Imagine having a furious client informing you they do not wish to pay for your services. As a freelancer, this is very disheartening because you've exerted effort with the provisions you've supplied. While invoices don't certainly ensure clients can pull out of a deal, these make transactions more official. Show your professionalism through streamlined products, which can result in clients taking you more seriously in terms of bills payment. So, explore from our stack of ready-made Freelancer Invoice Templates to help you. These are printable, easy to edit, and guaranteed effective and reliable. You're sure-fire to get paid, so download any of our templates now!

How to Create a Freelancer Invoice?

Clients who don't pay the right amount is a nightmare to any business, especially for independent workers like freelancers. ZipRecruiter's 2019 study found that freelancers can earn an average of $58,032 if they worked at least 36 hours a week. And for a freelancer to quickly request the client's payment, he or she must send an invoice.

A freelance invoice is a document that contains a deliberate description of a client's bill. A freelancer can use it to record and track every transaction with a client.

The tips below will surely help you create a proper freelance invoice. Check them out now below.

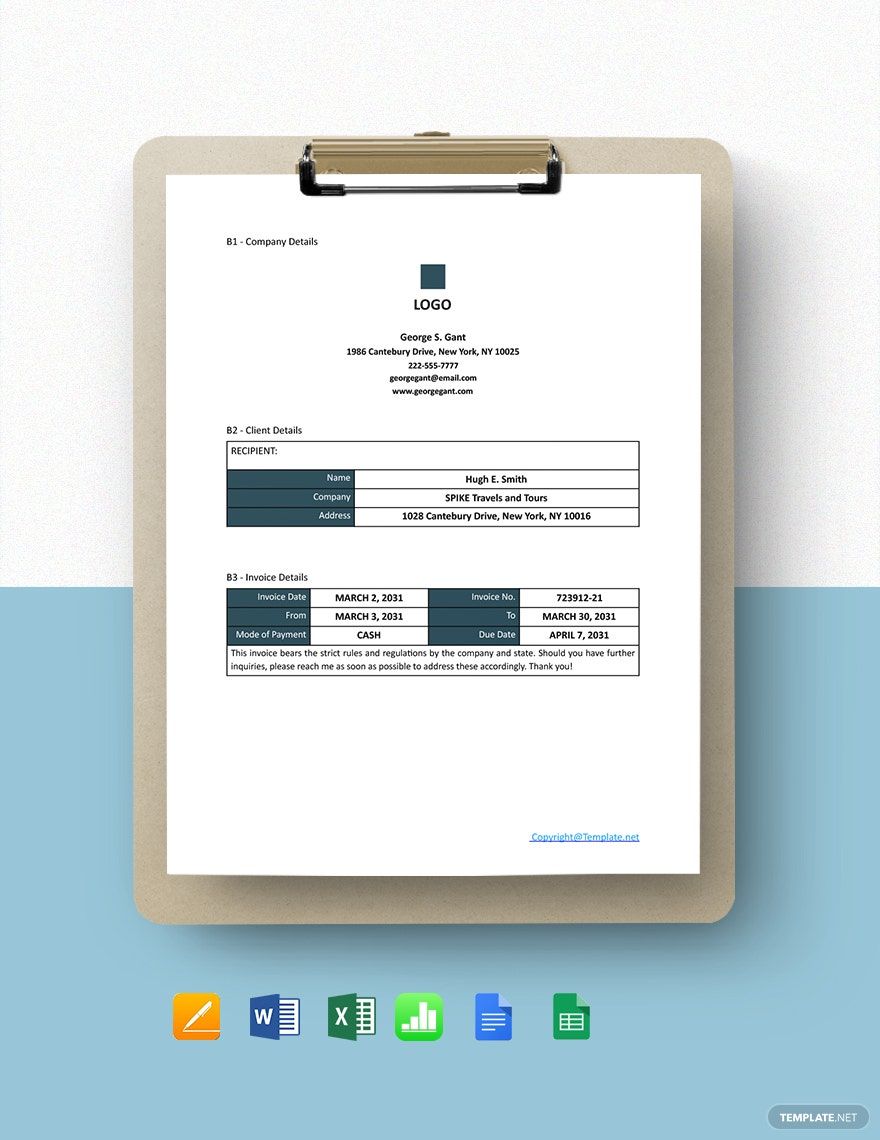

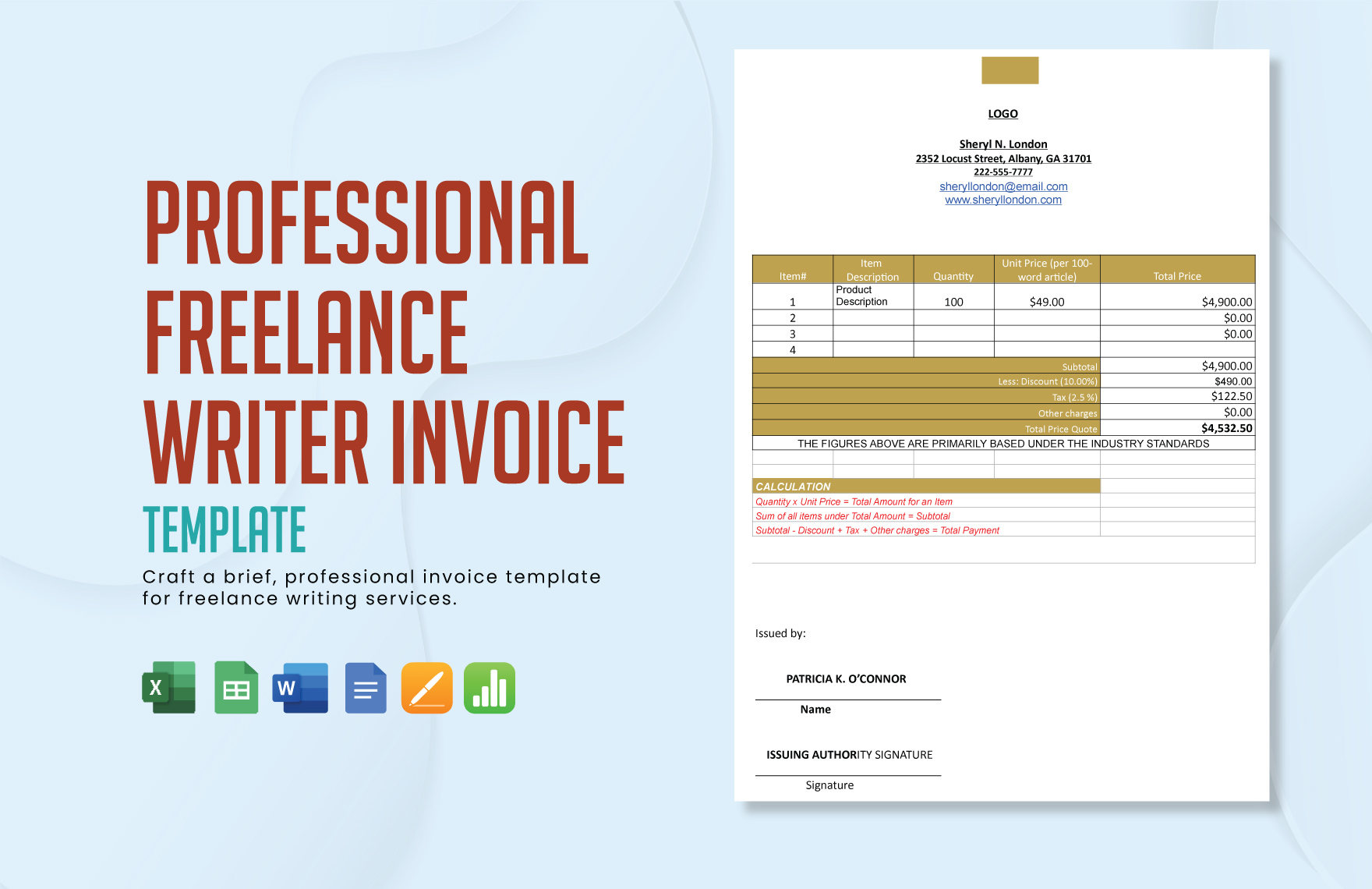

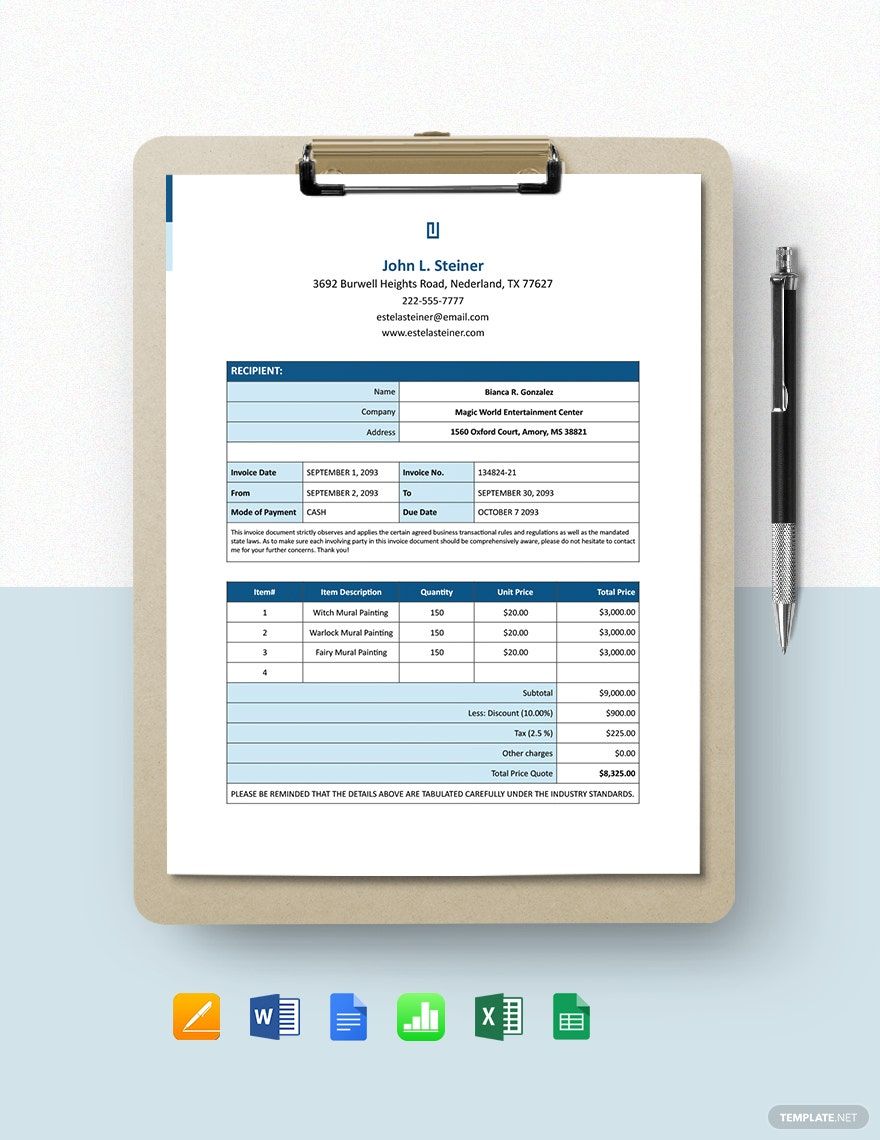

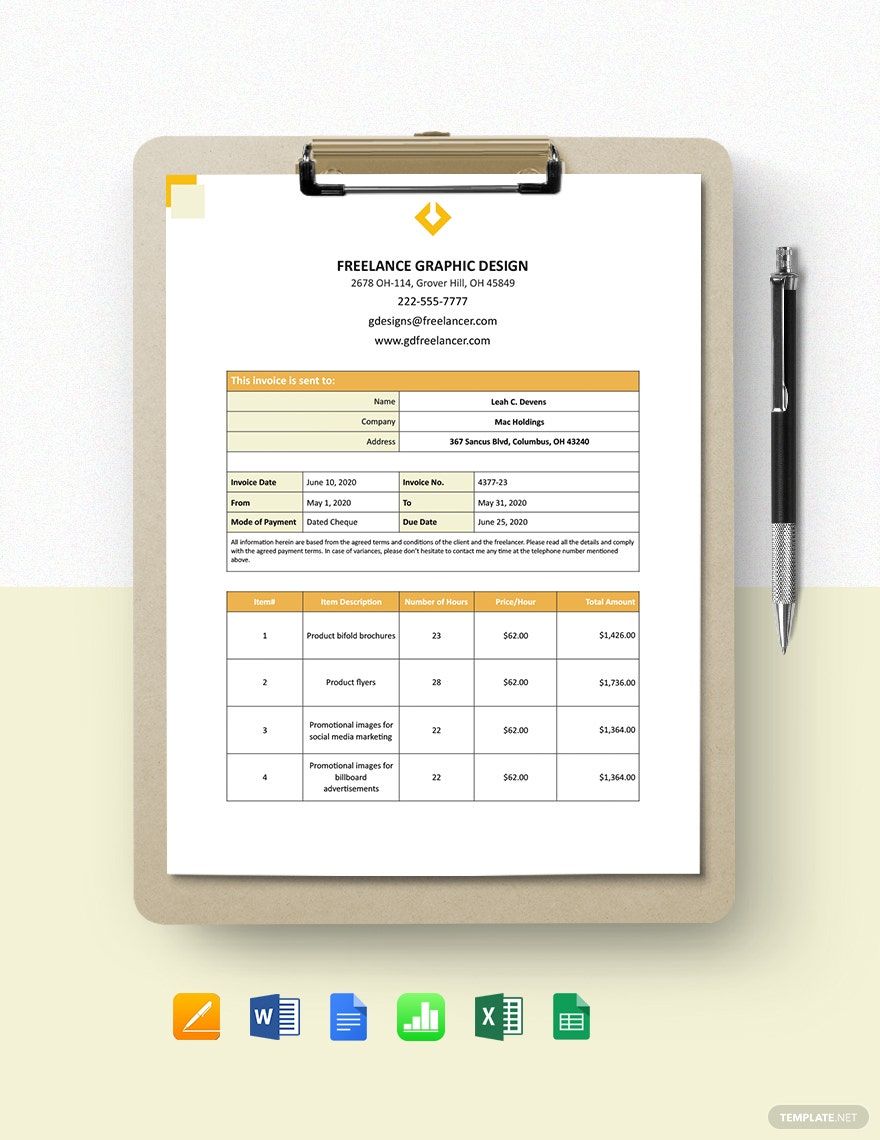

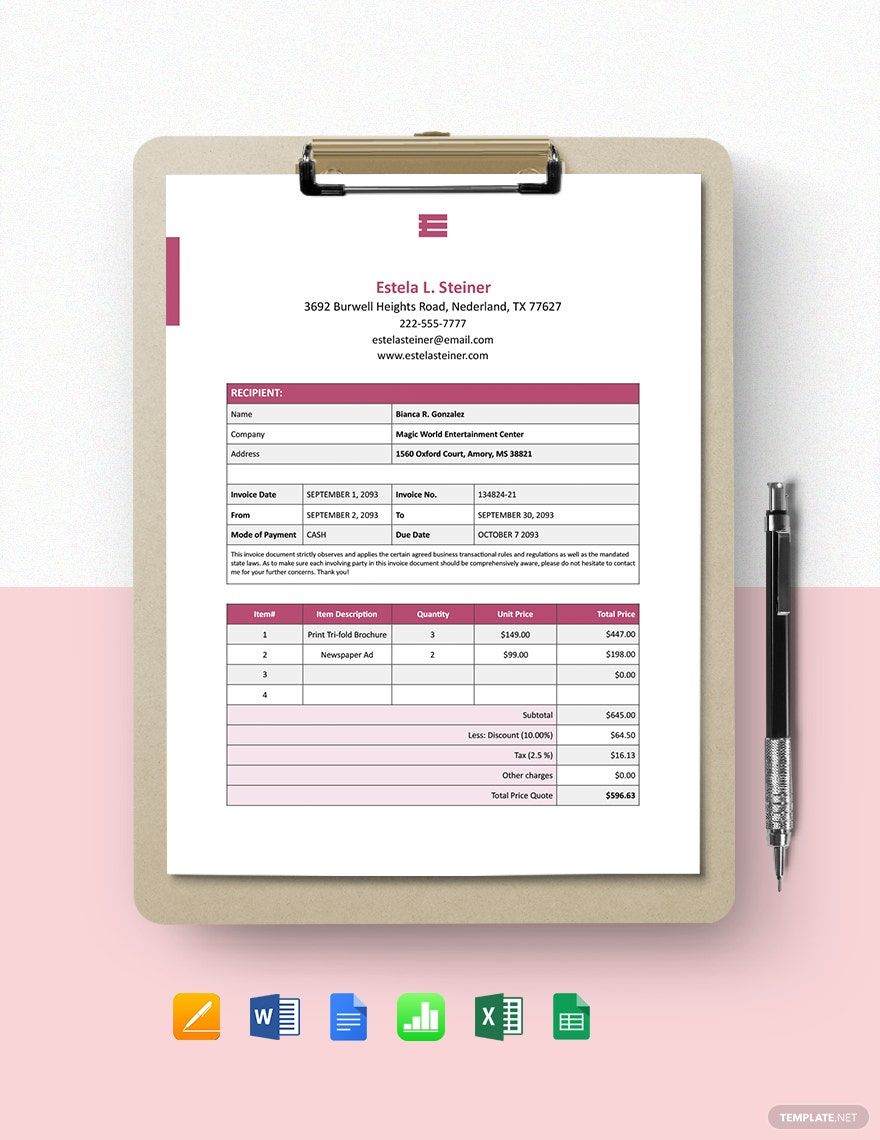

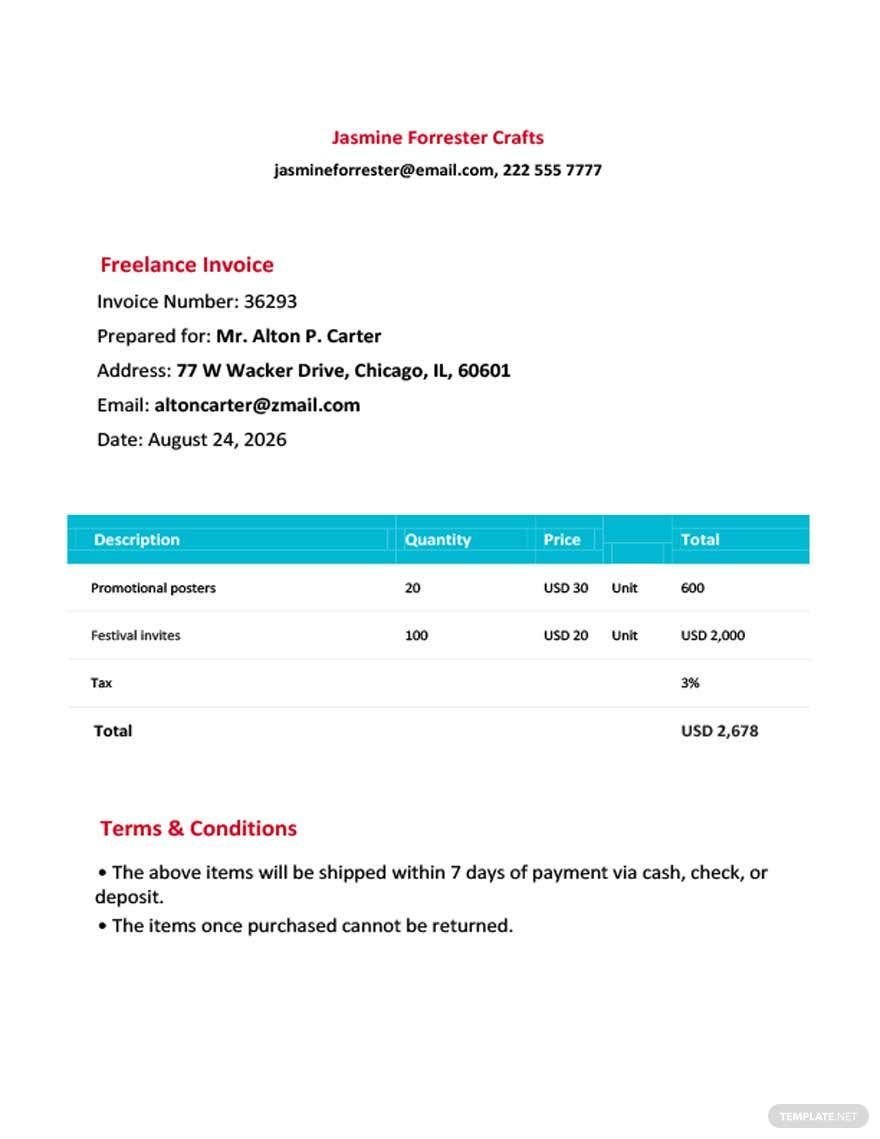

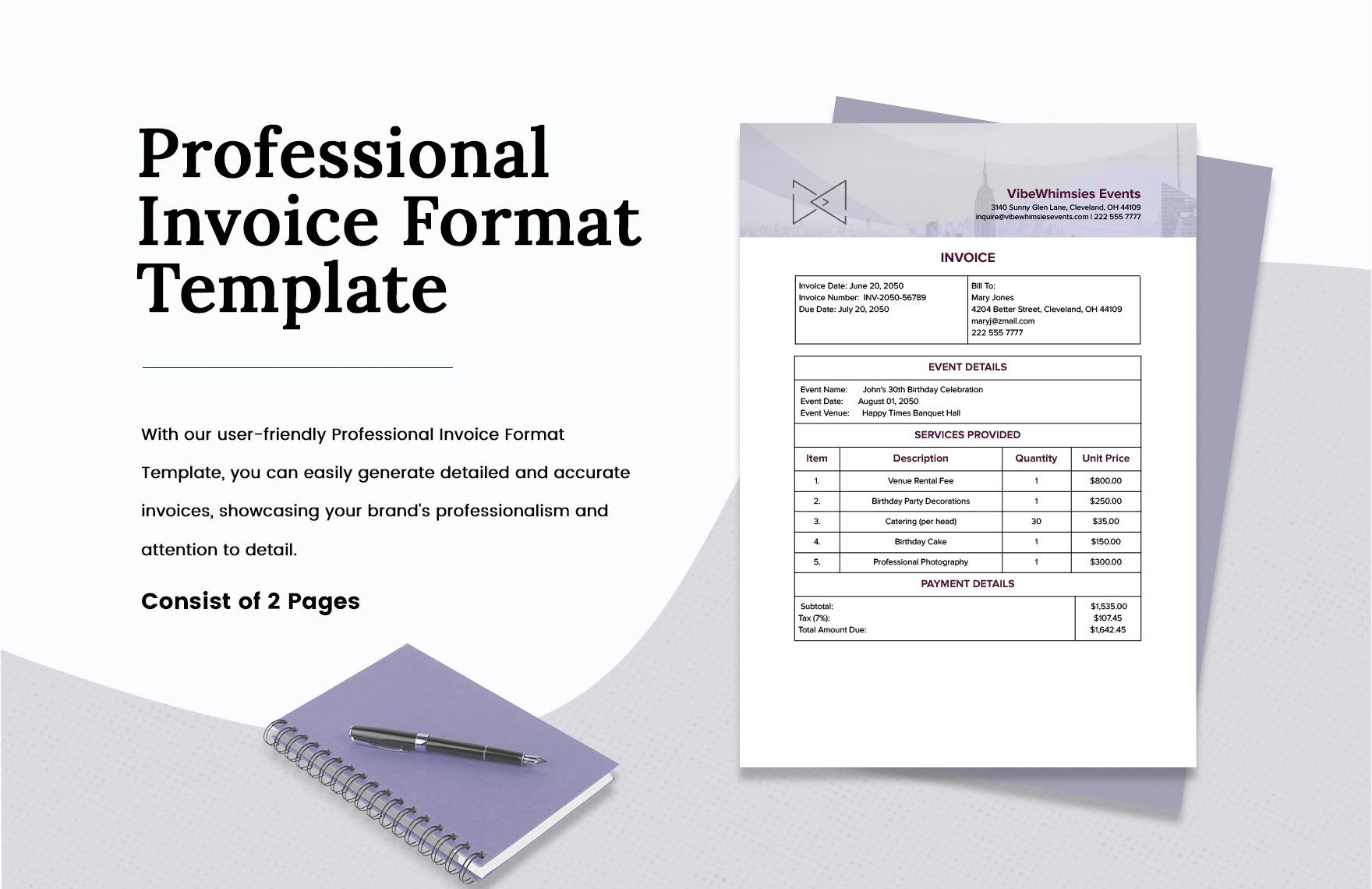

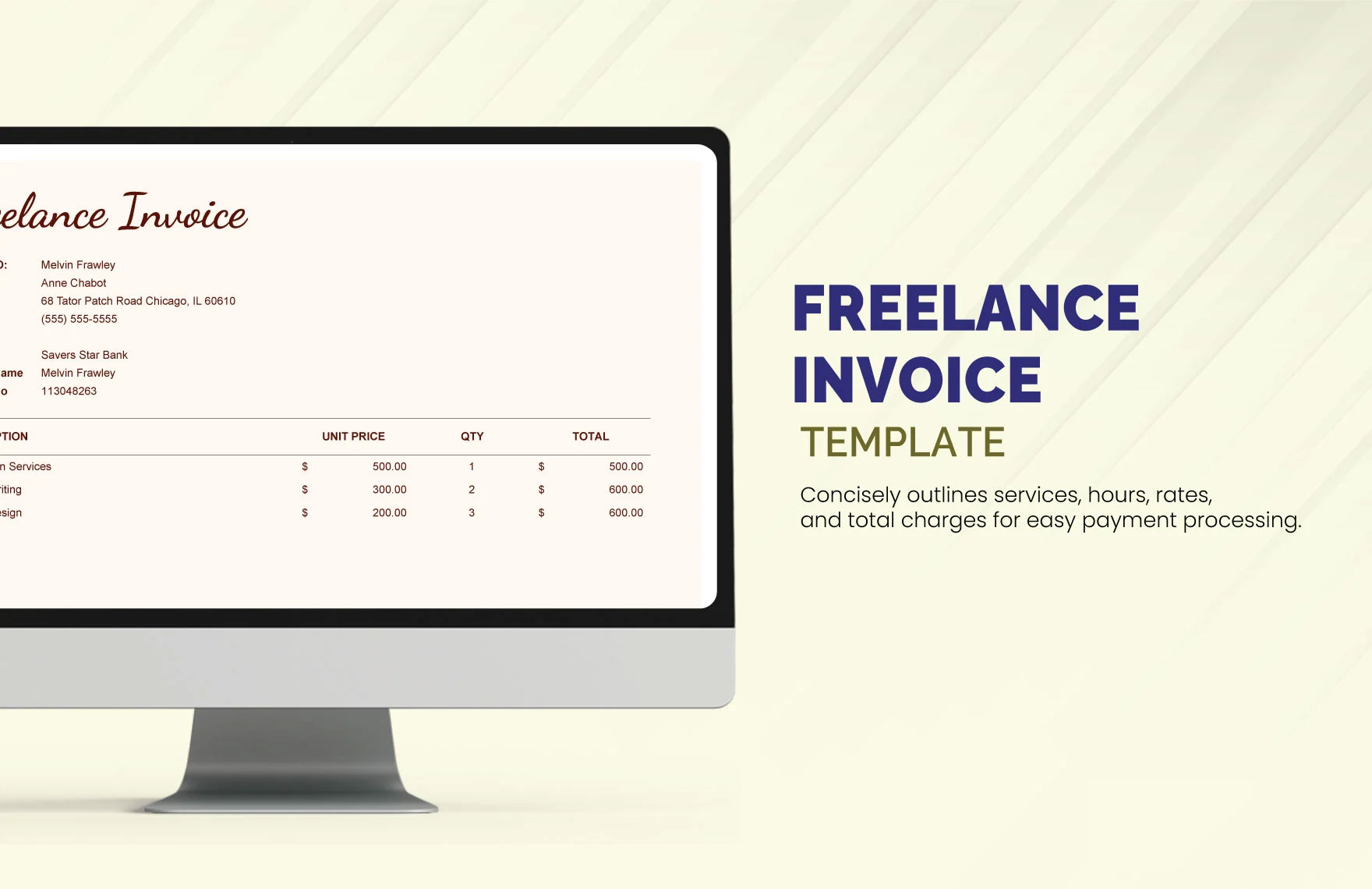

1. Showcase Your Letterhead

Place your letterhead

at the top of your invoice. A professionally made one guarantees a good impression to clients and represents you as a freelancer. Having this visible also lets your clients contact you should there be any discrepancies needed to iron out.

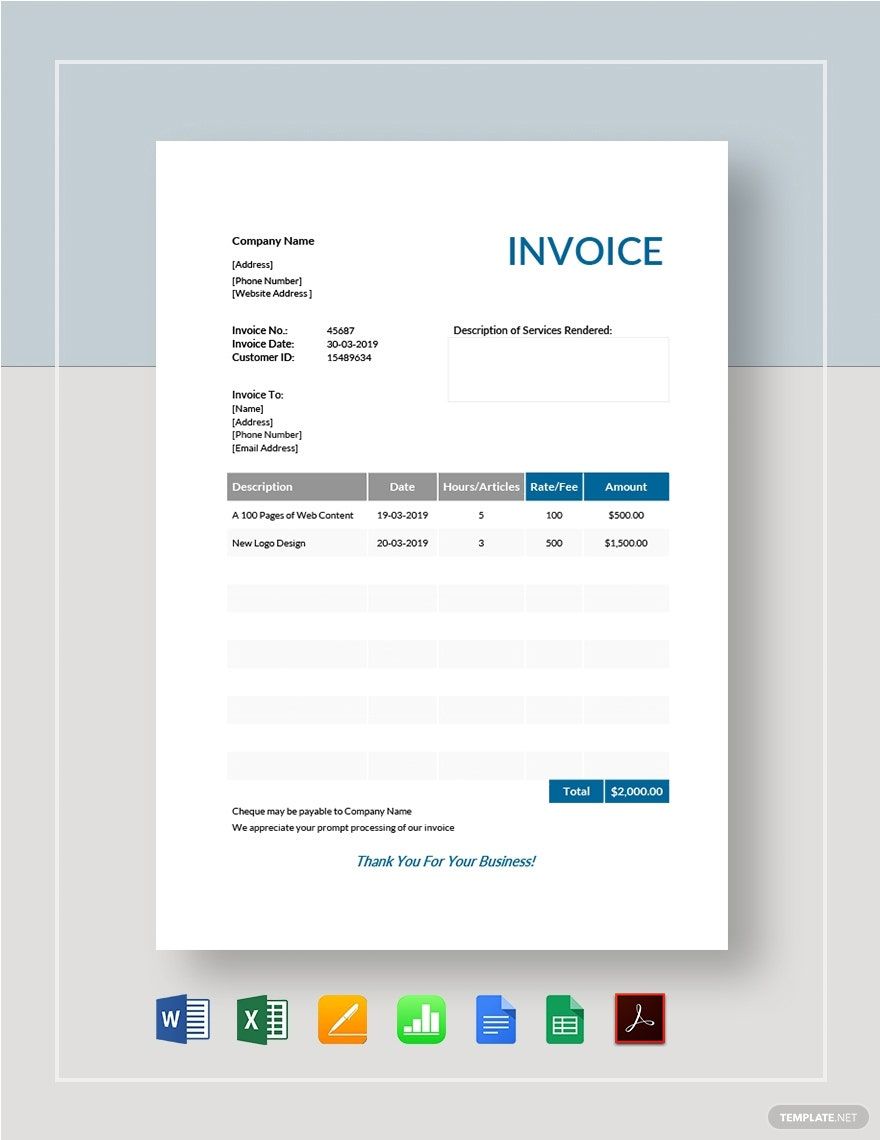

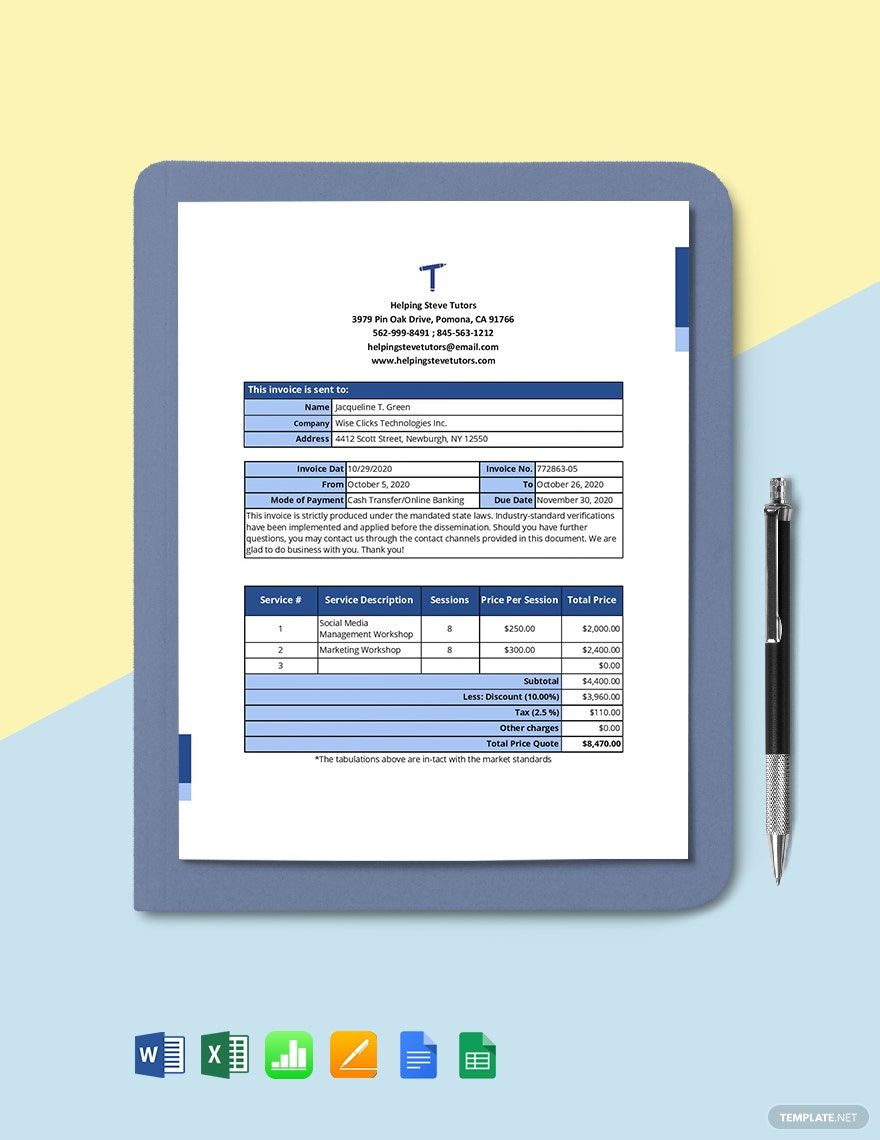

2. Present the Details

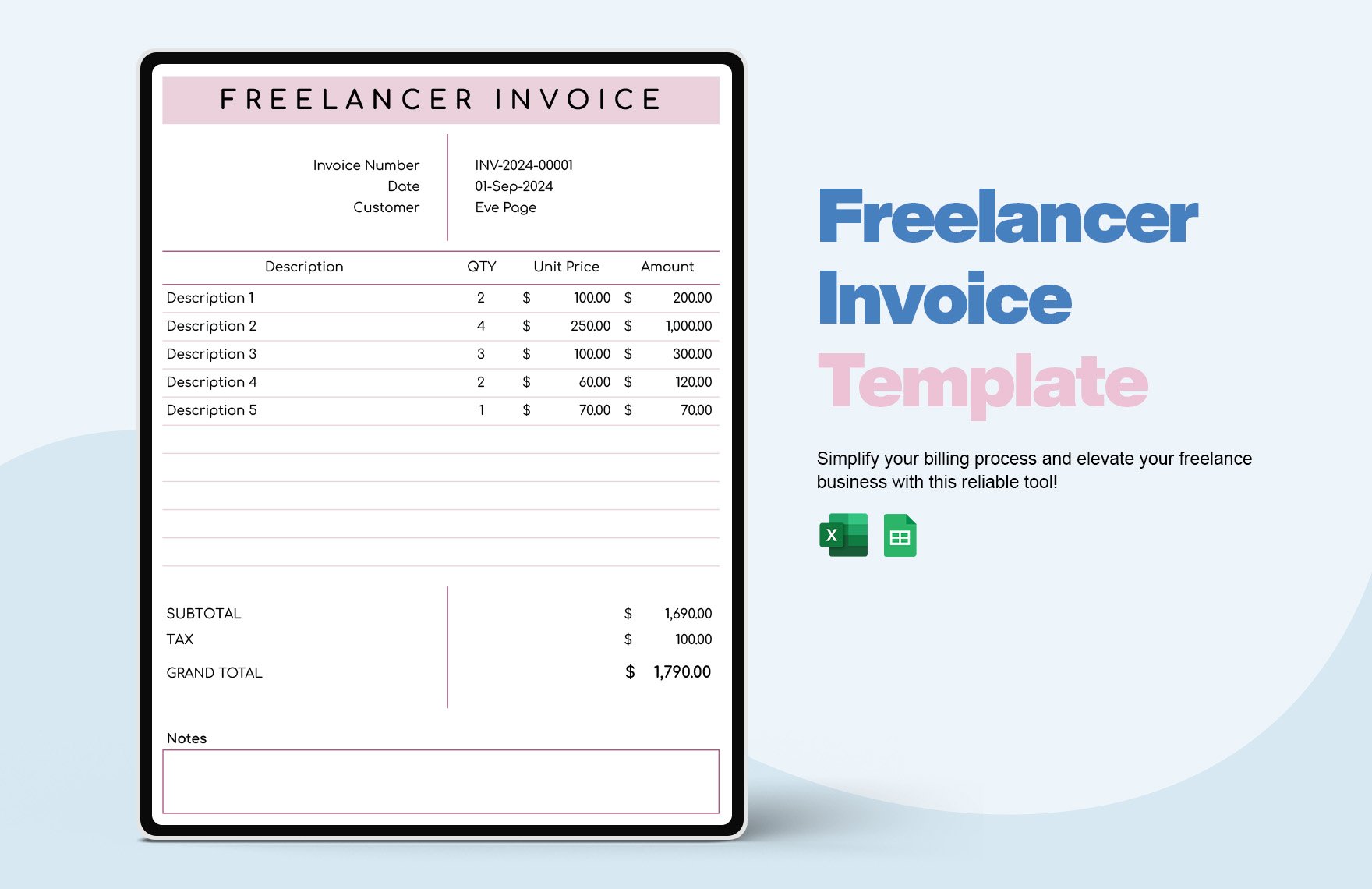

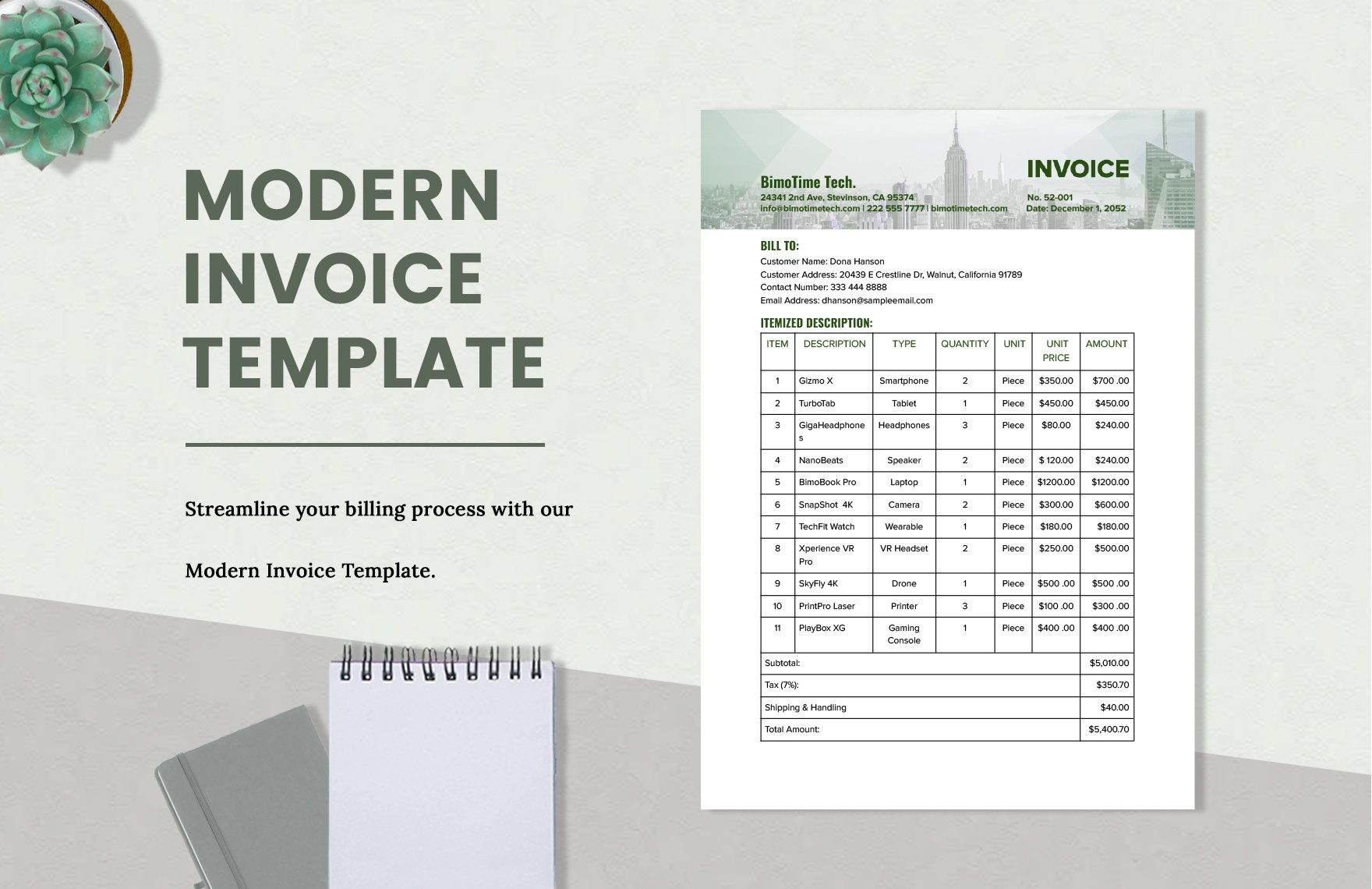

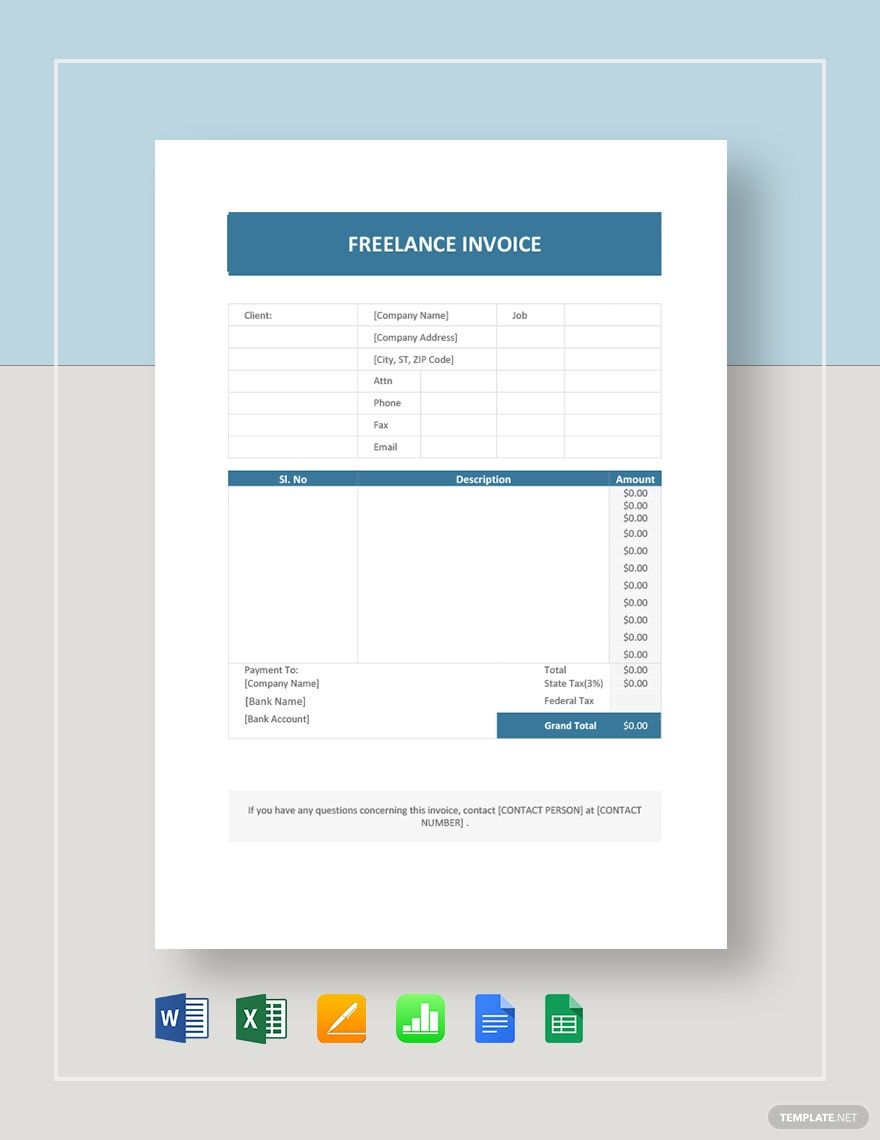

For identification purposes, add your client's details on your sample invoice. These details include the client's name, company, and address. Don't forget to add the date of billing, invoice number, due date, and mode of payment. Features like these are useful for both ends of the agreement as you can track the transactions readily.

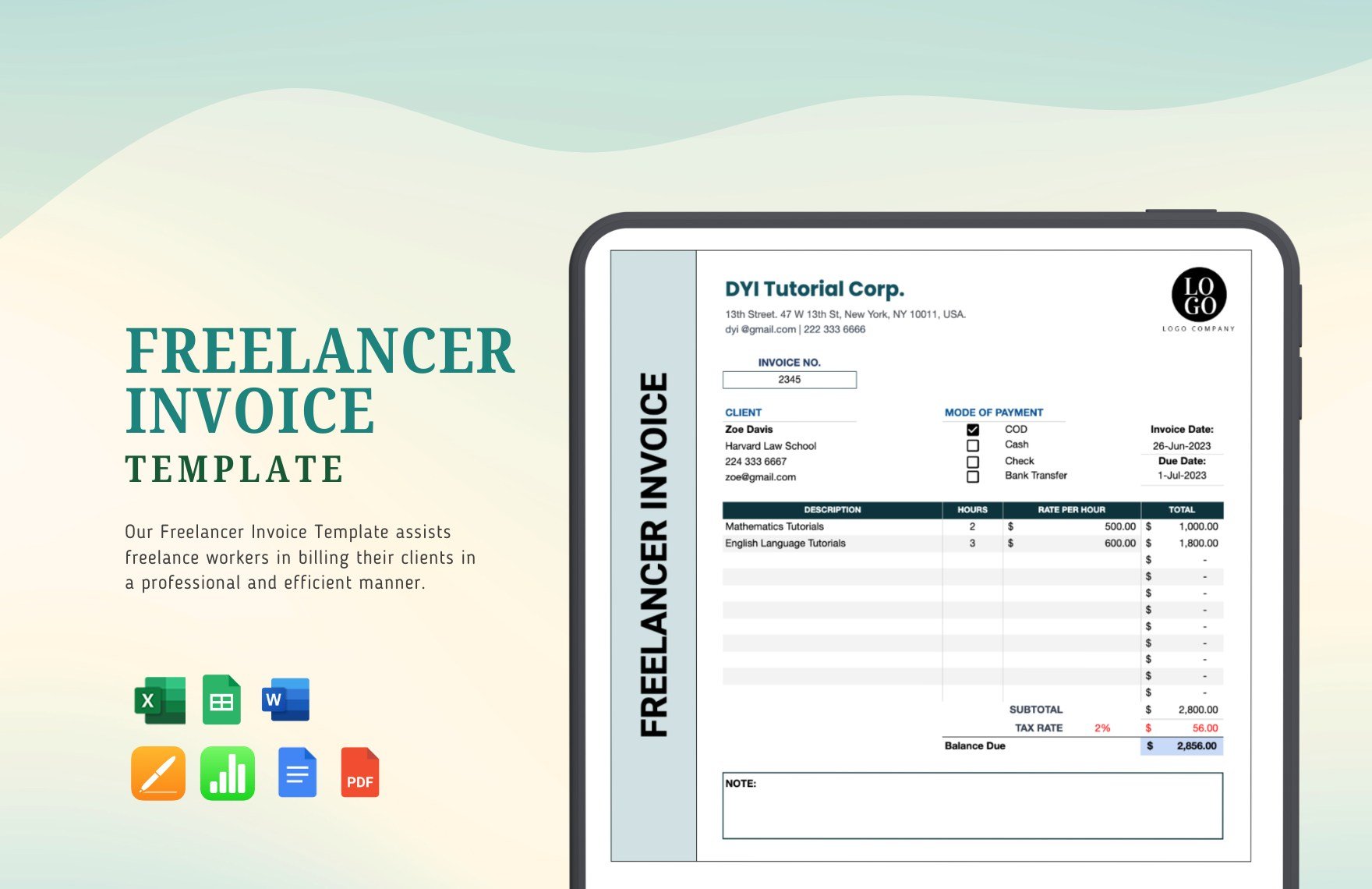

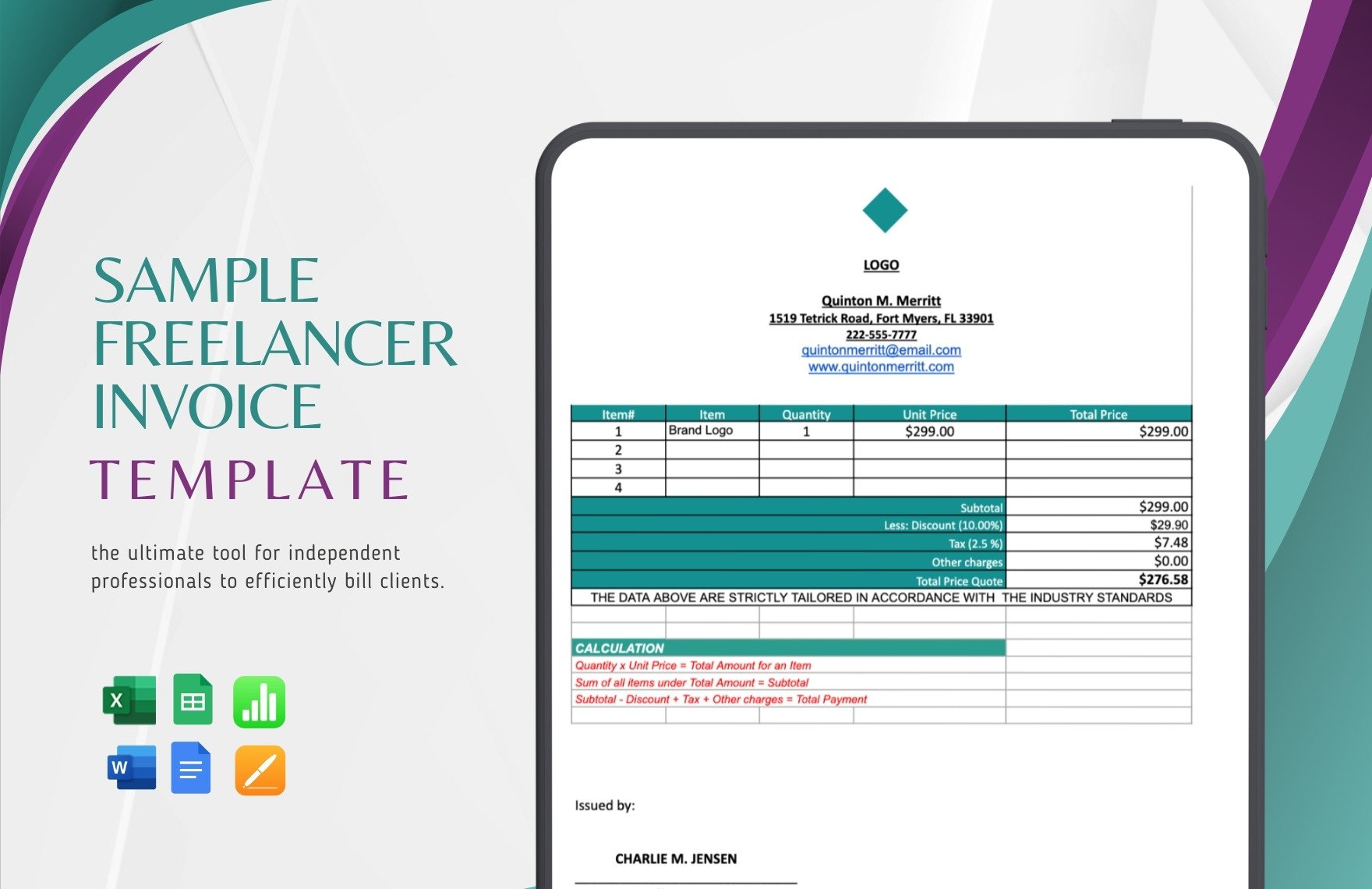

3. Provide the Service Information

Other essential details that you don't have to miss are the service details. Usually, it includes the service you gave, hourly rates, and total price on the tax invoice. Be mindful while writing additional information, because one mistake and your client can leave a bad review for your, or worst, will call you a scam artist.

