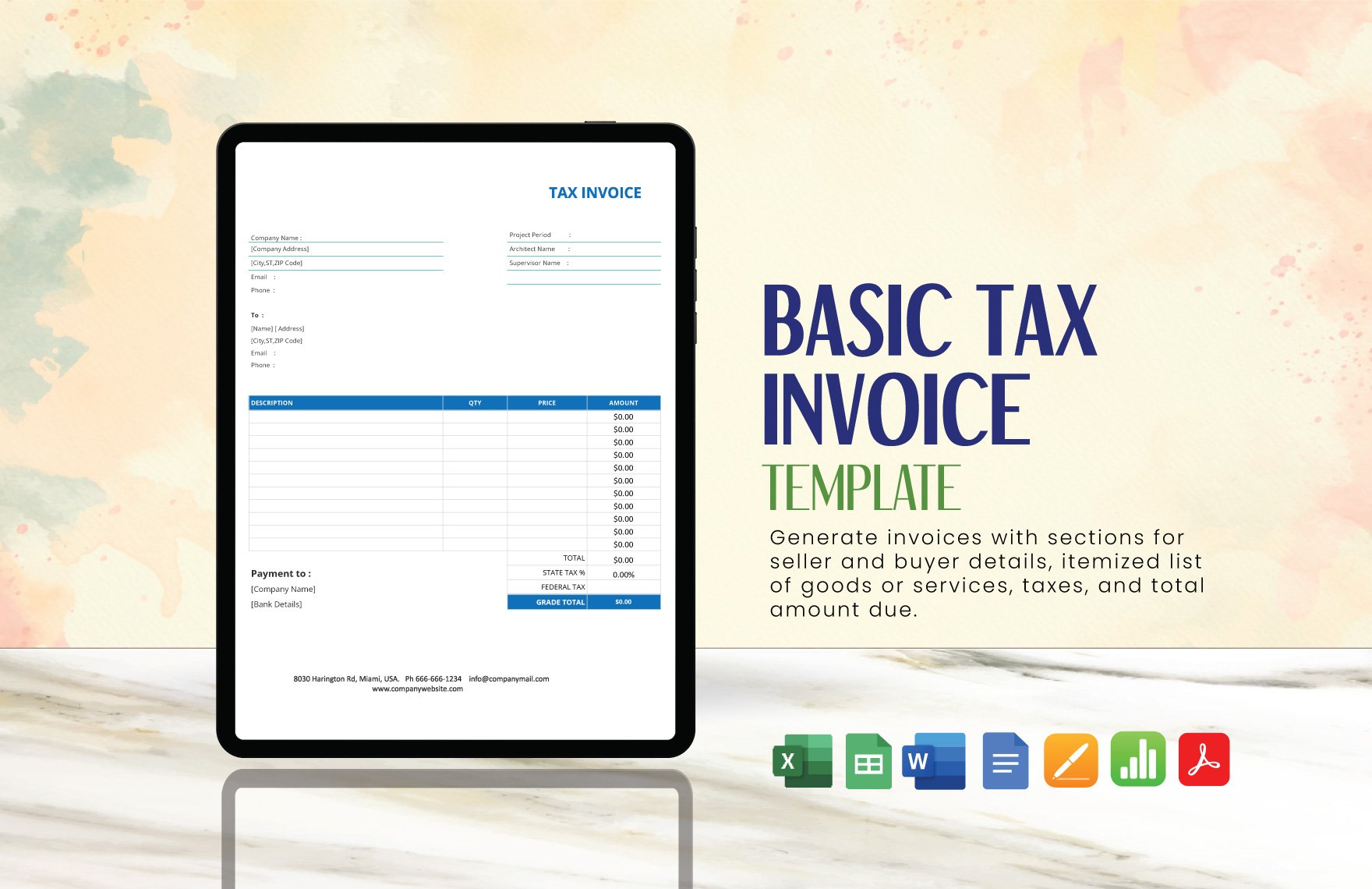

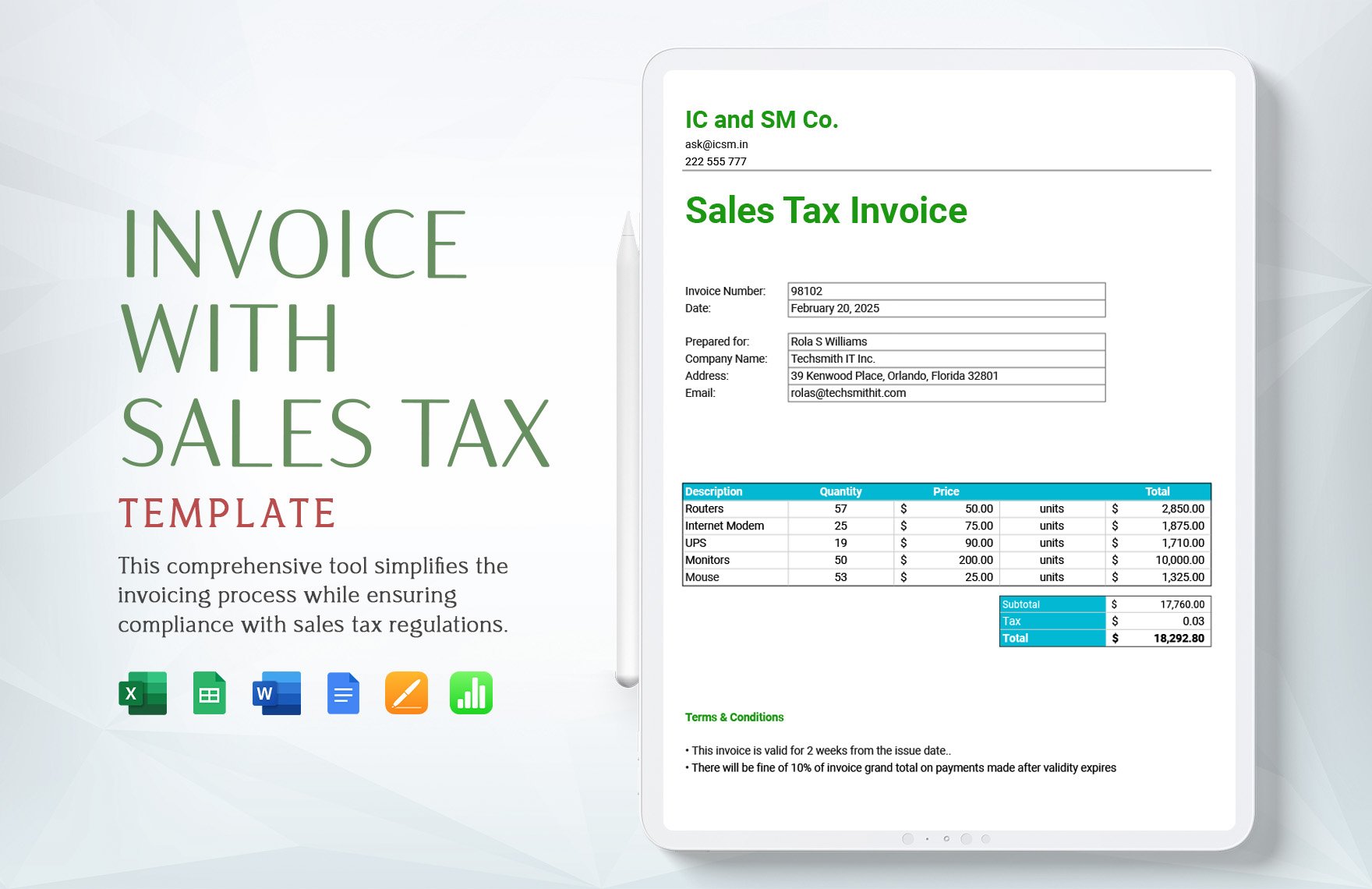

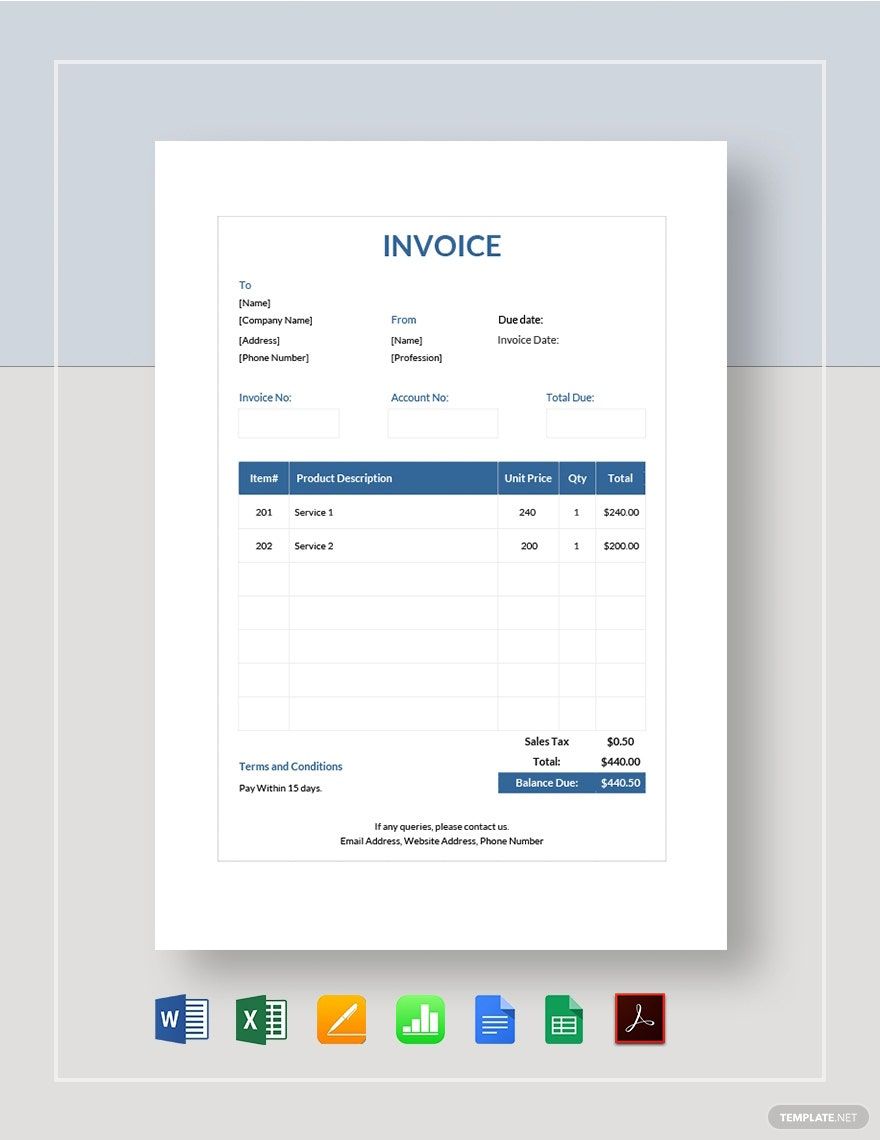

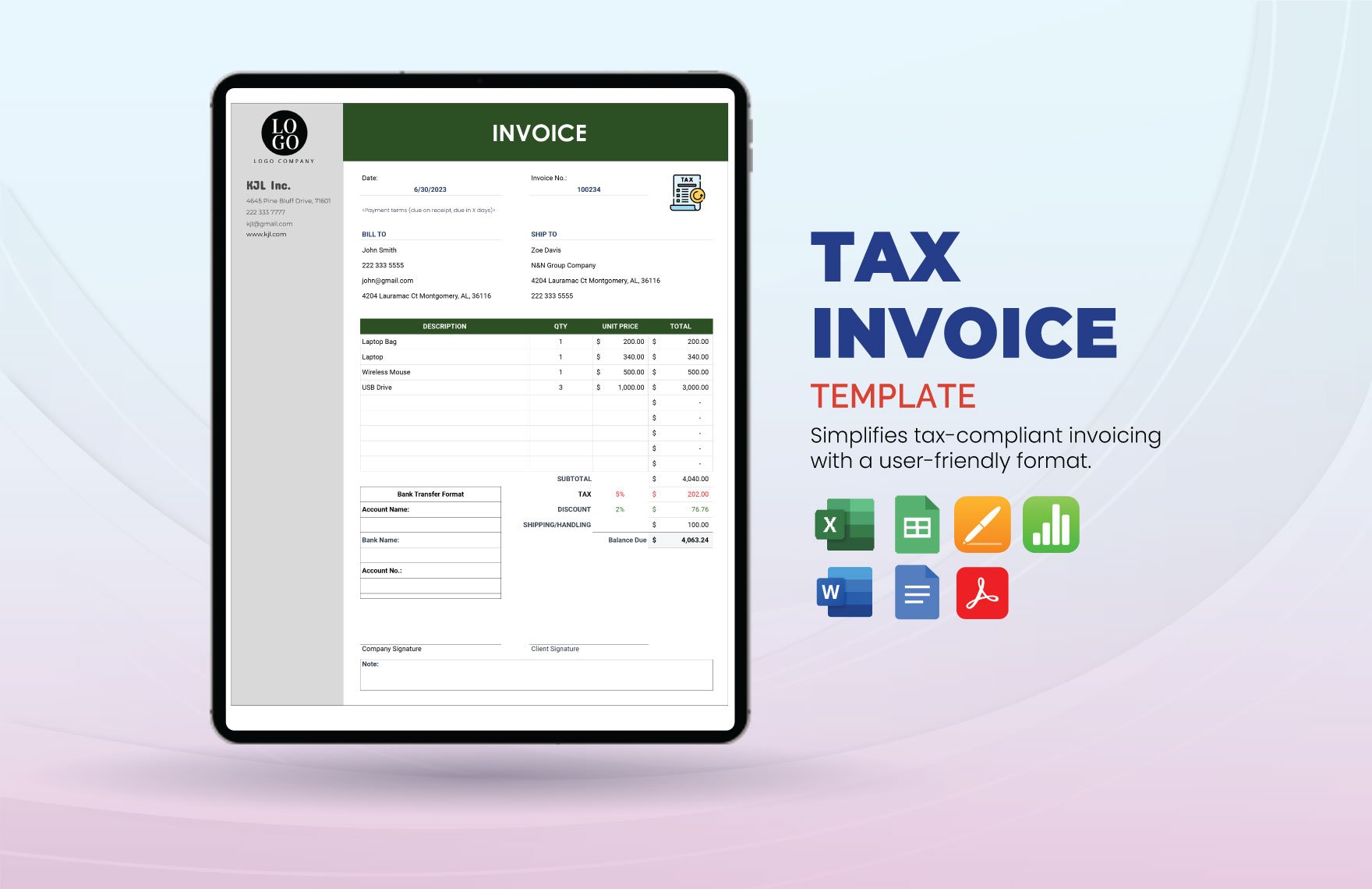

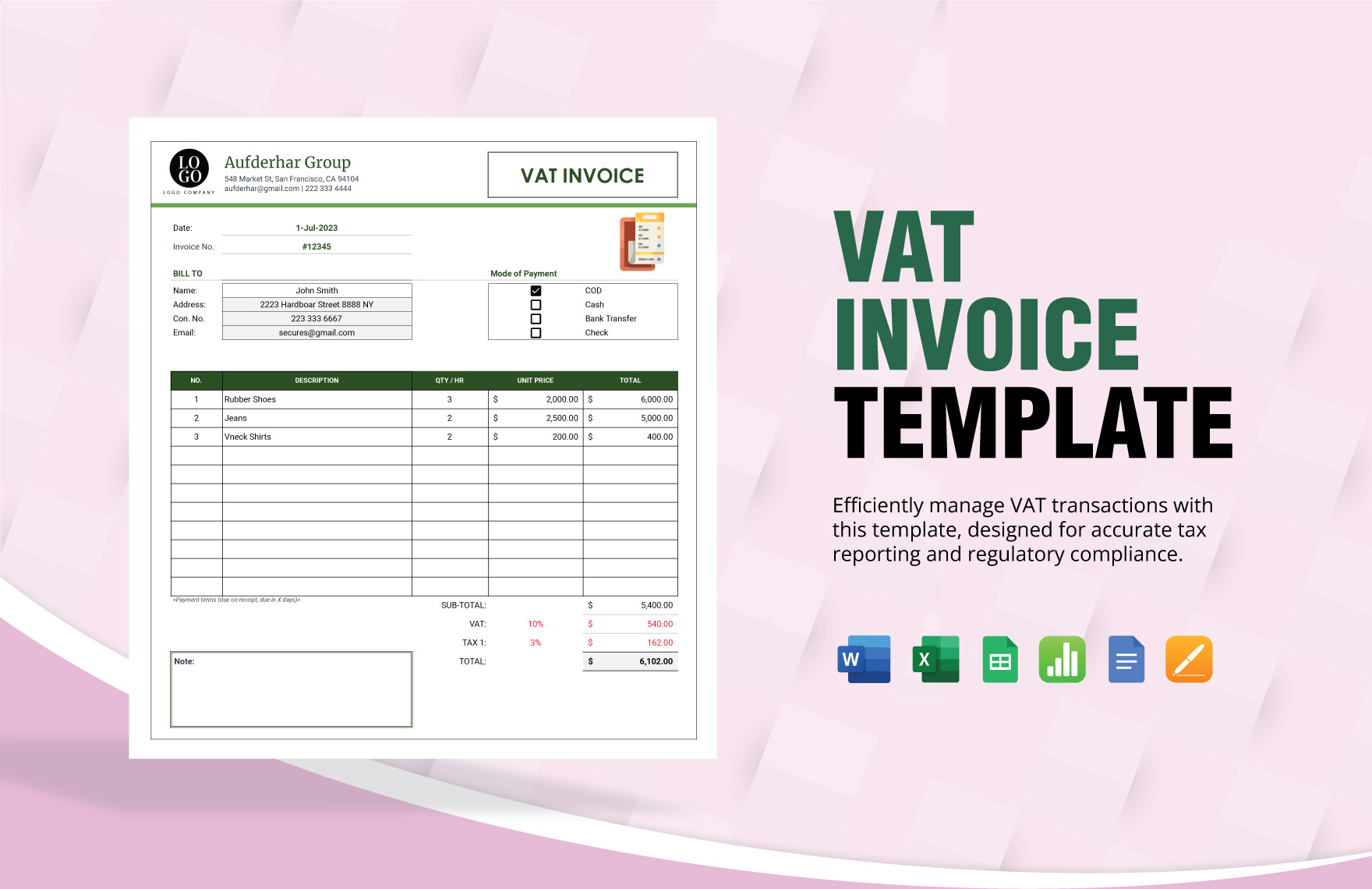

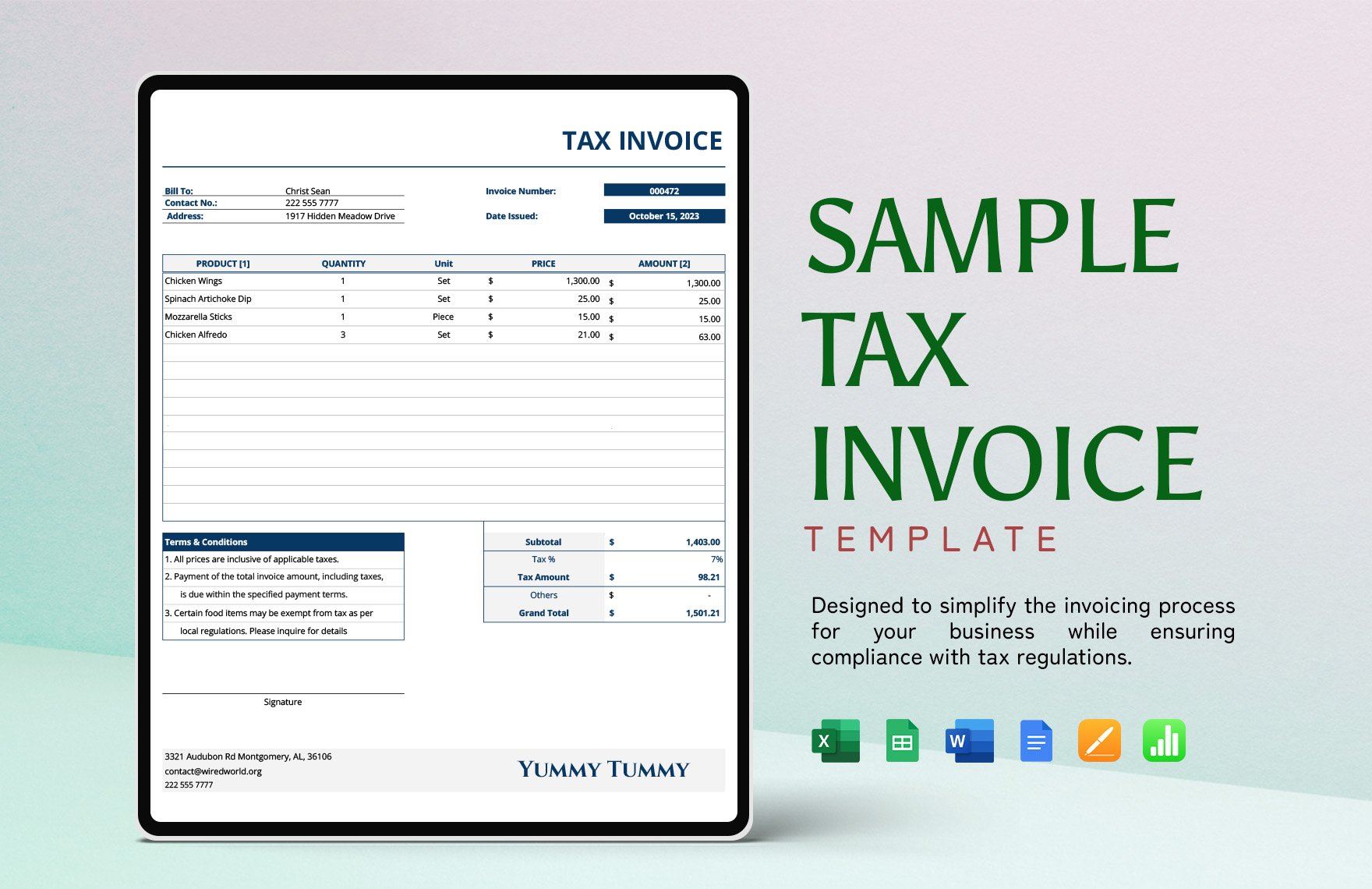

Your clients must be knowledgeable about the tax amount they should pay. So, you must prepare a complete document for that. To help save time, download from our collection of Tax Invoice Templates in Apple (MAC) Numbers. These templates are 100% editable. What are you waiting for? Download a template and excel in making an invoice!

