Table of Contents

- 10+ Municipal Bond Funds Templates in DOC | PDF

- 1. Municipal Bond Funds Template

- 2. Mutual Funds to Examining Bond Funds

- 3. Market Based Financing Bond Funds

- 4. Portfolio of Mutual Funds Template

- 5. Sample Municipal Bond Fund

- 6. Simple Municipal Bond Fund Template

- 7. Municipal Bond Fund Example

- 8. Municipal Bond Investor Funds Template

- 9. Municipal Bonds Template

- 10. Municipal Bond Funds in PDF Template

- 11. Value in Municipal Bond Closed-End Funds

- 5 Steps to get the municipal bond fund?

- What are the examples of Municipal Bond Funds?

10+ Municipal Bond Funds Templates in DOC | PDF

The municipal bond fund is the funds that invest in municipal bonds. Municipal bond funds shall be handled with different goals that are frequently relying on location, credit quality, and duration. The Municipal bonds are debt securities send out by a state, municipality, county, or special purpose district to finance capital expenses. On the other hand, Municipal bond funds are free from federal tax and shall also be exempt from state taxes.

10+ Municipal Bond Funds Templates in DOC | PDF

1. Municipal Bond Funds Template

bivio.com

bivio.com2. Mutual Funds to Examining Bond Funds

bivio.com

bivio.com3. Market Based Financing Bond Funds

southasia.berkeley.edu

southasia.berkeley.edu4. Portfolio of Mutual Funds Template

rohanchambers.com

rohanchambers.com5. Sample Municipal Bond Fund

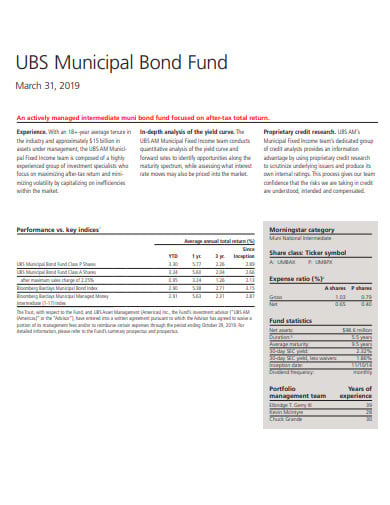

ubs.com

ubs.com6. Simple Municipal Bond Fund Template

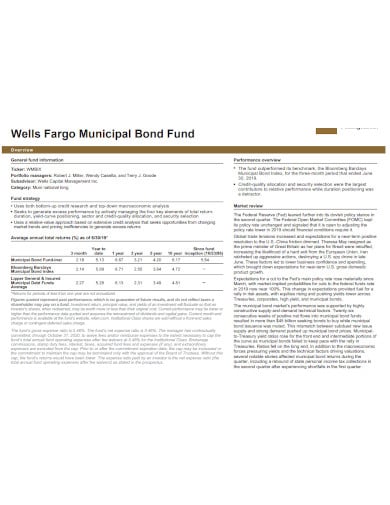

wellsfargofunds.com

wellsfargofunds.com7. Municipal Bond Fund Example

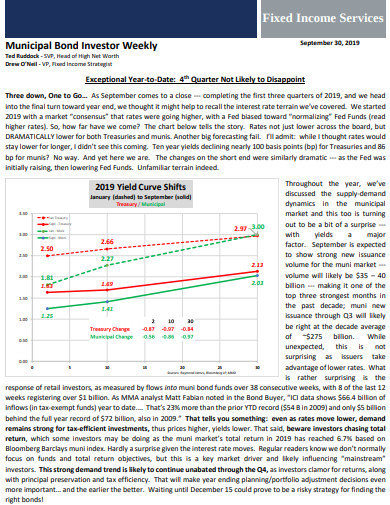

wellsfargofunds.com

wellsfargofunds.com8. Municipal Bond Investor Funds Template

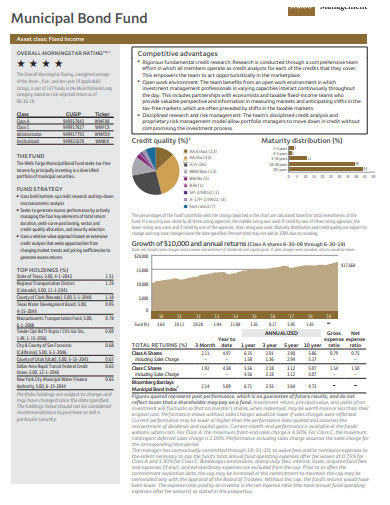

raymondjames.com

raymondjames.com9. Municipal Bonds Template

janaagraha.org

janaagraha.org10. Municipal Bond Funds in PDF Template

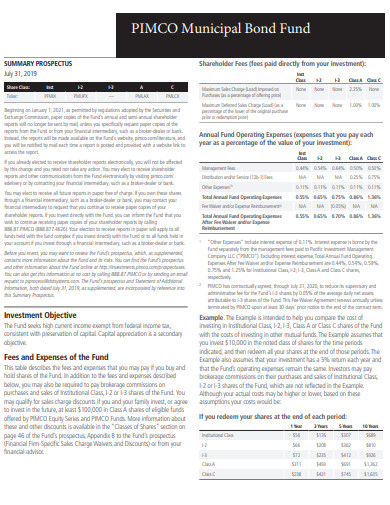

pimco.com

pimco.com11. Value in Municipal Bond Closed-End Funds

vaneck.com

vaneck.com5 Steps to get the municipal bond fund?

The Municipal bond funds are from amongst the few investments in the market that offer tax-free options. For all investors, it offers products and can be a good fixed source of income choice for conservative portfolio allocation

Step 1 Investment of smaller amounts

People are naturally after those investment options that provide good returns. Zero percent tax on returns, among other advantages creates tax-free bonds that are one of the most should be invested option of investments in the market. The options of defaulting on interest payments are available at low rates as these schemes are straight from the government’s kitty. And these lead to low-risk rates on the investment.

Step 2 Investment are tax exempted

A Tax-free bond is an excellent option for those investors who are looking for permanent income like senior citizens. As the government enterprises usually issue these bonds for a longer time, default risk is very less than others in these bonds and you are ensured of a fixed income for a longer period, generally ten years or more. The government firm invests the funds collected through the issuance of these bonds in various profit-oriented infrastructure and housing projects.

Step 3 Investment involves lower risks

The Municipal bonds are the debt securities send out by states, cities, agencies and local districts to stake on capital and infrastructure projects, such as roads and bridges, schools, government buildings, and other public projects, etc. And it also provides capital security and a fixed monthly or yearly income. Therefore, it can be agreed to be quite safe and sound.

Step 4 Investing in the primary and secondary market

When you buy the bond in the primary market, there are no fees or charges for the purchase. A financial organization or group of banks will bring the bond issue to the trade market and you would be required to have an eligible account with one of the banks taking lead the new subscription or syndicating the offering. The secondary market gives access to the investors to buy bonds, that have already been issued, from other investors, bond dealers, banks and brokerage firms.

Step 5 Do your basic research

It is a better option that you may spread your funds out around various individuals and a small number of municipal bonds. But it is an intellectual step to do research and a significant study on the basis of the municipal bonds before investment

What are the examples of Municipal Bond Funds?

The Municipal bonds are brought by the local or state government to raise money for infrastructure projects, like the construction of a convention center, water treatment provision or regional airport. Mostly, this bond does not come under federal income taxes.

The municipality might bring out a bond that is not eligible for federal tax exemption, concluding in the generated income being accountable to federal taxes. The general obligation bond (GO) is brought by the governmental entity and not supported by revenue from a certain project, such as a toll road.

For example, a city might issue the bonds to invest in the construction of a high-speed toll road. And the money collected in tolls could then be utilized to generate profits, thereby helping the city to pay back to its holders.

How does a Municipal Bond fund work?

The person that buys a municipal bond is efficiently loaning funds to a government entity, that will make a preplanned amount of interest and capital payments to the purchaser. Those issuing typically use municipal bond proceed to offer financial help day-to-day for operating activities or capital expenses for the sake of public good such as road, hospital, school, or infrastructure projects.

Mostly, there are different kinds of municipal bonds, but among them two most significant are general obligation bonds