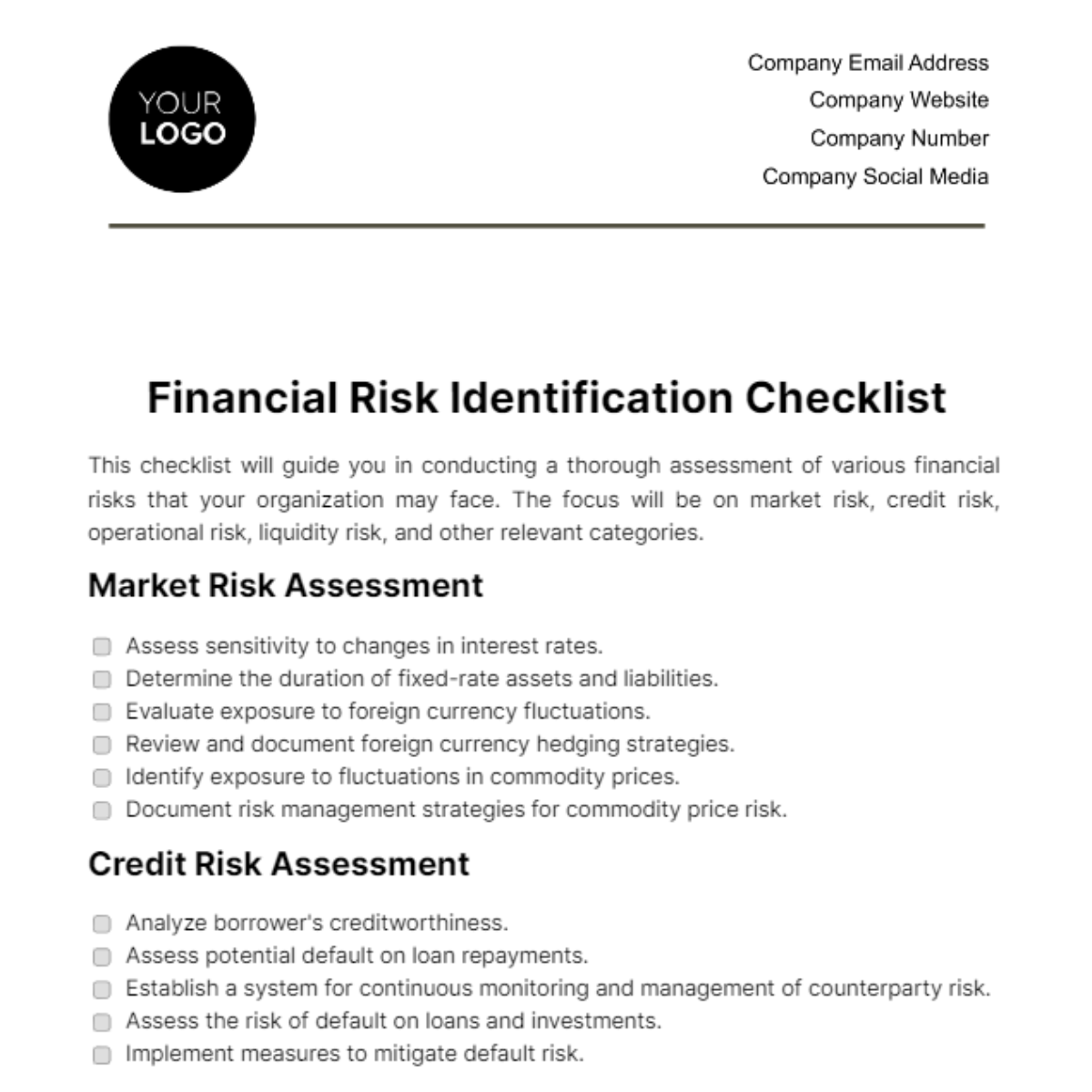

Free Financial Risk Identification Checklist

This checklist will guide you in conducting a thorough assessment of various financial risks that your organization may face. The focus will be on market risk, credit risk, operational risk, liquidity risk, and other relevant categories.

Market Risk Assessment

Assess sensitivity to changes in interest rates.

Determine the duration of fixed-rate assets and liabilities.

Evaluate exposure to foreign currency fluctuations.

Review and document foreign currency hedging strategies.

Identify exposure to fluctuations in commodity prices.

Document risk management strategies for commodity price risk.

Credit Risk Assessment

Analyze borrower's creditworthiness.

Assess potential default on loan repayments.

Establish a system for continuous monitoring and management of counterparty risk.

Assess the risk of default on loans and investments.

Implement measures to mitigate default risk.

Operational Risk Assessment

Assess the risk associated with failed internal processes.

Evaluate risks due to improper employee actions.

Assess the risk of technology failures and cyber threats.

Regularly evaluate system vulnerabilities.

Evaluate risks associated with human resources (turnover, training).

Develop succession plans for key roles.

Liquidity Risk Assessment

Review the organization's cash flow management practices.

Develop contingency plans for unexpected liquidity needs.

Assess the risk of not securing funding when needed.

Diversify funding sources where possible.

Additional Risk Categories

Establish a system for monitoring and managing reputational risks.

Define communication strategies to address negative events.

Stay informed about changes in regulations.

Implement internal controls to ensure regulatory compliance.

Identify and assess risks associated with long-term strategic decisions.

Develop mechanisms to adjust strategies in response to changing market conditions.

Regularly review insurance policies for coverage adequacy.

Establish a process for efficient insurance claims processing and monitoring.

Overall Risk Evaluation

After the complete assessment of each identified risk category has reached its conclusion, an exhaustive and comprehensive evaluation of the financial risks must be undertaken. This step is not only essential but the very backbone of the process aiming to gather, in a systematic and detailed manner, a deep understanding of the risk profile about the financial aspects of the organization. One cannot grasp the intricate web of financial implications without this organizational risk profile. This method serves as a crucial building block in the bigger picture of understanding the organization's financial health and vulnerability.

This note was prepared by: [YOUR NAME].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore peace of mind with Template.net's Financial Risk Identification Checklist Template. This editable and customizable template, powered by an intuitive AI Editor Tool, ensures a tailored risk management strategy. Effortlessly identify market, credit, operational, and liquidity risks. Stay proactive in financial decision-making with this comprehensive tool, a must-have for organizations navigating dynamic landscapes.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

