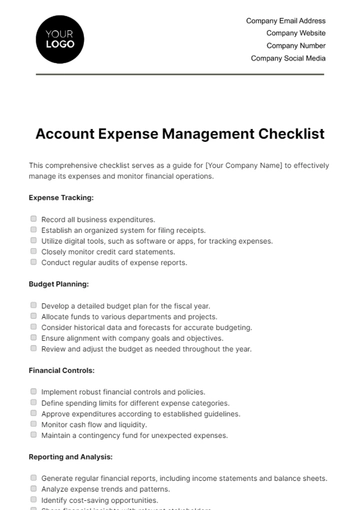

Free Account Expense Management Checklist

This comprehensive checklist serves as a guide for [Your Company Name] to effectively manage its expenses and monitor financial operations.

Expense Tracking:

Record all business expenditures.

Establish an organized system for filing receipts.

Utilize digital tools, such as software or apps, for tracking expenses.

Closely monitor credit card statements.

Conduct regular audits of expense reports.

Budget Planning:

Develop a detailed budget plan for the fiscal year.

Allocate funds to various departments and projects.

Consider historical data and forecasts for accurate budgeting.

Ensure alignment with company goals and objectives.

Review and adjust the budget as needed throughout the year.

Financial Controls:

Implement robust financial controls and policies.

Define spending limits for different expense categories.

Approve expenditures according to established guidelines.

Monitor cash flow and liquidity.

Maintain a contingency fund for unexpected expenses.

Reporting and Analysis:

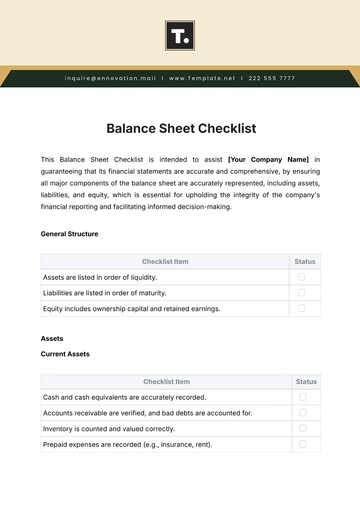

Generate regular financial reports, including income statements and balance sheets.

Analyze expense trends and patterns.

Identify cost-saving opportunities.

Share financial insights with relevant stakeholders.

Use data-driven analysis for informed decision-making.

Expense Policy Compliance:

Develop and communicate a clear expense policy.

Ensure employees are aware of the policy and its guidelines.

Provide training on expense reporting procedures.

Monitor compliance with the expense policy.

Enforce consequences for policy violations when necessary.

By following this Account Expense Management Checklist, [Your Company Name] can maintain financial stability, control costs, and optimize budget allocation for sustainable growth.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your financial control with Template.net's Account Expense Management Checklist Template, effortlessly editable using our AI editor tool. Stay organized and manage expenses with ease. This user-friendly checklist ensures that no financial detail goes unnoticed. Elevate your expense management with Template.net's customizable solution today!

You may also like

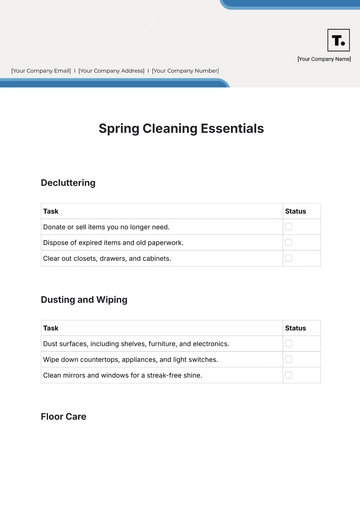

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

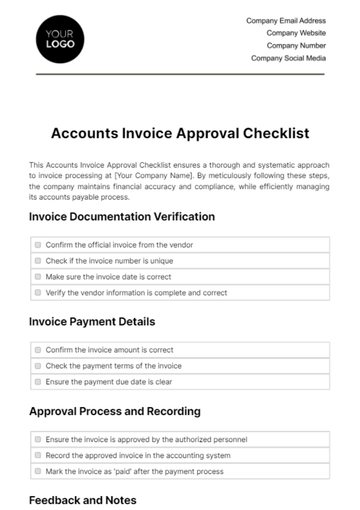

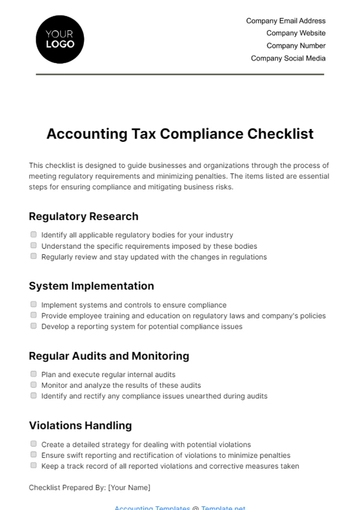

- Compliance Checklist

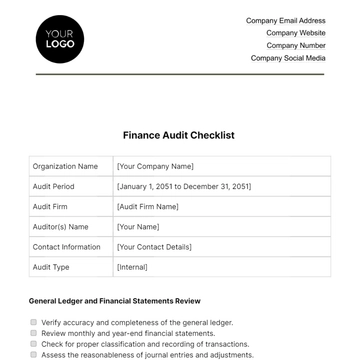

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

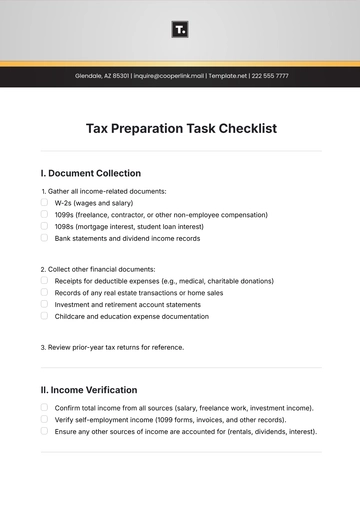

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

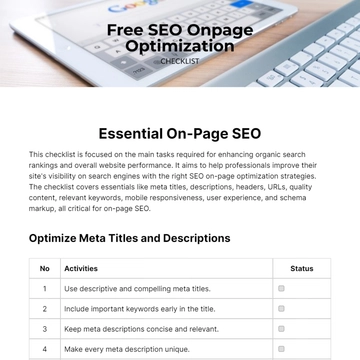

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist