Free SMART Goals for Saving Money

Prepared by: [YOUR NAME]

Company: [YOUR COMPANY NAME]

Description

This template is specifically designed to assist individuals in setting goals to build an emergency savings fund to cover unforeseen expenses. It encourages detailed planning and presents a structured approach towards achieving significant financial objectives.

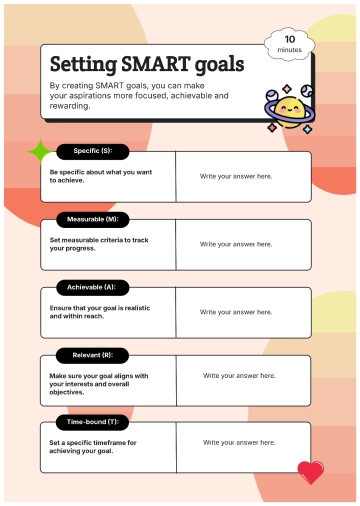

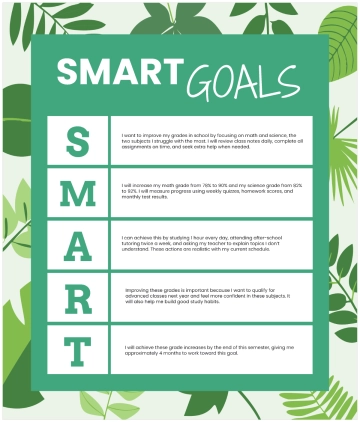

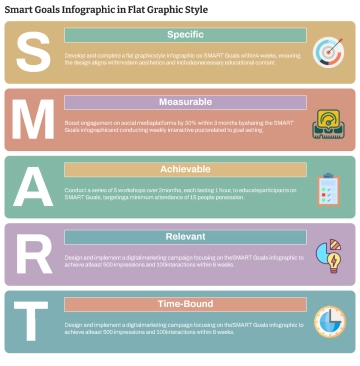

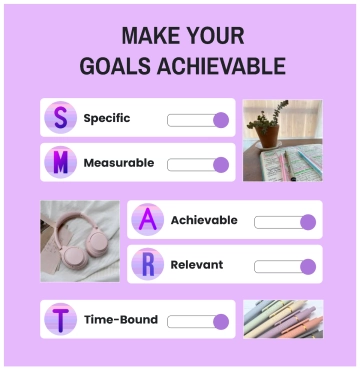

Initial | Meaning | Component |

|---|---|---|

S | Specific | Clearly defined and detailed savings goal. To achieve this, define the exact amount of money you want to save like, "[DESIRED SAVINGS AMOUNT]" |

M | Measurable | Set a system for tracking your progress. You achieve this by determining how much you need to save every month to reach your goal "[MONTHLY SAVINGS TRAGET]". |

A | Achievable | Ensure your savings goal is realistic considering your income and expenses. Identify savings approaches like "[YOUR SAVING STRATEGIES]" that will enable you to reach your target. |

R | Relevant | The goal should align with your broader financial plan. Describe why the emergency fund is essential to your financial stability like " [RELEVANCE TO YOUR FINANCIAL HEALTH]". |

T | Time-bound | Select a specific time-frame by which you want to establish your emergency savings fund like "". [TRAGET COMPLETION DATE] |

Action Plan

Assess Current Financial Situation: Review [MONTHLY INCOME], [EXPENSES BREAKDOWN], and existing savings to determine how much can be allocated to the emergency fund each month.

Set Monthly Savings Targets: Determine the amount of money to save each month to reach the desired emergency fund goal within the specified [TIMEFRAME].

Create a Separate Savings Account: Open a dedicated savings account specifically for the emergency fund to prevent it from being used for [NON-EMERGENCIES].

Automate Savings Contributions: Set up automatic transfers from the primary checking account to the emergency fund savings account on a recurring [DATE].

Monitor Progress Regularly: Track savings progress each [MONTH] and adjust contributions as needed to stay on track with the savings goal.

Accountability: |

|

Notes: |

|

Smart Goals Template @ Template.net

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the SMART Goals Template for Saving Money exclusively on Template.net. This editable and customizable template empowers you to set Specific, Measurable, Achievable, Relevant, and Time-bound financial goals effortlessly. Crafted for precision and adaptability, it's editable in our Ai Editor Tool, ensuring seamless customization for your financial aspirations.