Table of Contents

- 10+ Projects Return on Investment Templates in PDF | DOC

- 1. Capital Projects Return on Investment

- 2. Project Justification Return on Investment

- 3. Highway Construction Projects Return on Investment

- 4. Prioritizing Projects to Maximize Return on Investment

- 5. Profit Projects Return on Investment

- 6. Return on Investment from driven Projects in Construction

- 7. Projects Return on Investment for Capital Projects

- 8. Project Scoring Matrix to Measure Social Return on Investment

- 9. Project Schedules and Return on Investment

- 10. Software Projects Return on Investment

- 11. Sample Projects Return on Investment

- What Is Return on Investment (ROI)?

- Project ROI Formula

- Understanding Return on Investment (ROI)

- Limitations of ROI

- Developments in ROI

- Project Return on Investment

- Problems Using the Project Return on Investment Method

10+ Projects Return on Investment Templates in PDF | DOC

A metric used for calculating a project’s financial savings/gain (or loss) relative to its expense. It is usually used to assess whether a project can bring positive financial benefits, and in effect to give the approval to proceed. The formula for a project ROI= ((financial gain or loss of the project – cost of the project) / cost of the project) X 100.

Businesses are set to make money in business. But it has always been difficult to quantify the true value of any project with respect to its effect on margin, mainly due to the difficulty of converting ideas into dollar values.

It is obvious, for example, that educating workers would increase competence and efficiency, but how does that translate into savings or revenue growth at the bottom? Spending thousands of dollars on automated systems and software is likely to improve work efficiency but what is that efficiency’s dollar-value improvement?

Investment Return (ROI) is a crucial factor in answering these questions, as well as showing the profitability of the project and its potential effects.

There are multiple interpretations of ROI, depending upon the industry. For the purposes of this article, ROI is an indicator used to measure a project’s financial gain / loss (or “value”) relative to its cost. It’s usually used to assess whether a project can yield a good payback and have business value.

10+ Projects Return on Investment Templates in PDF | DOC

1. Capital Projects Return on Investment

uspsoig.gov

uspsoig.gov2. Project Justification Return on Investment

hubspot.net

hubspot.net3. Highway Construction Projects Return on Investment

fhwa.dot.gov

fhwa.dot.gov4. Prioritizing Projects to Maximize Return on Investment

ccpace.com

ccpace.com5. Profit Projects Return on Investment

dhg.com

dhg.com6. Return on Investment from driven Projects in Construction

nrc-publications.canada.ca

nrc-publications.canada.ca7. Projects Return on Investment for Capital Projects

deloitte.com

deloitte.com8. Project Scoring Matrix to Measure Social Return on Investment

comm.eval.org

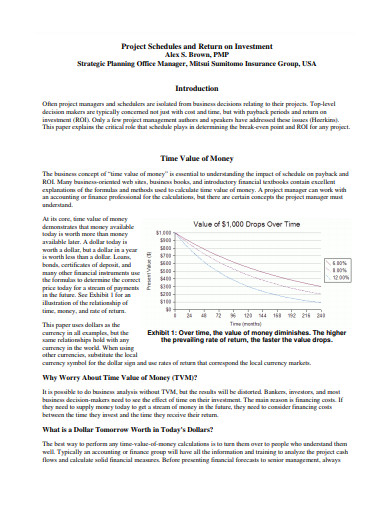

comm.eval.org9. Project Schedules and Return on Investment

alexsbrown.com

alexsbrown.com10. Software Projects Return on Investment

ijarcsse.com

ijarcsse.com11. Sample Projects Return on Investment

econrsa.org

econrsa.orgWhat Is Return on Investment (ROI)?

Return on Investment (ROI) is a performance measure used to evaluate the efficiency of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost. To calculate ROI, the benefit (or return) of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio.

How to Calculate ROI

The return on investment formula is as follows:

ROI = Cost of InvestmentCurrent Value of Investment?Cost of Investment)/Cost of Investment

Current Investment Value “refers to the proceeds from the sale of the interest investment. Since ROI is expressed as a percentage, it can be easily compared with other investment returns, allowing one to calculate a variety of different forms of investment against each other.

Project ROI Formula

There are two distinct ways of calculating investment returns. Each return a different interpretation of the same test. The investor viewpoint also tends to see the ROI as a metric while the company owners and managers will need to weigh the actual profit figures into the big business strategy.

To calculate the return as a hard number, estimate the projected income and subtract the costs. The final figure is the money which the project has made. Divide the hard number from the latter calculation by the original cost, to determine the percentage return.

For example, if you spend $5,000-dollar on a project and make $10,000-dollar after the project is completed, you’ll get a return of $5,000. You divide the return by the initial $5,000 dollar investment by $5,000 dollars. The result as a return is 1 or 100 percent. In many companies, a 100 percent return is amazing.

The most time-intensive aspect of the process is completing the cost analysis and the returns. The final ROI estimate takes just a few minutes when all the figures are in order.

Understanding Return on Investment (ROI)

Its flexibility and simplicity make ROI a common metric. Essentially, ROI may be used as a simplistic gage of the profitability of an investment. This could be the ROI on a stock investment, the ROI that a company expects to expand a factory or the ROI that was created in a real estate deal. The calculation itself isn’t too difficult, and its wide range of implementations makes it relatively easy to understand. If the ROI of investment is a positive net, it is likely worth it. But if there are other opportunities available with higher ROIs, those signals will help investors exclude or select the best choices. Investors can also avoid negative ROIs, which would mean a net loss.

Limitations of ROI

One has to be cautious in their evaluation of ROI for their projects because it has some limitations, firstly if the payback period is not considered then the ROI decision may lead to erroneous conclusions. The best way to measure ROI is to divide overall ROI by the number of periods it takes to reach, which will provide you with a quarterly ROI that is easier to compare with the IRR. A project with a higher ROI period will be preferred over another one because the expected return would take less time to achieve.

Secondly, the situation and nature of the business are subjective to certain criteria in quantifying the benefits, hence the people involved in the calculation process have to recognize the complexity and situational variables in order to reach the best result. Anybody responsible for measuring ROI should be careful not to exaggerate the estimate of the value.

Developments in ROI

Some investors and companies have recently taken an interest in developing a new version of the ROI metric, called “Financial Return on Investment,” or SROI. SROI was initially developed in the early 2000s and takes into account the wider impacts of extra-financial value ventures (i.e., social and environmental indicators not usually expressed in traditional financial accounts).1 SROI helps to understand the value proposition of some ESG (Environmental Social & Governance) parameters used in socially responsible investment (SRI) activities. A business will, for example, attempt to recycle water at its factories and replace its lighting with all LED bulbs. Such undertakings have an immediate cost that can have an adverse effect on conventional ROI, but the net benefit to society and the environment may lead to a positive SROI

Several other new ROI flavors have been created for specific purposes. Social media statistics ROI measures the efficacy of efforts on social media— for example, how many clicks or likes are created for an effort unit. Similarly, ROI’s marketing figures attempt to identify the return due to marketing or advertising campaigns. The so-called learning ROI has to do with the amount of information gained and maintained as a return on education or training in skills. A variety of other specialized types of ROI are likely to be created in the future as the environment advances and the economy changes.

Project Return on Investment Methods

There are many different names and a variety of calculation methods for this, however, all basically calculate a ratio of the profit to the investment outlay:

- Return on Capital Employed

- Accounting Rate of Return

- Return on Investment

- Return on Initial Investment

This blog will describe the Accounting Rate of Return (ROI) method.

Project Return on Investment

The Return on Investment (ROI) is calculated as the average annual profit as a percentage of the initial investment.

((financial gain or loss of the project -cost of the project) / cost of the project) X 100.

To calculate the ROI we need the total profit, and the number of years to calculate the average annual profit

Problems Using the Project Return on Investment Method

The ROI method has some disadvantages:

1. When comparing two projects, the relative risks to each project

2. must be taken into account. Both future savings and profits are predicted-and may be incorrect!

3. In the future, the value of money is less from inflation and investment opportunities

4. The method uses the average annual income, where cash flow can be greater

Why is ROI Important?

- This quantifies project value–Perhaps the most important aspect of ROI is its ability to show dollar figures of the value of a project to the business leaders. ROI transforms the intangible into the objective which can often help ambiguity.

- It can build support from stakeholders–attaching a dollar value to a project could help with a “go / no – go” decision. Stakeholders also want to see what the dollar value is to them if they want to help a given project. That’s very hard to do without an ROI.

- It can discover additional benefits–the method of measuring ROI encourages practitioners to explore advantages that might not have been obvious at the beginning of the project.

- It can contribute to project prioritization–ROI helps to assess the ranking of the project among other priorities once a decision has been made to start a project; typically projects with higher ROI are ranked higher, and financial support is obtained quicker.