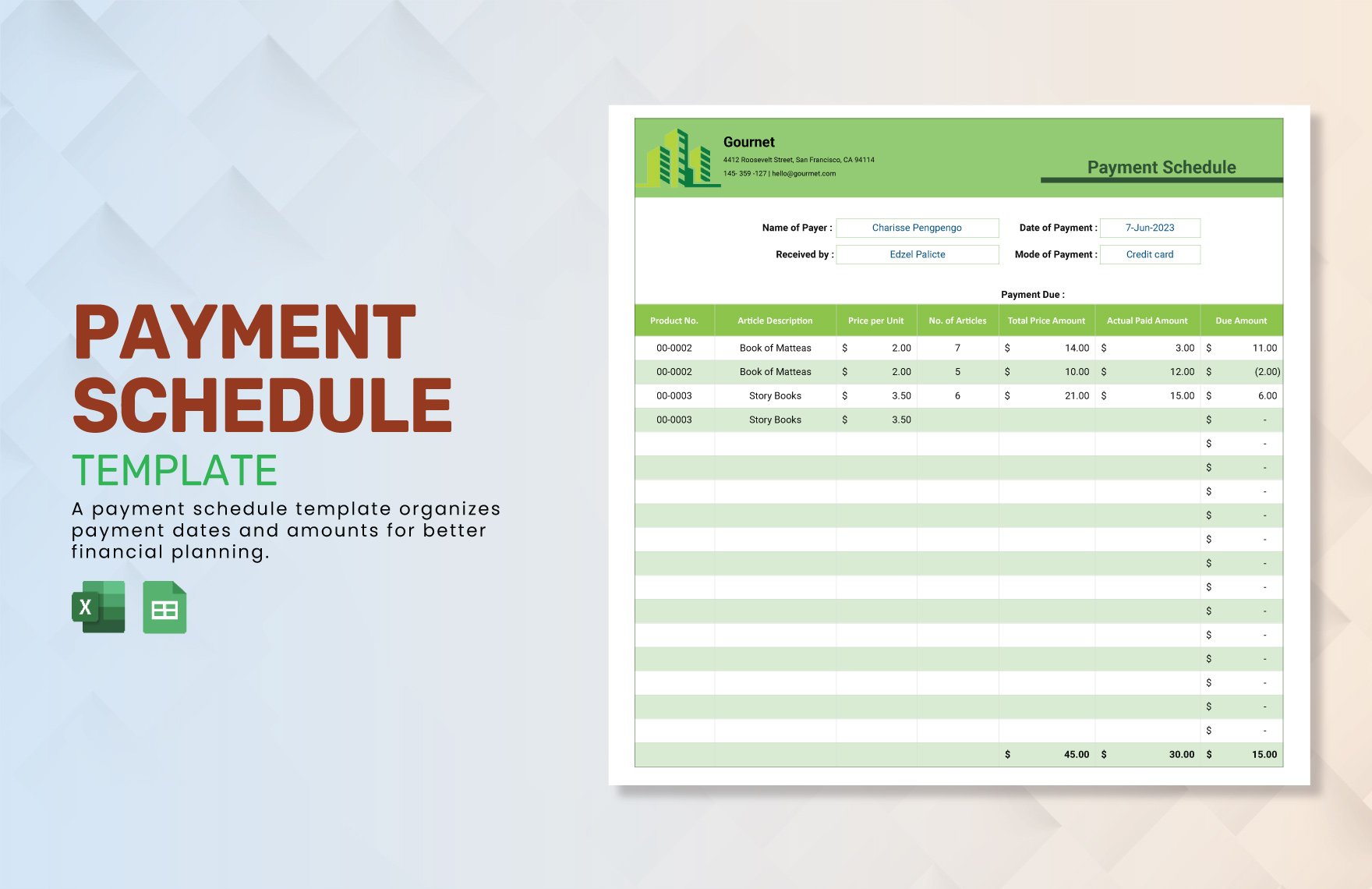

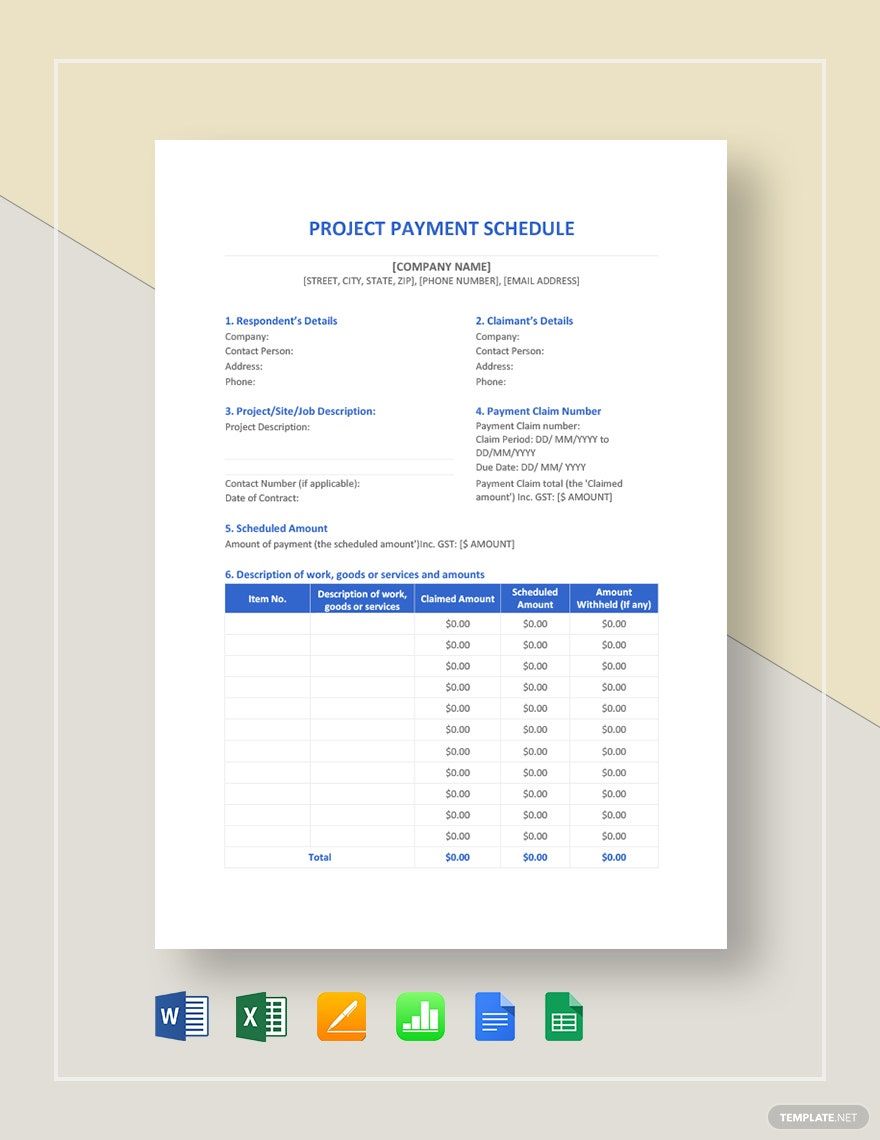

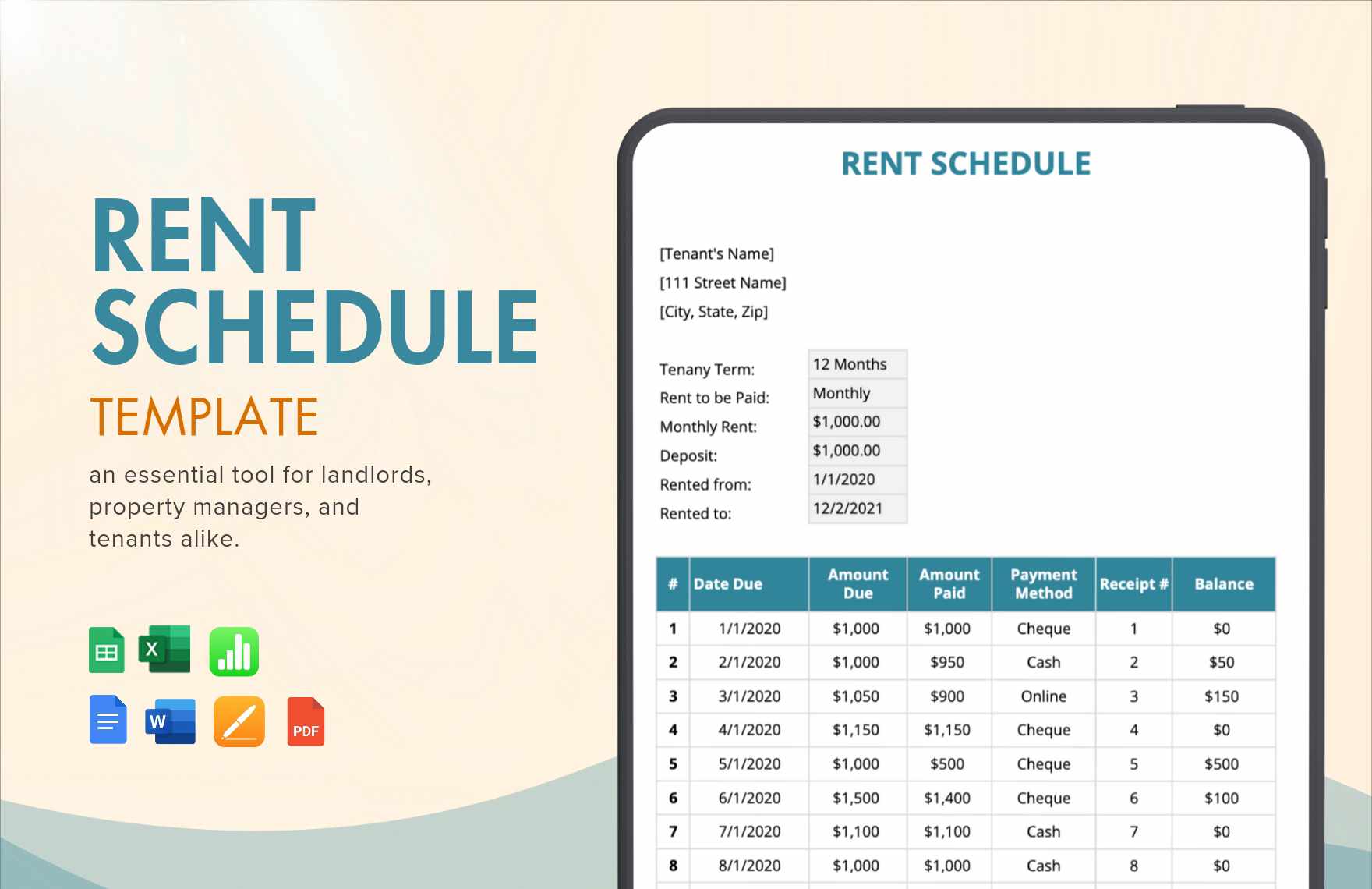

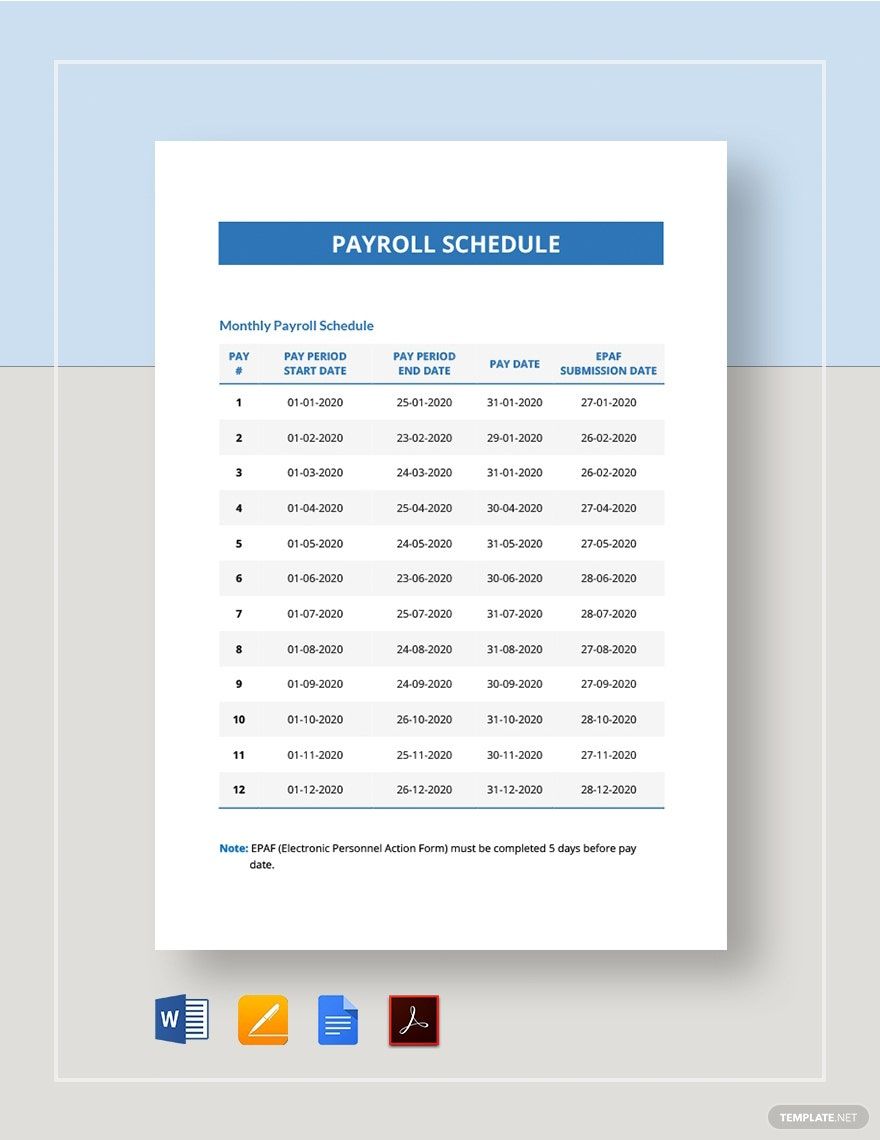

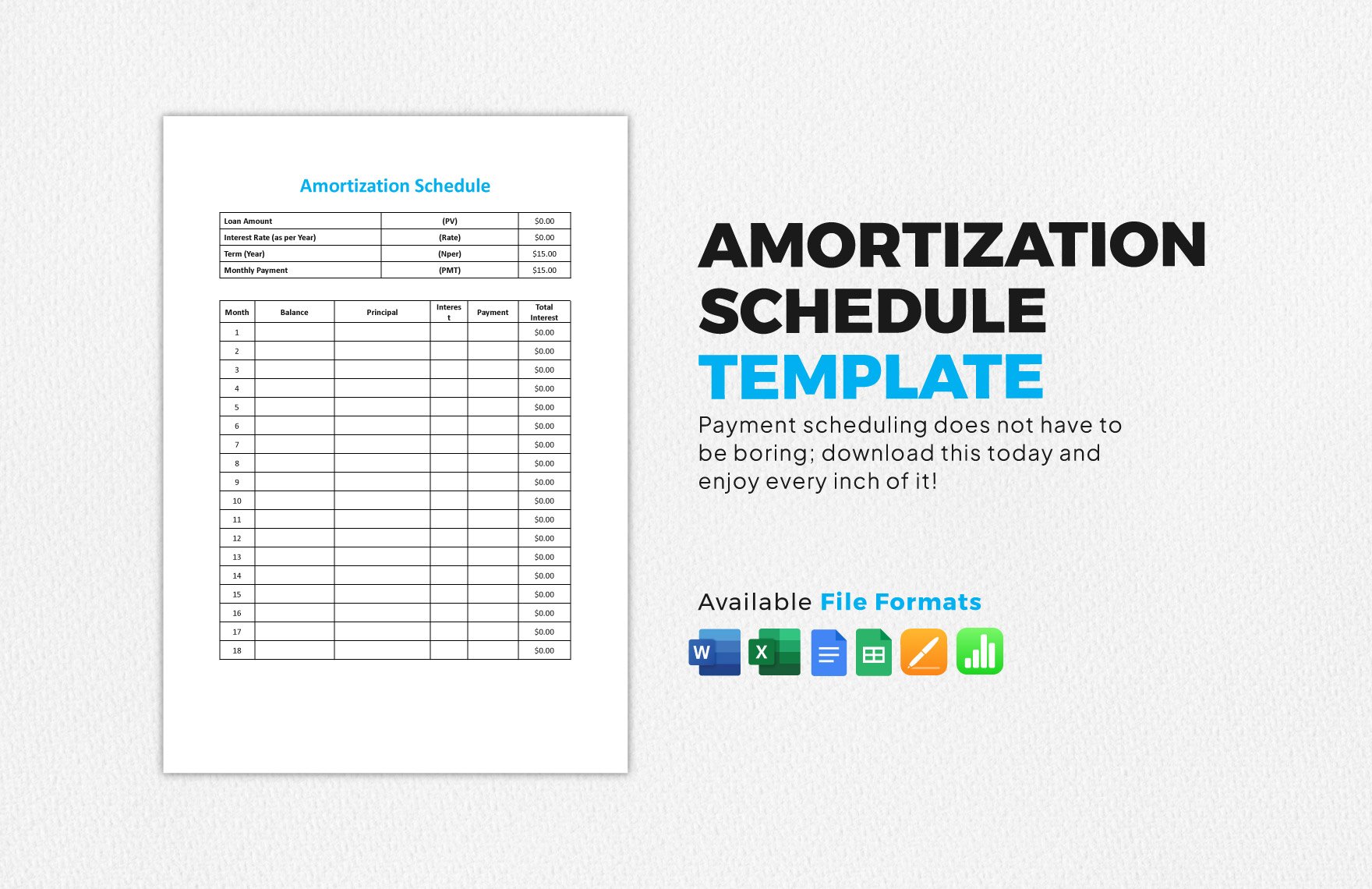

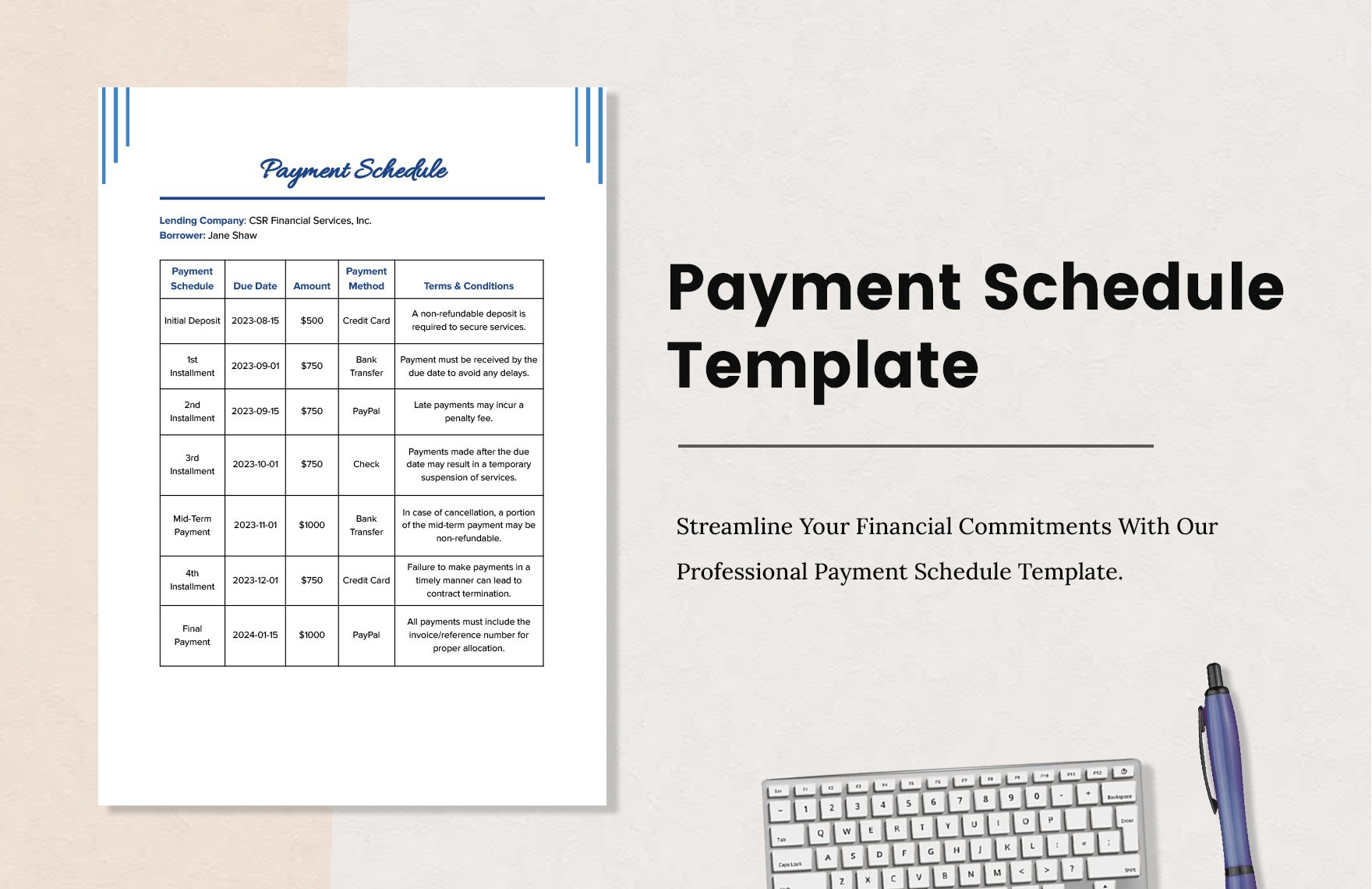

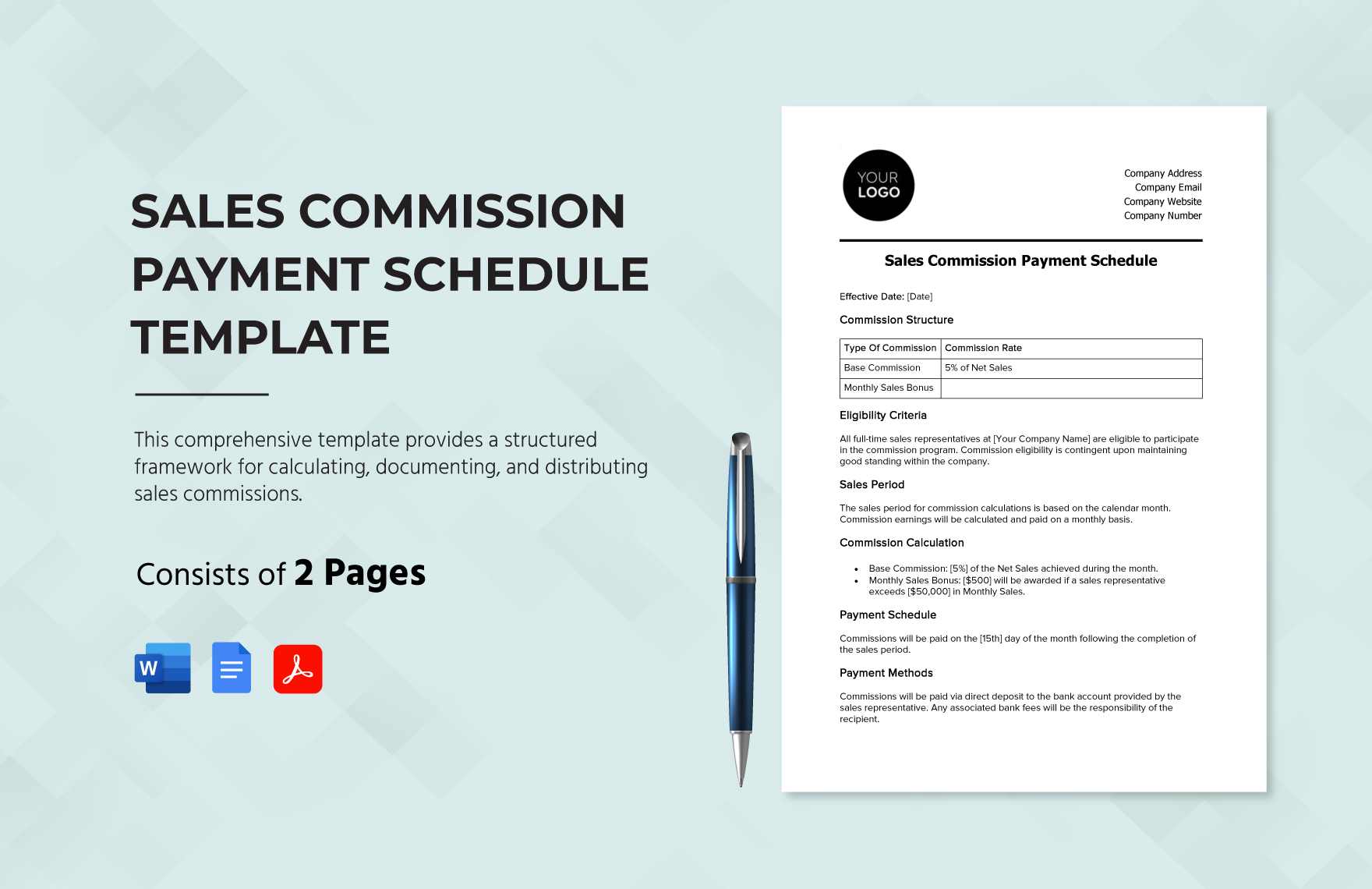

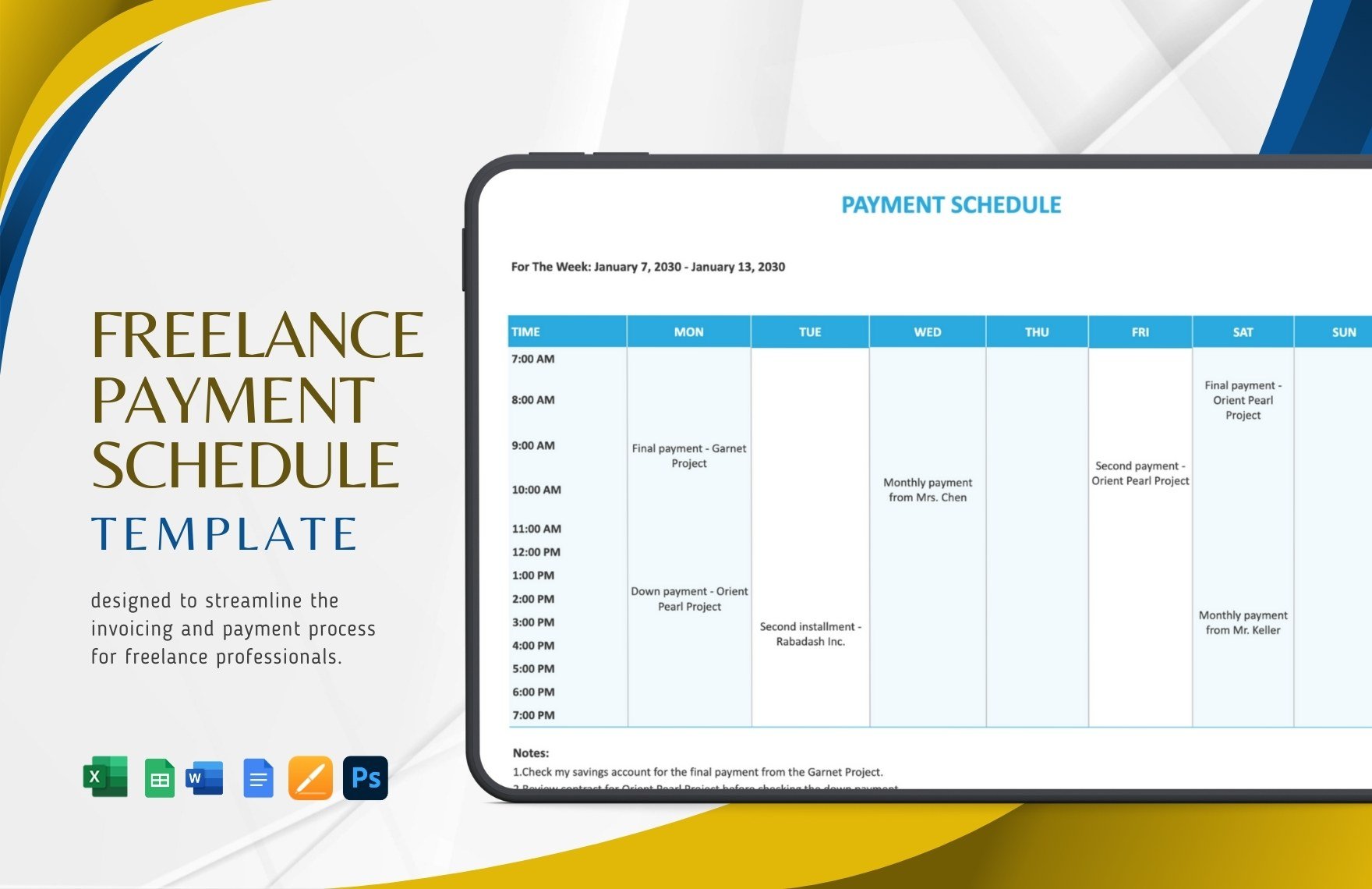

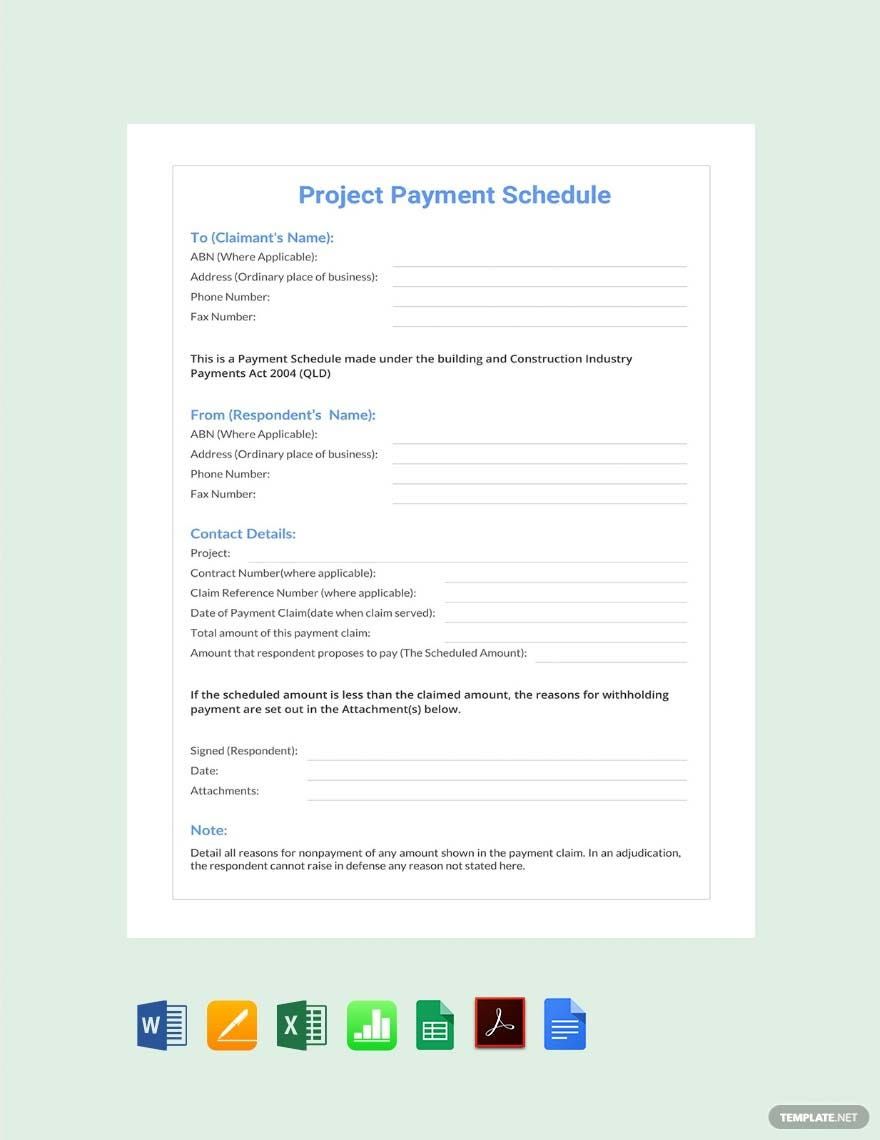

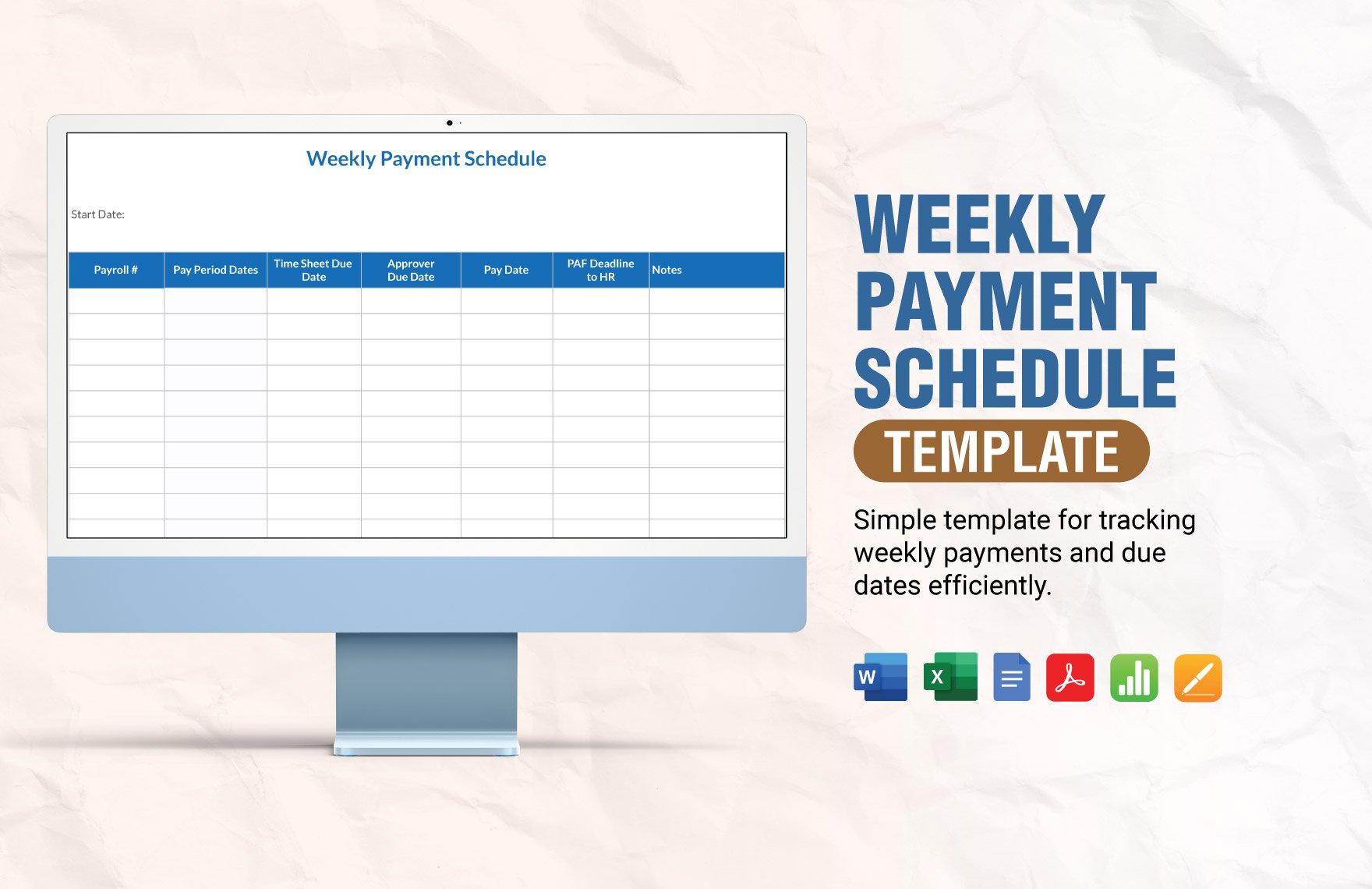

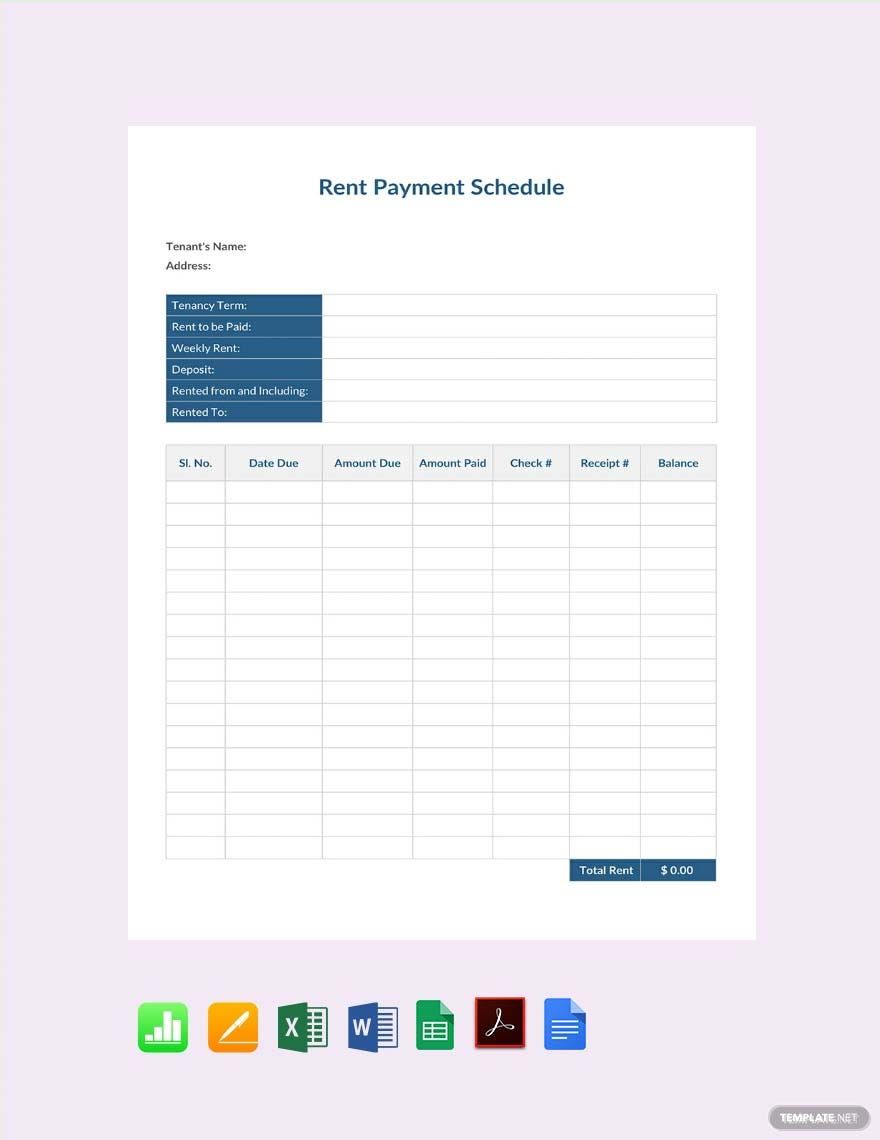

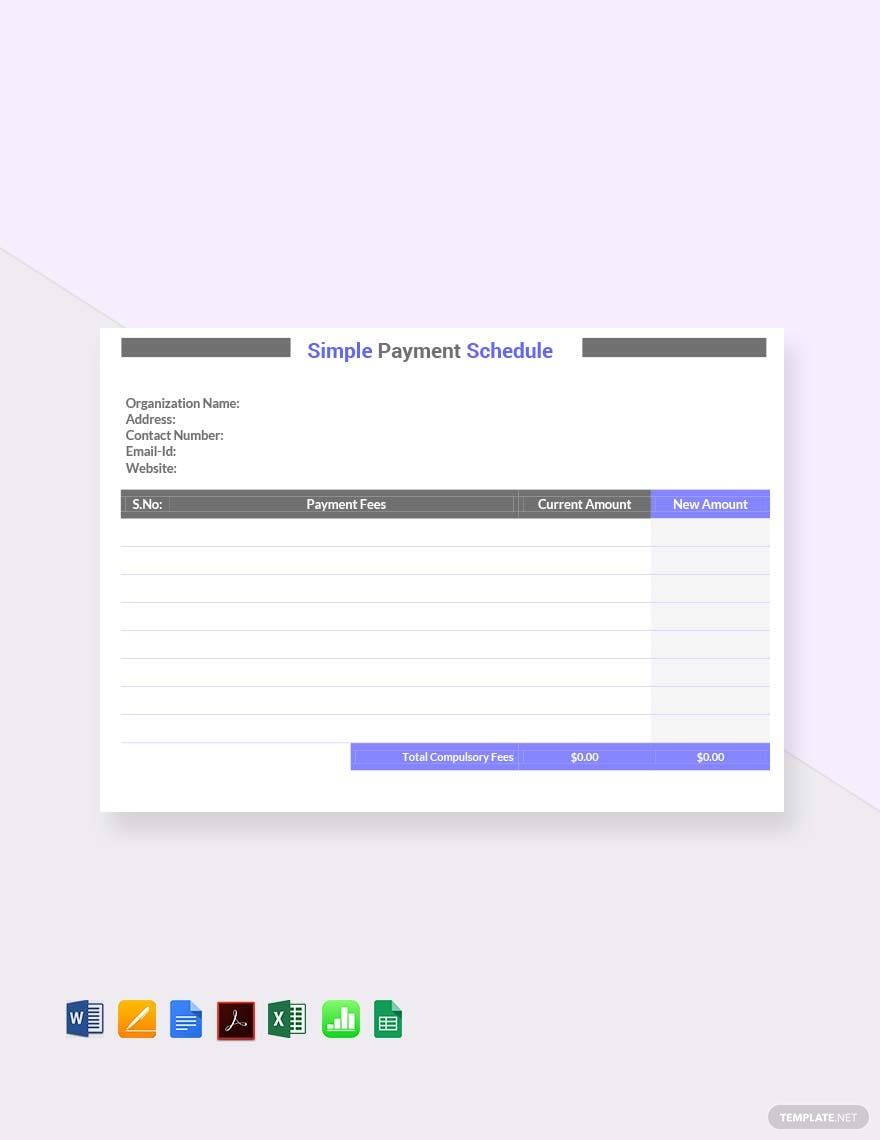

Payments are one of the most difficult things to settle when it comes to business transactions. According to statistics, Americans usually pay seven days late after their payment due dates. To avoid this from happening to you and your business, you need to make sure that you have a record of each unsettled payment. You can do this by downloading our premium, industry-compliant and professionally written Payment Schedule Templates. These templates are easily editable and are customizable to ensure that your needs are met. Moreover, they can be edited in Google Docs and other programs compatible with the Doc format. So what are you waiting for? Download one today!

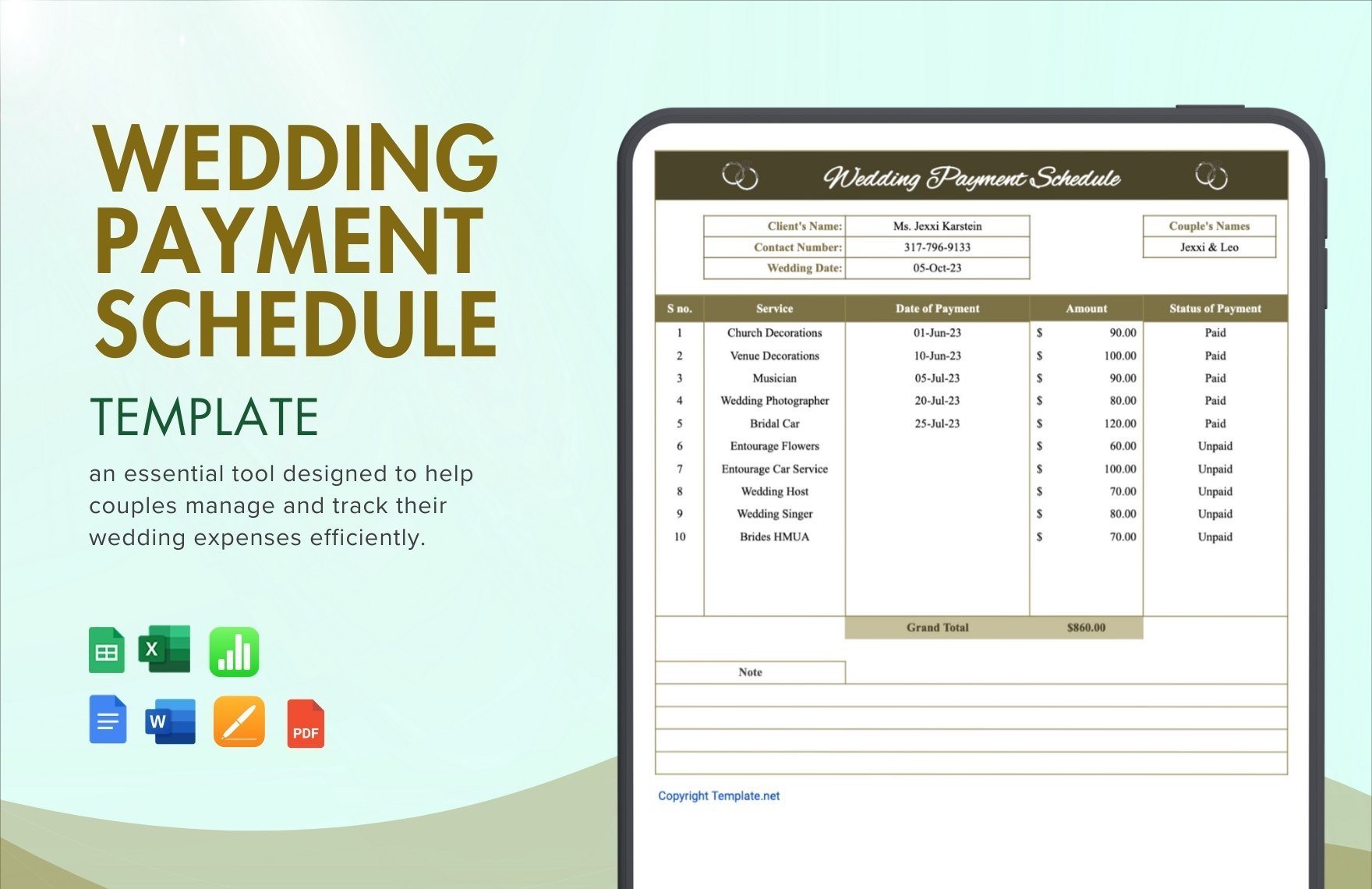

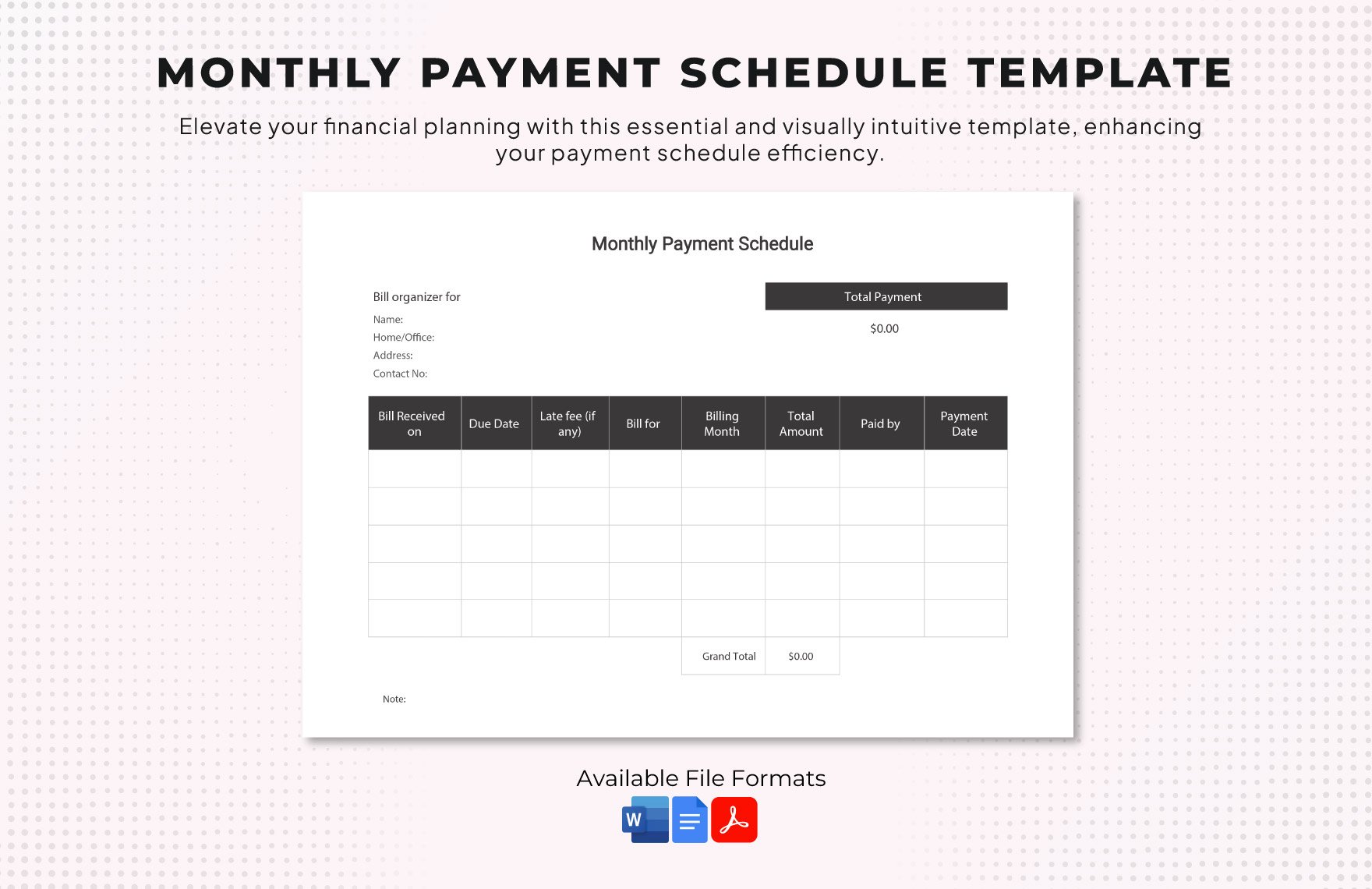

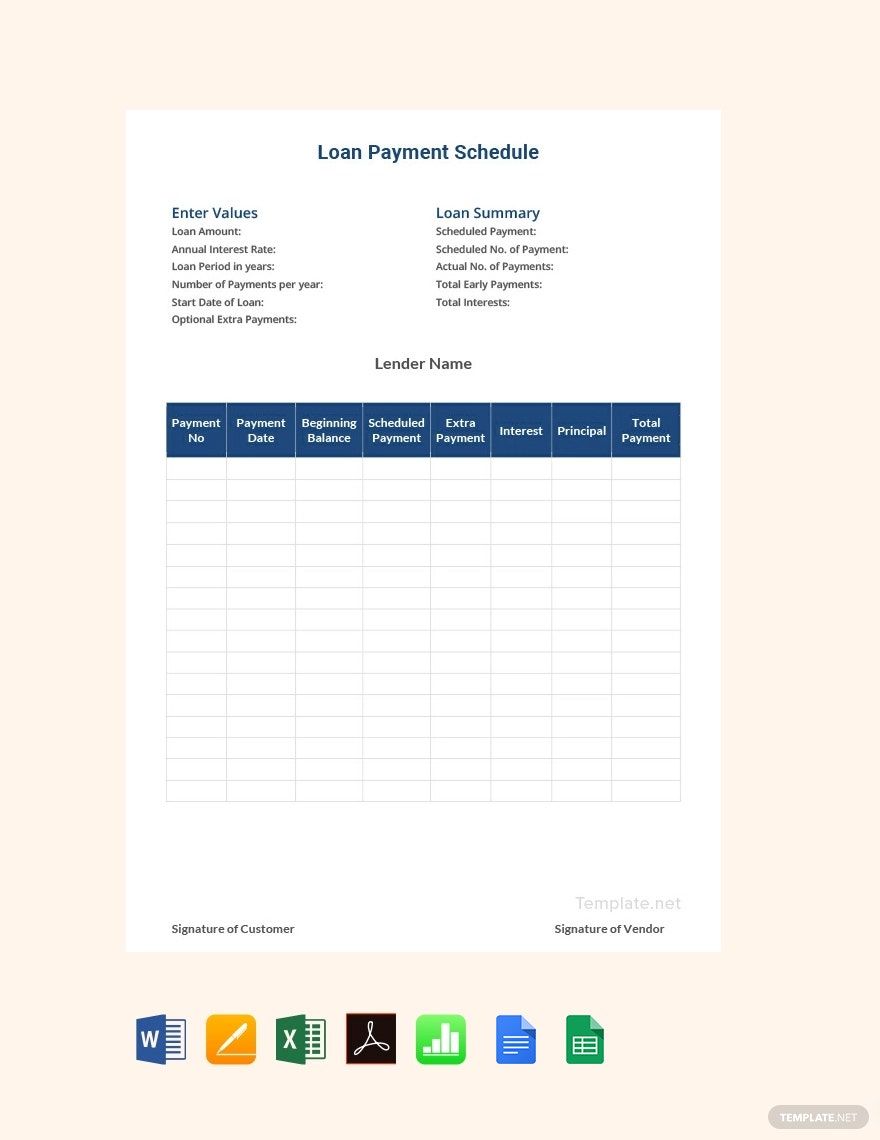

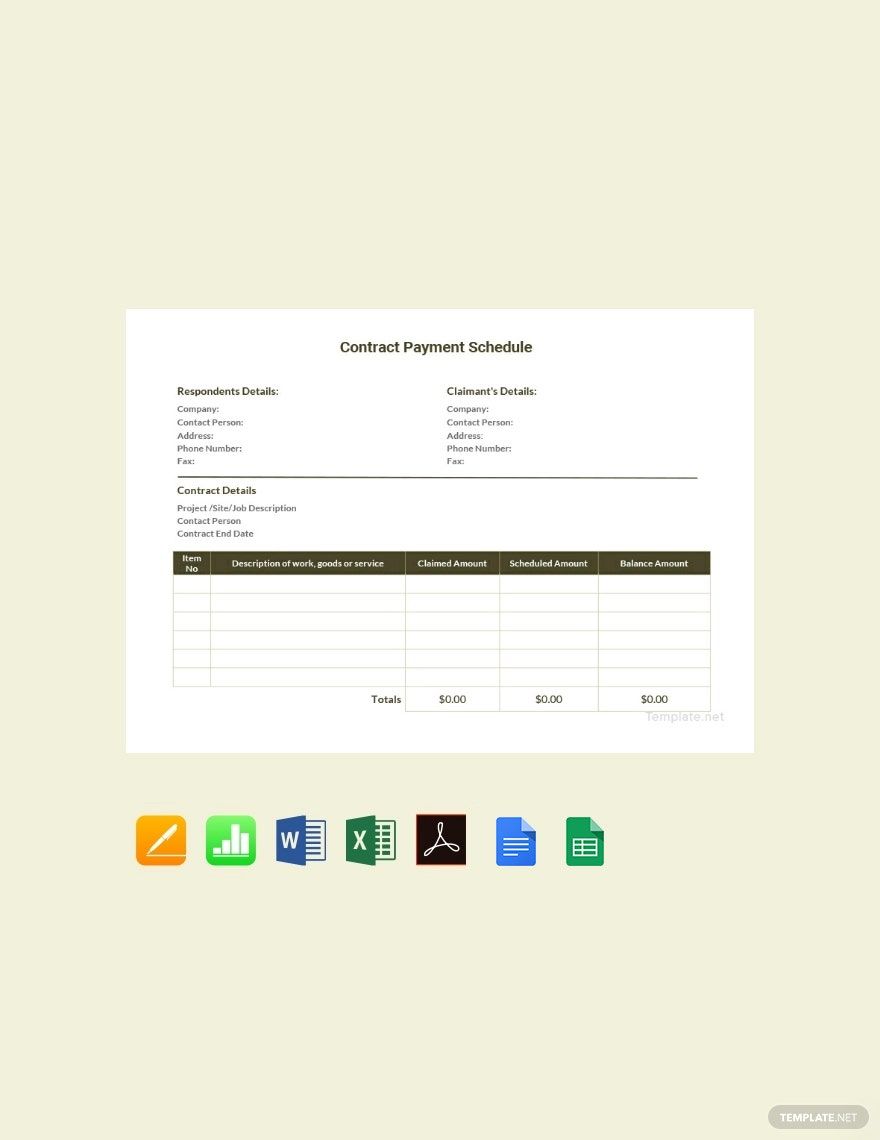

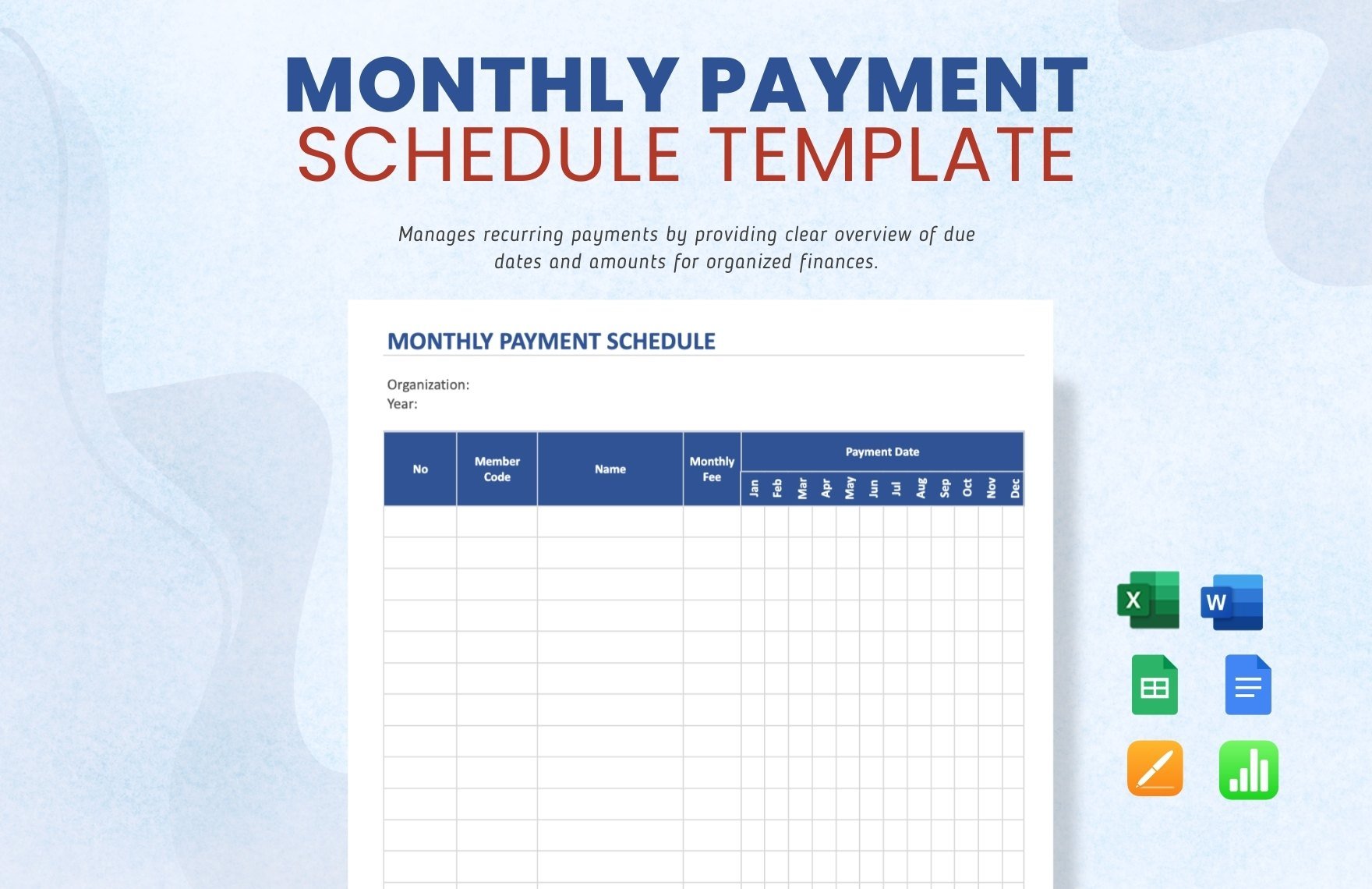

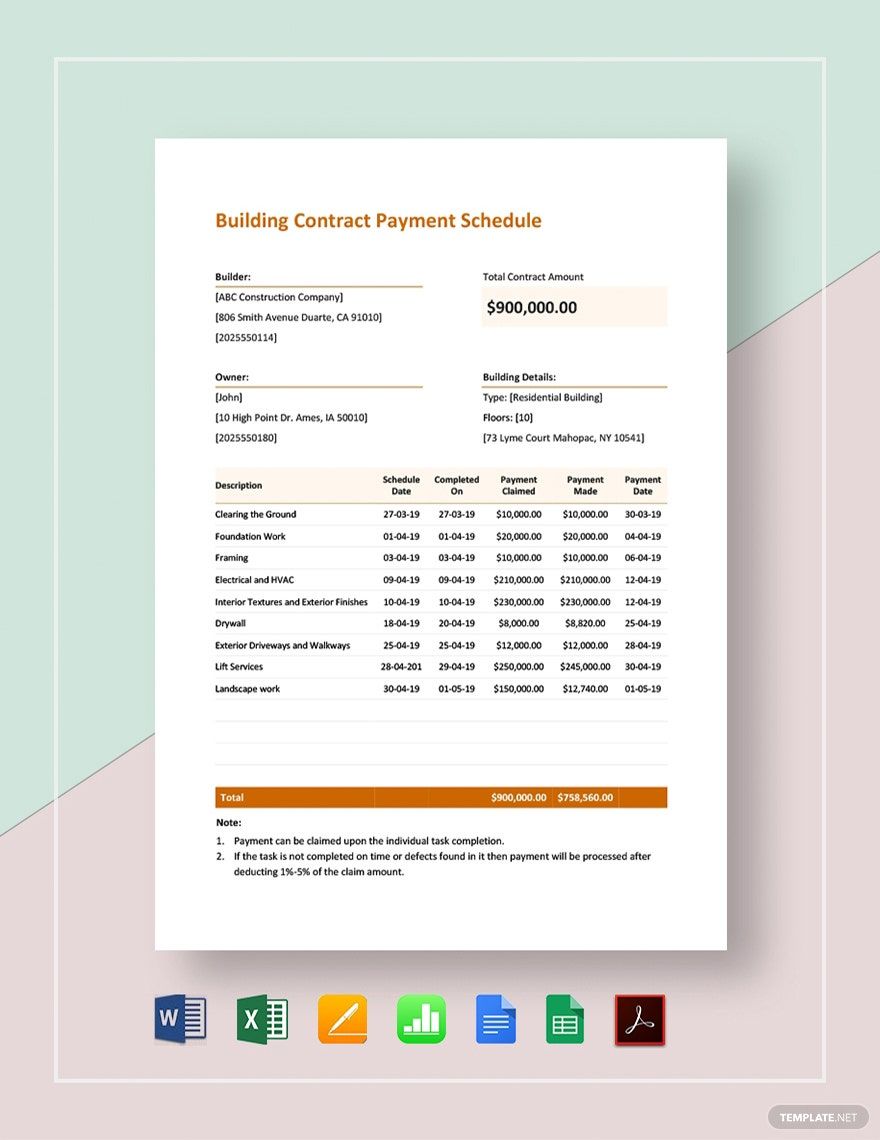

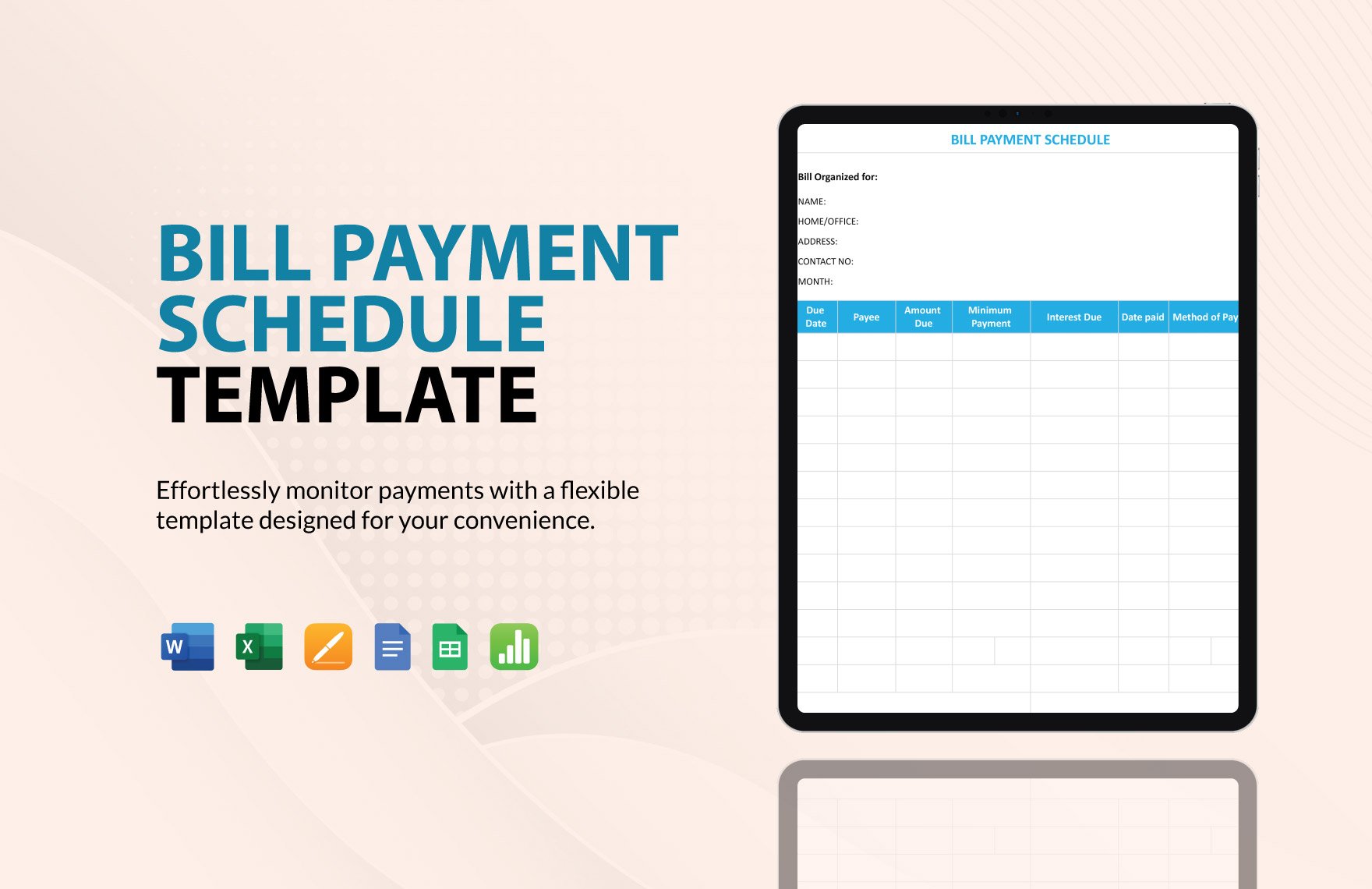

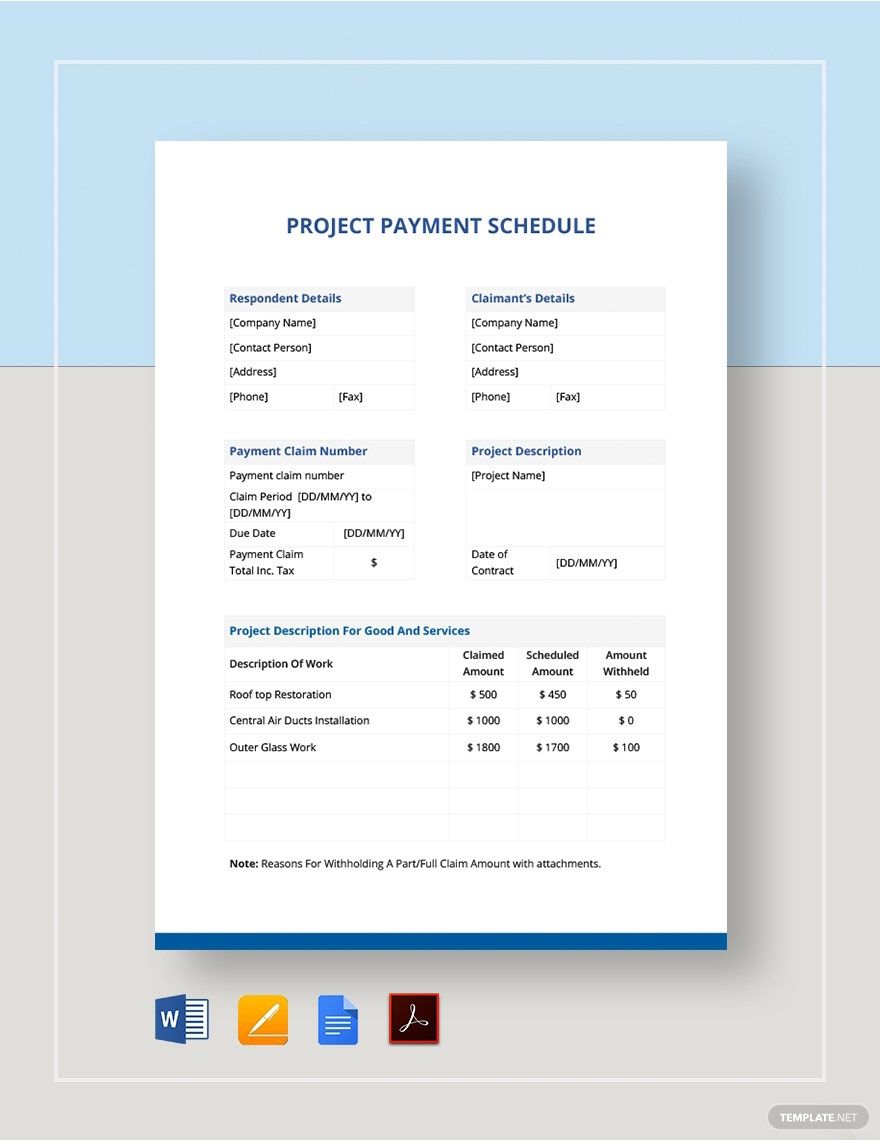

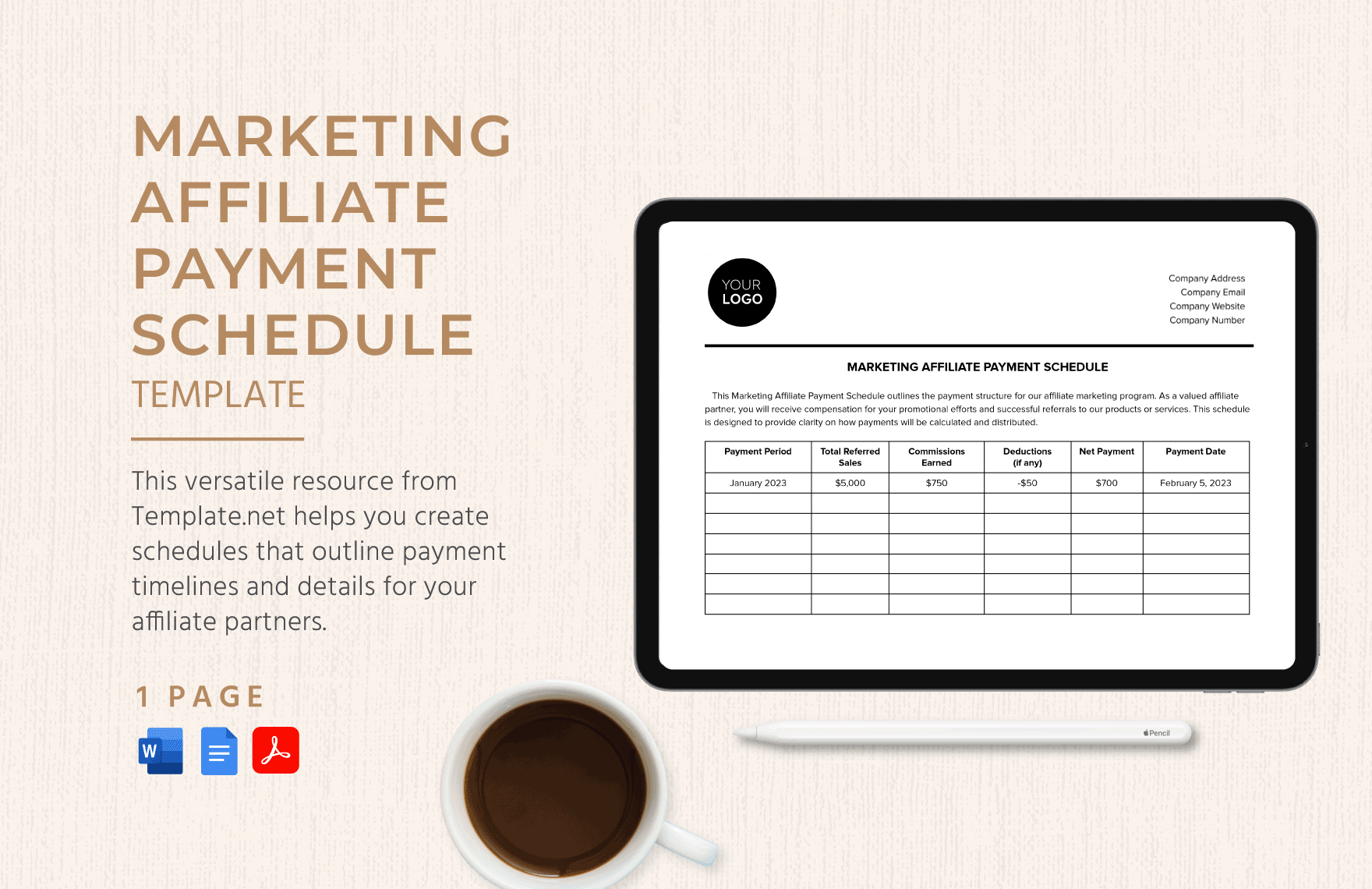

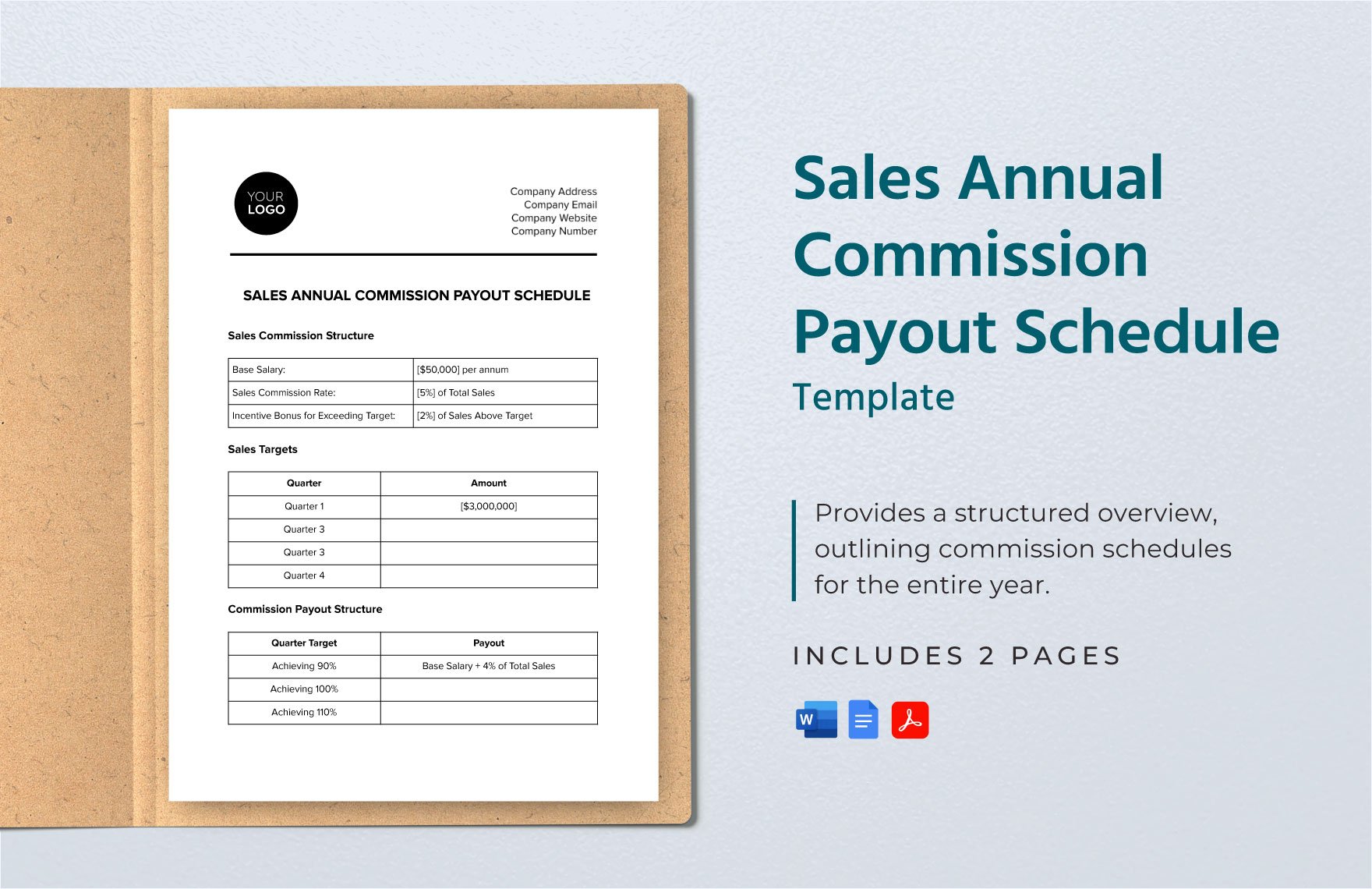

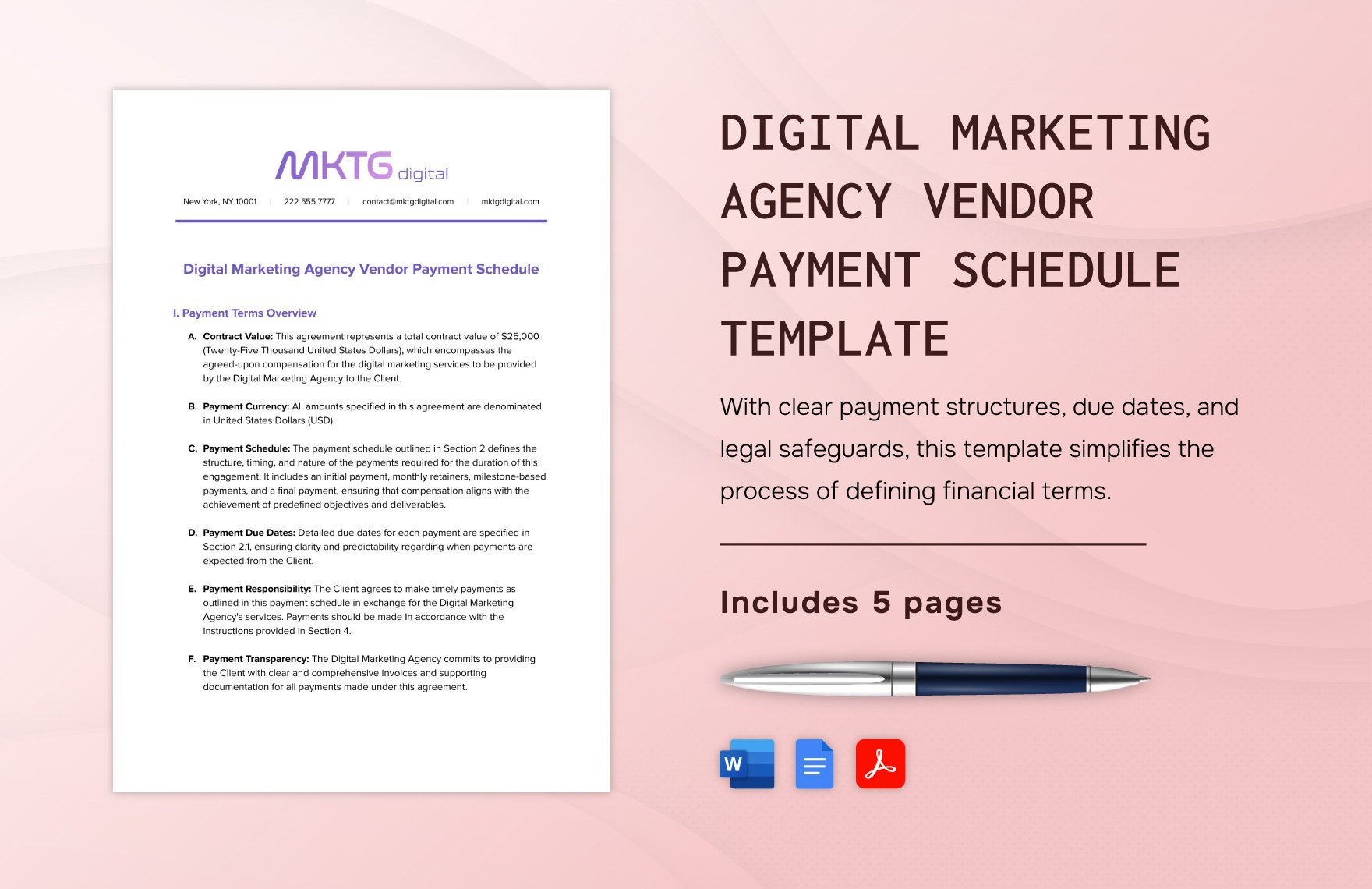

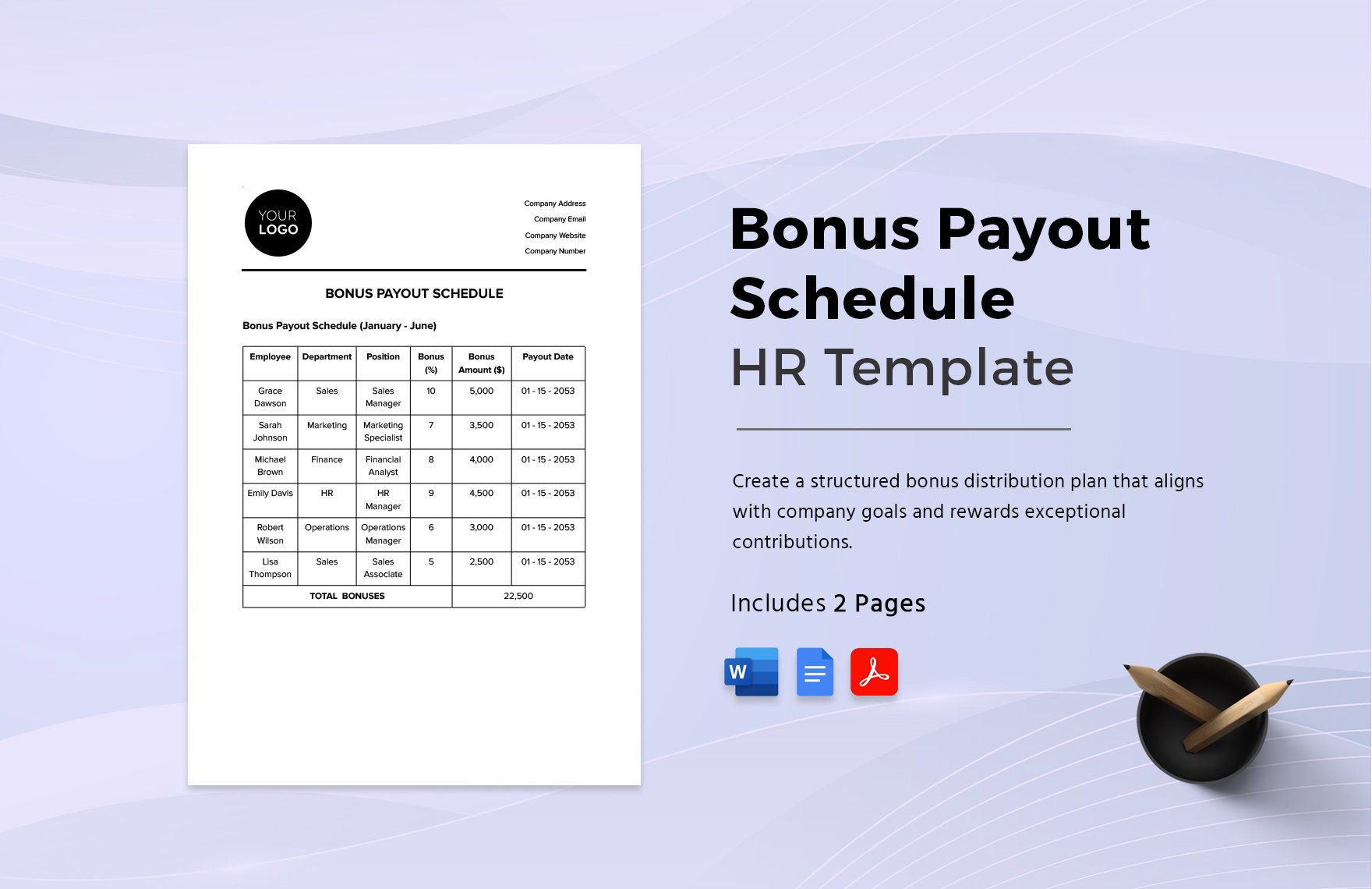

Payment Schedule Templates in Google Docs

Explore professionally designed editable payment schedule templates in Google Docs. Free, customizable, and printable for professional quality. Download now!