Free Finance Budget Variance Report

This Finance Budget Variance Report provides an overview of our financial performance in comparison to the budgeted figures for the [Month Year]. It highlights areas of variance and provides explanations for significant differences between actual and budgeted amounts.

The purpose of this report is to assess our financial performance, identify areas of concern, and make informed decisions to achieve our financial objectives.

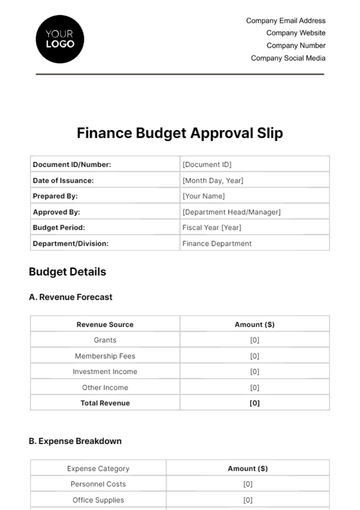

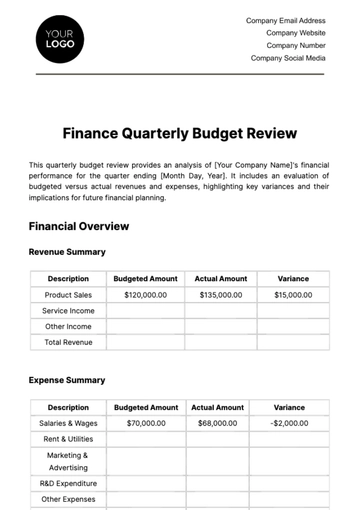

Budget vs. Actual Analysis

Budget (USD) | Actual (USD) | Variance (USD) | Variance (%) | |

Revenue | 0 | 0 | 0 | 0 |

Cost of Goods Sold | 0 | 0 | 0 | 0 |

Gross Profit | 0 | 0 | 0 | 0 |

Operating Expenses | 0 | 0 | 0 | 0 |

Operating Income | 0 | 0 | 0 | 0 |

Net Income | 0 | 0 | 0 | 0 |

Variance Analysis

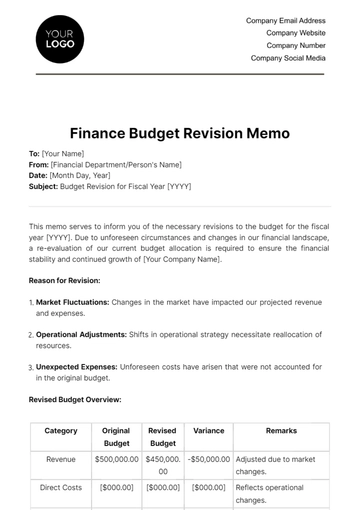

Revenue Variance: The variance in revenue is primarily attributed to lower-than-expected sales in our main product line. A decline in customer orders during the summer contributed to the revenue decrease.

COGS Variance: The variance in the cost of goods sold is due to unexpected price increases in raw materials. This led to higher production costs and a subsequent reduction in gross profit.

Expenses Variance: The variance in operating expenses is mainly due to higher-than-anticipated marketing expenses. We invested in a marketing campaign to boost sales during the slow season, which resulted in increased costs.

Operating Income Variance: The variance in operating income is a result of lower revenue and higher expenses. Our efforts to stimulate sales impacted profitability negatively.

Net Income Variance: The net income variance is influenced by lower operating income and changes in tax liabilities. We incurred higher tax expenses due to the reduced profitability.

Key Findings

The decline in revenue and gross profit is concerning and requires immediate attention.

The marketing campaign did not yield the expected results in terms of revenue generation.

Cost control measures are necessary to address the declining profitability.

Recommendations

Implement cost-saving measures in production to mitigate the impact of increased raw material costs.

Review and adjust marketing strategies to enhance their effectiveness in generating revenue.

Carefully monitor expenses and consider a temporary reduction in discretionary spending.

Conclusion

In conclusion, the [Month Year] Finance Budget Variance Report highlights areas of concern in our financial performance. The decline in revenue and profitability necessitates swift action to reverse the trend.

[Name]

Chief Financial Officer

[Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate tool for financial management with Template.net's Finance Budget Variance Report Template. This editable and customizable template empowers you to track and analyze budget variances effortlessly. Harness the power of our AI Editor Tool to streamline your financial reporting process. Take control of your finances today!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising