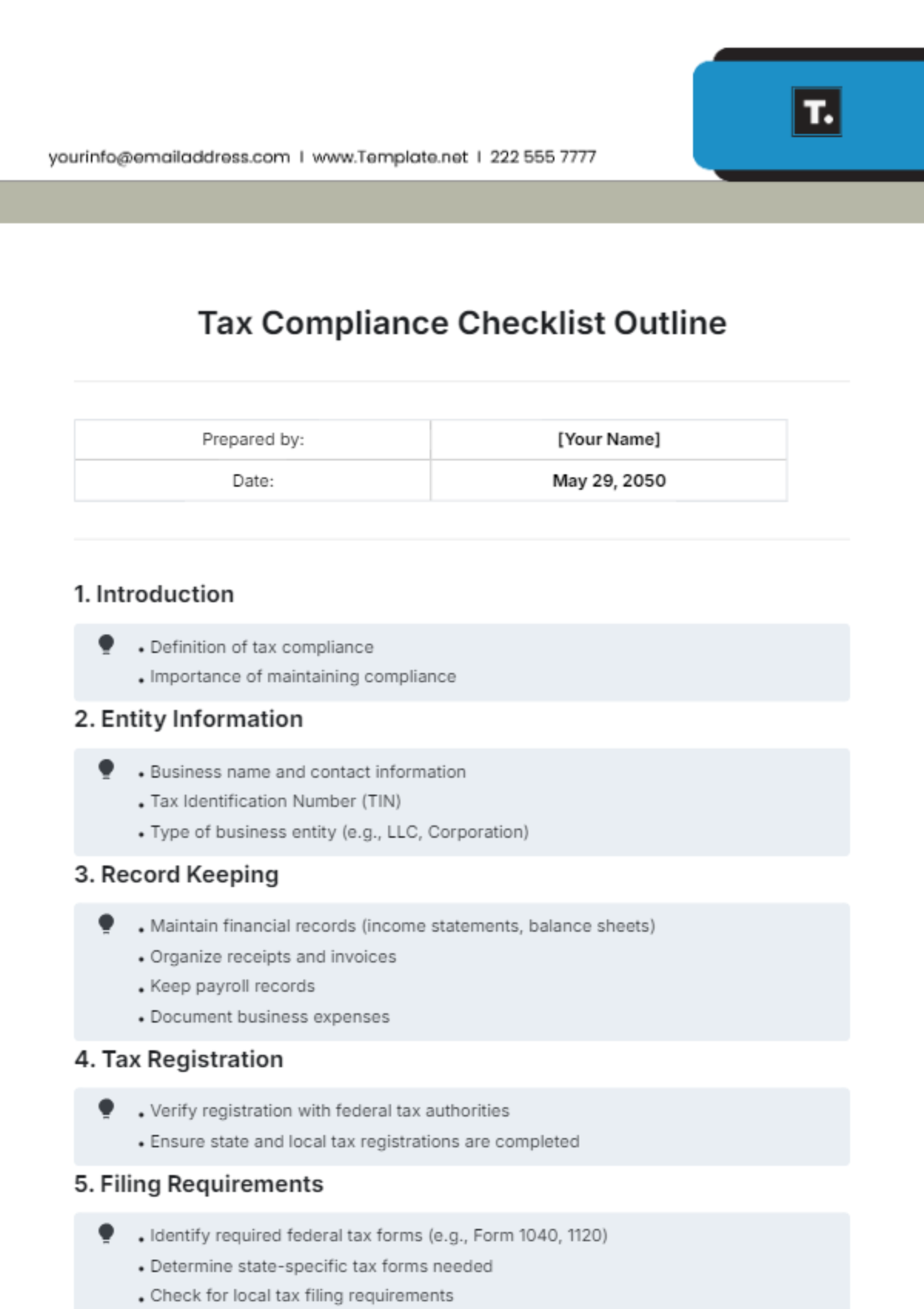

Free Tax Compliance Checklist Outline

Prepared by: | [Your Name] |

Date: | May 29, 2050 |

1. Introduction

Definition of tax compliance

Importance of maintaining compliance

2. Entity Information

Business name and contact information

Tax Identification Number (TIN)

Type of business entity (e.g., LLC, Corporation)

3. Record Keeping

Maintain financial records (income statements, balance sheets)

Organize receipts and invoices

Keep payroll records

Document business expenses

4. Tax Registration

Verify registration with federal tax authorities

Ensure state and local tax registrations are completed

5. Filing Requirements

Identify required federal tax forms (e.g., Form 1040, 1120)

Determine state-specific tax forms needed

Check for local tax filing requirements

6. Deadlines

Note key tax filing dates

Record payment deadlines for taxes

7. Estimated Tax Payments

Assess if estimated tax payments are necessary

Schedule quarterly estimated tax payments if applicable

8. Compliance Review

Conduct regular audits of tax-related records

Review for applicable deductions and credits

Stay updated on changes in tax laws

9. Professional Assistance

Consider hiring a tax advisor or accountant

Seek guidance for complex tax situations

10. Final Steps

Review all completed tax forms before submission

Keep copies of filed forms and documentation

Monitor for any correspondence from tax authorities

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify your tax filing process with Template.net's Tax Compliance Checklist Outline Template. This customizable and editable template helps you stay on top of tax requirements, ensuring nothing is overlooked. Easily personalize the template using our AI Editor Tool, making tax season less stressful by having a comprehensive and compliant outline at hand.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist