Free Finance Budget Planning Policy

I. Introduction

This policy outlines the principles, guidelines, and procedures governing the finance-driven budget planning process within our company. This document serves as a foundation, promoting transparency, accountability, and optimal utilization of financial resources. By adhering to this policy, we aim to fortify our financial foundations, ensuring the alignment of budgeting efforts with corporate objectives and fostering a culture of fiscal responsibility.

II. Policy Objectives

The objectives of this policy are to:

A. Optimize Resource Allocation

Efficiently allocate financial resources to support key business objectives, including market expansion, product innovation, and customer experience enhancement.

B. Enhance Transparency

Provide stakeholders, including employees, investors, and partners, with a clear and transparent view of the budgeting process, instilling confidence in our financial decision-making processes.

C. Ensure Accountability

Guarantee accountability for the responsible use of allocated resources, linking budgetary allocations to strategic goals and setting clear expectations for performance.

III. Responsibilities and Roles

A. Budget Preparation

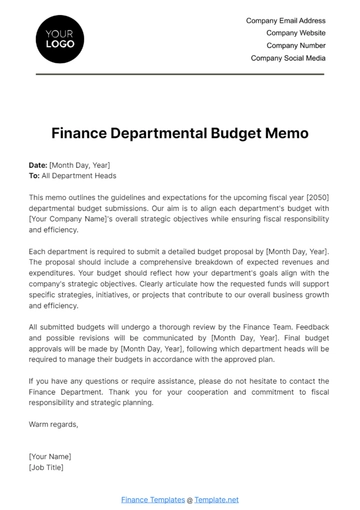

The Finance Department, under the leadership of the Chief Financial Officer (CFO), will lead the budget preparation process. Department heads will collaborate closely, providing detailed projections based on historical data and future forecasts.

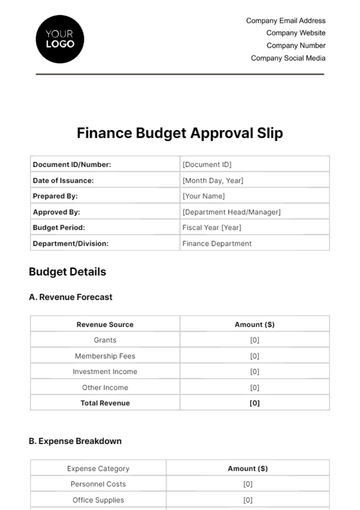

B. Approval Process

The Budget Review Committee, comprising the CFO, department heads, and senior management, will convene for rigorous reviews. The final budget will be presented to the executive team for approval, ensuring alignment with corporate objectives.

C. Monitoring and Reporting

Department heads, acting as budget owners, will actively monitor their budgets throughout the fiscal year. Quarterly reports on actual performance against budgeted targets will be submitted to the Finance Department.

IV. Budgeting Principles

The budgeting process will adhere to the following principles:

A. Accuracy

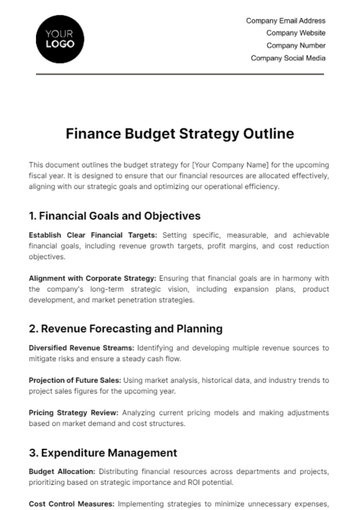

Base budgets on accurate and reliable financial data, leveraging historical performance metrics and market analyses to inform projections.

B. Transparency

Maintain transparency by detailing the rationale behind budgetary decisions, ensuring stakeholders understand the financial priorities and resource allocations.

C. Alignment with Goals

Align budgets with corporate strategic goals and objectives, ensuring a purposeful and unified financial plan that supports the company's overarching mission.

V. Budget Cycle

A. Timeline

The budget cycle will follow a defined timeline, starting with departmental budget submissions in Q1, committee reviews in Q2, executive approval in Q3, and quarterly performance assessments throughout the fiscal year.

B. Milestones

Communicate key milestones to all relevant stakeholders, ensuring a collective understanding of the budget cycle and facilitating timely progression.

VI. Data and Assumptions

A. Data Sources

Rely on accurate and up-to-date financial data sourced from internal systems, external market research, and industry benchmarks.

B. Assumptions

Clearly document and periodically review assumptions, such as inflation rates, currency fluctuations, and market trends, to enhance the accuracy of budget projections.

VII. Performance Measurement and Evaluation

A. Criteria

Evaluate budget performance based on key performance indicators (KPIs), financial metrics, and the degree of alignment with predetermined strategic objectives.

B. Review Frequency

Conduct quarterly reviews to assess actual performance against budgeted targets, fostering a continuous improvement mindset and allowing for timely adjustments.

VIII. Flexibility and Contingency Planning

A. Dynamic Adjustments

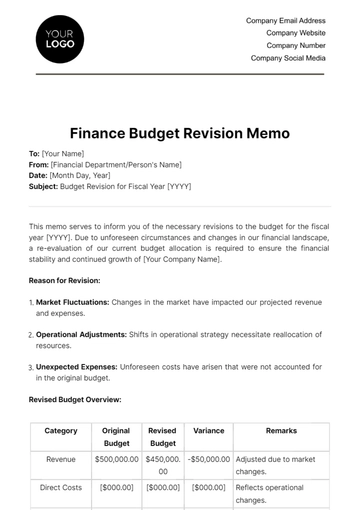

Embrace flexibility to accommodate changes in economic conditions, market dynamics, or unexpected internal challenges that may impact the budget.

B. Contingency Plans

Develop contingency plans for potential scenarios, ensuring the company remains agile and can respond effectively to unforeseen circumstances.

IX. Communication and Reporting

A. Channels

Establish clear communication channels, including regular town hall meetings, departmental briefings, and digital platforms, to disseminate budget-related information to stakeholders.

B. Reporting Formats

Provide regular reports in accessible formats, utilizing visualizations and narrative summaries to convey budget status, variances, and performance metrics.

X. Review and Amendments

A. Periodic Reviews

Undertake annual reviews of the policy, engaging key stakeholders to ensure its continued relevance and alignment with evolving corporate goals.

B. Amendment Process

Amendments to the policy will follow a structured process, involving key stakeholders, soliciting feedback, and obtaining final approval from the executive team to maintain the policy's effectiveness.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Finance Budget Planning Policy Template. It's fully editable and customizable, allowing you to tailor financial policies to your organization's needs. With our AI Editor Tool, streamline policy creation and ensure compliance with financial regulations. Empower your team with Template.net's innovative solutions for effective budget planning.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising