Free Real Estate Property Compliance Audit

I. Introduction

A. Purpose

The purpose of this Real Estate Property Compliance Audit is to ensure that all properties managed by [Your Company Name] comply with relevant laws, regulations, and industry standards pertaining to property management and operations. By conducting this audit, we aim to identify any areas of non-compliance and assess associated risks, ultimately enhancing our overall compliance efforts and mitigating potential legal and financial liabilities.

B. Background

[Your Company Name] operates a diverse portfolio of real estate properties, including residential, commercial, and mixed-use developments. As part of our commitment to maintaining high standards of compliance and accountability, we have initiated this audit process to evaluate our adherence to regulatory requirements and operational best practices.

II. Audit Objectives

A. Regulatory Compliance

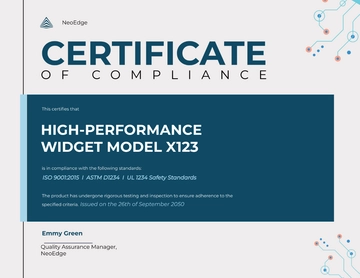

To ensure that all properties managed by [Your Company Name] comply with applicable local, state, and federal regulations, including zoning ordinances, building codes, fair housing laws, environmental regulations, and ADA accessibility standards.

B. Operational Standards

To assess the effectiveness of our property management practices, including property maintenance procedures, tenant screening processes, lease agreements, rent collection procedures, and emergency preparedness plans.

C. Risk Identification

To identify any potential areas of non-compliance and assess the associated risks, including legal and financial implications, reputational risks, and impacts on tenant satisfaction and retention.

III. Audit Criteria

A. Regulatory Compliance

Local Zoning Regulations: Evaluate compliance with local zoning ordinances and land use regulations to ensure that properties are being used in accordance with permitted uses and zoning designations.

Building Codes: Assess adherence to building codes and construction standards to verify the safety and structural integrity of buildings and facilities.

Fair Housing Act: Review policies and procedures to ensure compliance with the Fair Housing Act, including non-discriminatory practices in tenant selection and accommodation of reasonable accommodation requests.

Environmental Regulations: Verify compliance with environmental regulations, including waste management, hazardous materials handling, and pollution prevention measures.

ADA Accessibility Standards: Evaluate accessibility features and accommodations to ensure compliance with the Americans with Disabilities Act (ADA) requirements for accessibility in public accommodations.

B. Operational Standards

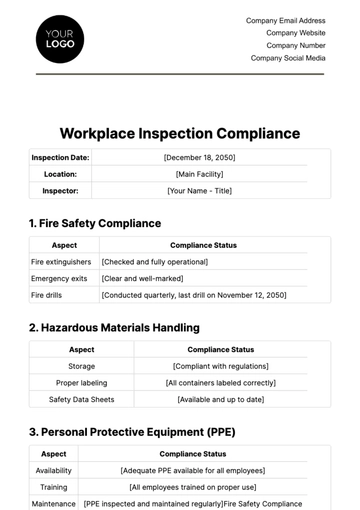

Property Maintenance: Assess the effectiveness of property maintenance programs to ensure that properties are kept in good repair and meet habitability standards.

Tenant Screening Processes: Review tenant screening procedures to ensure compliance with fair housing laws and effective screening of prospective tenants.

Lease Agreements: Evaluate lease agreements to ensure compliance with legal requirements and proper documentation of tenant rights and responsibilities.

Rent Collection Procedures: Assess rent collection processes to ensure timely and accurate collection of rent and compliance with applicable laws regarding rent increases, late fees, and eviction procedures.

Emergency Preparedness Plans: Review emergency preparedness plans to assess readiness for emergencies such as natural disasters, fires, and other unforeseen events.

IV. Audit Methodology

A. Document Review

Lease Agreements: Review lease agreements to ensure compliance with legal requirements and inclusion of necessary provisions.

Property Management Policies and Procedures: Assess the effectiveness and completeness of property management policies and procedures in ensuring compliance with regulations and operational standards.

Financial Records: Review financial records, including rent rolls, income statements, and expense reports, to assess financial management practices and compliance with accounting standards.

Maintenance Logs: Examine maintenance logs and records to assess the frequency and quality of property maintenance activities.

Inspection Reports: Review inspection reports from regulatory agencies, insurance providers, and internal inspections to identify any areas of concern or non-compliance.

B. On-Site Inspections

Physical Condition of Properties: Conduct on-site inspections to assess the physical condition of properties, including building exteriors, common areas, and individual units.

Safety and Security Measures: Evaluate the implementation of safety and security measures, such as lighting, surveillance cameras, and access control systems.

Compliance with Accessibility Standards: Verify compliance with ADA accessibility standards by inspecting facilities and amenities for accessibility features and accommodations.

Tenant Interviews: Conduct interviews with tenants to gather feedback on their living experience and assess their satisfaction with property management services and amenities.

C. Interviews with Staff

Property Managers: Interview property managers to understand their roles and responsibilities, as well as their knowledge of relevant regulations and operational procedures.

Maintenance Personnel: Interview maintenance personnel to assess their training, experience, and adherence to property maintenance protocols.

Legal Counsel (if applicable): Consult with legal counsel to review legal documents and obtain guidance on compliance issues and risk management strategies.

V. Audit Process

A. Pre-Audit Preparation

Review of Relevant Laws and Regulations: Conduct a comprehensive review of local, state, and federal laws and regulations governing property management to identify applicable requirements.

Selection of Properties for Audit: Determine the properties to be included in the audit based on factors such as size, location, property type, and risk assessment.

Notification to Property Owners and Managers: Inform property owners and managers about the upcoming audit process, including the objectives, timeline, and expectations.

B. Fieldwork

On-Site Inspections: Conduct thorough on-site inspections of selected properties to assess compliance with regulatory requirements and operational standards.

Interviews with Staff and Tenants: Interview property managers, maintenance personnel, and tenants to gather information on property management practices, maintenance procedures, and tenant relations.

Review of Documents and Records: Review lease agreements, property management policies, financial records, maintenance logs, and inspection reports to assess compliance and identify any areas of concern.

C. Analysis and Reporting

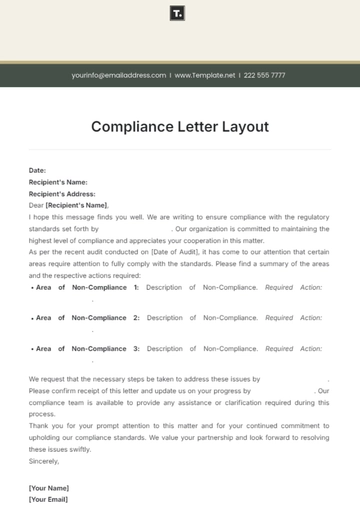

Identification of Compliance Issues: Analyze findings from on-site inspections, interviews, and document reviews to identify areas of non-compliance with regulatory requirements and operational standards.

Risk Assessment: Assess the potential risks associated with identified compliance issues, including legal, financial, reputational, and operational risks.

Development of Audit Findings Report: Prepare a comprehensive audit findings report detailing the findings, conclusions, and recommendations for corrective actions.

Presentation of Recommendations: Present the audit findings and recommendations to [Your Company Name] management and property owners/managers, emphasizing the importance of addressing identified issues and implementing corrective actions.

VI. Audit Findings

A. Regulatory Compliance

Summary of Findings: Provide an overview of compliance findings related to local zoning regulations, building codes, fair housing laws, environmental regulations, and ADA accessibility standards.

Identified Areas of Non-Compliance: Detail specific areas where properties were found to be non-compliant with regulatory requirements, including any violations or deficiencies observed during the audit.

Potential Legal and Financial Risks: Assess the potential legal and financial risks associated with identified compliance issues, including potential penalties, fines, lawsuits, and reputational damage.

B. Operational Standards

Assessment of Property Maintenance Practices: Evaluate the effectiveness of property maintenance practices in ensuring the safety, cleanliness, and habitability of properties.

Evaluation of Tenant Relations Processes: Review tenant relations processes, including tenant screening, lease agreements, and rent collection procedures, to identify areas for improvement and ensure fair and transparent tenant interactions.

Analysis of Financial Management Procedures: Assess financial management procedures, including rent collection, budgeting, and accounting practices, to ensure accuracy, transparency, and compliance with accounting standards.

VII. Recommendations

A. Immediate Corrective Actions

Remediation of Identified Compliance Issues: Implement immediate corrective actions to address any identified compliance deficiencies, such as addressing building code violations, resolving accessibility issues, and updating lease agreements to ensure compliance with fair housing laws.

Implementation of Safety Measures: Take proactive steps to enhance safety and security measures, including improving lighting, installing security cameras, and conducting safety trainings for staff and tenants.

B. Long-Term Strategies

Training and Education for Staff: Provide ongoing training and education for property management staff to ensure awareness of regulatory requirements, operational best practices, and compliance obligations.

Development of Updated Policies and Procedures: Review and update property management policies and procedures to incorporate lessons learned from the audit process, improve compliance practices, and enhance overall operational efficiency.

VIII. Conclusion

A. Summary of Audit Findings

Following a thorough audit process, several key findings have emerged regarding [Your Company Name]'s compliance with regulatory requirements and operational standards. These findings encompass both areas of compliance and areas requiring improvement, providing valuable insights into our current practices.

B. Acknowledgment of Cooperation

[Your Company Name] would like to extend sincere appreciation to the property owners, managers, and staff who contributed to the audit process through their cooperation and assistance. Your collaboration has been invaluable in ensuring the thoroughness and accuracy of our assessments.

C. Commitment to Continuous Improvement

Moving forward, [Your Company Name] remains dedicated to the pursuit of excellence in compliance practices and operational standards. We are committed to implementing the necessary corrective actions outlined in this report and to continually monitoring, evaluating, and enhancing our compliance efforts to uphold the highest standards of integrity and professionalism.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure compliance effortlessly with the Real Estate Property Compliance Audit Template from Template.net. This editable and customizable template simplifies the audit process, covering essential regulatory requirements. Easily tailor it to your needs using our Ai Editor Tool for a personalized touch. Simplify and enhance your property compliance procedures today.