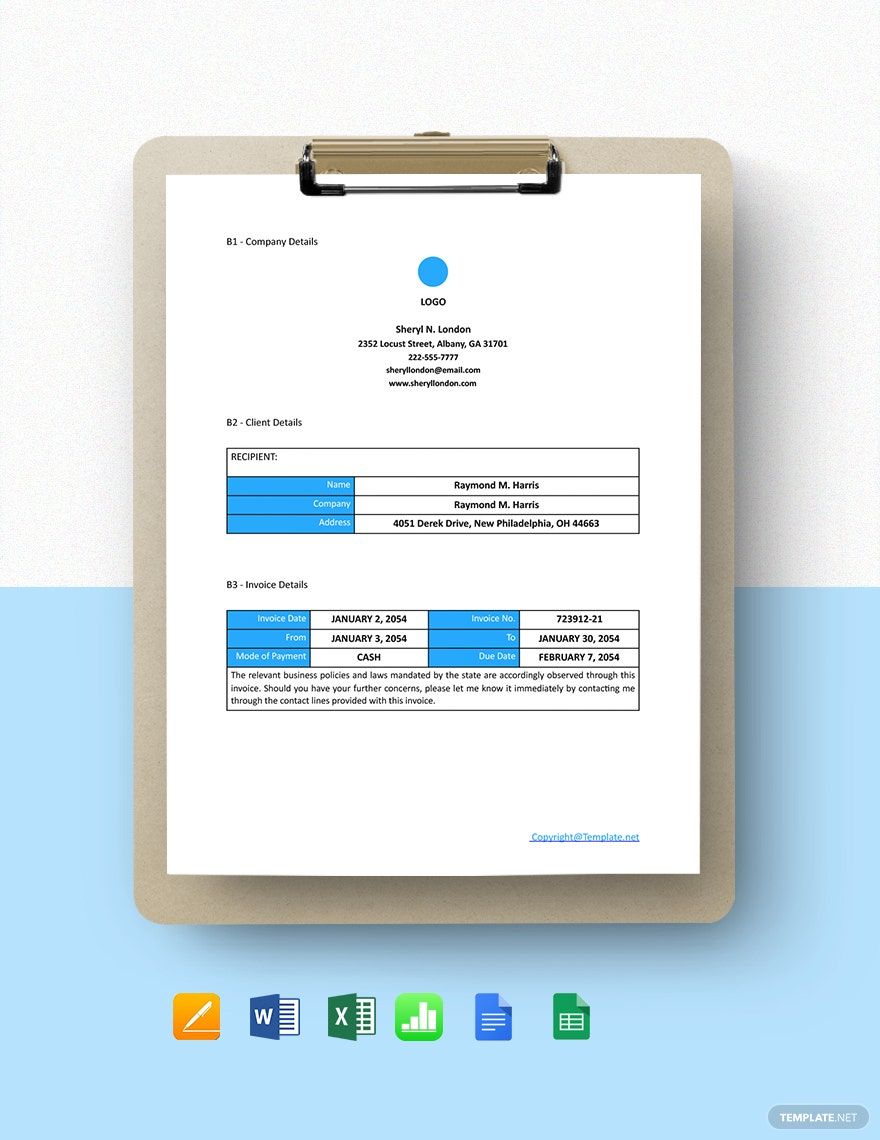

4. Design It

You don't need a graphic designer to make your invoice look pleasing to the eyes. You can do it using any software like Word, Excel, Google Docs, or others. Explore by adding colors and non-distracting typography to your service invoice. It doesn't have to look over the top, but having an invoice that fits your brand will level up the experience a client will work for you.