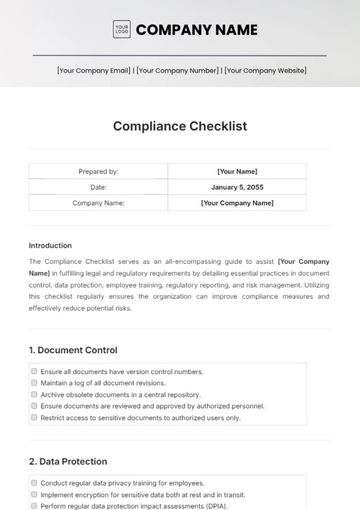

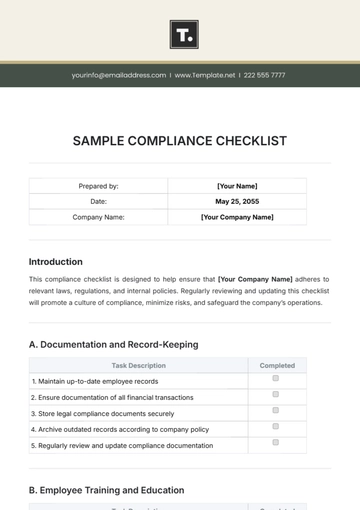

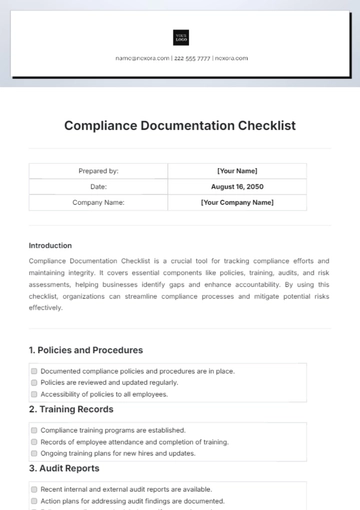

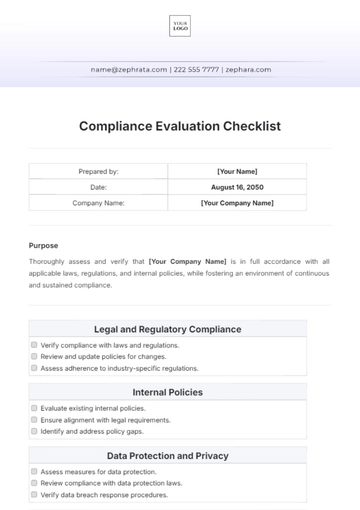

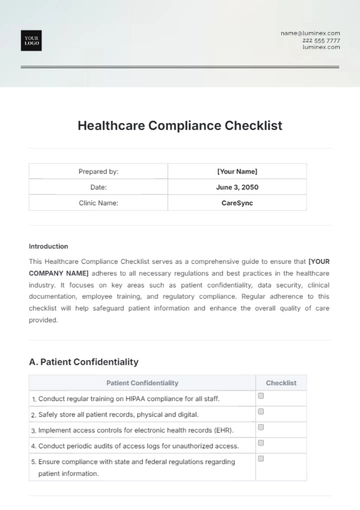

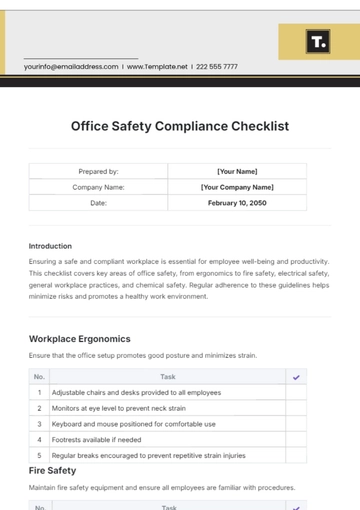

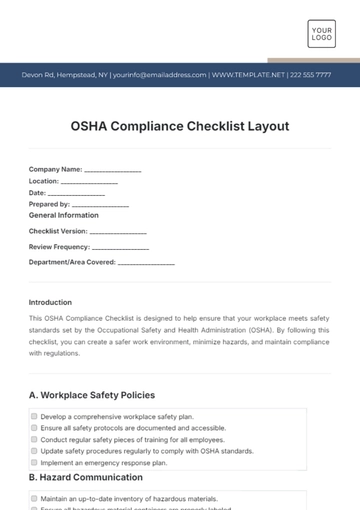

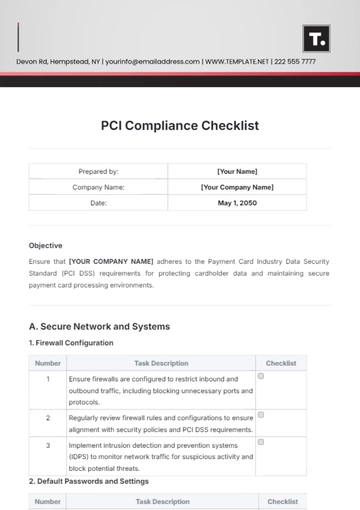

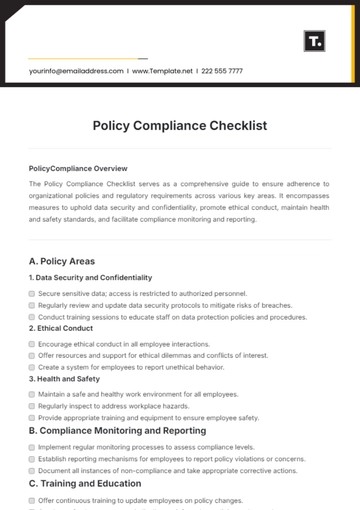

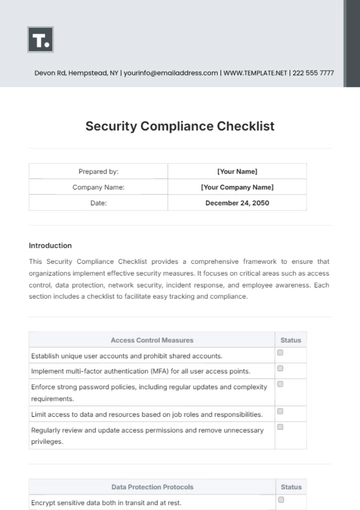

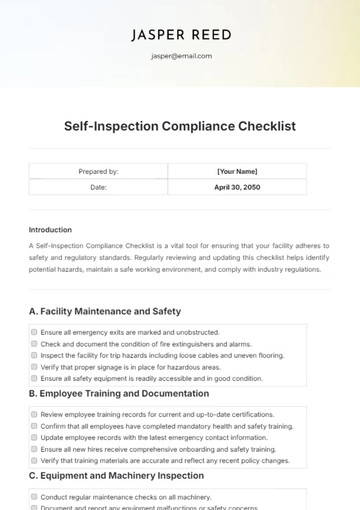

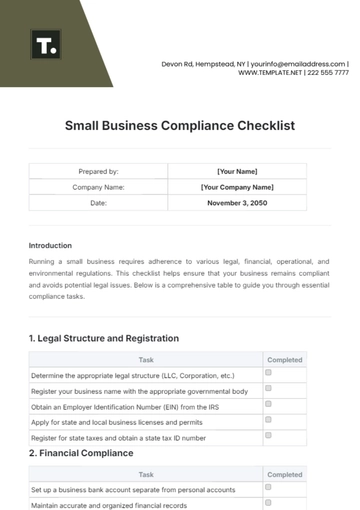

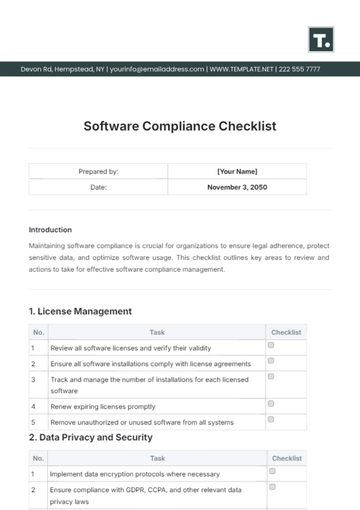

- Compliance Checklist

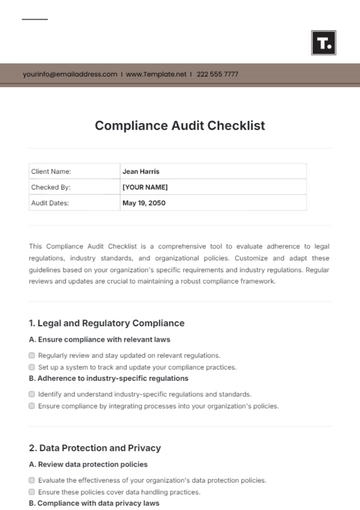

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

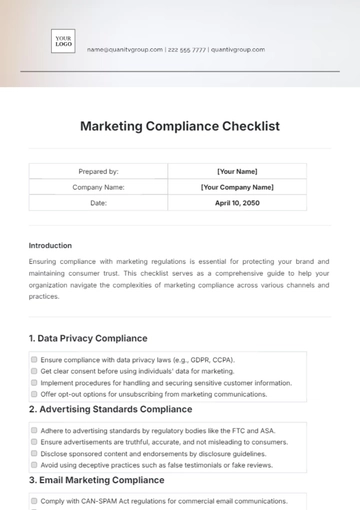

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

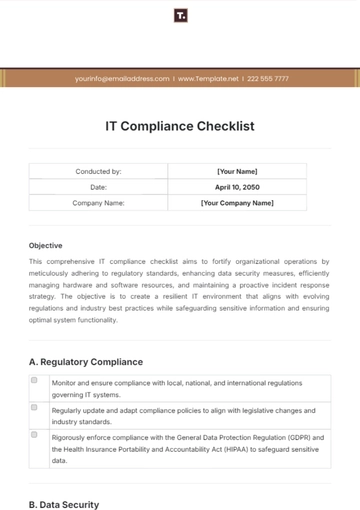

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist