Free Business Review Report

I. Introduction

This Business Review Report provides a comprehensive assessment of the financial status and performance of [Your Company Name] for the fiscal year ending December 31, 2060. The purpose of this report is to deliver an in-depth analysis of our financial health, evaluate key performance metrics, and offer strategic recommendations to enhance our financial management and strategic decision-making.

II. Executive Summary

The Executive Summary provides a high-level overview of the company’s financial performance, highlighting significant achievements and areas requiring attention.

Key Highlights

Revenue Growth: [Your Company Name] experienced a revenue growth of 15% year-over-year, reaching a total revenue of $150 million in 2060.

Net Profit Margin: The net profit margin improved to 12% from 10% in the previous year.

Operating Expenses: Operating expenses increased by 8% due to expanded operational activities.

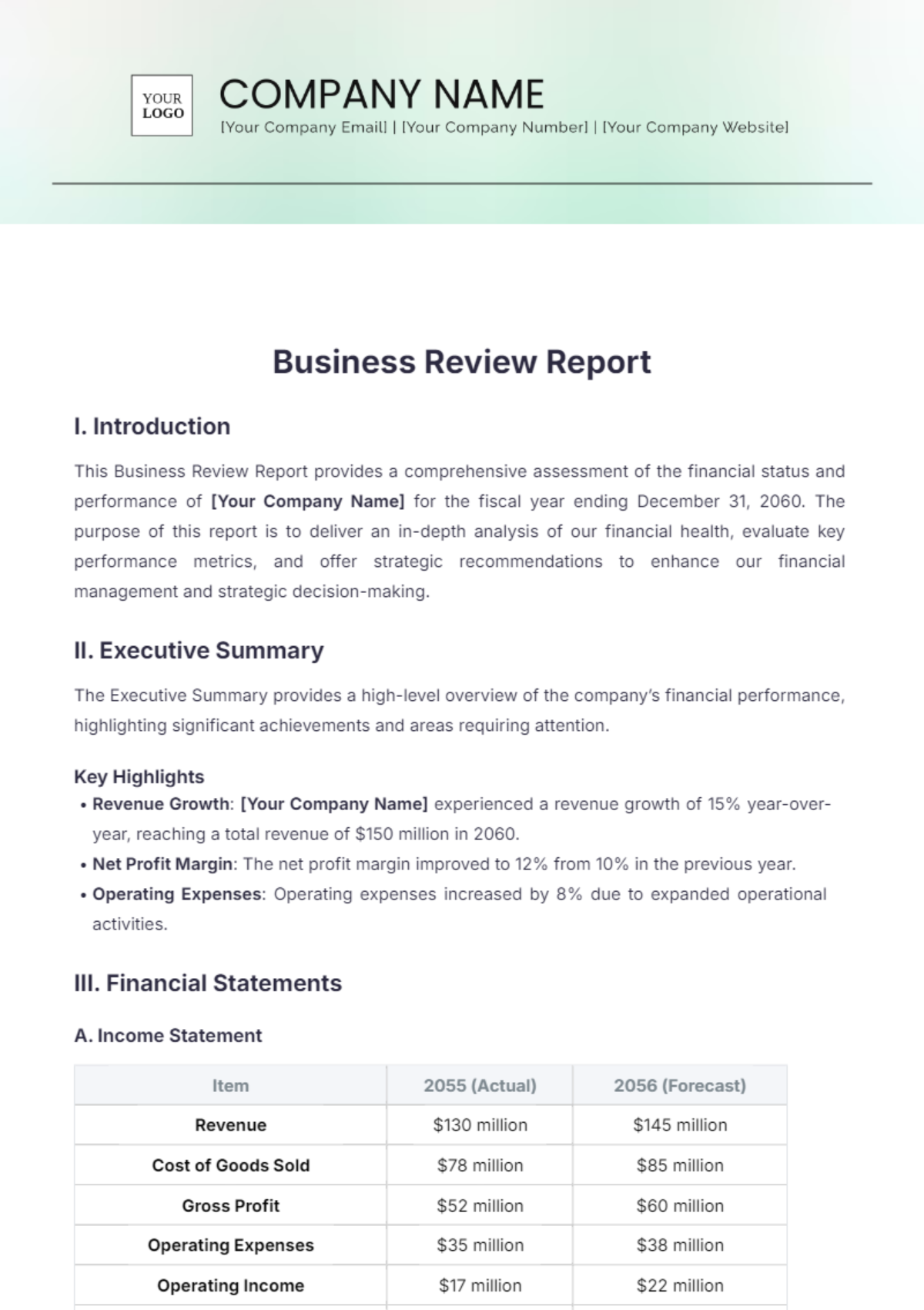

III. Financial Statements

A. Income Statement

Item | 2055 (Actual) | 2056 (Forecast) |

|---|---|---|

Revenue | $130 million | $145 million |

Cost of Goods Sold | $78 million | $85 million |

Gross Profit | $52 million | $60 million |

Operating Expenses | $35 million | $38 million |

Operating Income | $17 million | $22 million |

Other Income/Expenses | $1 million | $1 million |

Net Income Before Taxes | $18 million | $23 million |

Income Tax Expense | $6 million | $7 million |

Net Income | $12 million | $16 million |

B. Balance Sheet

Assets

Item | December 31, 2060 | December 31, 2059 |

|---|---|---|

Current Assets | $60 million | $55 million |

Non-Current Assets | $100 million | $90 million |

Total Assets | $160 million | $145 million |

Liabilities

Item | December 31, 2060 | December 31, 2059 |

|---|---|---|

Current Liabilities | $30 million | $28 million |

Long-Term Liabilities | $40 million | $35 million |

Total Liabilities | $70 million | $63 million |

Equity

Item | December 31, 2060 | December 31, 2059 |

|---|---|---|

Shareholder Equity | $90 million | $82 million |

Total Liabilities and Equity | $160 million | $145 million |

C. Cash Flow Statement

Item | 2055 (Actual) | 2056 (Forecast) |

|---|---|---|

Cash Flow from Operations | $20 million | $25 million |

Cash Flow from Investing Activities | -$15 million | -$18 million |

Cash Flow from Financing Activities | $10 million | $12 million |

Net Increase in Cash | $15 million | $19 million |

Cash at Beginning of Year | $25 million | $40 million |

Cash at End of Year | $40 million | $59 million |

IV. Key Performance Indicators (KPIs)

A. Profitability Ratios

Ratio | 2055 | 2056 (Forecast) |

|---|---|---|

Gross Margin | 40% | 41% |

Operating Margin | 13% | 15% |

Net Profit Margin | 12% | 14% |

B. Liquidity Ratios

Ratio | 2055 | 2056 (Forecast) |

|---|---|---|

Current Ratio | 2.0 | 2.1 |

Quick Ratio | 1.5 | 1.6 |

C. Solvency Ratios

Ratio | 2025 | 2026 (Forecast) |

|---|---|---|

Debt to Equity Ratio | 0.77 | 0.76 |

Interest Coverage Ratio | 3.0 | 3.2 |

V. Analysis of Results

The financial performance of [Your Company Name] in 2060 reflects a solid growth trajectory with a notable increase in revenue and net income. The improved profit margins and efficient management of operating expenses underscore the company's strong financial position. However, the increase in operating expenses suggests the need for ongoing monitoring to maintain cost efficiency.

VI. Challenges and Risks

Increased Competition: Intensified competition may pressure profit margins and market share.

Economic Fluctuations: Potential economic downturns could impact revenue and overall financial stability.

Operational Costs: Rising costs in operational activities may affect profitability if not managed effectively.

VII. Recommendations

Cost Control: Implement strategies to control rising operational costs and enhance cost efficiency.

Diversification: Explore opportunities for market diversification to mitigate risks associated with economic fluctuations.

Investment in Technology: Invest in advanced technologies to streamline operations and improve productivity.

VIII. Conclusion

The financial analysis for 2060 demonstrates that [Your Company Name] is on a positive trajectory with strong financial performance. Continued focus on managing costs and strategic investments will be essential to sustaining growth and achieving long-term financial objectives.

For further details, please contact us at:

Email: [Your Company Email]

Address: [Your Company Address]

Phone: [Your Company Number]

Website: [Your Company Website]

Social Media: [Your Company Social Media]

Review Prepared by: [Your Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance your business analysis with the Business Review Report Template from Template.net. This customizable, downloadable, and printable template ensures a structured approach to your business reviews. Editable in our AI Editor Tool, it provides a clear framework for organizing performance metrics, insights, and recommendations. Optimize your reporting process with this essential template.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report