Free Marketing SWOT Analysis on Financial Management

Introduction

[Your Company Name] is a renowned entity in the marketing realm, priding itself on ensuring the highest returns on marketing investments. With the dynamism of the marketing world, financial management within this realm is not just about budgeting but involves strategic allocation, risk assessment, and performance monitoring. This SWOT Analysis delves into the Marketing Financial Management capabilities of the company. Through this, we aim to provide an understanding of where we stand and how we envision navigating the turbulent waters of the future marketing landscape.

Evolution of Marketing Financial Management at [Your Company Name]:

Over the past decades, [Your Company Name] has seen an evolution in its financial management strategies. Initially rooted in traditional financial accounting, our approaches have evolved to incorporate cutting-edge technologies, advanced forecasting models, and integrated communication systems. Our journey from basic budgeting to intricate financial modeling showcases our adaptability and commitment to excellence.

Our Commitment to Stakeholders:

At the heart of [Your Company Name]'s operations lies a strong commitment to our stakeholders. Whether it's our clients, investors, or employees, our financial management strategies are designed to provide clarity, transparency, and value. We believe that when every stakeholder is aligned with our financial vision and trusts our processes, it leads to better collaborations, innovative solutions, and sustained growth. Our continuous endeavors are focused on fortifying this trust and ensuring mutual growth.

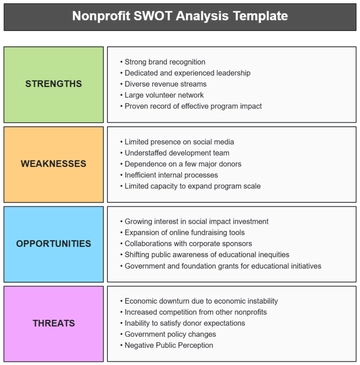

Strengths

In the dynamic world of marketing, a company's strengths serve as its anchor, ensuring stability and forward momentum even amidst turbulent times. At [Your Company Name], we've nurtured and honed specific competencies that set us apart in the domain of marketing financial management. Let's delve into these strengths, which not only underline our expertise but also shine a light on our commitment to excellence.

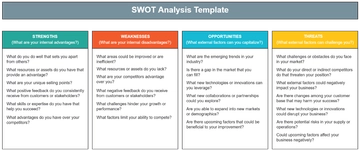

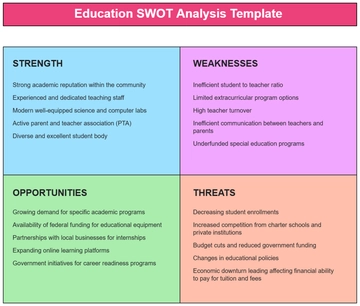

STRENGTHS |

Cutting-edge Proprietary Financial Tools Our investment in research and development has resulted in the creation of industry-leading financial tools designed specifically for the marketing realm. These tools not only allow us to optimize budgets but also forecast potential returns with a high degree of accuracy. |

Year | ROI | Top Performing Marketing Channels |

2051 | 18% | Digital, Influencer Marketing, TV |

Incorporating these enhanced strengths not only provides a deeper insight into the prowess of [Your Company Name]'s marketing financial management but also reaffirms the company's position as an industry leader in this domain.

Weaknesses

Recognizing our imperfections is not a sign of weakness but rather a testament to [Your Company Name]'s commitment to growth and excellence. As we navigate the vast realm of marketing financial management, we understand that acknowledging areas of improvement is the first step toward refining our strategies and strengthening our foundation. In this section, we shed light on these areas, not as limitations, but as opportunities for growth and evolution.

WEAKNESSES |

Software Tool Dependency While our cutting-edge proprietary financial tools have consistently provided us with an edge, our over-reliance on these technologies poses a potential vulnerability. A single technical disruption could impact our decision-making process, emphasizing the need for a more diverse set of tools or backup systems. |

Acknowledging these weaknesses provides [Your Company Name] with a roadmap for improvement. As we strive for excellence, addressing these areas will ensure our strategies are robust, comprehensive, and future-ready.

Opportunities

In the ever-evolving landscape of marketing financial management, new horizons constantly beckon. Opportunities arise not just from emerging trends, but also from the challenges and shifts in the industry's fabric. For [Your Company Name], these opportunities represent not just growth potential, but a chance to redefine the contours of our industry. Here, we explore the myriad possibilities that lie ahead, ready for us to seize and shape.

OPPORTUNITIES |

Tapping into Emerging Markets As new economies rise and mature, they bring forth a plethora of untapped audiences and unique market dynamics. Venturing into these emerging markets can offer the company some fresh perspectives and a broader canvas to apply our proven strategies. |

By capitalizing on these opportunities, [Your Company Name] is poised to not only expand its footprint but also to pioneer new directions in the realm of marketing and financial management.

Threats

In the journey towards excellence, even the most seasoned travelers face unforeseen challenges. The marketing financial management sector, with its intricate interplay of data, money, and strategies, is not immune to external threats. We believe in preemptive vigilance. Understanding potential roadblocks allows us to prepare, adapt, and innovate. Here, we outline the challenges that might emerge on our horizon, with a focus on turning these threats into avenues for learning and adaptation.

THREATS |

Global Economic Volatility The interconnectedness of today's world economy means that ripples in one region can create waves globally. Economic downturns or sudden market crashes can impact marketing budgets and necessitate rapid recalibration of our strategies. |

Year | Anticipated Regulatory Changes |

2054 | Enhanced data privacy mandates. |

While these threats present challenges, they also emphasize the importance of adaptability, foresight, and resilience for [Your Company Name]. With a proactive approach, we aim to transform these potential hurdles into stepping stones towards a brighter future.

Analysis

The marketing and financial management landscape is both intricate and dynamic. As we have evaluated [Your Company Name]'s position through a SWOT lens, the implications of our strengths, weaknesses, opportunities, and threats come into sharper focus. This section aims to dive deeper into the interconnected nature of these elements, analyzing the broader context and the potential paths forward for our organization.

1. Interplay of Strengths and Opportunities: Our strengths in financial data analytics can be combined with the opportunities presented by AI & ML to create unparalleled forecasting models. Leveraging our strong foundation in domestic markets, we can explore emerging markets, capitalizing on our expertise to create a unique niche for ourselves.

2. Mitigating Weaknesses through Opportunities: Our software tool dependency can be mitigated by integrating AI and ML, ensuring a more resilient and diversified toolkit. The challenge of data overload can be addressed by personalized marketing through advanced data analytics, filtering out noise and focusing on actionable insights.

3. Threats as Catalysts for Change: The global economic volatility, while a threat, can push the company to develop more adaptive and agile financial strategies, ensuring resilience against market fluctuations. The surge in competitive innovations should drive us to consistently innovate, ensuring that we're not just keeping pace but setting industry benchmarks.

4. Stakeholder Dynamics and Future Strategy: With an increasingly informed and involved stakeholder base, our future strategies should be built on transparency, collaboration, and education. This not only enhances trust but fosters a collective spirit towards growth.

5. Technological Innovations: While embracing technological innovations such as blockchain, AR, and quantum computing can provide significant advantages, it is vital to assess the potential risks associated with each. Proper training, implementation, and risk management strategies are crucial.

6. Evolutionary Response to Regulatory Changes: Instead of viewing regulatory changes as hurdles, they can be seen as evolutionary pressures that push the company to refine its strategies, ensuring compliance while maintaining operational efficiency.

This analysis underlines that while [Your Company Name] stands on a solid foundation, the future requires a blend of leveraging strengths, addressing weaknesses, capitalizing on opportunities, and preemptively tackling threats. The interplay of these elements, combined with a clear understanding of technological and stakeholder dynamics, will shape our path forward in the realm of marketing financial management.

Recommendations

In light of our detailed SWOT Analysis for [Your Company Name] in the realm of marketing financial management, several strategic pathways emerge. These recommendations not only address potential challenges but also leverage the company's inherent strengths to pave the way for sustainable growth and innovation.

1. Diversify Technological Portfolio: While our proprietary tools offer a competitive edge, diversifying our tech stack can provide a safety net against unforeseen disruptions. Partnering with leading tech providers or exploring open-source solutions can enhance resilience and adaptability.

2. Global Expansion Strategy: To address our geographic concentration weakness, a phased approach to entering emerging markets should be devised. This includes market research, localization strategies, and forming local alliances to ensure a smooth transition.

3. Investment in Continuous Learning: With the rapid evolution of technology and market dynamics, investing in regular training programs for our teams is crucial. This not only addresses the challenges of data overload but ensures our strategies remain relevant and cutting-edge.

4. Strengthen Cybersecurity Framework: To combat the looming threat of cyberattacks, a comprehensive review and overhaul of our cybersecurity protocols are needed. Collaborating with leading cybersecurity firms can provide the expertise and tools required to fortify our defenses.

5. Stakeholder Communication Portal: Creating a dedicated portal for stakeholders can streamline communication, provide real-time data access, and serve as a platform for feedback and collaboration. This portal could integrate AR capabilities for immersive data visualization, enhancing stakeholder engagement.

6. Sustainability-Driven Marketing: Given the rising global focus on sustainability, we recommend prioritizing green marketing campaigns and investments. This not only caters to shifting consumer preferences but positions [Your Company Name] as a forward-thinking, responsible entity.

7. Proactive Regulatory Engagement: Instead of reactively adapting to regulatory changes, the company should engage with regulatory bodies. Being part of the conversation ensures that we have a say in shaping policies and are better prepared for upcoming changes.

By adopting these recommendations, [Your Company Name] can reinforce its position as an industry leader, drive meaningful engagement with its stakeholders, and navigate the complexities of the future with confidence and vision.

Conclusion

While [Your Company Name] has showcased strength in the domain of marketing financial management, it's crucial to address our inherent weaknesses and be vigilant about potential threats. The evolving market landscape offers numerous opportunities that can be tapped into with the right strategies.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize financial management strategies with Template.net's Marketing SWOT Analysis on Financial Management Template. This editable and customizable tool facilitates in-depth assessment of strengths, weaknesses, opportunities, and threats. Easily tailor analysis using our Ai Editor Tool to align with your objectives. Enhance financial decision-making with precision and efficiency.