Tax Invoice Templates in Apple Numbers

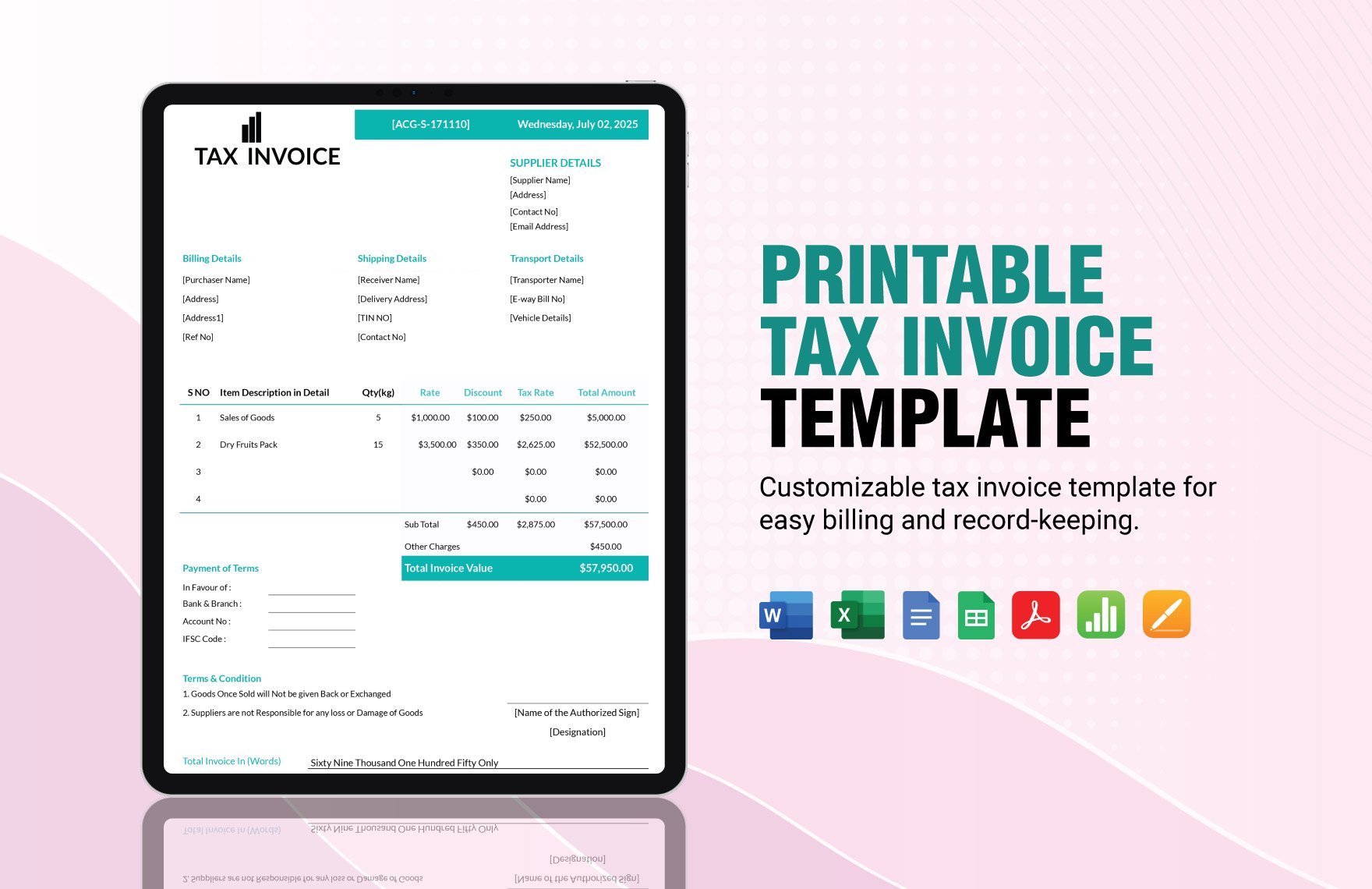

Explore professionally designed, customizable tax invoice templates in Apple Numbers. Download for free and impress with professional quality. Start now!

Bring your financial documentation to life with pre-designed Tax Invoice Templates in Apple Numbers by Template.net

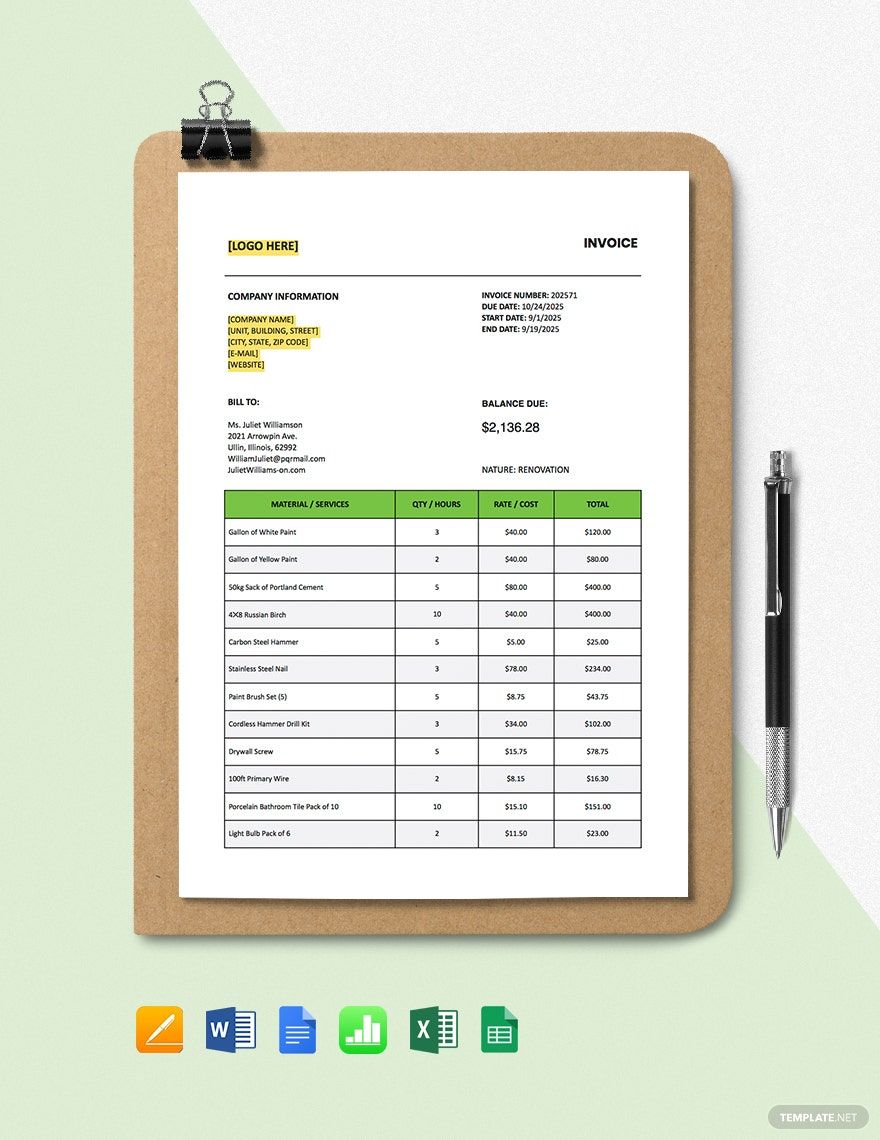

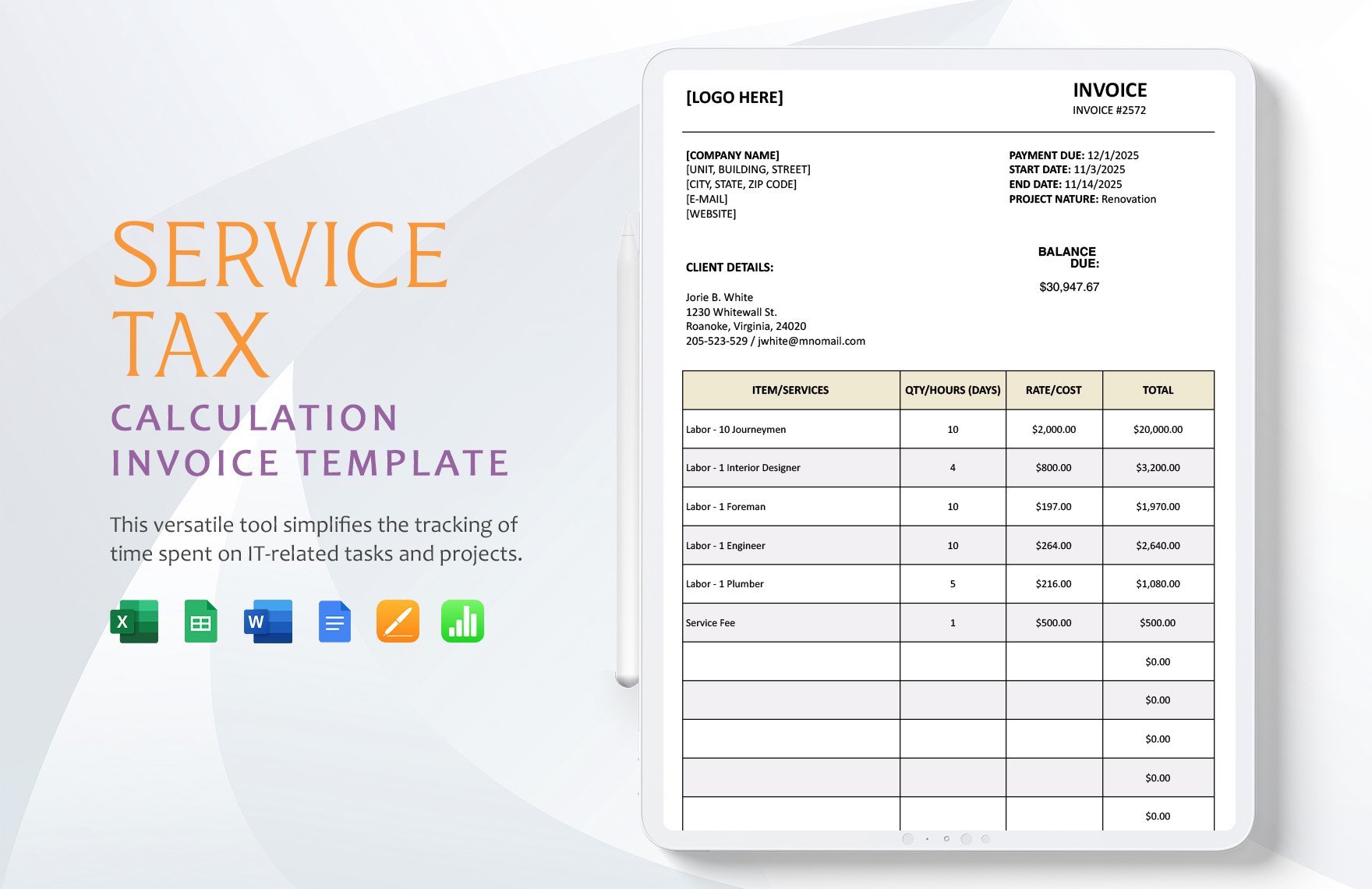

Free and easy to use, pre-designed Tax Invoice Templates by Template.net are perfect for business owners and freelancers looking to create professional-grade invoices with no prior design experience. Enhance the professional appeal of your paperwork and streamline your billing process effortlessly. Whether you're looking to issue an invoice for a completed project or need to bill a client for ongoing services, these templates have you covered with beautiful pre-designed layouts that are fully customizable. Available for free download in Apple Numbers format, they offer the flexibility of both print and digital distribution, ensuring your invoices reach their intended recipients promptly.

Explore more beautiful premium pre-designed templates in Apple Numbers to elevate your invoicing process. With a library that is regularly updated with fresh designs, Template.net ensures you always have access to the latest styles and formats. Take advantage of the platform’s flexibility by downloading templates or sharing them directly via email for increased reach. To ensure you get the most out of your invoicing process, consider mixing both free and premium templates for maximum variety and customization.

Frequently Asked Questions

What is the difference between a tax invoice and an invoice?

Tax invoices contain Goods and Services Tax (GST) amount payable, but a basic invoice doesn't have it.

What is the invoice number for?

An invoice number is a number that is unique and distinct to every transaction. Businesses can use the invoice number to track different transactions with their clients.

What are the different types of invoices?

Invoices come in different types and functions, and the list below contains some of its types.

- Debit Invoice

- Credit Invoice

- Recurring Invoice

- Commercial Invoice

- Tax Invoice

- Sales Invoice

- Proforma Invoice

What is an invoice and what is it used for?

An invoice is a transaction document that you receive after receiving the products or services from a seller or service provider. The invoice will serve as a request for payment.

What happens if you don't pay an invoice?

Not paying an invoice can lead to consequences. The company can charge you with late fees, stop working with the project, or worse sue you. So, you need to pay your invoice.