Free Financial Investment Impact Analysis

I. Executive Summary

This analysis aims to provide an overview of the proposed investment's potential impact. Highlighting positive financial projections and a robust risk management strategy, it underscores the impact surrounding the venture. Noteworthy trends in cash flow, revenue, and return on investment contribute to a favorable financial outlook. The emphasis on prudent cost management reflects a commitment to long-term financial sustainability. Through proactive risk mitigation strategies and strategic recommendations, this analysis sets the foundation for a resilient and successful investment journey.

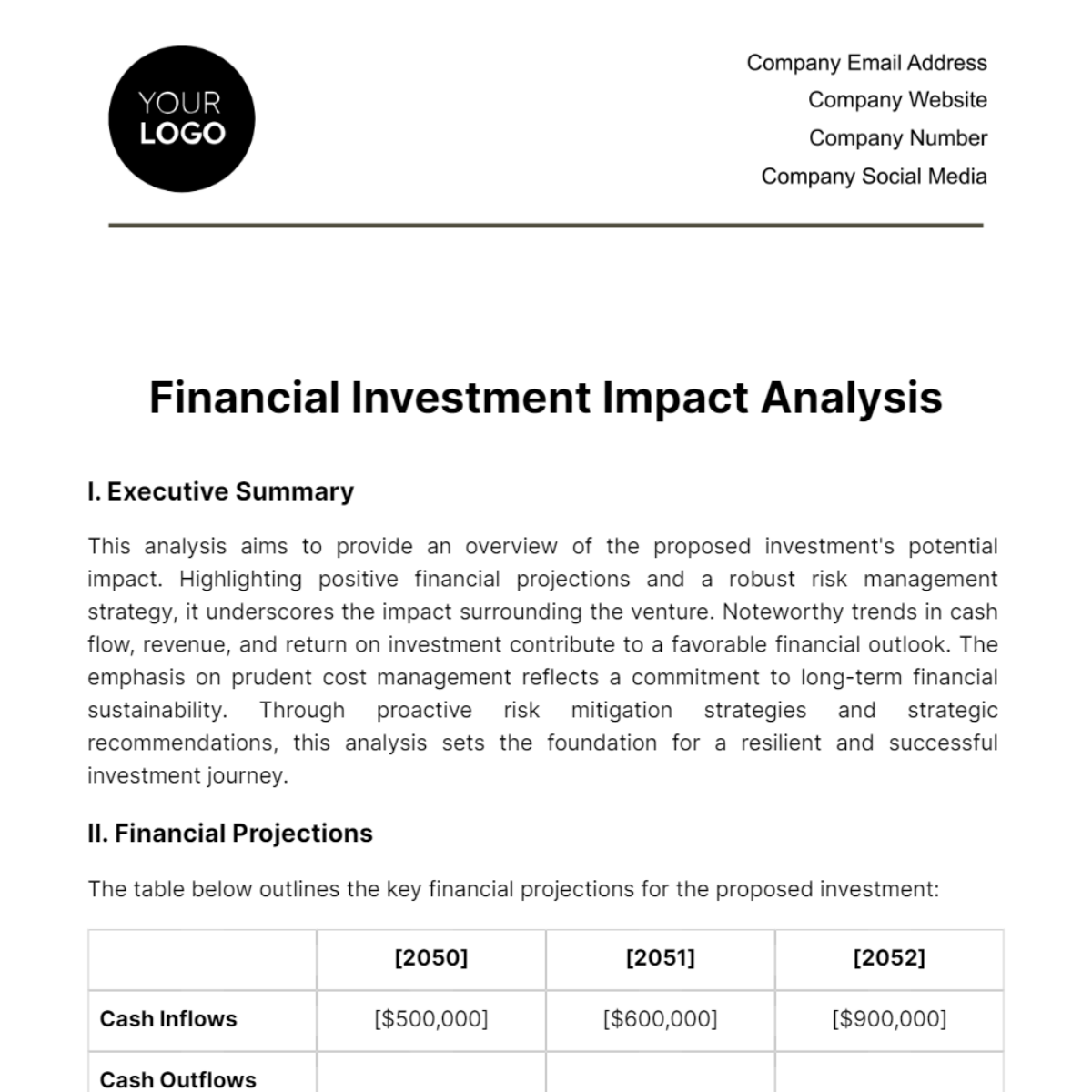

II. Financial Projections

The table below outlines the key financial projections for the proposed investment:

[2050] | [2051] | [2052] | |

Cash Inflows | [$500,000] | [$600,000] | [$900,000] |

Cash Outflows | |||

Net Cash Flow | |||

Revenue | |||

Expenses | |||

Profit | |||

ROI |

The presented financial projections indicate a consistent growth pattern in cash inflows and revenue throughout the specified period. This positive trend is indicative of the investment's potential to generate favorable returns. The net cash flow, which showcases the financial health of the project, exhibits a steady increase, demonstrating efficient management of operational costs and resources.

Moreover, the rising profit trend highlights the profitability of the investment, underscoring the potential for creating value. The calculated Return on Investment (ROI) percentages reinforce the favorable financial outlook, demonstrating an attractive balance between risk and reward. These projections serve to instill confidence in stakeholders, showcasing the investment's capability to yield substantial financial benefits over the forecasted period.

III. Investment Costs

The table below details the various costs associated with the proposed investment:

Category | [2050] | [2051] | [2052] |

Operational Expenses | [$150,000] | [$180,000] | [$200,000] |

The breakdown of investment costs demonstrates a well-balanced allocation of resources across different categories. This approach not only mitigates potential financial risks but also positions the investment for long-term success. The total investment costs, align with the positive financial projections, reinforcing the notion that the investment is well-positioned to achieve its financial objectives while maintaining prudent financial management practices.

IV. Risk Analysis

Effective risk management is paramount to the success of any investment. The identified risks are:

Market Risks

Fluctuations in market demand and competitive dynamics can impact revenue. However, the diversified nature of the target market and robust market research mitigate this risk.

Operational Risks

Operational challenges, such as supply chain disruptions or technological issues, have been considered. The implementation of contingency plans and ongoing monitoring will ensure swift responses to mitigate operational risks.

Financial Risks

Currency exchange rates and interest rate fluctuations pose potential financial risks. Hedging strategies and financial instruments are in place to safeguard against adverse movements in these variables.

Regulatory and Compliance Risks

Changes in regulations or compliance requirements can affect the investment. Regular audits, legal consultations, and a proactive approach to compliance ensure that the investment remains aligned with the regulatory landscape.

Strategic Risks

Changes in the competitive landscape or shifts in consumer preferences may impact the success of the investment. Continuous monitoring and adaptability in strategic planning help mitigate such risks.

Execution Risks

Implementation challenges, including project delays or unexpected obstacles, have been assessed. Robust project management practices and contingency plans are in place to address potential execution risks.

V. Conclusion

In conclusion, the analysis reveals a positive outlook for the proposed investment, supported by promising projections and prudent cost management. The thorough examination of potential risks underscores a proactive approach to risk mitigation. The alignment of financial projections with strategic cost considerations positions the investment for long-term success. Overall, the comprehensive analysis indicates the potential for significant returns, while the robust risk mitigation strategies instill confidence in the investment's resilience.

VI. Recommendations

Based on the comprehensive analysis conducted, the following recommendations are put forth to optimize the success of the proposed investment:

Financial Strategy

Implement a dynamic financial strategy that aligns with the positive projections. Continuously monitor and adapt the strategy to capitalize on emerging opportunities and mitigate potential financial risks.

Cost Management

Maintain a disciplined approach to cost management, regularly reviewing and optimizing operational and project-related expenses. This will enhance the efficiency of resource utilization and contribute to sustained profitability.

Risk Mitigation

Regularly reassess and update the risk mitigation strategies in response to changing market conditions and potential threats. Proactively address any identified risks to minimize their impact on the investment.

Strategic Flexibility

Foster strategic flexibility by remaining attuned to market dynamics and being open to adjusting the investment strategy as needed. This adaptability will enhance the investment's resilience in the face of unforeseen challenges.

Stakeholder Communication

Establish transparent and consistent communication channels with stakeholders. Provide regular updates on financial performance, risk management measures, and any strategic shifts to maintain trust and confidence.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Assess investment impact with less hassle with our Financial Investment Impact Analysis Template from Template.net! This editable and customizable template facilitates a thorough analysis of investment impact. Optimize decision-making, ensuring your investments align with your financial goals. Utilize the simplicity of our advanced AI Editor Tool for easy customization now!