Table of Contents

- 1. Investment Policy Reviews Template

- 2. Foreign Investment Risk Review Template

- 3. Investment & Enterprise Responsibility Review Template

- 4. Investment Comparative Review Template

- 5. Investment by Foreign Portfolio Investors Review Template

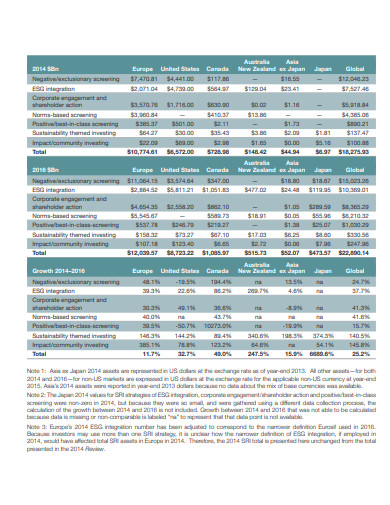

- 6. Global Sustainable Investment Review Template

- 7. Quarterly Investment Review Template

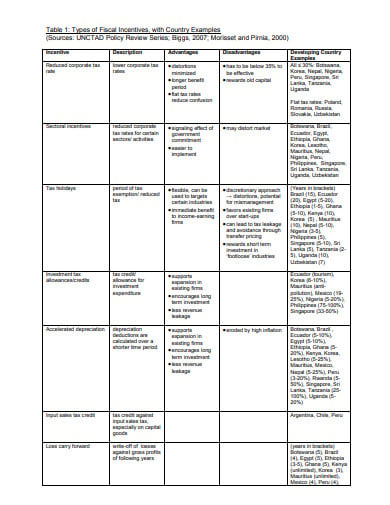

- 8. Review of Investment Incentives Template

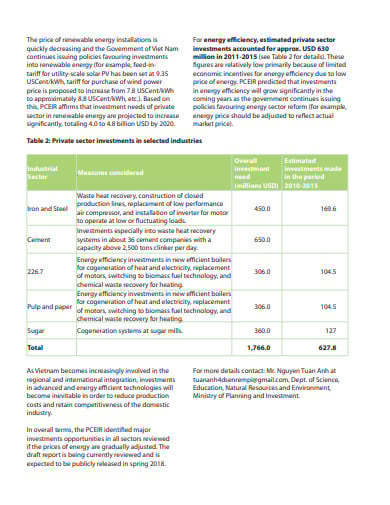

- 9. Climate Expenditure Investment Review Template

- 10. Community Development Investment Review Template

- 11. Investment Centre Annual Review Template

- 12. Capital Investment Review Template

- How to establish an Investment Review?

- What is the use of an Investment Review?

- What is the importance of Investment Review?

11+ Investment Review Templates in DOC | PDF

The Investment Review includes researching and assessing security to plan their future performance and their suitability, given an investor requirement, objective, and risk tolerance. And its analysis can also include assessing an overall financial or investment portfolio strategy. And there are the type of investment analyses that include bottom-up, top-down, fundamental and technical.

11+ Investment Review Templates in DOC | PDF

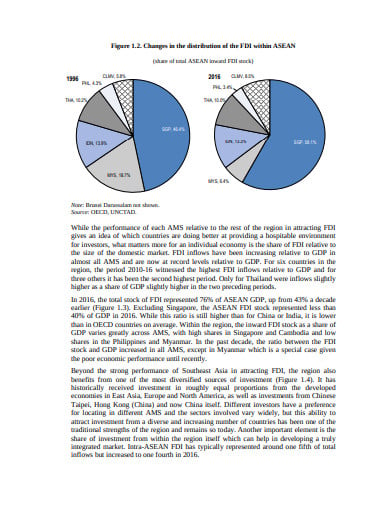

1. Investment Policy Reviews Template

oecd.org

oecd.org2. Foreign Investment Risk Review Template

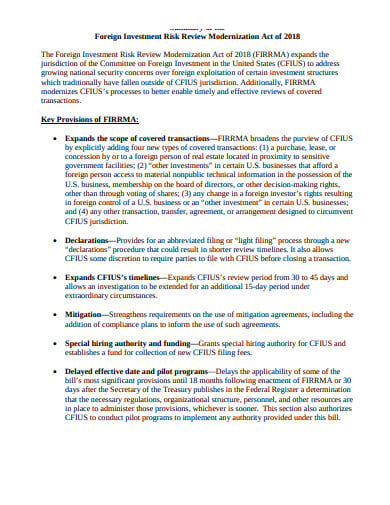

treasury.gov

treasury.gov3. Investment & Enterprise Responsibility Review Template

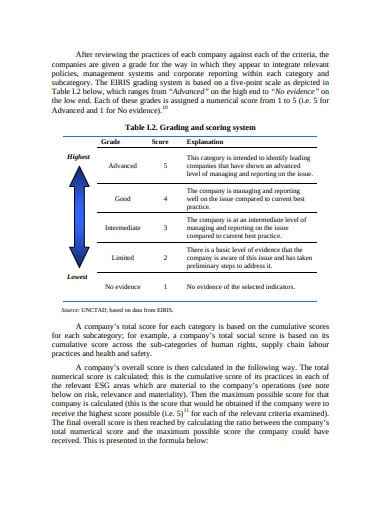

unctad.org

unctad.org4. Investment Comparative Review Template

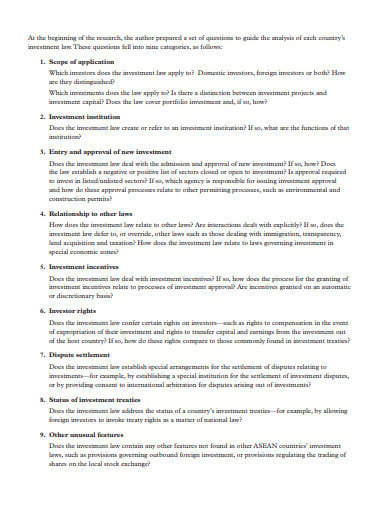

iisd.org

iisd.org5. Investment by Foreign Portfolio Investors Review Template

rbidocs.rbi.org.in

rbidocs.rbi.org.in6. Global Sustainable Investment Review Template

eurosif.org

eurosif.org7. Quarterly Investment Review Template

jpmorgan.com

jpmorgan.com8. Review of Investment Incentives Template

theigc.org

theigc.org9. Climate Expenditure Investment Review Template

ledsgp.org

ledsgp.org10. Community Development Investment Review Template

frbsf.org

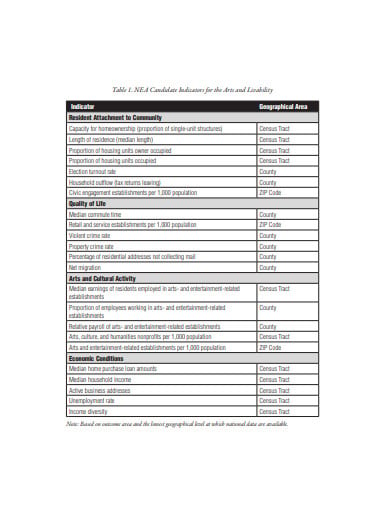

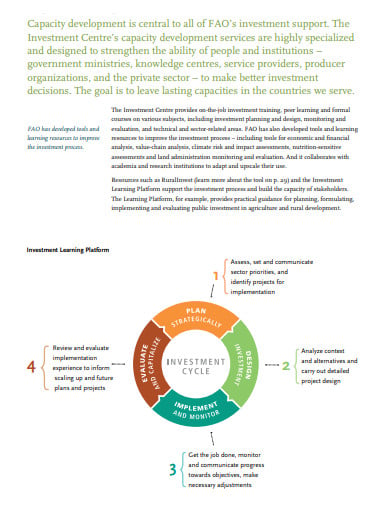

frbsf.org11. Investment Centre Annual Review Template

fao.org

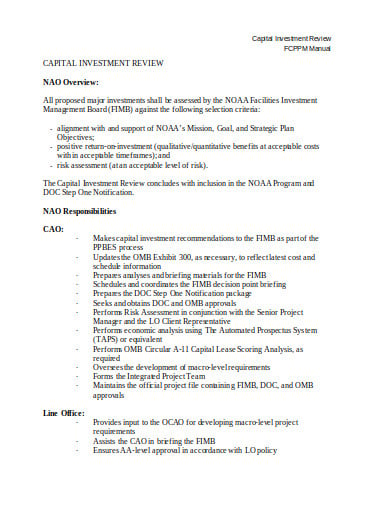

fao.org12. Capital Investment Review Template

corporateservices.noaa.gov

corporateservices.noaa.gov How to establish an Investment Review?

Step 1: Framing of Investment Policy

Before creating any investment policy, one must formulate the investment policy for the systematic function. And the main element of the investment review is the investible funds, source of funds i.e the saving or borrowing, the required rate of return, need for regular income.

Step 2: Investment Analysis

After the suitable investment, the policy has been formulated, and the next step is to imply the market, industry, and company to look after the securities one plan to buy. The market review helps the investor to get lots of information about the economy and its changes in it. Whereas, the industry review is to get sufficient ideas about the scope of growth and development of the industry.

Step 3: Valuation

And in this step of the industry review comprise the expected risks and returns from the investment. The intrinsic value of the stocks and shares is calculated and measured using the particular procedure. And intrinsic value can be formulated by adding book value with the percentage ratio compared with the market price.

Step 4: Portfolio Construction

The investment portfolio construction is done by combining the securities. It is constructed in such a way that it meets the needs and objectives of both the investors and the institution and that delivers maximum return with the minimum losses. In conclusion, the fund is allocated to selected security.

Step 5: Portfolio Evaluation

The portfolio is periodically evaluated and determined to calculate the variability of the returns from different securities. And the portfolio is comprised of the two dimensions like the risk and return. Both are important in regulating investment analysis fruitful.

What is the use of an Investment Review?

An Investment Review can also involve assessing an overall investment strategy, in terms of thought procedure that went into creating it, require financial situation at the time, how decisions affect portfolio performance and the need to adjust or correct in any way. In the process of investment, an investor who is not agreeably doing their investment analysis can seek advice from the investment advisor or another financial professional.

The Investment Review should assist in determining how an investment is likely to carry out and how suitable it is for a given investor. There are key factors in investment that analyze the include entry price, expected time horizon for holding an investment and these roles are played in the investment portfolio.

And in conducting a process of investment analysis of mutual funds that an investor looks at factors like how the funds performed compared to the standards or peers. The peer fund comparison involves investigating the difference in performance, expenditure ratio, management of stability, and asset allocation, etc.

After the suitable investment policy is introduced, the next step is to conduct the market and another kind of analysis to scrutinize the security that an individual plan to buy. And the market analysis assists the investors to clearly understand the economy. The market fluctuation like recession, inflations enforce the investor’s money to face some kind of losses.

What is the importance of Investment Review?

The Investment Review is the process of evaluating the investment for the probability and risk factors. It has the need of measuring how the investment is good and fit for the investment portfolio. Therefore, it starts with a single bond in the personal portfolio, to the investment in startups, and even big scale corporate assignments.

And the investment analysis is analyzing the investment for the income, risk, and resale of the value. And it is important to someone those who are investing regardless of their types. Mainly the investment analysis analyzes the three factors like the risks, cash-flow and resale value. And these factors must be looked out by the financial expert.

The first factor that is being evaluated by any investment analysis is the risks. The specific reasons are there behind the risk factors in the investment. And these are the risk of the investment is likely too great and the losses are quite obvious. The simple calculation is to calculate the rate of occurrence by the impact of the event.

And the second factor in the investment analysis is the cash-flow. The cash flow occurs in different ways like the dividends, interest payment on the bonds, or even the free cash flows. Cash flow is the method of repayment on investments. Lastly, the third factor is the resale value. The profits from the resale are made through gain in the market value of assets. Hence, the investment analysis depends on these factors that will create an impact on the investor’s money and funds.