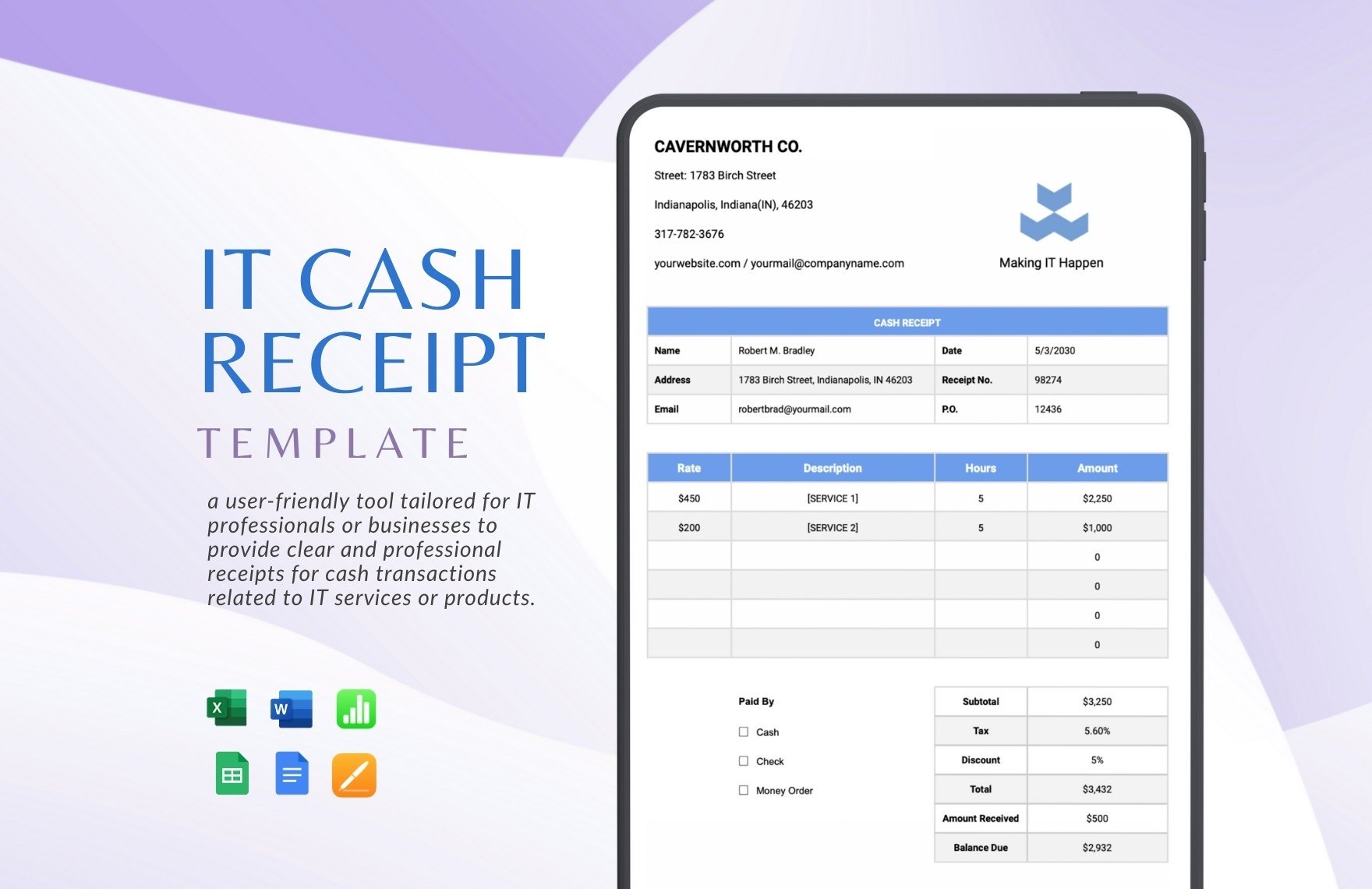

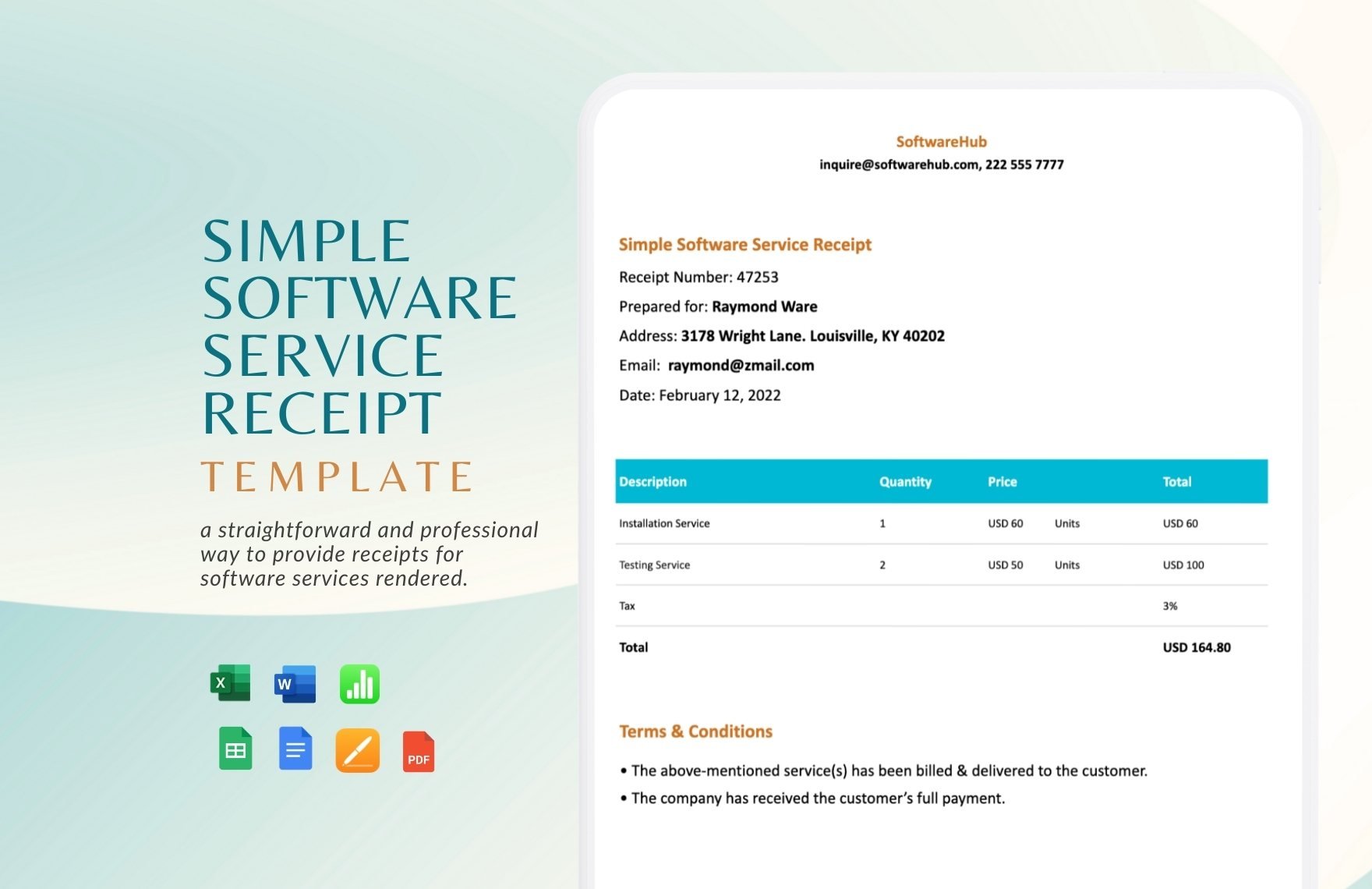

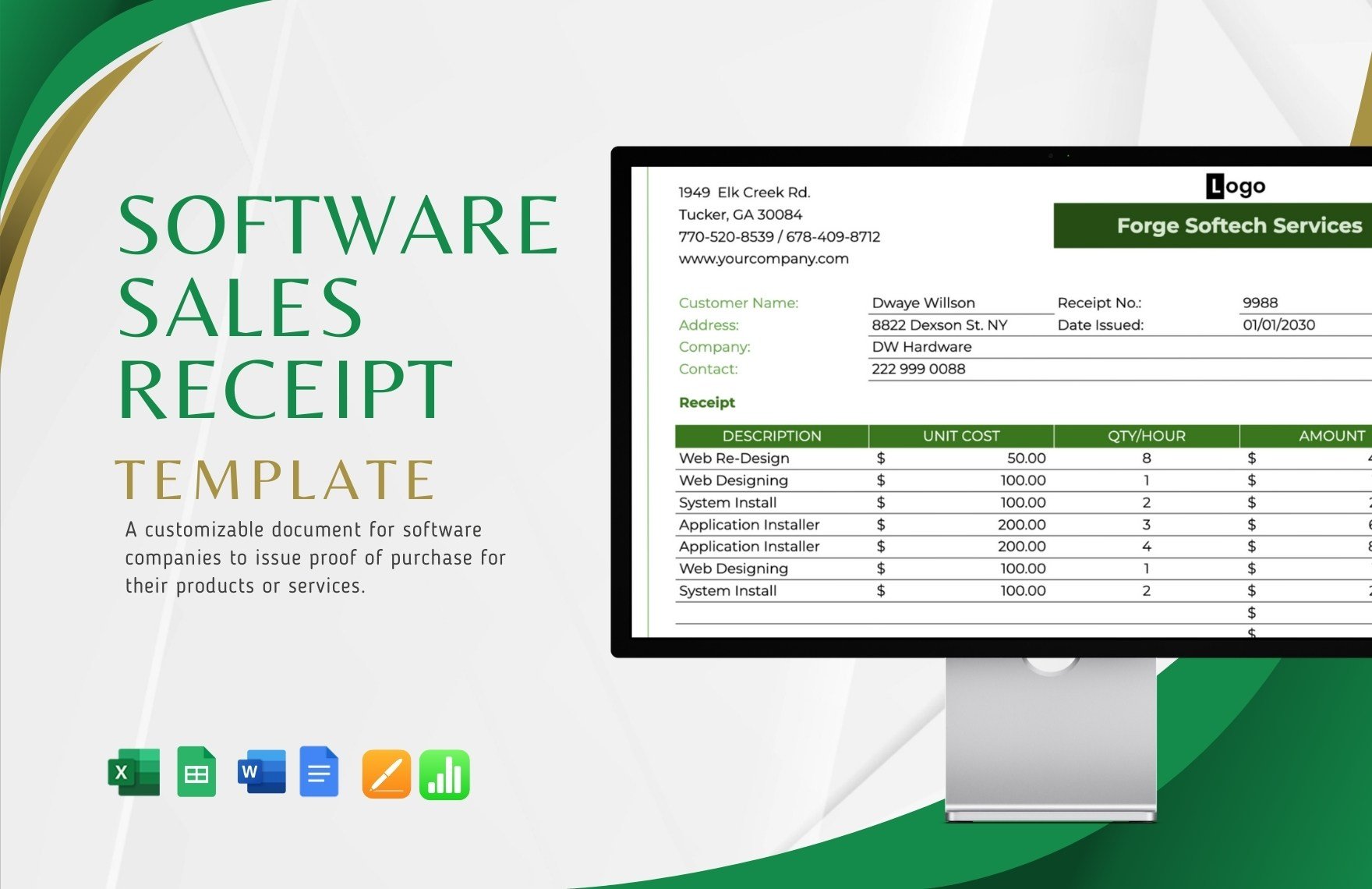

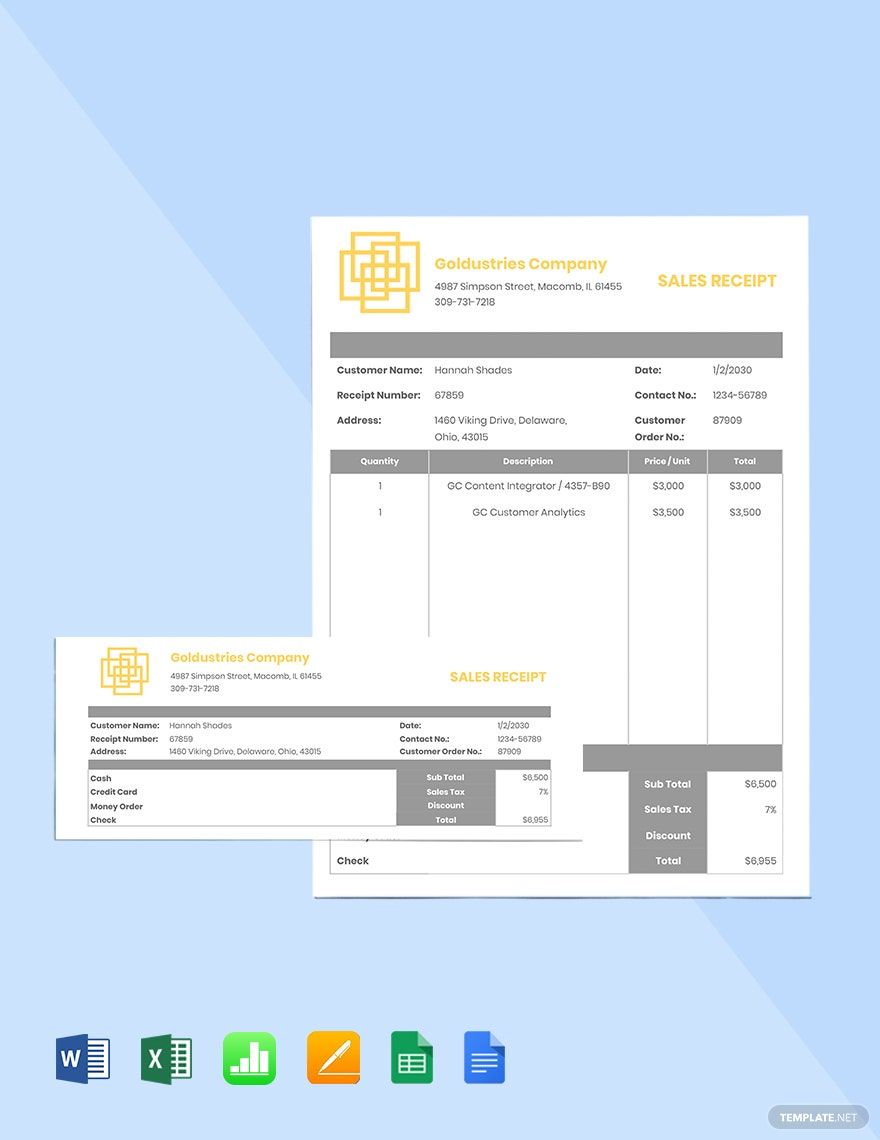

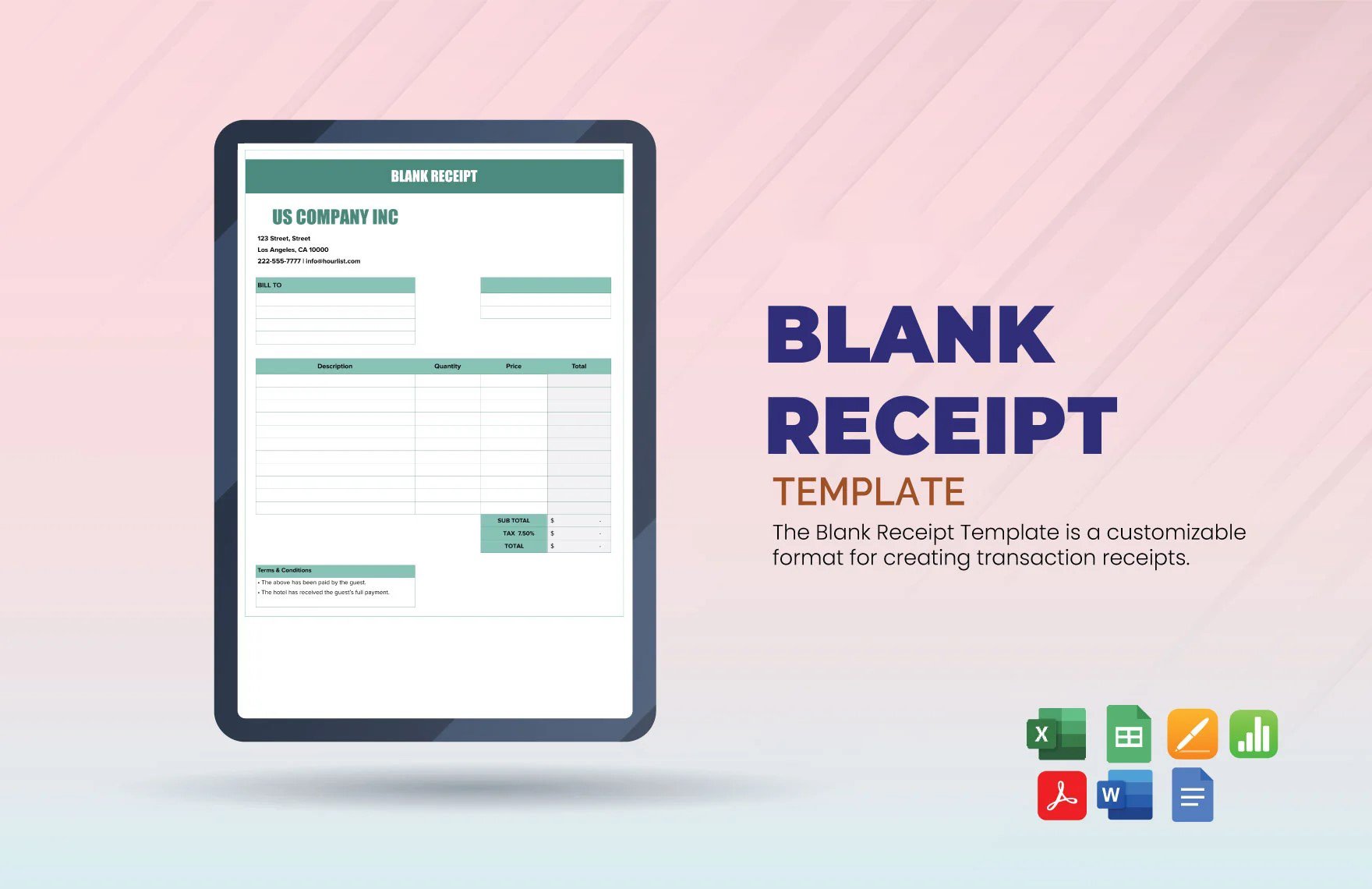

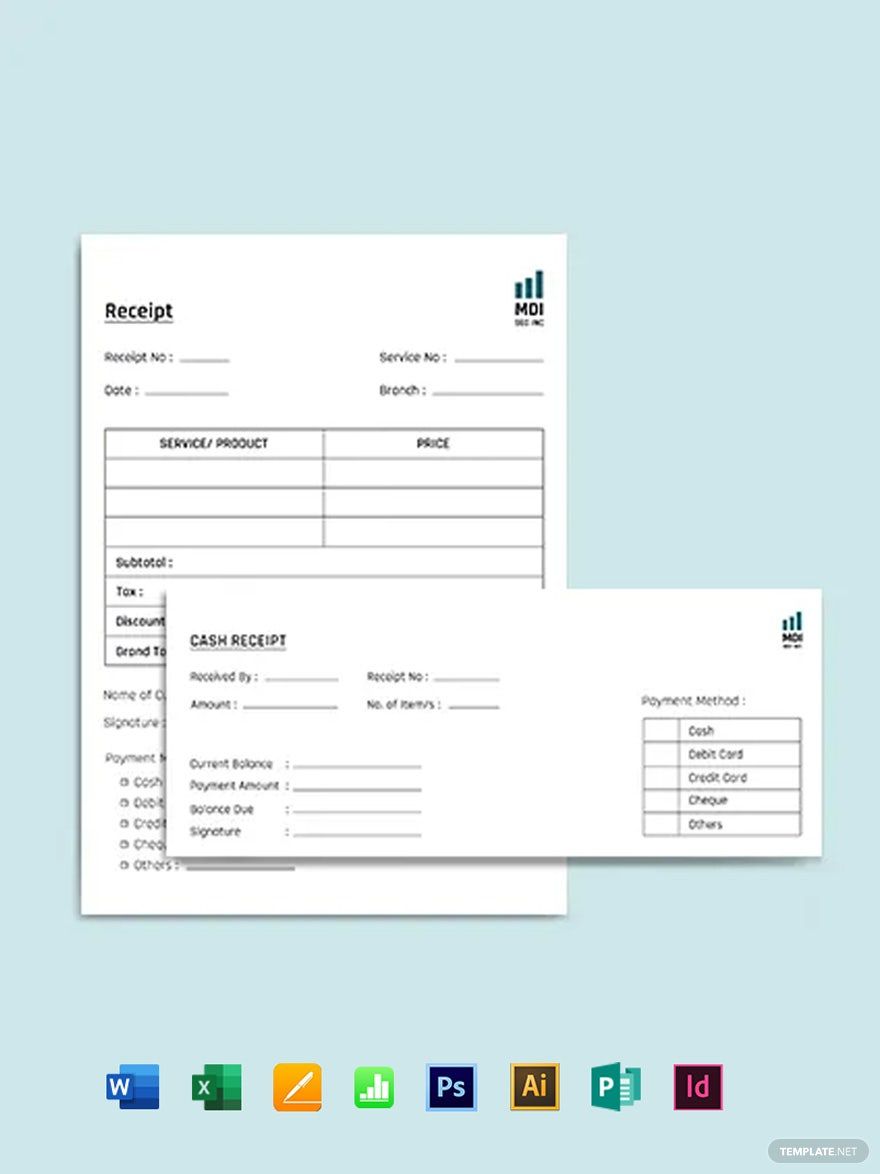

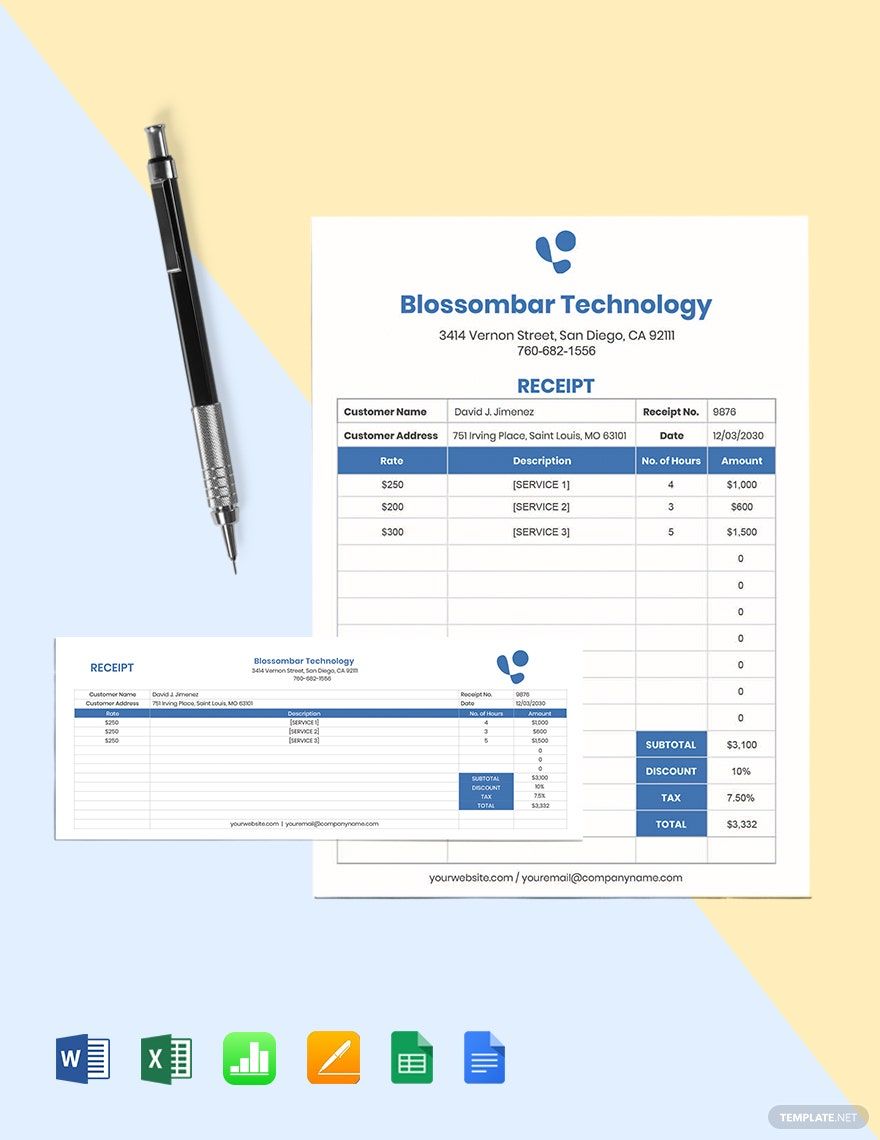

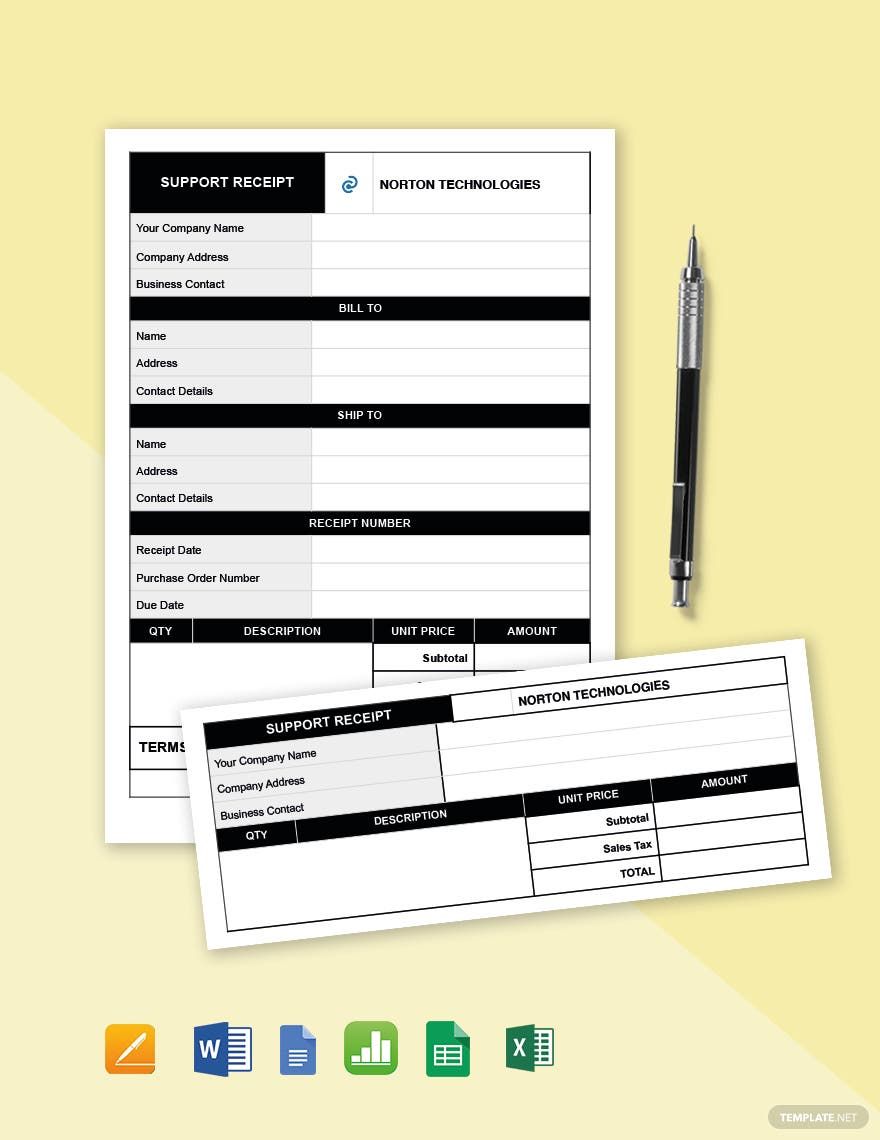

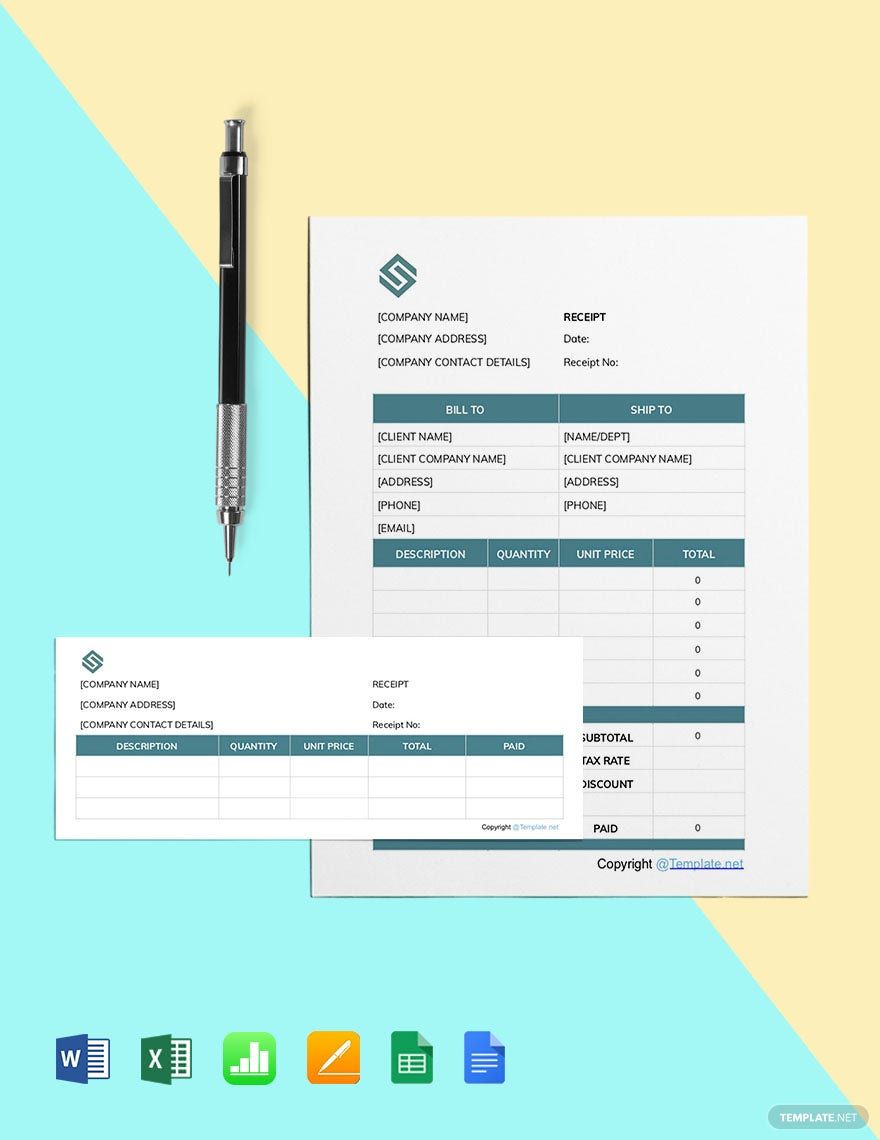

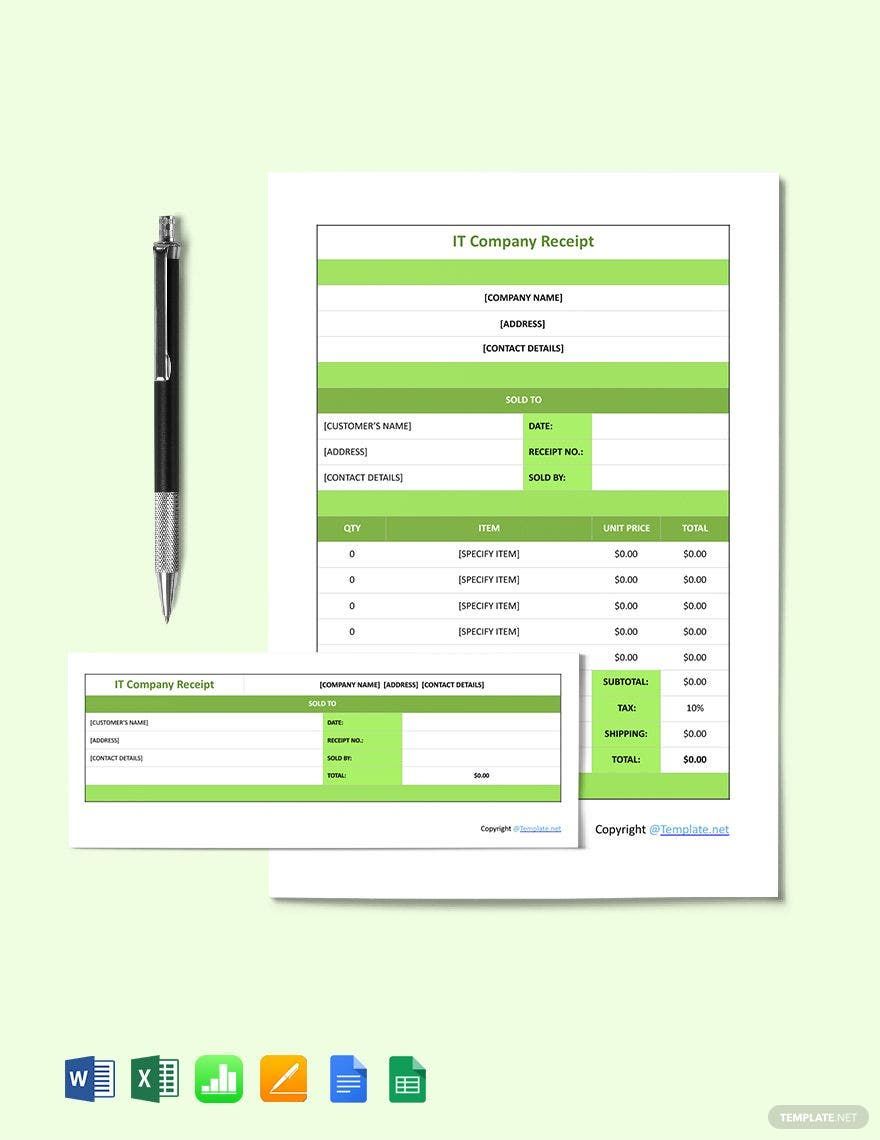

Accounting is an essential part of any business; it helps to track and record costs, expenses, revenue, bills, etc. Tracking these expenditures helps the business to grow. A vital part of accounting is receipts that itemize customer purchases, which is critical for keeping track of transactions. If you need this document for your business, we have a collection of IT/SW Receipt Templates ready to cater to you. The templates contain all the essential headers that you and your customers would like to see in it. They are easily editable, customize, and printable too. Having them will save your time and effort from making it yourself from scratch. They are also available in different file formats like Microsoft Word, Apple Pages, Google Docs, Apple Numbers, Microsoft Excel, and Google Sheets. Do not ponder any more and get these now. Subscribe now to start downloading!

How to Make an IT/SW Receipt?

Word of mouth is not enough proof for the completion of transactions, and one can't deny the fact that receipts are credible proof of purchase. In fact, back in 7500 BC in Jericho, a ball of clay was given to represent the completion of a trade. From there, the significance of receipts was forged to what it is today. If you want to create a receipt for your IT/SW business, we have provided easy tips that you can refer to below.

1. Note the Essential Information

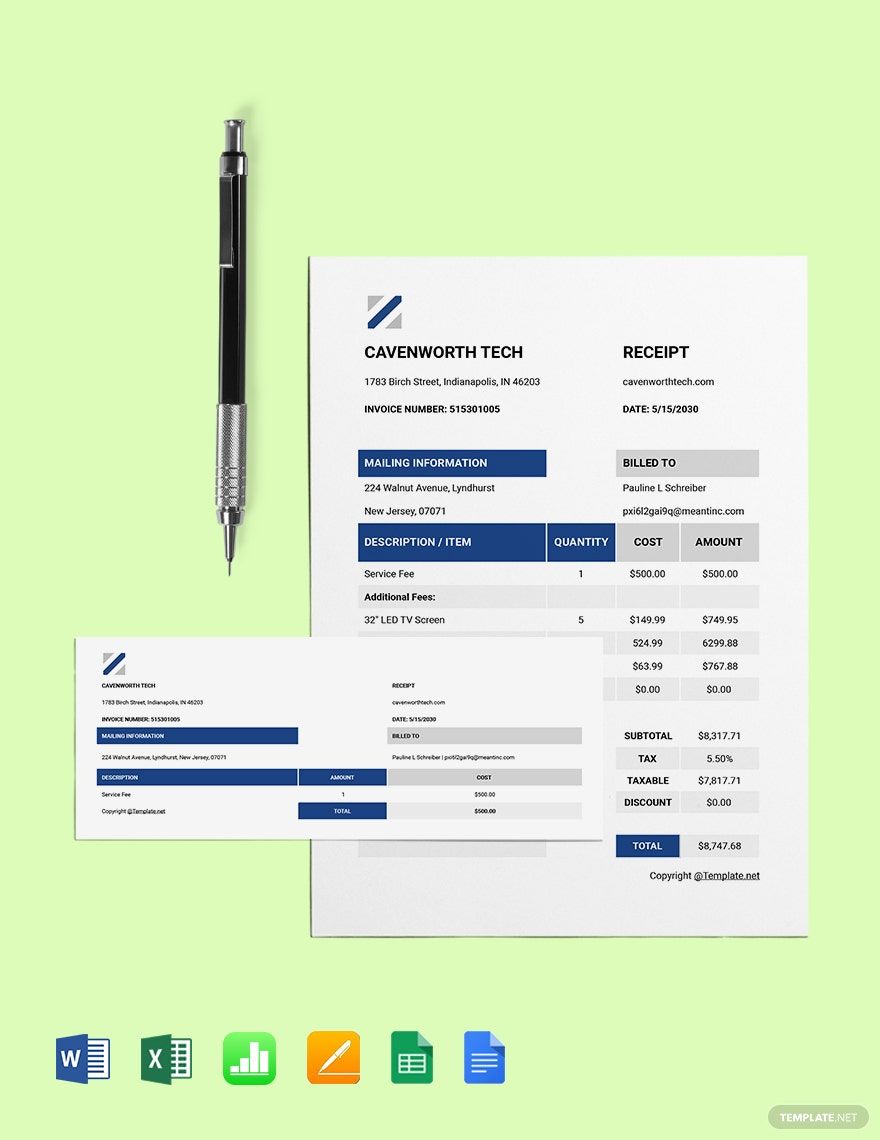

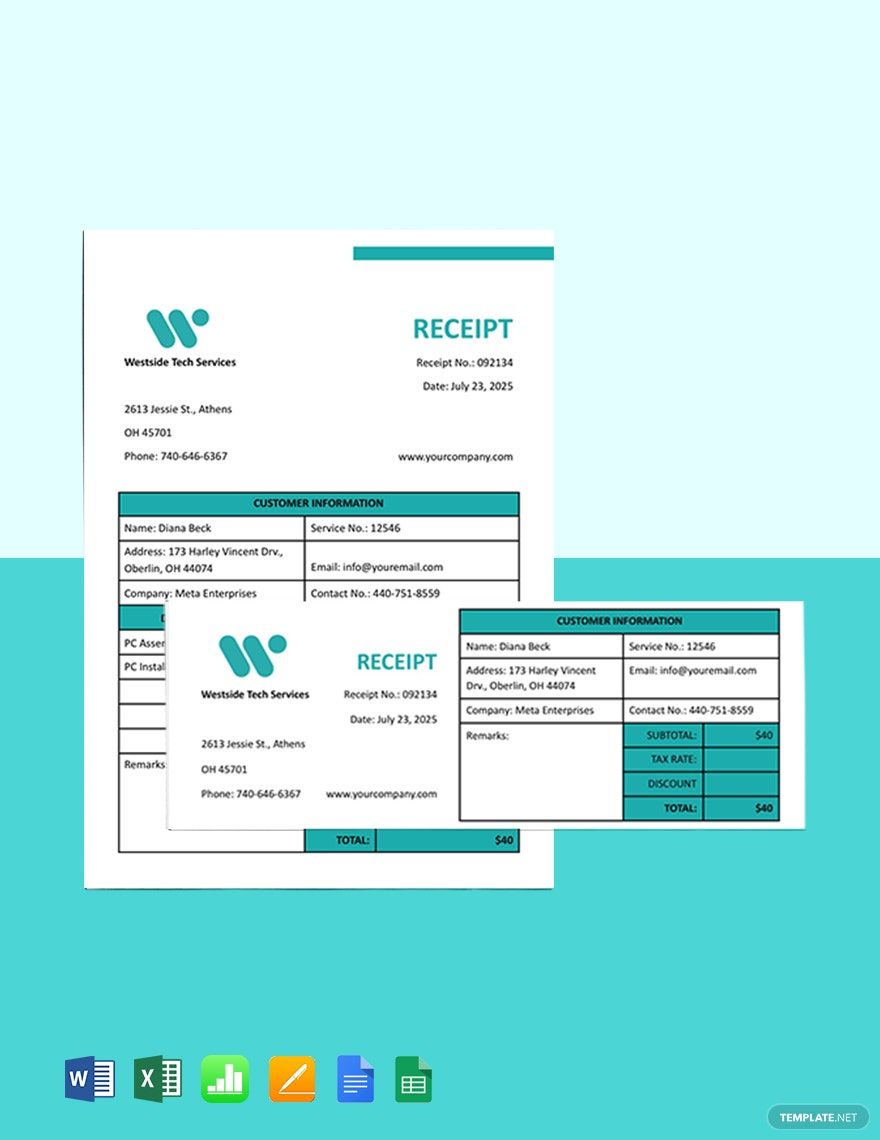

Receipts help in recording all the payment details for each transaction, but for recordkeeping, to be accurate you need all the essential information in your receipt. Determine what information per transaction is important, e.g., name of customer, number and types of items purchase, the amount for each item and total, etc.

2. Decide on a Layout

A receipt can either be in a portrait or landscape layout. You have to determine which layout is best to use to ensure you can include all the information you need in your receipt. You can test each layout to identify what is the better option for your needs.

3. Incorporate Recordkeeping Features

The primary purpose of a receipt is for accounting and recordkeeping. Hence, the importance of ensuring your receipts has recordkeeping features. Your cash receipts can have a unique receipt number, billing number, item SKU/UPC, special codes, etc. to ensure the accuracy of all your receipts and records.

4. Include Company Branding

Aside from recordkeeping, your receipt is also an excellent marketing tool. By incorporating your company branding in the payment receipt, your customers can provide reliable recommendations to other potential customers. You can include your company name, address, contact information, signs, logo, etc.