Table of Contents

- 11+ Investment Commitment Letter Templates in PDF | DOC

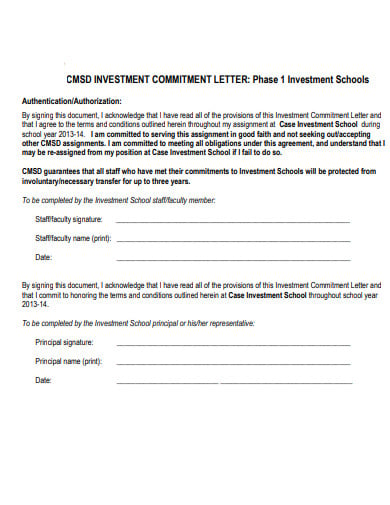

- 1. Investment School Commitment Letter

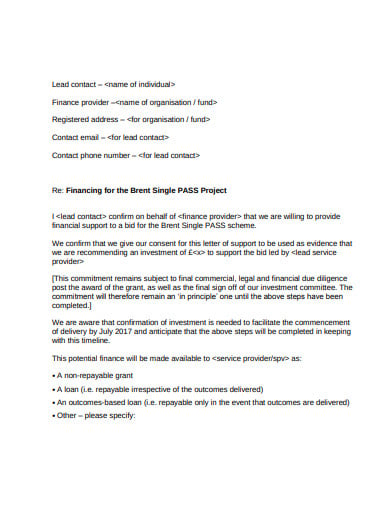

- 2. Final Investment Commitment Letter

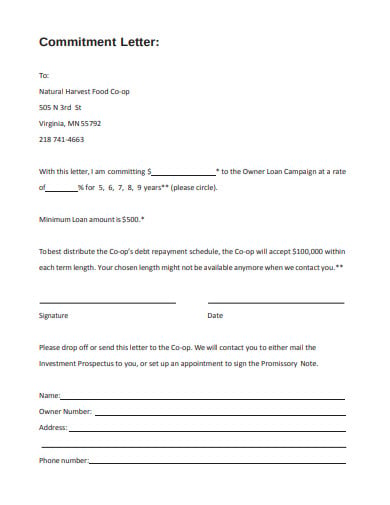

- 3. Natural Harvest Investment Commitment Letter

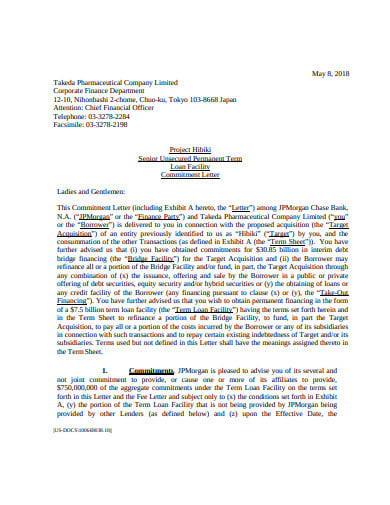

- 4. Investment Banking Commitment Letter

- 5. Investment Amended Commitment Letter

- 6. Investment Commitment Letter of Intent

- 7. Confidential Investment Commitment Letter

- 8. Investment Fund Commitment Letter

- 9. Investment Action Commitment Letter

- 10. Investment Commitment Notice Cover Letter

- 11. Capital Investment Commitment Letter

- 12. Investment Partner Commitment Letter

- 5 Tips for writing the investment commitment letter

- Why do you need an investment commitment letter?

- What are the few things included in the letter?

11+ Investment Commitment Letter Templates in PDF | DOC

The investment commitment letters are the engagement between two organizations promising to render financial assistance or pay back the debt if any. When the commitment letter is written, it is that the lending organization is promising to provide some kind of financial assistance and help a debtor in the form of loans. The commitment letter is a promise and duty to provide financial help to the organization. It is the medium through which one can inform regarding their commitment to invest. You may also see more different types of investment commitment letters in Word from our official website template.net.

11+ Investment Commitment Letter Templates in PDF | DOC

1. Investment School Commitment Letter

nctq.org

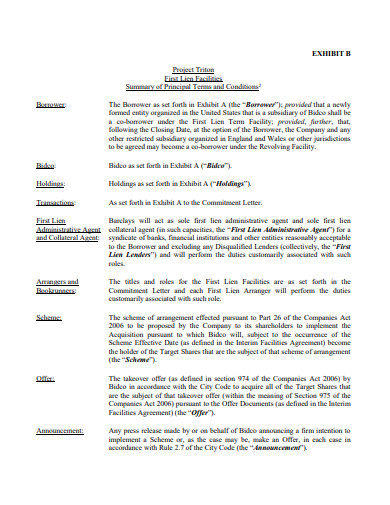

nctq.org2. Final Investment Commitment Letter

gov.uk

gov.uk3. Natural Harvest Investment Commitment Letter

naturalharvest.coop

naturalharvest.coop4. Investment Banking Commitment Letter

takeda.com

takeda.com5. Investment Amended Commitment Letter

inmarsat.com

inmarsat.com6. Investment Commitment Letter of Intent

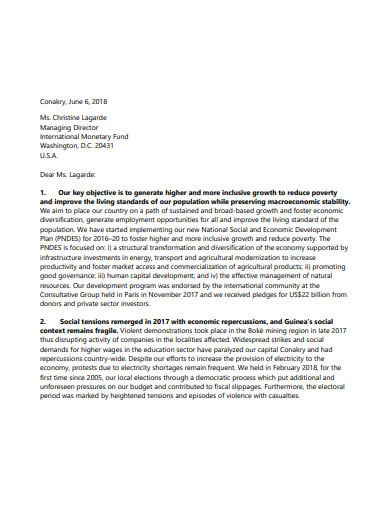

imf.org

imf.org7. Confidential Investment Commitment Letter

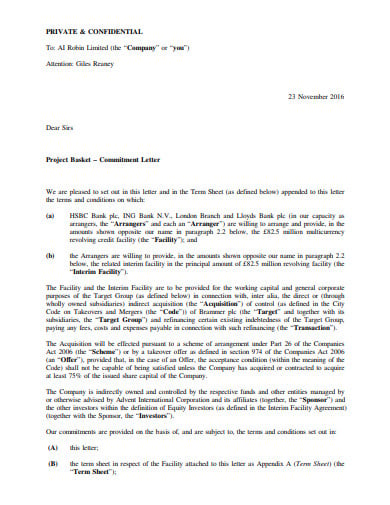

brammer.biz

brammer.biz8. Investment Fund Commitment Letter

blacktiefund.com

blacktiefund.com9. Investment Action Commitment Letter

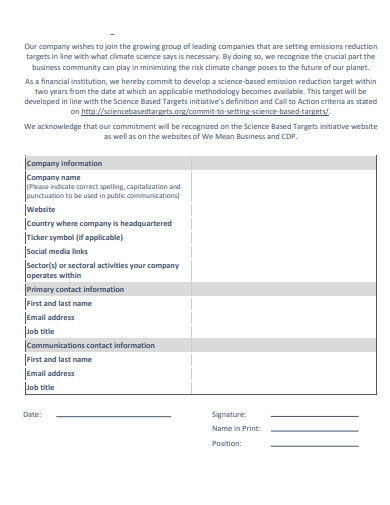

targets.org

targets.org10. Investment Commitment Notice Cover Letter

ap.se

ap.se11. Capital Investment Commitment Letter

dot.gov

dot.gov12. Investment Partner Commitment Letter

oregon.gov

oregon.gov5 Tips for writing the investment commitment letter

This simple letter is a form of the commitment to help the one who has asked help from you financially. It is an assurance and confirmation from the sponsor to guide you and organization at the time of scarcity and need. The person writing the letter is sure of eradicating the financial issues of the debtor. Some steps are mentioned to know the things included in the investment commitment letter. For a wider selection of Formal Letter Templates, check out more options here.

Step 1: Details of Lender and Borrower

The commitment letter is the entity between the lender and the borrower that should have in it the name and address of both the parties. This is the first step to write an investment commitment letter. The sample free letters also outlines things like the amount provided by the lender, the duration of granting the sum of money, etc.

Step 2: Write about the amount and time

It is utterly important to write about the amount lent or borrowed in the letter of commitment. It should be mentioned in the letter format about the time when the lender is going to give away the money to the borrower. The letter should clearly state it to avoid confusion later on.

Step 3: Mention about term and condition

The investment commitment letter should write about the term and the condition in which both parties must agree to accept it. The terms and conditions are mentioned beforehand, prior to approving the loan. It is not the same as a contract but both the party must agree to it. View a wider selection of Creative Letter Templates right here.

Step 4: Mention the costing

It is the duty of the lender to write about the costing involved in the formation of the documents. So, it is necessary that you be clear with the costing and the expenses that you made while creating the loan document. It is through the commitment letter that you can express the complete expenditures. Explore a variety of investment proposal letter templates here.

Step 5: Mentioning expiry date of the term

The letter should contain each and everything clearly and must be transparent. The lender should clearly mention the date when the borrower needs to return the sum of money to the lender with or without interest rate. The expiry date of the term is important to note in the letter as a matter of fact. Check out more Personal Letter Templates available here.

Why do you need an investment commitment letter?

The investment commitment letter is the binding between the sponsor and the debtor. It is through the letter that the investor promises to invest the required amount to the debtor within a stipulated time period. The letter is to mention about the need and requirement of the funds in the form of the loan to the debtor. The organizations can be in the need of the debt and the money to invest in some projects or plans. Therefore, the letter is to confirm and assure the investment from the part of the investor and sponsor. You may also see more on Business Letter templates here.

It is through the letter of the commitment that is common between the two parties agreeing to fulfill certain terms and conditions. The investment commitment letter is used to reassure the recipient to pay that and agreed with the sum of the money and along with it, outstanding debt is settled among the two. It settles down the unforeseen circumstances that caused the late payment.

Whenever any businessman approaches the private financer and asks for a loan, then the financer agrees to pay the promised amount. The financer will provide the letter of commitment to the borrower outlining the terms and conditions. Here, the mortgage lender will send the letter to the debtor ahead of transferring the loan. Other than this, both parties are committed to agree with terms and understand the contracts. Looking for more insights? Dive into our blog post about business contract templates.

Then, for this reason, the letter is mentioned as a letter of intent. Both the contract and commitment letter differ from each other as you do not sign it but wish to move in a more positive and good faith. You can also find a wider variety of investment commitment letters in pages format on our official website at template.net.

What are the few things included in the letter?

The letter format the terms and conditions of the loan and the form of the prospective loan. It is the agreement that initiates the formal loan borrowing process. These also include the rise in the costing due to various circumstances before the loans get approved. The four major things that the letter of commitment contained in it are the amount borrowed, repayment period, the rate of interest, the terms and conditions. It also outlines the amount of attorney fee and any fee incurred in preparing the documents. Looking for more insights? Dive into our blog post about agreement letter templates.

The basic letter commits and assures the borrower from each prospect that the lender promises to give the mentioned amount of the fund in the stipulated period of time. It is through this medium that the borrower can become sure and expect assistance from the sponsor or lender. For the best experience, explore a wider range of investment commitment letters in Google Docs directly from our official website, template.net.

Explore additional investment commitment letter templates on our website, template.net, to find a variety of options that suit your needs.