Free Financial Investment Report

Fiscal Year: [2050]

Prepared By: [Your Name]

Date: [Month, Day, Year]

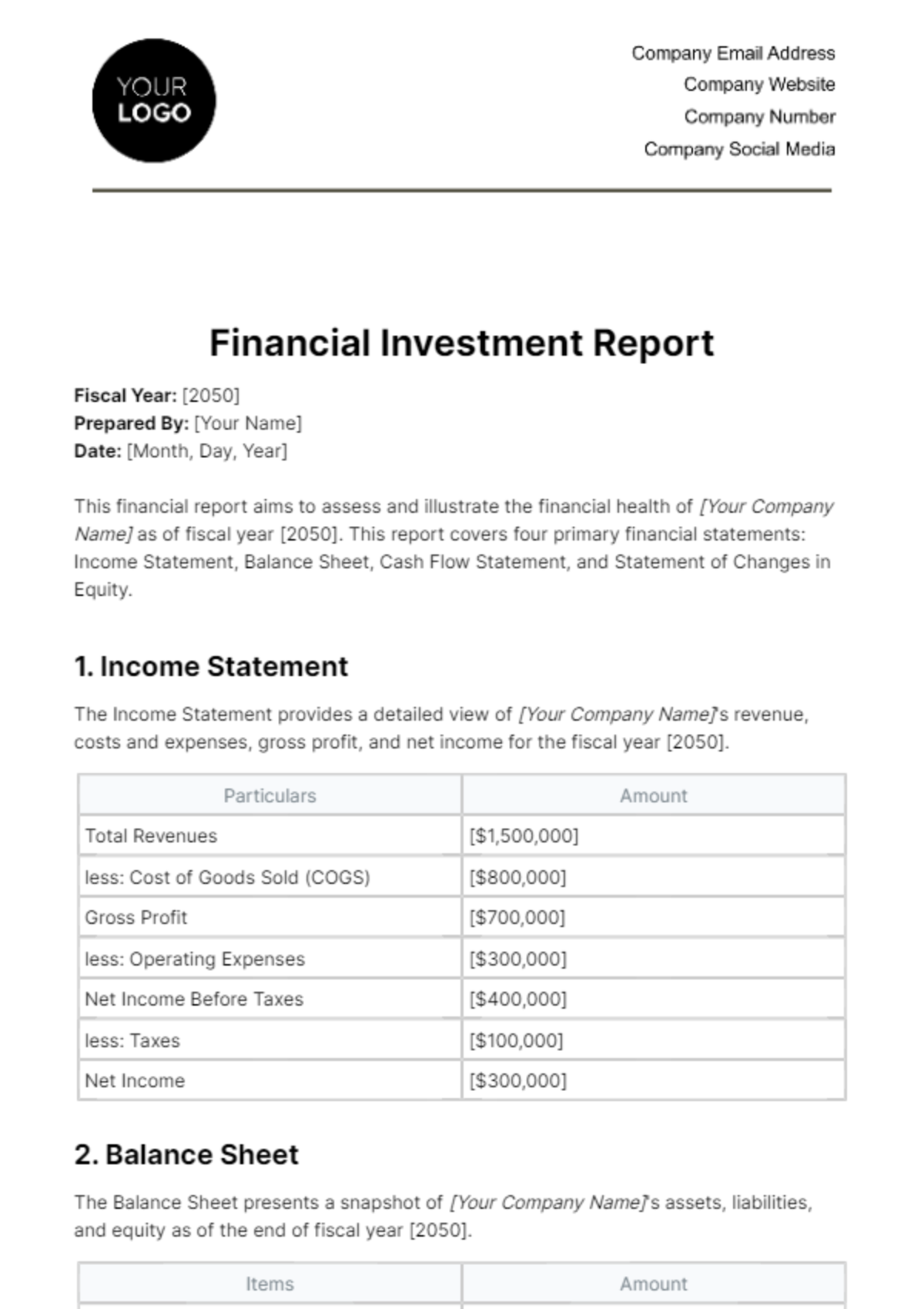

This financial report aims to assess and illustrate the financial health of [Your Company Name] as of fiscal year [2050]. This report covers four primary financial statements: Income Statement, Balance Sheet, Cash Flow Statement, and Statement of Changes in Equity.

1. Income Statement

The Income Statement provides a detailed view of [Your Company Name]'s revenue, costs and expenses, gross profit, and net income for the fiscal year [2050].

Particulars | Amount |

|---|---|

Total Revenues | [$1,500,000] |

less: Cost of Goods Sold (COGS) | [$800,000] |

Gross Profit | [$700,000] |

less: Operating Expenses | [$300,000] |

Net Income Before Taxes | [$400,000] |

less: Taxes | [$100,000] |

Net Income | [$300,000] |

2. Balance Sheet

The Balance Sheet presents a snapshot of [Your Company Name]'s assets, liabilities, and equity as of the end of fiscal year [2050].

Items | Amount |

|---|---|

Total Assets | [$2,000,000] |

Total Liabilities | [$1,000,000] |

Owners’ Equity | [$1,000,000] |

3. Cash Flow Statement

The Cash Flow Statement shows the inflow and outflow of cash within [Your Company Name] during the fiscal year [2050].

Categories | Amount |

|---|---|

Net Cash from Operating Activities | [$500,000] |

Net Cash from Investing Activities | [-$200,000] |

Net Cash from Financing Activities | [-$100,000] |

Net increase/decrease in Cash | [$200,000] |

4. Statement of Changes in Equity

The Statement of Changes in Equity outlines the changes in [Your Company Name]'s equity during the fiscal year [2050].

Items | Amount |

|---|---|

Opening Equity | [$900,000] |

Add: Net Income | [$300,000] |

Subtract: Dividends paid | [$200,000] |

Closing Equity | [$1,000,000] |

Conclusion

In fiscal year [2050], [Your Company Name] exhibited strong financial performance with stable profits and cash flows. The balance sheet discloses a solid financial position with a balanced mix of assets, liabilities, and equity. These figures emphasize [Your Company Name]'s effective management, strategic planning, and the ability to generate significant returns.

Therefore, [Your Company Name]'s financial health in fiscal year [2050] is positively robust, and it is well-positioned for sustainable growth in future years.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore Template.net's Financial Investment Report Template, comprehensively editable and customizable. This user-friendly template, easily efitable in our Ai Editor Tool, simplifies your financial documentation, making professionalism and precision readily accessible. Step up your reporting standards easily with us.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report