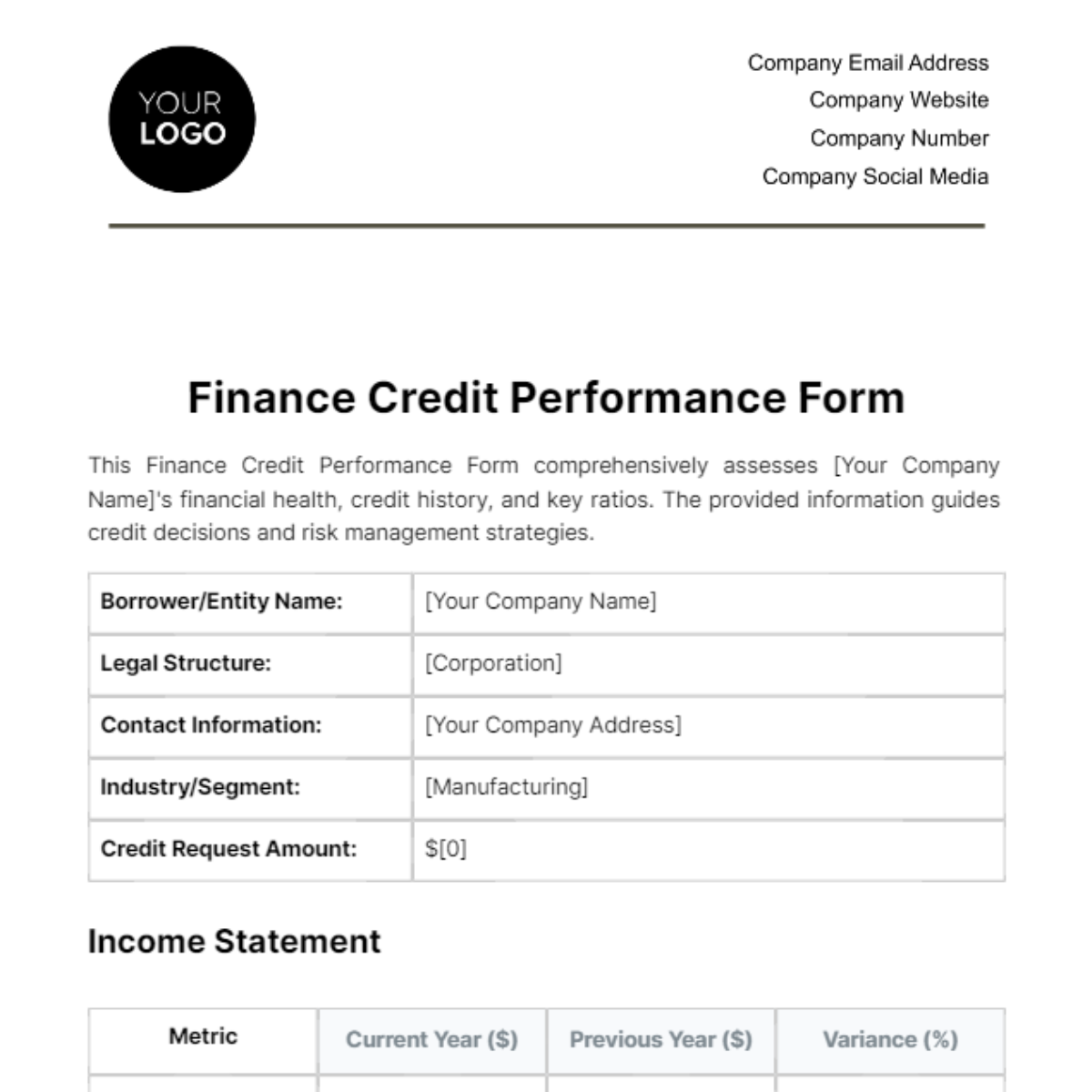

Finance Credit Performance Form

This Finance Credit Performance Form comprehensively assesses [Your Company Name]'s financial health, credit history, and key ratios. The provided information guides credit decisions and risk management strategies.

Borrower/Entity Name: | [Your Company Name] |

Legal Structure: | [Corporation] |

Contact Information: | [Your Company Address] |

Industry/Segment: | [Manufacturing] |

Credit Request Amount: | $[0] |

Income Statement

Metric | Current Year ($) | Previous Year ($) | Variance (%) |

|---|

Revenue | $[0] | $[0] | $[0] |

Cost of Goods Sold (COGS) | $[0] | $[0] | $[0] |

Gross Profit | $[0] | $[0] | $[0] |

Operating Expenses | $[0] | $[0] | $[0] |

Net Income | $[0] | $[0] | $[0] |

Credit Scores

Credit Bureau | Score |

|---|

Experian | $[0] |

Equifax | $[0] |

TransUnion | $[0] |

Risk Factors and Mitigation Strategies

Market Risk

Description: [Your Company Name] operates in a highly competitive market susceptible to economic downturns. Changes in consumer demand and market trends could impact revenue.

Mitigation Strategies: To address market risks, [Your Company Name] employs a strategy of diversifying its product lines to adapt to evolving consumer preferences. Additionally, proactive monitoring of market trends allows for swift adjustments in production and marketing strategies to maintain competitiveness.

Credit Risk

Description: Despite a commendable credit history and minimal overdue payments, [Your Company Name] recognizes the inherent risk associated with extending credit. This includes potential changes in customer financial health or unforeseen economic challenges.

Mitigation Strategies: [Your Company Name] implements robust credit risk management practices. This includes regular credit reviews to assess customer creditworthiness, setting appropriate credit limits, and establishing clear payment terms. These measures aim to minimize the impact of potential credit defaults and ensure responsible lending practices.

Operational Risk

Description: While internal processes at [Your Company Name] are streamlined, there exists operational risk due to dependencies on specific suppliers and potential disruptions in the supply chain.

Mitigation Strategies: To mitigate operational risks, [Your Company Name] has established relationships with alternative suppliers, ensuring a degree of flexibility. Additionally, robust inventory management practices and regular operational audits are in place to identify and address potential disruptions promptly. These measures contribute to maintaining operational resilience in the face of unforeseen challenges.

Conclusion and Recommendations

In conclusion, the comprehensive analysis presented in this Finance Credit Performance Form affirms [Your Company Name]'s overall financial stability, creditworthiness, and effective risk management practices. With a commendable credit history, strong key performance ratios, and diligent risk mitigation strategies in place, the credit analyst recommends approving the credit request of $[0]. This decision aligns with the organization's commitment to responsible lending and strategic financial growth, ensuring a mutually beneficial partnership with [Your Company Name].