Free Income Tax Compliance Checklist

I. Compliance Overview

Objective: The Income Tax Compliance Checklist Template facilitates the preparation for tax filings and submissions to tax authorities. By systematically reviewing taxpayer identification, recordkeeping, income classification, deductions, tax filing, and payment processes, this checklist ensures that organizations fulfill their income tax compliance obligations effectively.

Responsible Party: [YOUR NAME] [YOUR DEPARTMENT]

Date of Last Review: [DATE]

Next Scheduled Review: [DATE]

II. Taxpayer Identification and Registration

Ensure the organization has a valid Taxpayer Identification Number (TIN) or other relevant identifiers.

Verify registration with the appropriate tax authorities for income tax purposes.

III. Recordkeeping and Documentation

Maintain accurate records of income, expenses, deductions, and credits relevant to income tax filings.

Organize and retain supporting documents such as receipts, invoices, and financial statements.

Review and update documentation periodically to reflect changes in financial activities.

IV. Income Classification and Reporting

Classify various sources of income accurately, including wages, salaries, investment income, and business profits.

Report income from all sources in accordance with applicable tax laws and regulations.

Ensure proper disclosure of income on relevant tax forms and schedules.

V. Deductions and Credits

Deductions and Credits | Status |

|---|---|

Identify eligible deductions and credits | |

Gather documentation supporting deductions | |

Maximize available tax credits |

VI. Tax Filing and Submission

Prepare income tax returns accurately and completely, using the appropriate forms and schedules.

Double-check calculations and entries before filing to avoid errors or discrepancies.

Submit tax returns to the relevant tax authorities within the prescribed deadlines.

VII. Payment of Taxes

Calculate the amount of tax owed based on the income tax return.

Make timely payments of income tax liabilities to avoid penalties and interest charges.

Retain records of tax payments for future reference and audit purposes.

VIII. Tax Audits and Reviews

Prepare for and cooperate with tax audits or reviews conducted by tax authorities.

Address any inquiries or requests for information from tax authorities promptly and accurately.

Implement recommendations or corrective actions resulting from tax audits to improve compliance processes.

IX. Tax Planning and Strategy

Tax Planning and Strategy Tasks | Status |

|---|---|

Engage in proactive tax planning to minimize tax liabilities | |

Evaluate tax implications of business decisions | |

Implement tax-saving strategies where applicable |

IX. Compliance Training and Awareness

Provide training to relevant personnel on income tax regulations, compliance requirements, and reporting obligations.

Keep staff informed about changes in tax laws and regulations through regular updates and communications.

Foster a culture of tax compliance and accountability throughout the organization.

X. Completion and Sign-off

By checking the box below, I acknowledge that I have reviewed and completed the Income Tax Compliance Checklist Template.

Completed by: [YOUR NAME] [YOUR DEPARTMENT]

Date: [DATE]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing our Income Tax Compliance Checklist Template, meticulously designed to ensure thorough evaluation and adherence to income tax regulations within your organization. Accessible on Template.net, this editable and customizable checklist covers essential areas such as tax reporting, deductions, exemptions, credits, and other income tax obligations applicable to your business operations. Utilize our Ai Editor Tool to tailor the checklist to your company's specific tax compliance needs and regulatory obligations. Simplify your compliance monitoring process and identify areas for improvement effectively with our meticulously crafted template. Elevate your organization's income tax compliance standards with Template.net.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

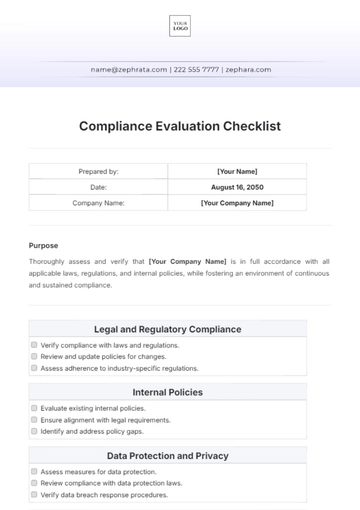

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

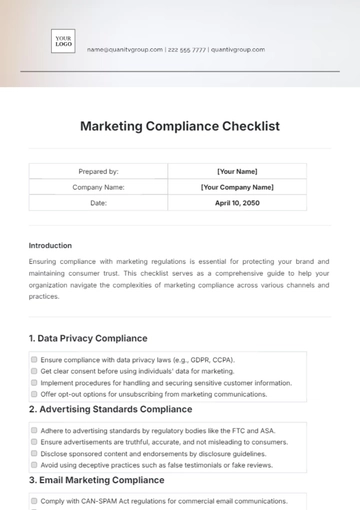

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

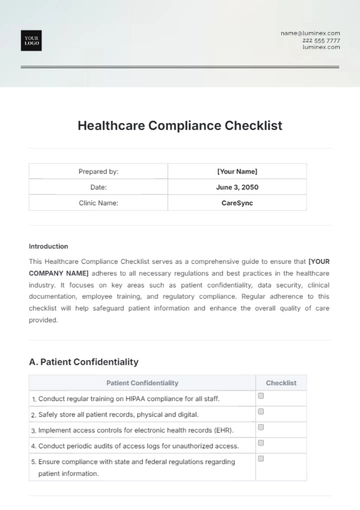

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

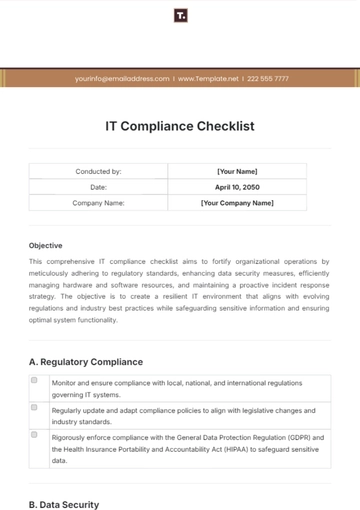

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist